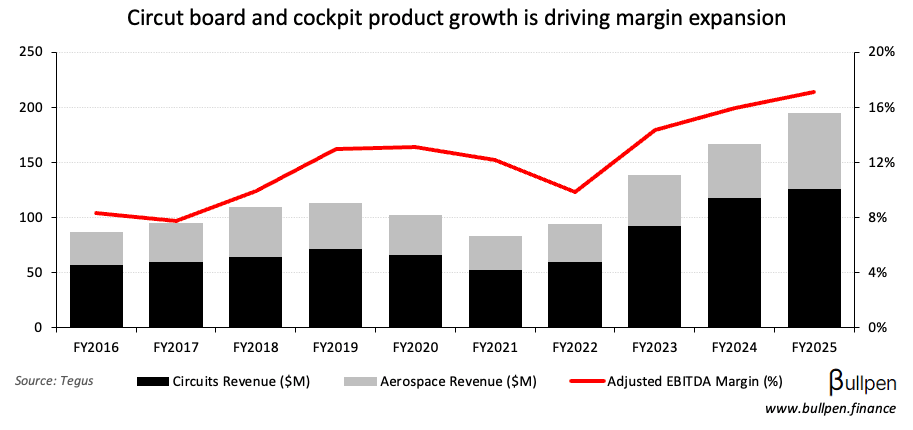

Firan Technology (FTG) added another 7% on its Q4 print, which beat on the top line and missed on EPS. The trajectory remains up and to the right, with management highlighting strong demand…

… across its business jet, aerospace, and defence markets - driving steady margin expansion and backlog growth in recent years.

There’s no question about the attractiveness of FTG’s fundamental setup, but with the stock trading above 12x NTM EBITDA (double the long-term average)…

… the next leg higher should be a slow grind relative to the three-year, >500% run in the stock.