|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

New home prices fall for 7th month

Retail sales fall on auto weakness

Dye & Durham gets a third Plantro bid

CareRx could be the real senior trade

HOT OFF THE PRESS

New home prices fall for 7th month straight

New home prices fell short of estimates in October, declining 0.4% M/M versus expectations for a flat reading - the seventh straight sequential drop…

… driven by growing pressure in Ontario and Western Canada, which offset smaller M/M gains in Quebec.

With elevated unabsorbed inventory and stagnating population growth, it doesn’t look like prices will be cleared for takeoff any time soon.

Retail sales fall on auto weakness

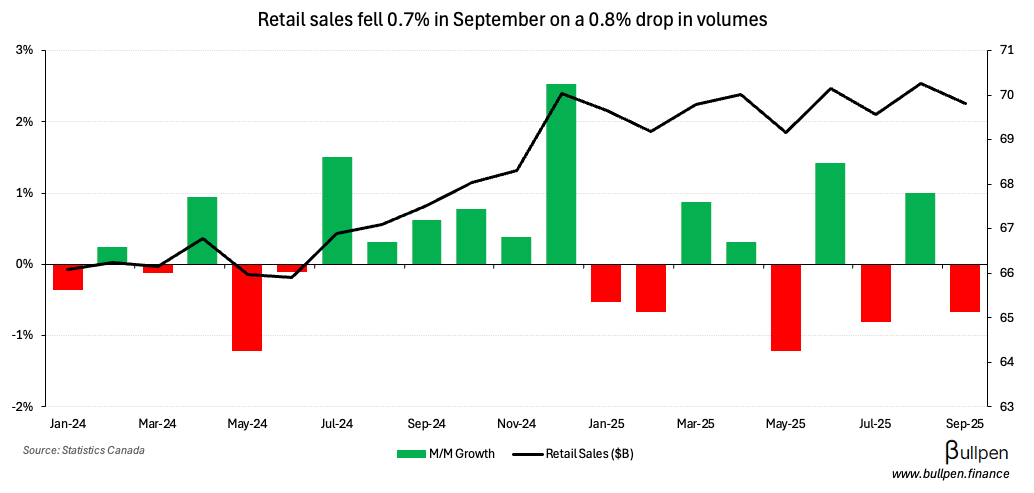

September’s retail sales shaped up largely as expected, falling 0.7% M/M on a 0.8% drop in volumes.

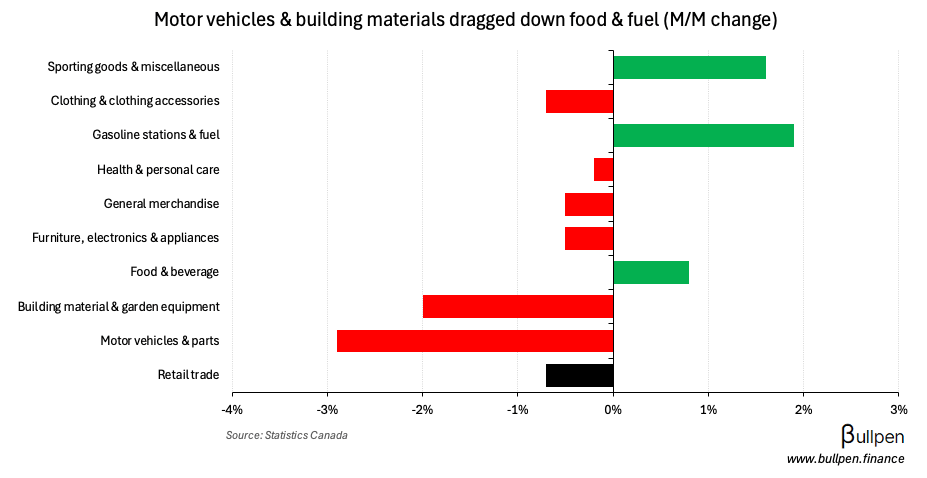

Results were anchored by a ~4% decline in vehicle sales, which dragged down the group on an absolute basis - more than offsetting stronger fuel & food sales…

