|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Employment beats on full-time gains

Building permits come up short

China offers a tariff truce

Brookfield invests $8B in two deals

HOT OFF THE PRESS

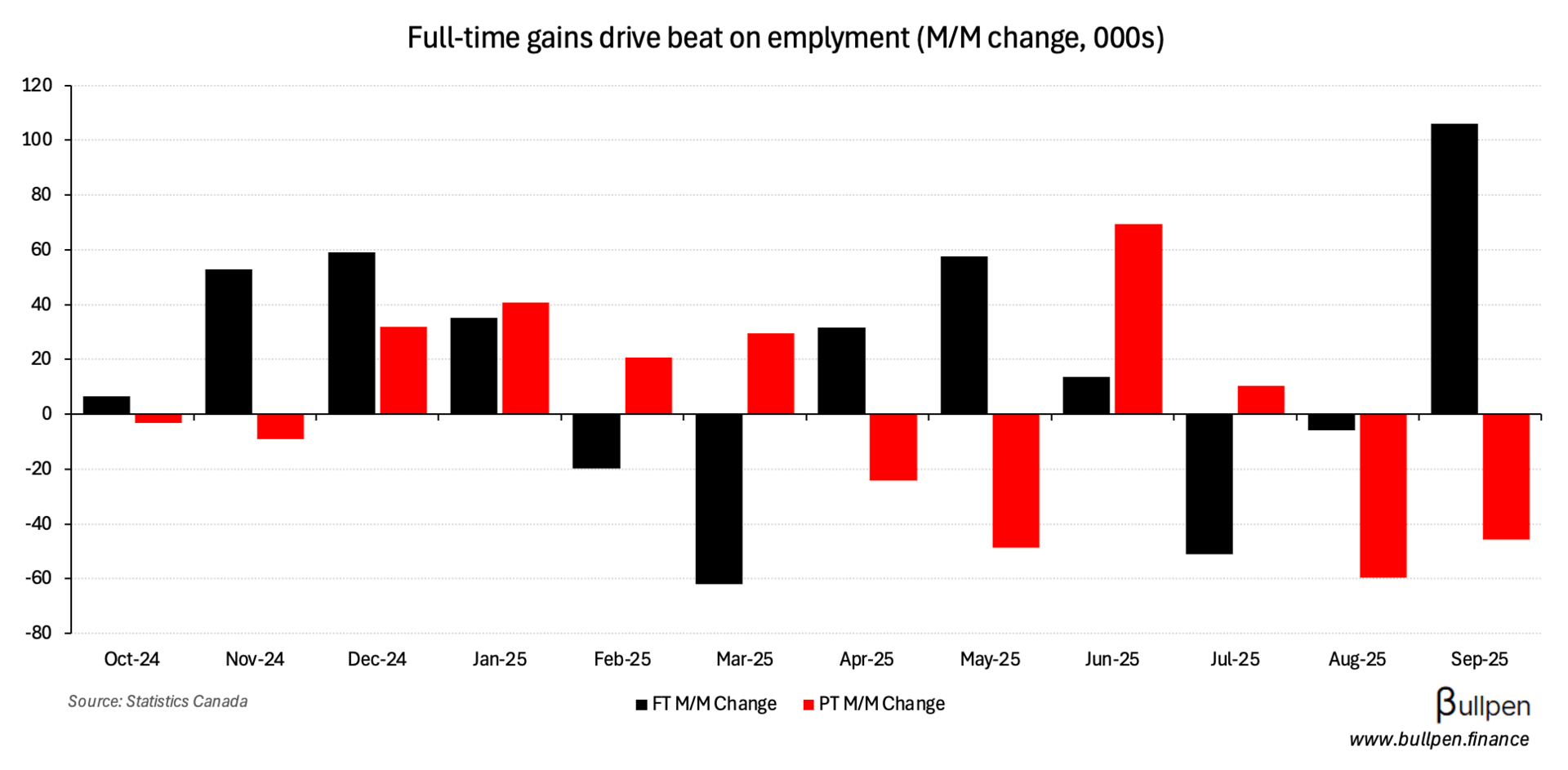

Full-time gains drive unemployment beat

The unemployment rate held steady at 7.1% in September, beating estimates for an increase to 7.2%…

… thanks to over 100K full-time adds, more than offsetting continued softness in part-time employment - which dropped ~50K jobs after a 60K decline in August.

