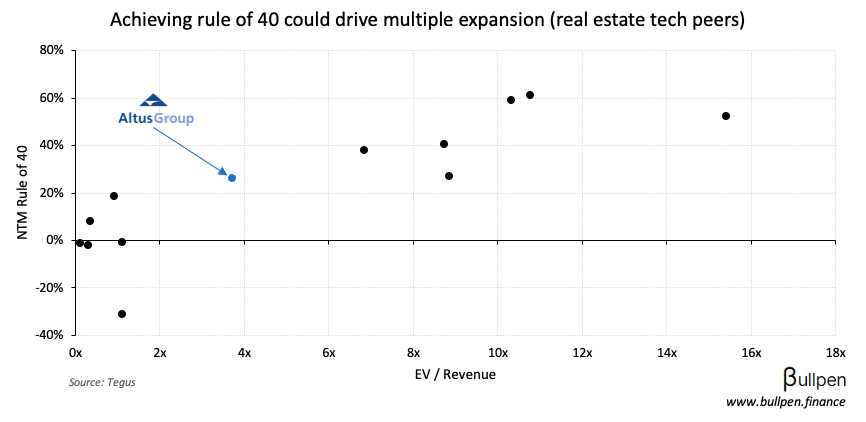

Altus Group (AIF) jumped 5% on its investor day, where the company unveiled a plan to join the rule of 40 club by the end of 2027…

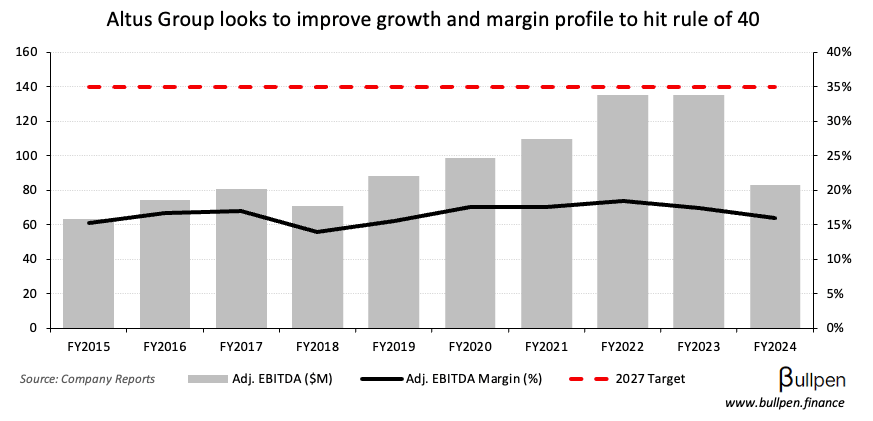

… by pulling top-line growth and EBITDA margins above 8% and 35% from 2% and 18%, respectively. The new targets are ambitious…

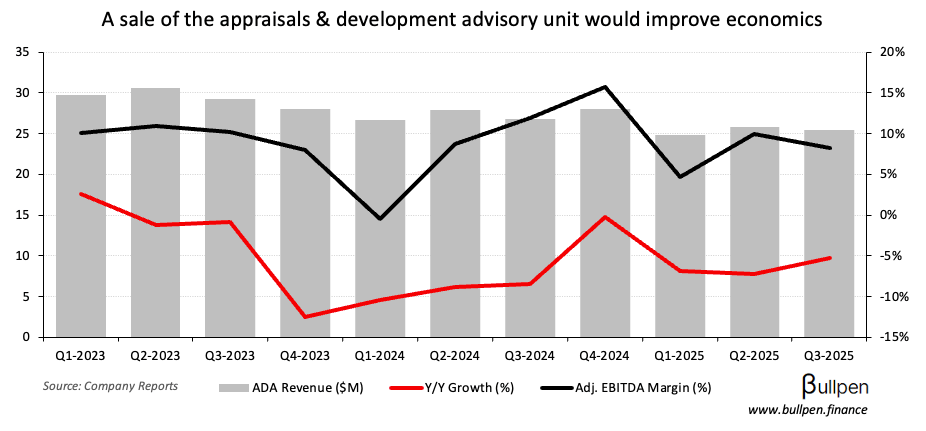

… but should look more achievable after the sale of its appraisals (signed LOI), development advisory, and select analytics businesses - units that weighed on Q3 results and management views as non-core.

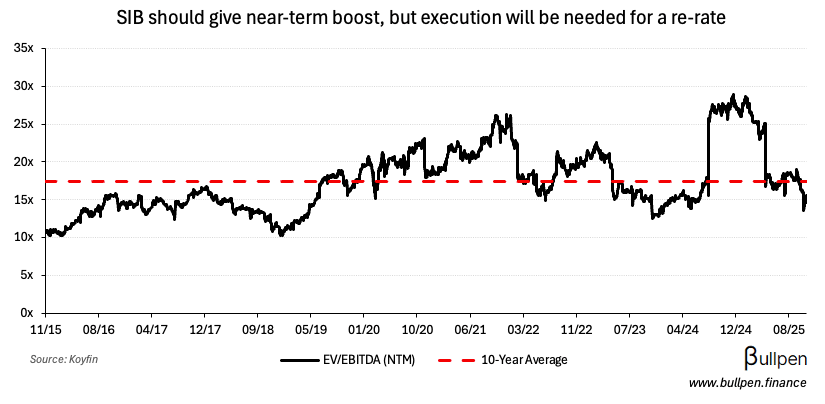

While the sales could be catalysts, today’s rally was likely driven by the company’s planned $350M substantial issuer bid. Priced in the $50-57 per share range, the SIB sets a near-term floor on AIF…

… but after that’s filled, attention turns back to execution. If shares don’t react to fundamental improvement, private equity might take a swing - given the growth → profitability transition is their sweet spot.