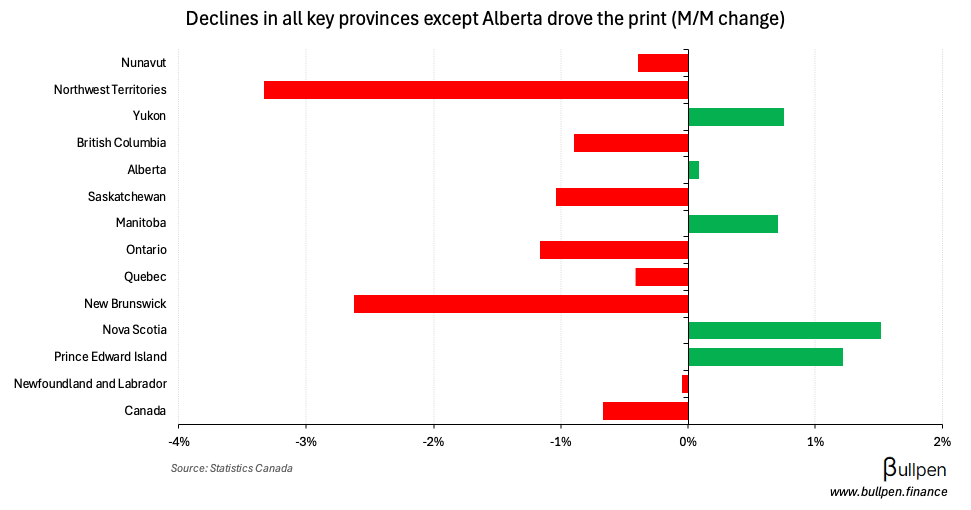

… and driving provincial results, with Ontario and Quebec weighing on the print. BC was weak too, driven by lower sales at building material dealers.

We should see more of the same in October, with preliminary estimates calling for stabilization at current levels.