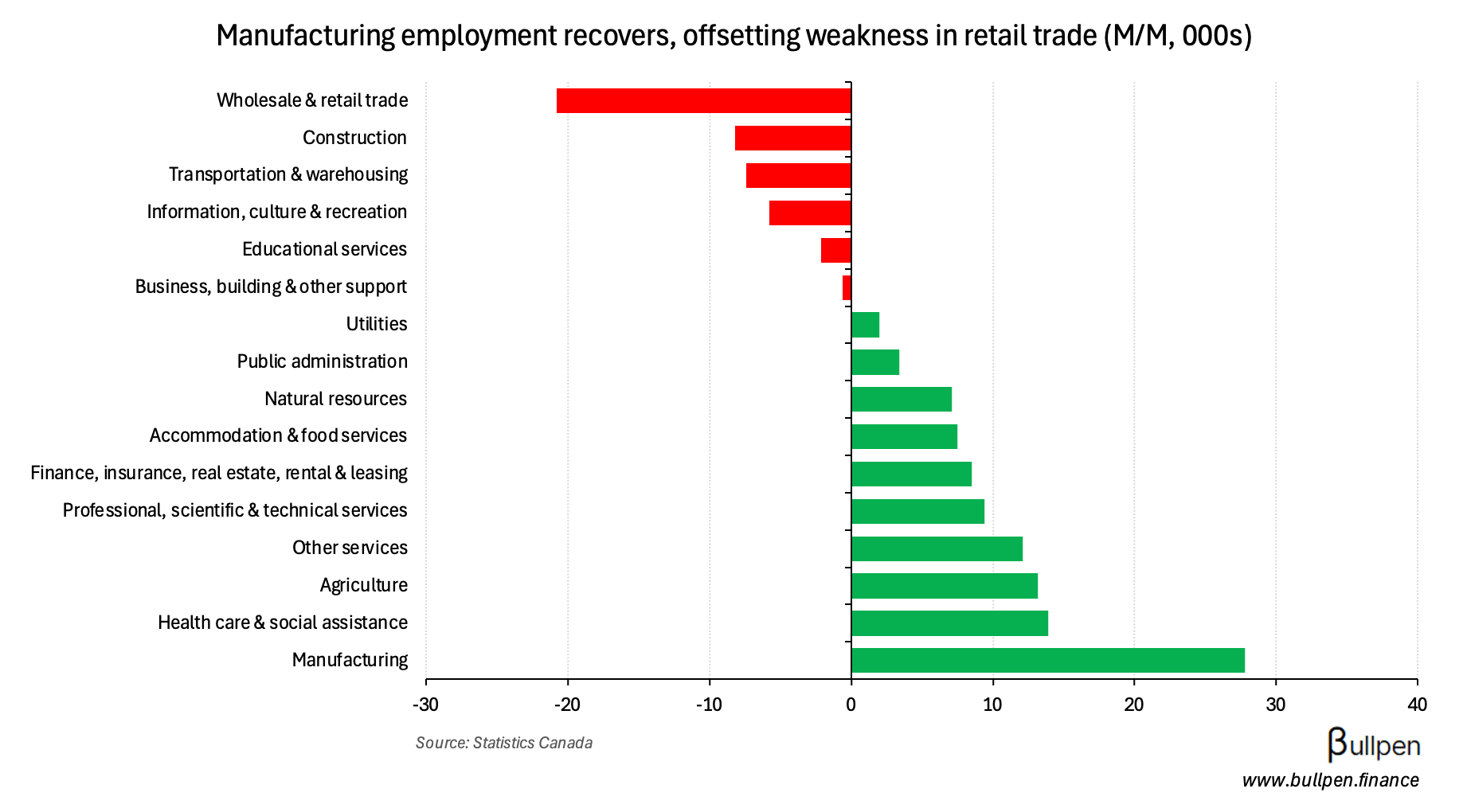

Results were mixed at the industry level, with weakness in retail trade carried by strength in manufacturing - a result we highlighted as likely in the Ivey PMI print…

