Get smarter on VersaBank

Receive our initiation report and ongoing, in-depth coverage of VersaBank straight to your inbox.

VersaBank

TSX/NASDAQ: VBNK

YTD: 1% 3Y: 96% 5Y: 143%

Last updated: 12/12/2025

Disclosure: Bullpen receives compensation from VersaBank for research coverage.

$636M

Market Cap.

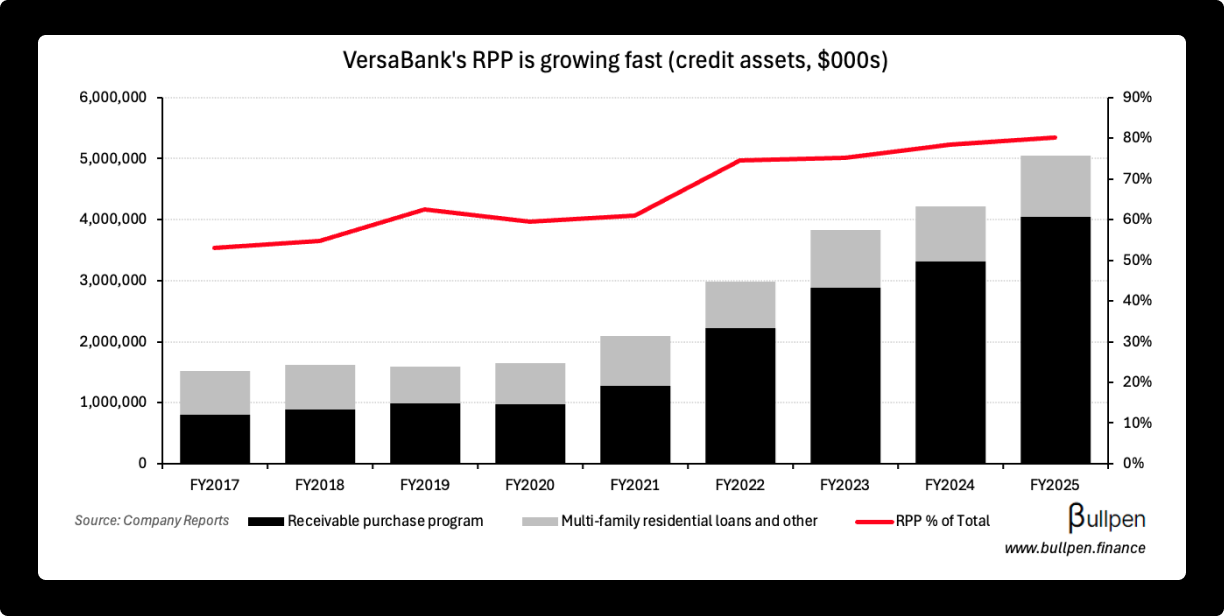

$5.1B

Credit Assets

$4.9B

Deposits

2.29%

NIM

51.8%

Efficiency*

7.89%

ROCE*

*Numbers are adjusted for one-time costs related to VBNK’s US expansion (advisory, legal, etc.)

A proven digital bank…

VersaBank is a federally licensed bank in both Canada and the USA. Instead of physical branches, the company uses technology to source deposits and purchase the receivables associated with point-of-sale loans from its partners. Its Receivable Purchase Program (RPP) is proven in Canada and has several benefits:

Healthy margins

VersaBank has maintained a net interest margin of around 250 bps regardless of the interest rate environment.

Low credit risk

Through a put-back provision and cash holdback in each agreement, VersaBank has never had a loan loss in this segment.

High efficiency

Because it requires little physical infrastructure and human capital to scale, VersaBank can run extremely lean as the asset base grows.

… expanding in the USA…

Through 2025 VersaBank has been expanding south of the border, reaching nearly US$300M in assets and targeting another US$1B in 2026. Given the US market is an order of magnitude larger than in Canada, the bank has ample runway to grow - which should drive:

Operating leverage

Asset growth should rapidly outpace growth in non-interest expenses, given VersaBank has already built the infrastructure to operate this business.

Higher ROE

Combined with the roll-off of one-time costs, that should translate to returns above its ~9% average (we model 13% ROE in 2027).

… which should drive returns.

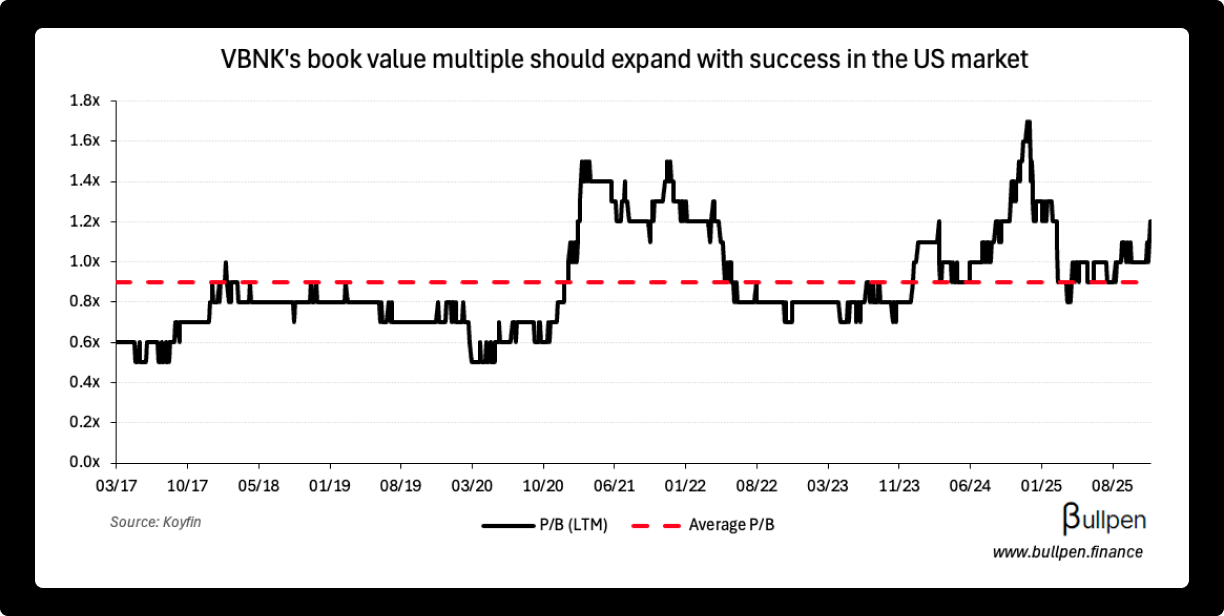

With VBNK trading just above book value today, we believe the market is still focused on the near-term expansion headwinds (higher costs, lower ROE). Success in the US market should drive returns in two ways:

Book value growth

Alongside Canadian growth, we expect VersaBank’s US expansion could push its historical 8% growth in book value per share above 10% in the coming years. At its current 1.2x P/B multiple, our 2027E (FY+1) BVPS implies ~25% upside from VBNK’s current stock price.

Multiple expansion

Higher sustained ROE should drive multiple expansion to maintain VBNK’s relationship to its peer group. For every 0.1x added to its current multiple, our implied upside increases by ~10%.

Get the full VersaBank research report

Receive our complete initiation report and ongoing, in-depth research coverage of VersaBank straight to your inbox.