FUNNY BUSINESS

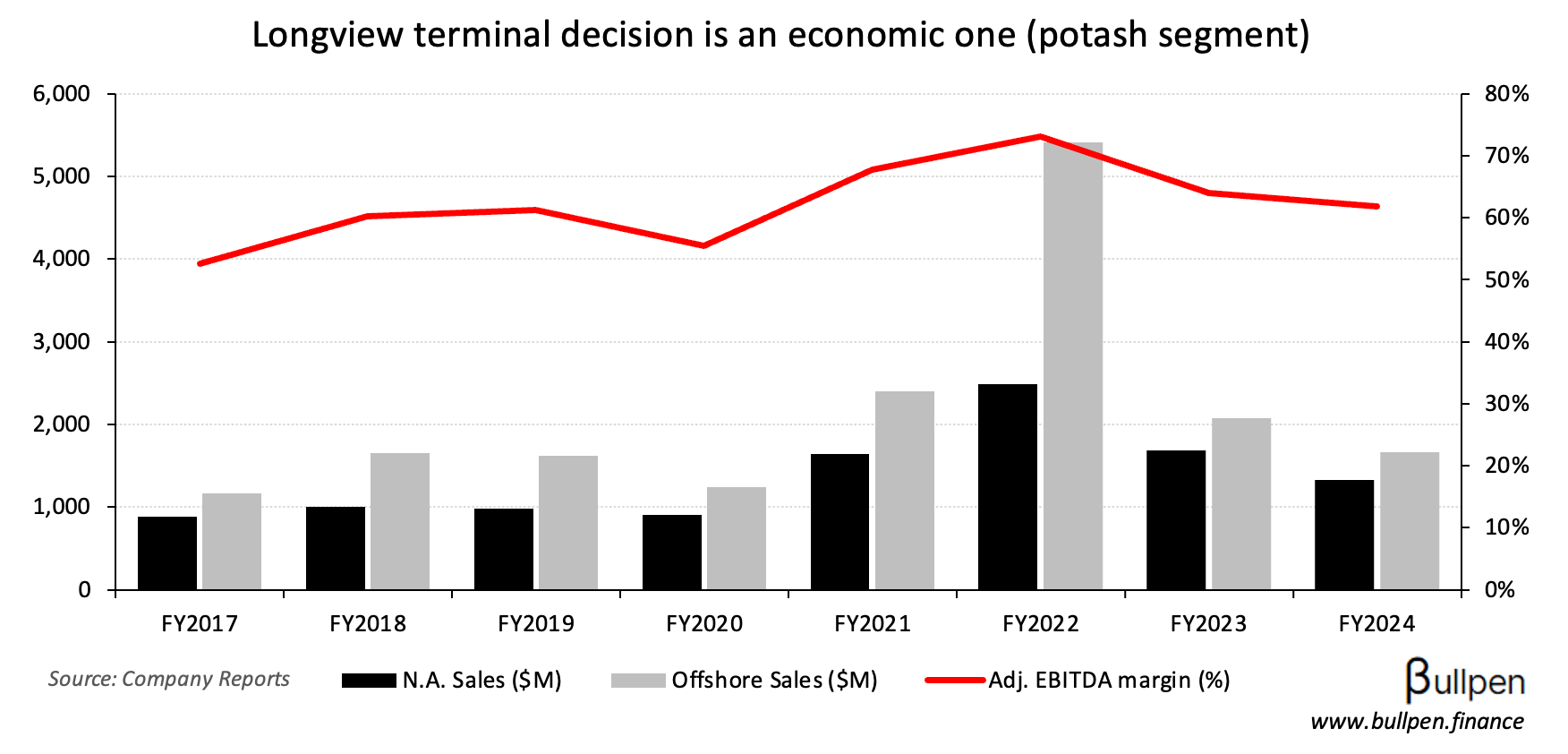

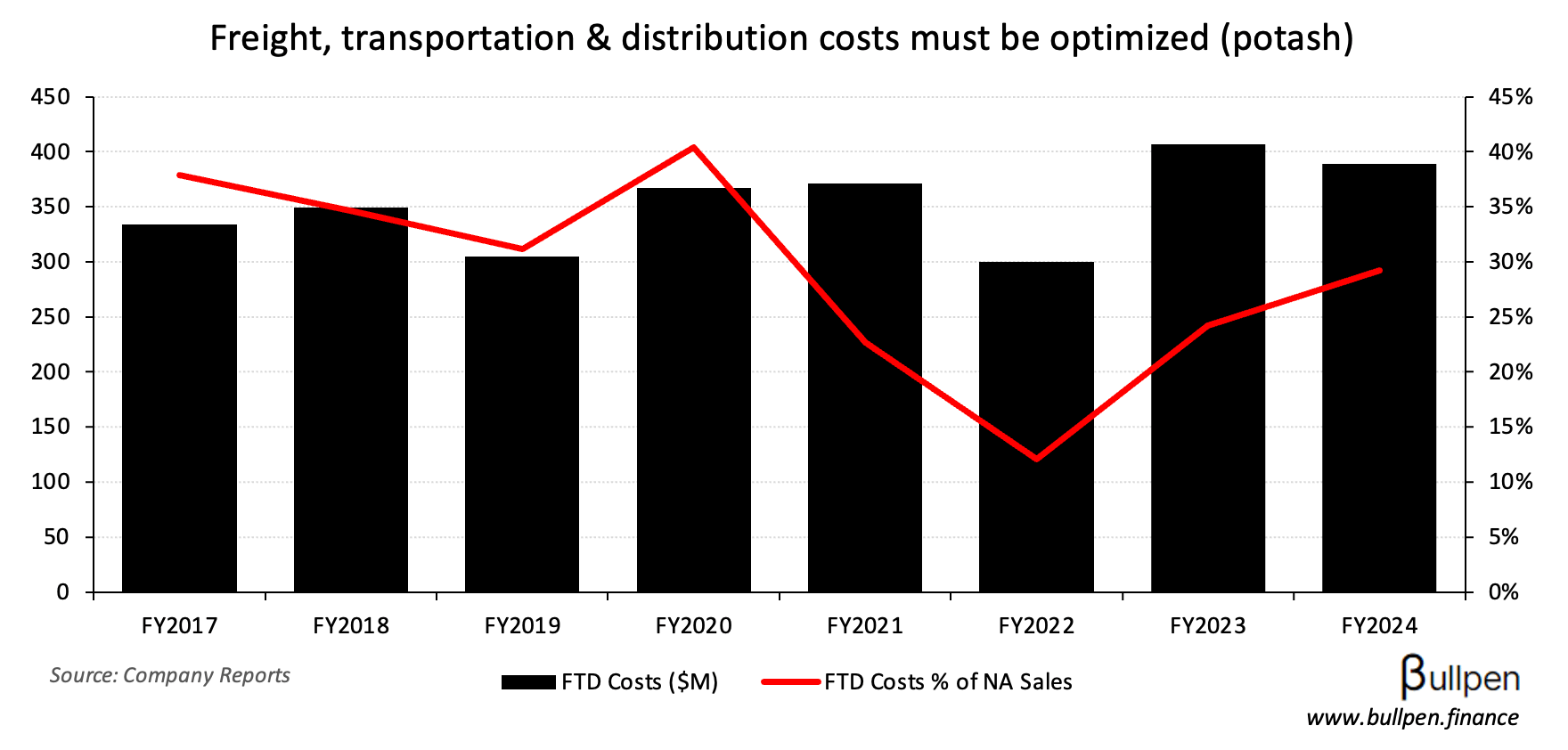

Nutrien (NTR) was in the media scope after selecting Longview (Washington) as the home of its next potash terminal, a potential $1B investment to meet growing Asian demand…

… that’s not going to stay in our backyard. Like its decision to explore the sale of its phosphate business, the move to build in the U.S. is financially motivated - with freight costs accounting for a meaningful portion of overall sales volumes.

But with a final investment decision not coming until 2027, you never know...