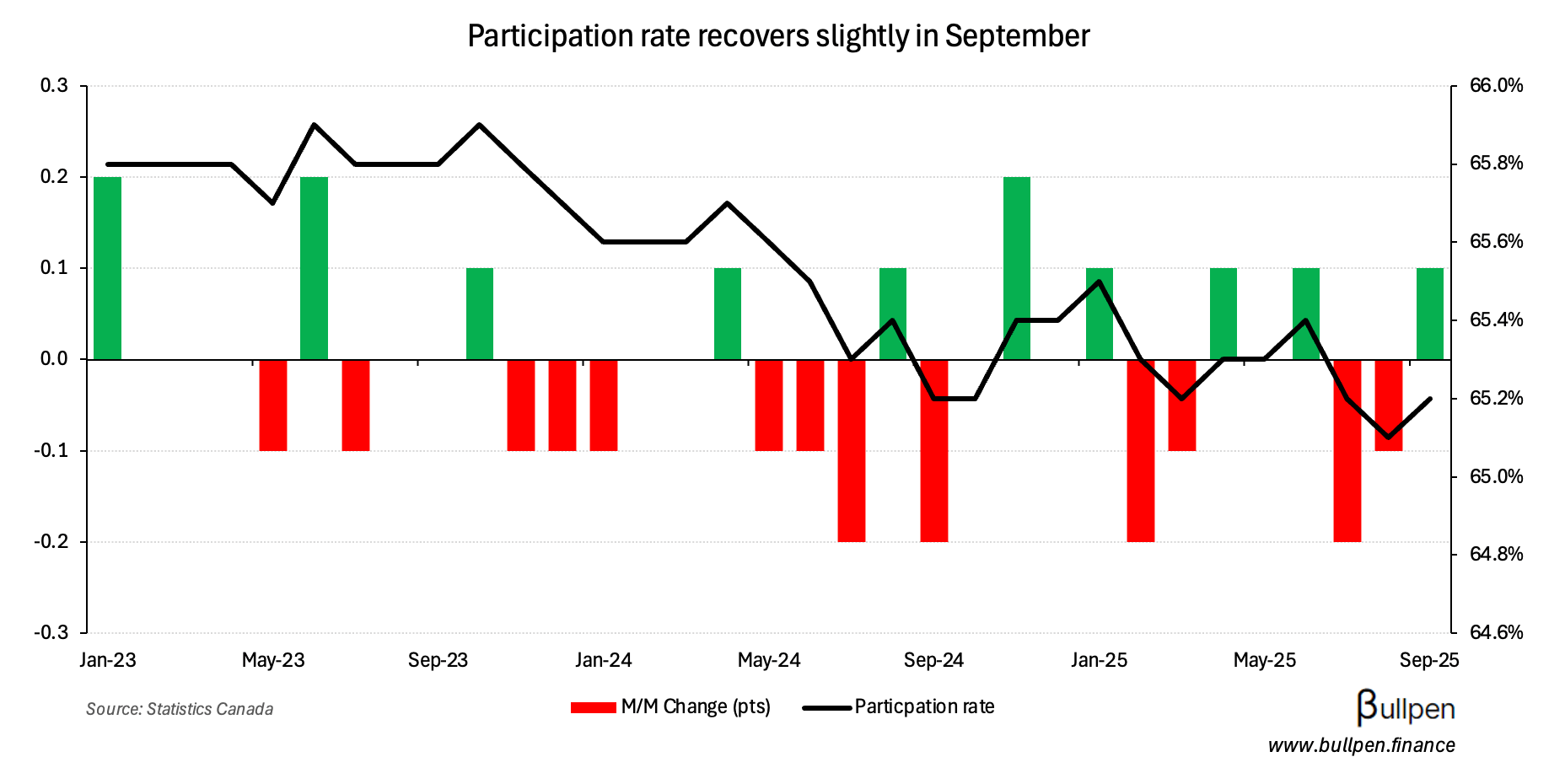

… and one that’s encouraging to see, given the amount of job loss we’ve seen in the industry this year. The employment gain didn’t result in a lower unemployment rate due to a rise in workforce participation…

