|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

$6B of capital returns to Canada

Mexico relationship expands in food

Interfor cuts lumber production again

Canaccord weighs UK wealth sale

HOT OFF THE PRESS

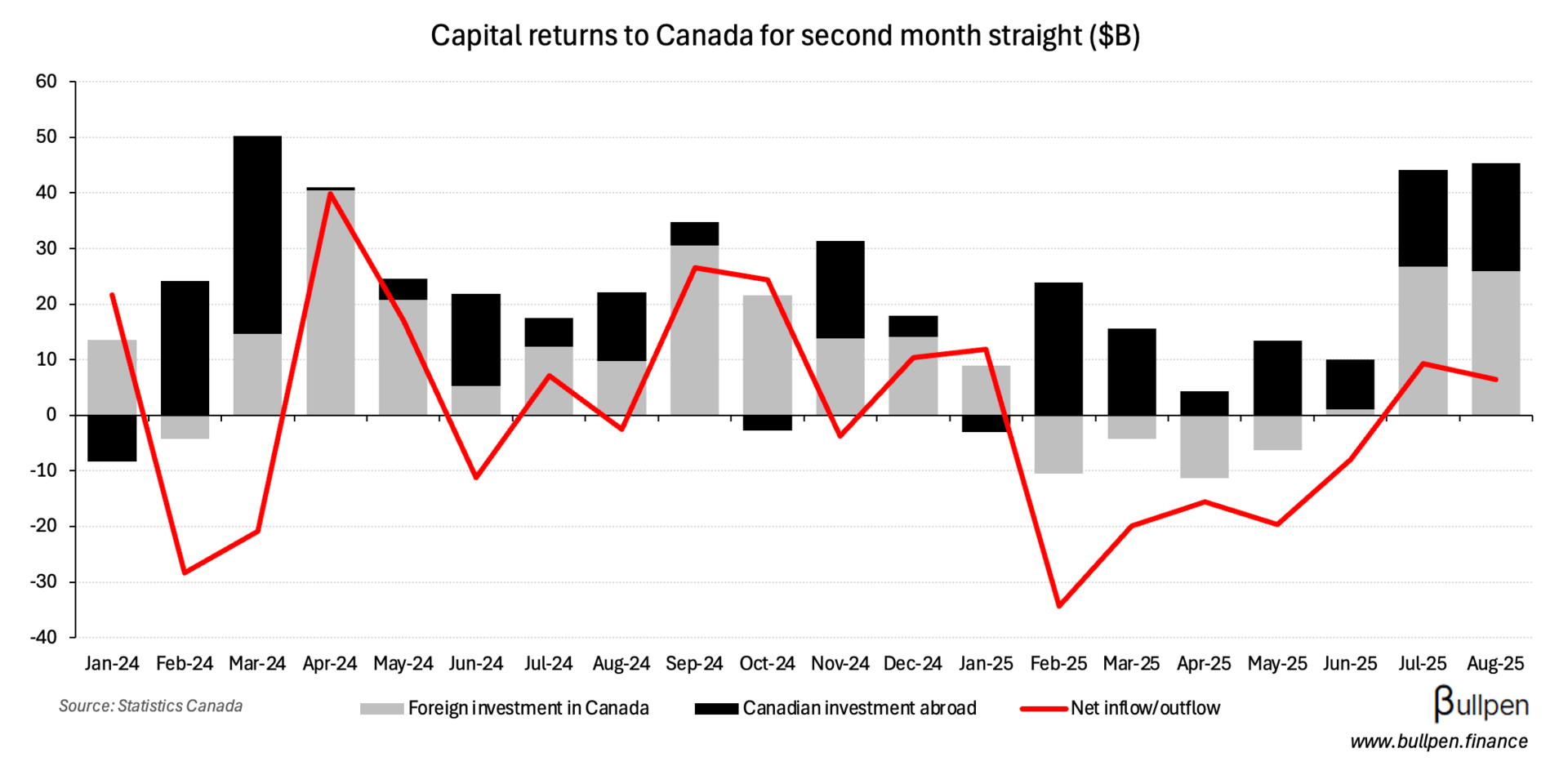

$6B returns to Canada

We had a net inflow of $6B in August, the second straight - with $26B of foreign investment more than offsetting $20B of Canadian investment abroad…