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

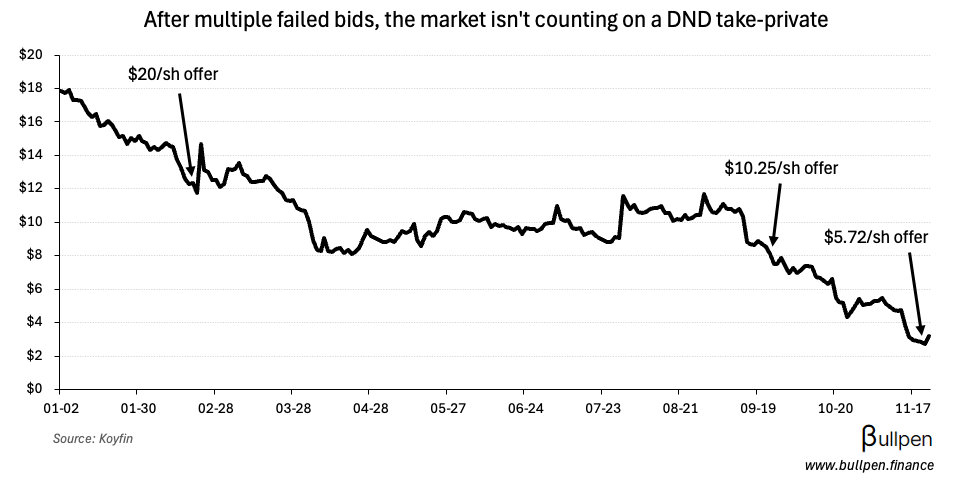

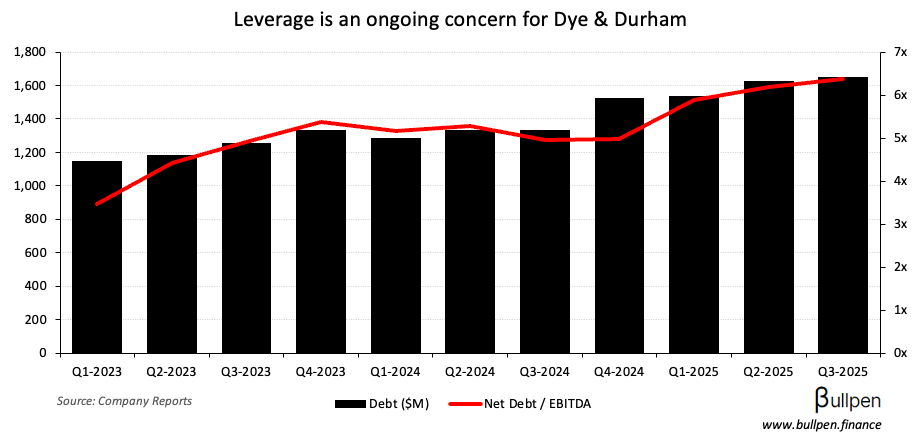

Dye & Durham (DND) ran 18% on confirmation of yet another take-private bid from Plantro, this time at $5.72/share - nearly half the September offer…

… and a quarter of the first $20/share offer in February. The step down in purchase price matches an ~80% YTD drawdown, fueled by concerns over the company’s ability to meet its debt obligations...

… and continued delays on filing results. With the current offer sitting ~80% above Friday’s close, the market isn’t convinced this one goes through… let’s see.