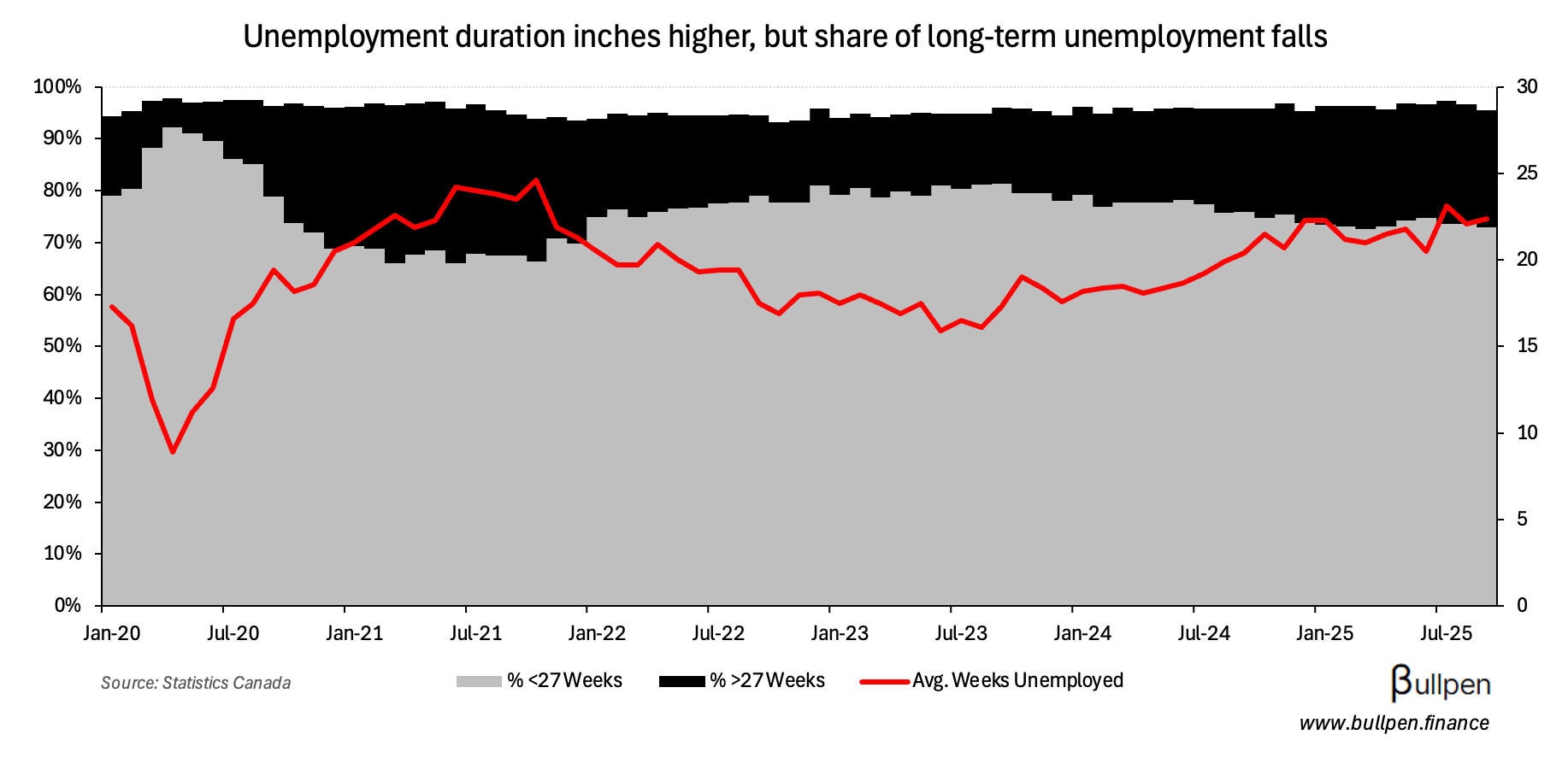

… which rebounded after contractions in the prior two months. For a sustained recovery, we’ll need to see higher job vacancies and lower unemployment duration.

Residential activity hits building permits

Building permits fell 1.2% to $11.6B in August, coming up weaker than expectations for a 0.1% decline…

… on the back of residential construction intentions, which fell more than 2% driven mainly by Ontario (down $433M) and Alberta (down $311M) - which tracks to the recent housing start data in those provinces.

Non-residential permitting was the bright spot, inching nearly 1% higher despite drawdowns in both commercial and industrial activity - thanks to a $235M institutional gain linked to hospital construction in the GTA.

China offers tariff truce

China’s made the strategic aim of its recent 75% canola seed tariffs clear, offering to drop them in exchange for the removal of Canada’s import tax on Chinese EVs. While that seems reasonable, given China’s importance as an end market…

… and the impact on producer profitability the tariffs have already had…

… it’s not that simple, as a resolution would mean breaking from U.S. policy - stirring the pot with a country that’s far more important to our auto trade than China. With the category accounting for >10% of total trade…

… Carney’s incentivized to keep it running smoothly, especially considering Ontario and Quebec own the lion’s share of it.

Bottom line: not an easy fix. If I had to guess, I assume Carney will use it as a bargaining chip in upcoming negotiations and find some other way to make the western provinces whole. Let’s see.

FUNNY BUSINESS

The above is especially sensitive given recent China/U.S. trade escalations - including rare earth export controls, 100% tariffs, export controls on software, port fees, cooking oil, and god knows what else.

With Trump and Xi set to meet at APEC in a couple weeks time, expect turbulence.

