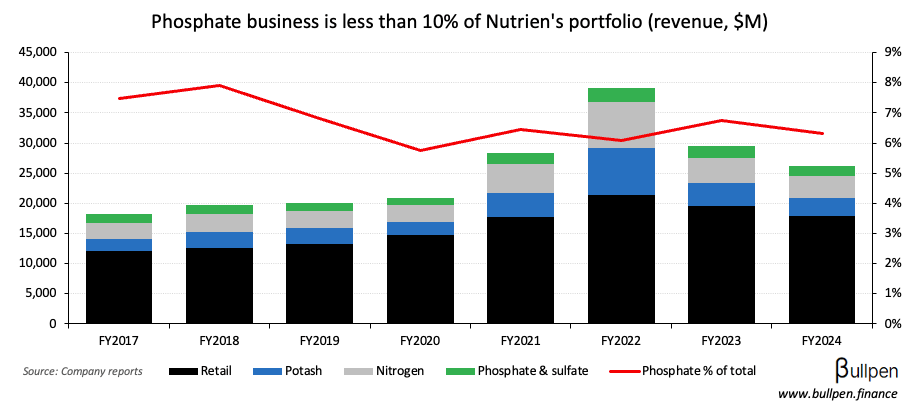

Nutrien (NTR) was up 3% on a Q3 beat but the results weren’t the story, with management running a process on its phosphate business. Given the segment is only ~6% of NTR’s top line…

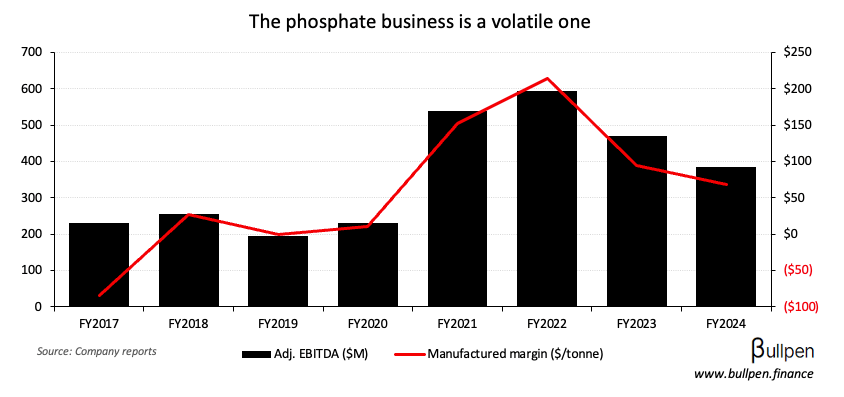

… and has been historically lumpy, a sale would reduce margin volatility…

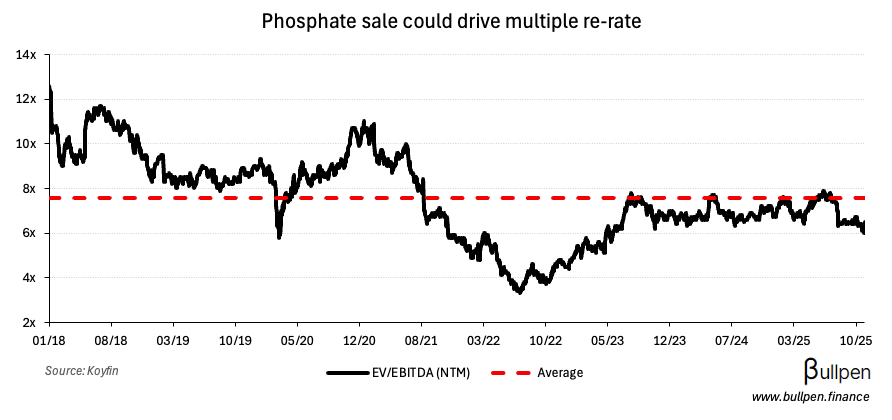

… and follow a series of streamlining initiatives including the wind down of its nitrogen ops in Trinidad and $600M Profertil sale. If a deal lines up with the 6-7x multiple NTR currently trades at…

… it would put another ~$2.5B in Nutrien’s pocket - let’s see.