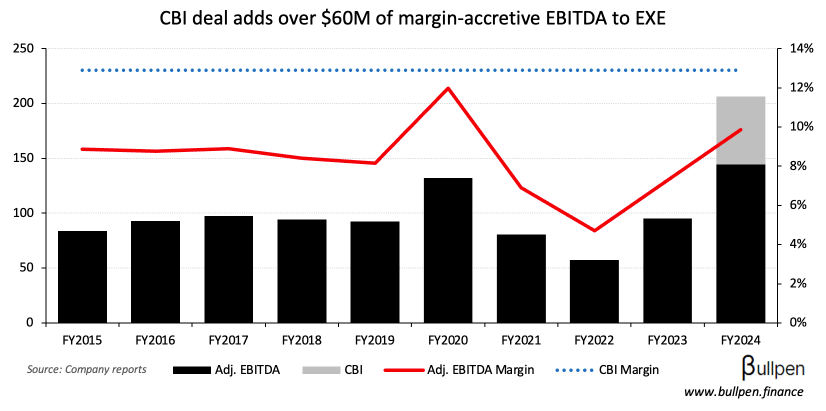

Extendicare (EXE) announced a splashy $570M acquisition of CBI Home Health, adding $62M of EBITDA at better economics than its base business…

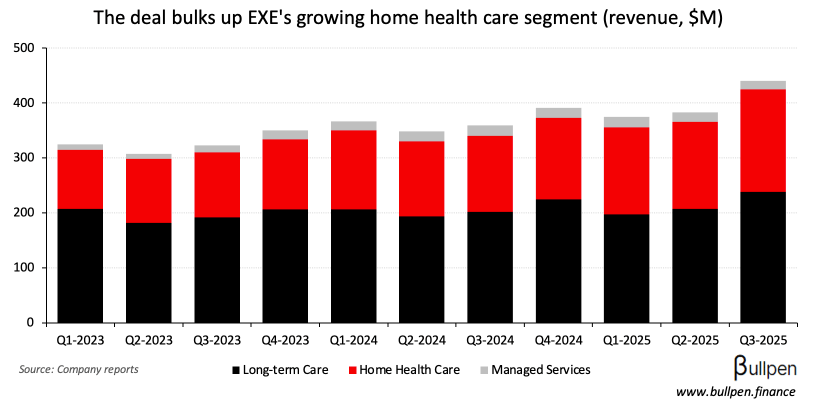

… and showing continued execution of its home health care M&A pipeline, after buying Closing the Gap for $75M in Q3.