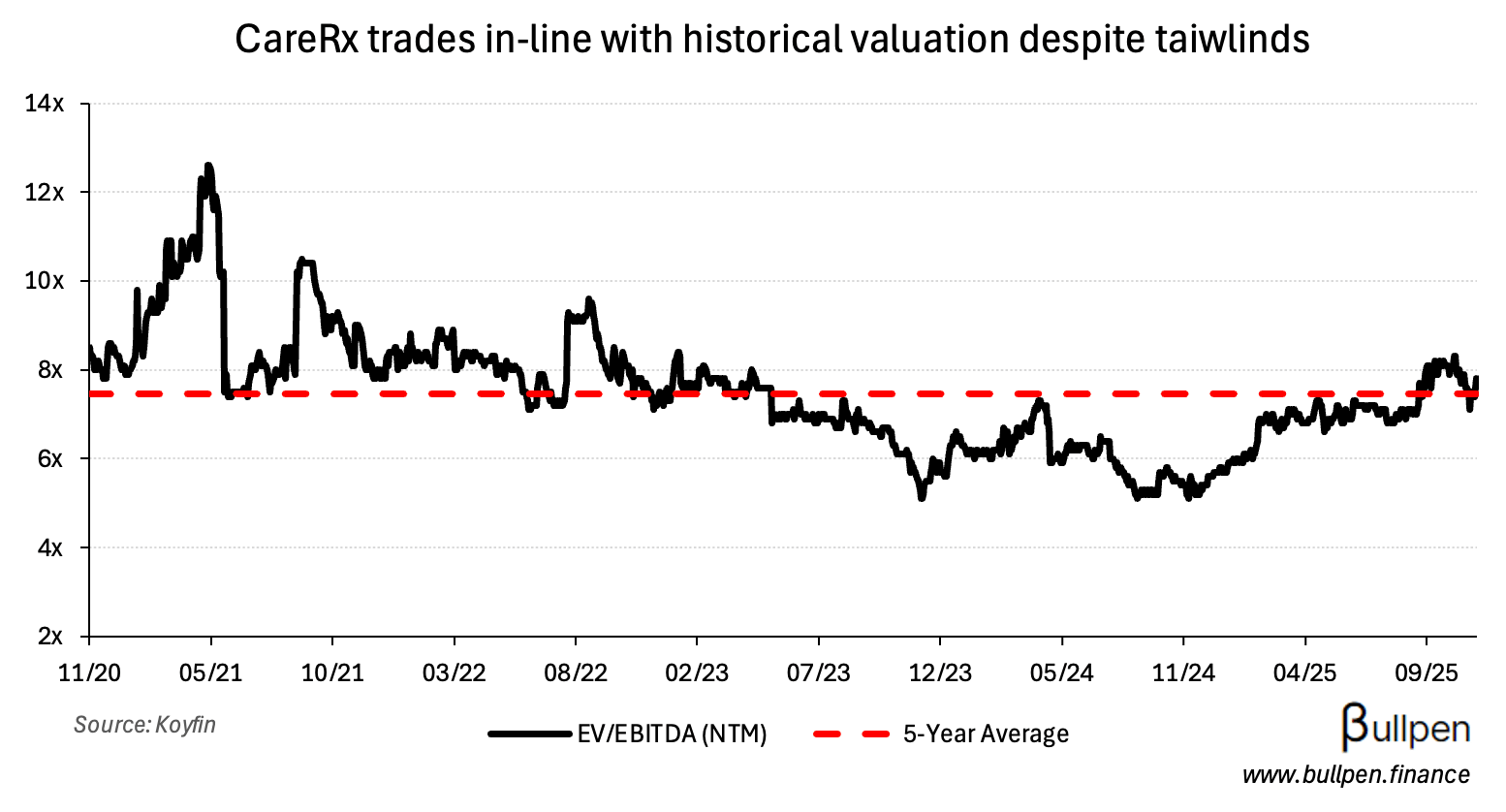

CareRx (CRRX) was up 8% on no news but it’s ripped 80% this year, so I wanted to put it on your radar. Through M&A the company became the largest pharmacy services provider to the senior living industry…

… but more recently, it’s taken its foot off the gas on dealmaking to focus on improving the margin profile…

… and reducing the debt load, two items that weighed on shares in years past. With the balance sheet now in great shape, management is open to deploying capital…

… but is likely to take a more measured approach this time around, with an ~8% organic growth outlook…

I think I’ve publicly stated 6,000 to 8,000 (beds) was our target for this year. We are comfortable for that same target next year for what we see in the pipeline.

… supported by growing bed supply and industry consolidation - with acquisitions by Extendicare, Chartwell, and Sienna (all clients) opening the door for new business. Trading in-line with its long-term average…

… it might not be a bad time to get smart on the name.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Christine Moritz | Great-West (GWO) | $296K |

| Karen McCarthy | Fortis (FTS) | $933K |

| Bruno Geremia | Birchcliff (BIR) | $503K |

| Christopher Carlsen | Birchcliff (BIR) | $375 |

| Duane Thompson | Birchcliff (BIR) | $242K |

| Todd Cione | Open Text (OTEX) | $815K |

| Paul Sweeney | Open Text (OTEX) | $3.5M |

| Michael Ridley | Black Diamond (BDI) | $600K |

| Edward Redmond | Black Diamond (BDI) | $568K |

| Michael Ridley | Franco-Nevada (FNV) | $777K |

| Rahim Hirji | Manulife (MFC) | $2.5M |

| Rahul Joshi | Manulife (MFC) | $4.3M |

| Naveed Irshad | Manulife (MFC) | $1.0M |

| Steve Finch | Manulife (MFC) | $4.6M |

| Philip Witherington | Manulife (MFC) | $520K |

| Alexander Davern | Computer Modelling (CMG) | $155K |

| Wai-Fong Au | Altus Group (AIF) | $141K |

Flagging the buying at Altus (AIF), which was filed on the heels of the company’s new strategic focus unveiled at investor day.

EARNINGS

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Couche-Tard (ATD) | PM | 0.74 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 New Home Prices M/M | -0.4% | 0.0% |

| 🇨🇦 Retail Sales M/M | -0.7% | -0.7% |

| 🇺🇸 Consumer Sentiment | 51.0 | 50.5 |

Was this forwarded to you? Join 3,500+ investors reading The Morning Meeting by clicking the button below.