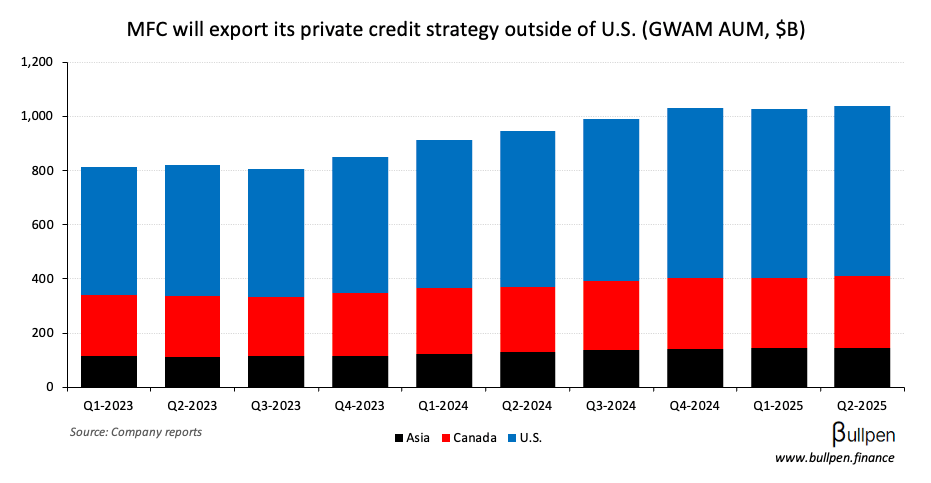

Alongside its earnings results, Manulife (MFC) announced the ~$1.2B acquisition of a 75% stake in Comvest - a U.S. private credit platform with ~$20B of AUM. Compared to MFC’s ~$1T under management, the transaction is small…

… but meaningful in the context of private credit, where MFC only has $5B today. Management likes the category, highlighting expected market runway…

… this is a market that’s expected to double in the next 4 to 5 years in terms of potential opportunity. And if you just look at the track record of Comvest, they’ve grown their fee earning AUM by a CAGR of 50% since 2020.

… and distribution synergies across MFC’s global footprint as factors supporting the continued growth of the strategy.

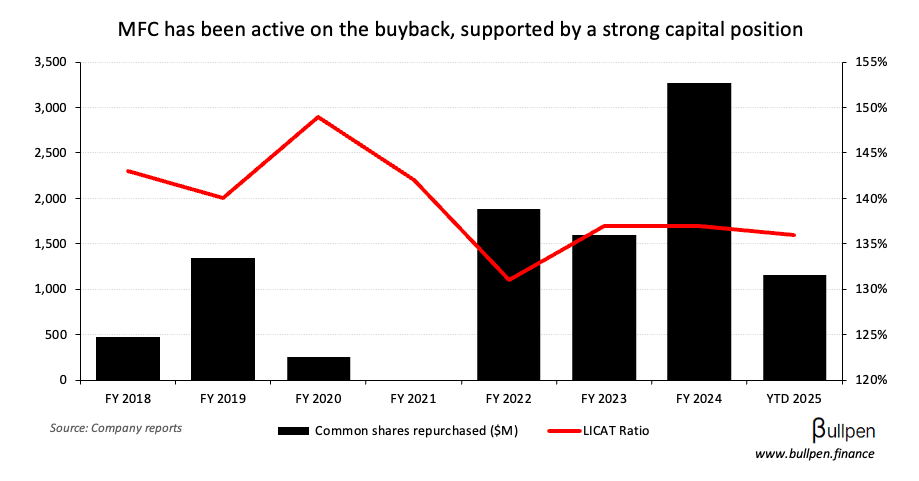

The market seems unconvinced for now, sending the stock down 4% - as sub-1% EPS accretion from the deal likely has investors wondering: why doesn’t Manulife just buy back stock (~2% accretion)?

My take: this is a more defensive acquisition than management is letting on. Private credit is hot and Manulife is late to the party. If clients have to get that exposure elsewhere…

… private credit is a fast-growing and in high demand strategy from our clients.

… the door opens for the new manager to pull additional capital away from Manulife. The deal rationale isn’t near-term accretion, it’s avoiding the longer-term dilution that comes from not meeting client needs.