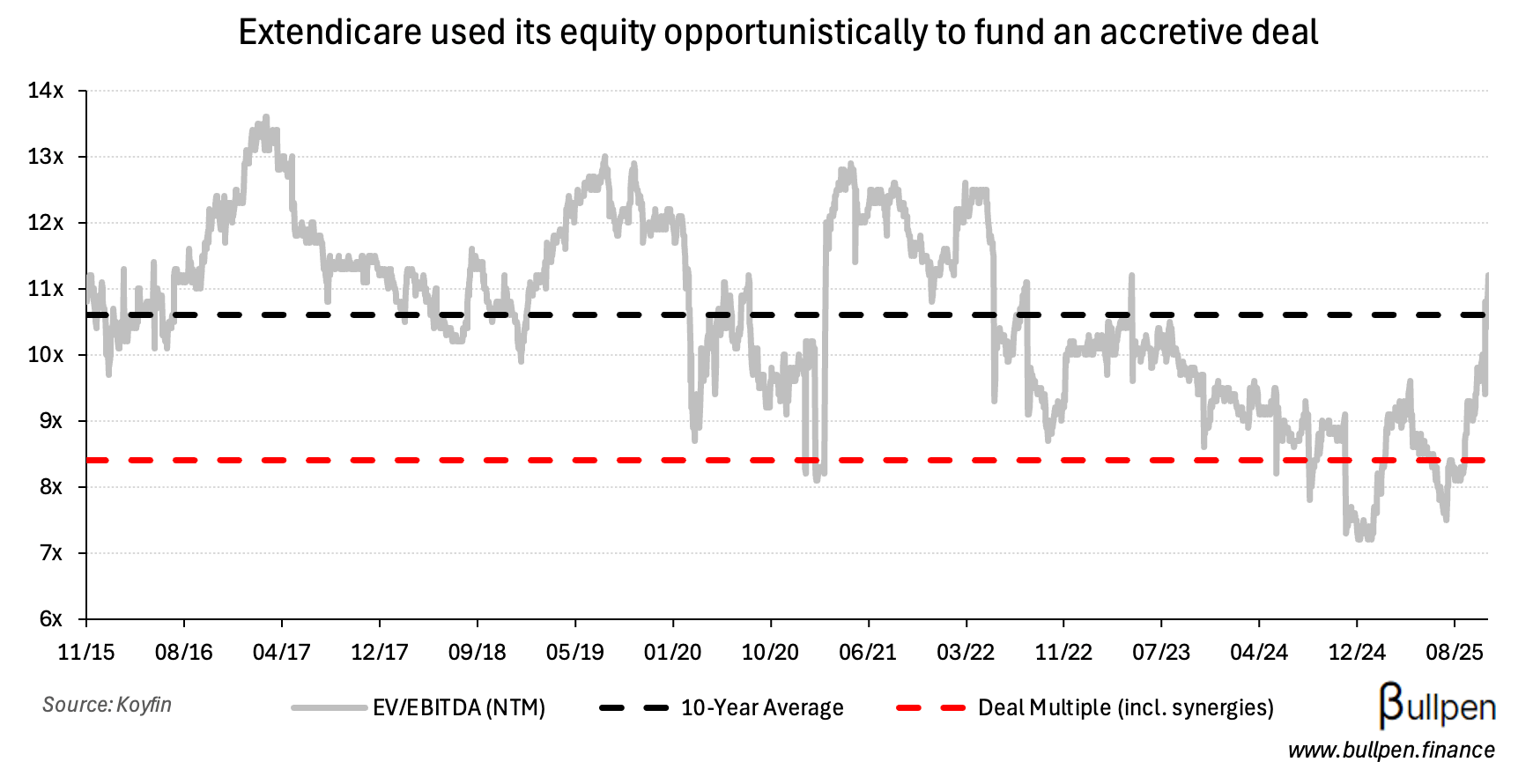

Including ~$7M of synergies, the deal math checks out at 8.4x EBITDA - well below current trading which allows EXE to fund $200M of the bid by raising equity…

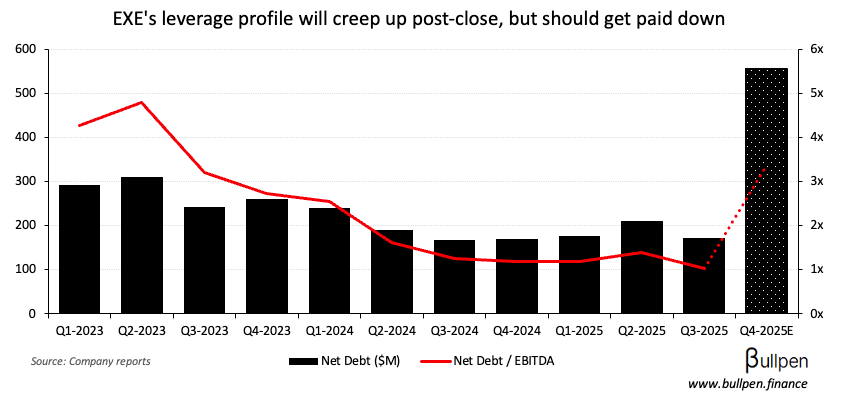

… and taking on additional debt for the rest, with management pointing to pro-forma leverage of 3.3x that should be paid down in short order…

… opening the door for more activity.

We continue to see M&A as an opportunity to augment our strong organic growth, particularly where there is an opportunity to diversify service mix and geography.