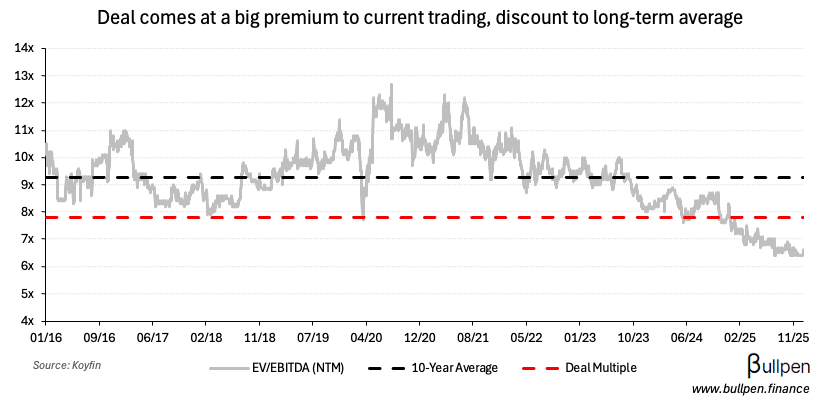

After a >30% drawdown over the last three years, GDI Integrated Facility Services (GDI) is going private in an ~$860M transaction led by Birch Hill. The $36.60/share price tag equates to just under 8x NTM EBITDA, a 25% premium to last close…

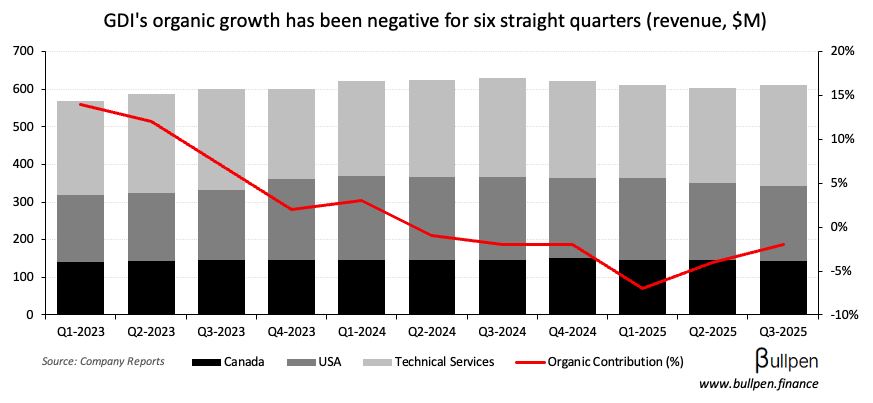

… but over a full turn below its long-term average multiple, driven by six straight quarters of negative organic growth…

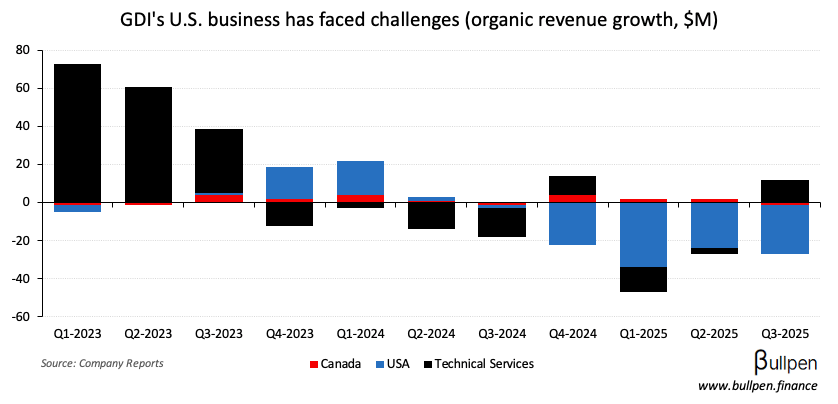

… caused mainly by a 75% reduction in a large U.S. contract beginning in 2024.

With the current CEO retaining his position/stake and Birch Hill’s track record of monetizing take-privates via IPO (like Sleep Country), it might not be the last time we see GDI in public markets.