ON OUR RADAR

Flagging two big headlines from Brookfield (BAM/BN), who’s deploying up to $8B in two vehicles: $3B for the remaining 26% stake in Oaktree and $5B in a strategic AI infra partnership with Bloom Energy.

The Oaktree deal adds ~$100M to fee-related earnings and brings additional scale to BAM’s leading private credit platform…

… but comes at a time when the strategy is as competitive as ever. Combined with management fee compression on the back of its push into insurance capital…

… it’s possible that Oaktree is timing its exit well.

The deal was when we bought the firm that we would — there was an opportunity for them, the partners to stay in and be owners with us. They also can put to us over time if they want to phase out of the business.

The Bloom deal is more interesting, given it’s BAM’s first investment in its dedicated AI infrastructure strategy - which should come with higher fees…

… and parlay nicely with its investments in power - where a recent $1B hydro deal and big tech framework agreements have made the firm’s strategy abundantly clear:

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Kris Begic | Platinum (PTM) | $278K |

| Robert Cross | Standard Lithium (SLI) | $479K |

| Rex McLennan | Endeavour (EDR) | $310K |

| Kim Chiu | Strathcona (SCR) | $125K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 JPMorgan (JPM) | 5.07 | 4.87 |

| 🇺🇸 Goldman (GS) | 12.20 | 10.60 |

| 🇺🇸 Citigroup (C) | 2.26 | 1.93 |

| 🇺🇸 BlackRock (BLK) | 11.60 | 11.30 |

| 🇺🇸 Wells Fargo (WFC) | 1.73 | 1.54 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇺🇸 Bank of America (BAC) | AM | 0.95 |

| 🇺🇸 Morgan Stanley (MS) | AM | 2.07 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | -1.2% | -0.1% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales M/M | 8:30AM | -1.5% |

| 🇨🇦 Wholesale Sales M/M | 8:30AM | -1.3% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.