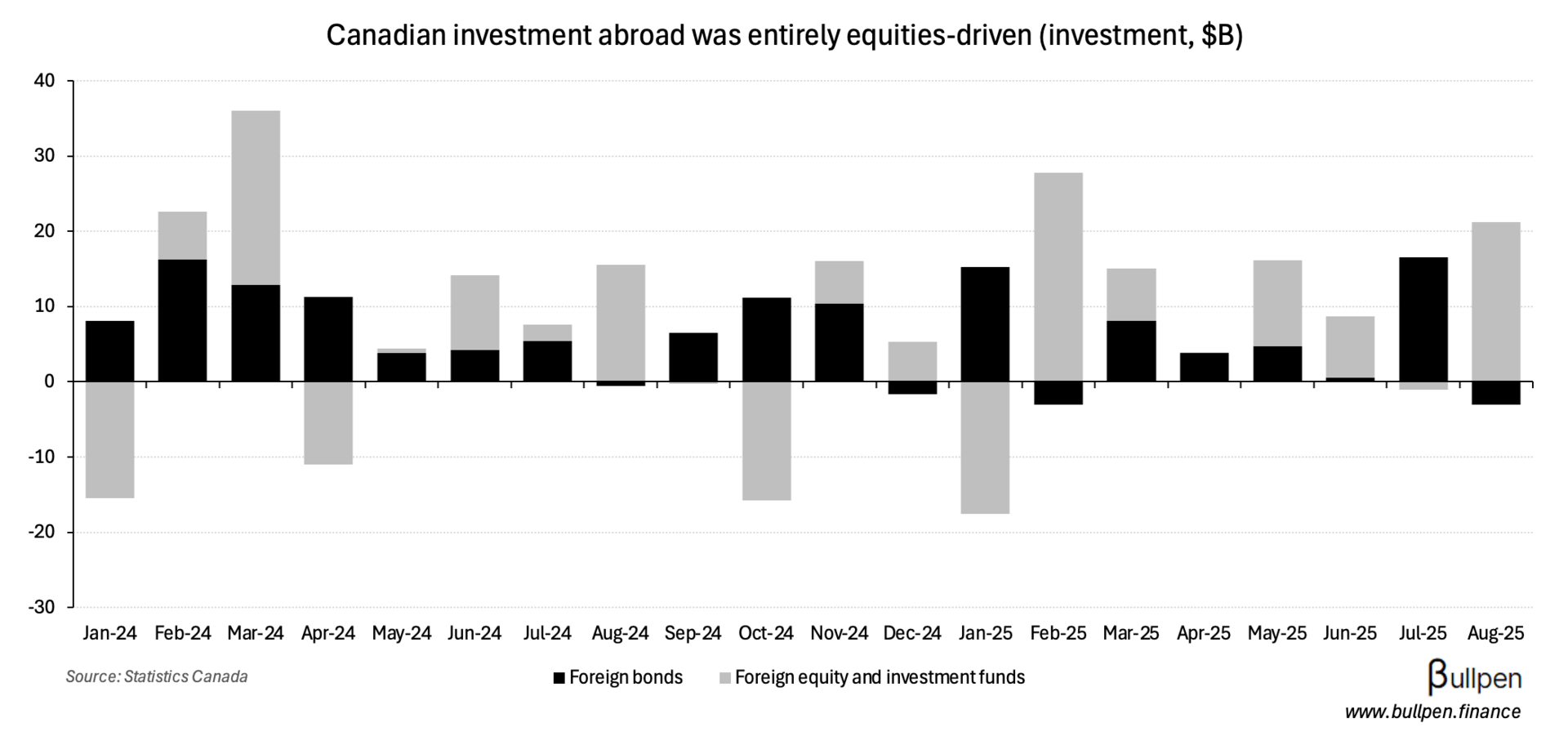

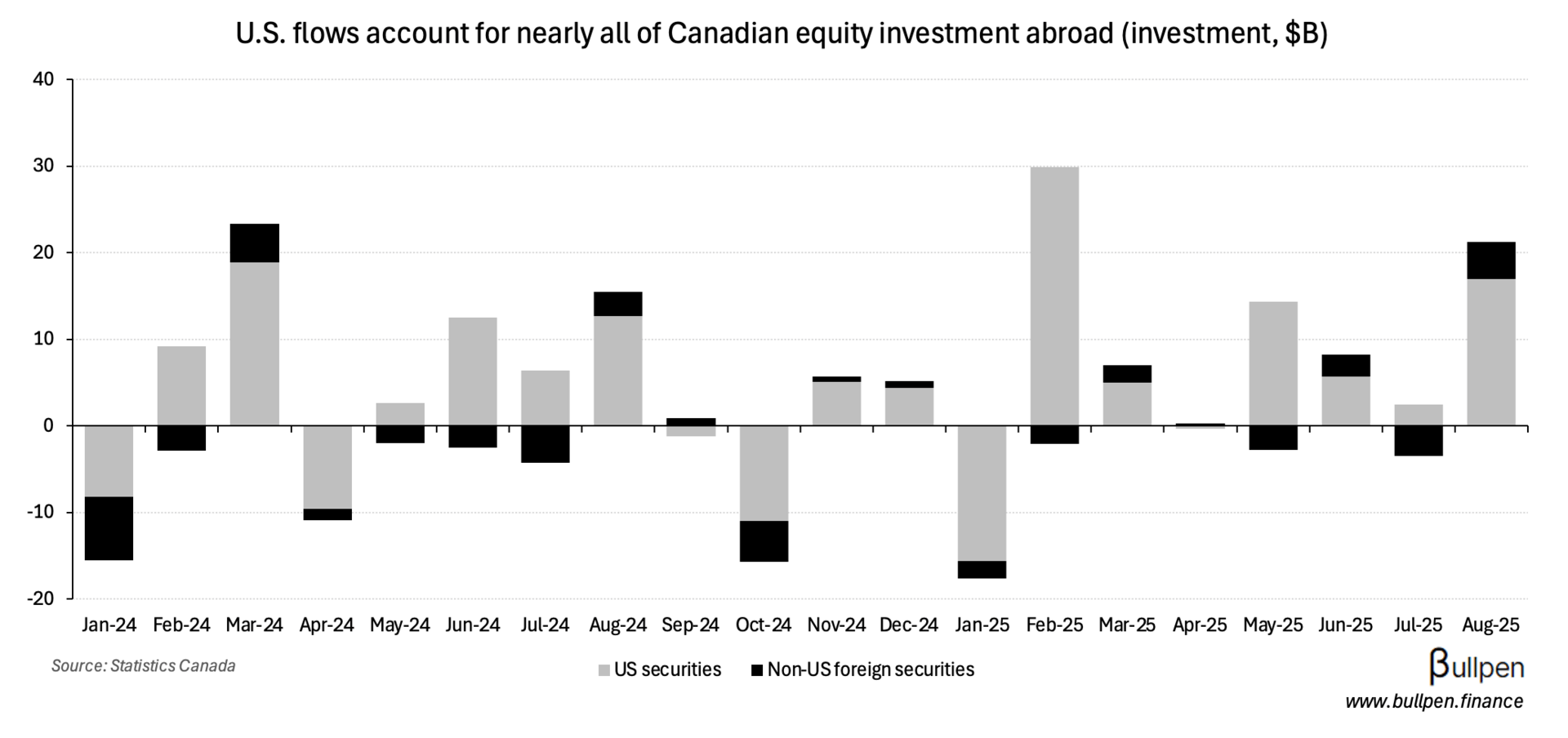

… driven by an additional $21B of foreign equity exposure…

… roughly 80% of which was directed towards U.S. markets.

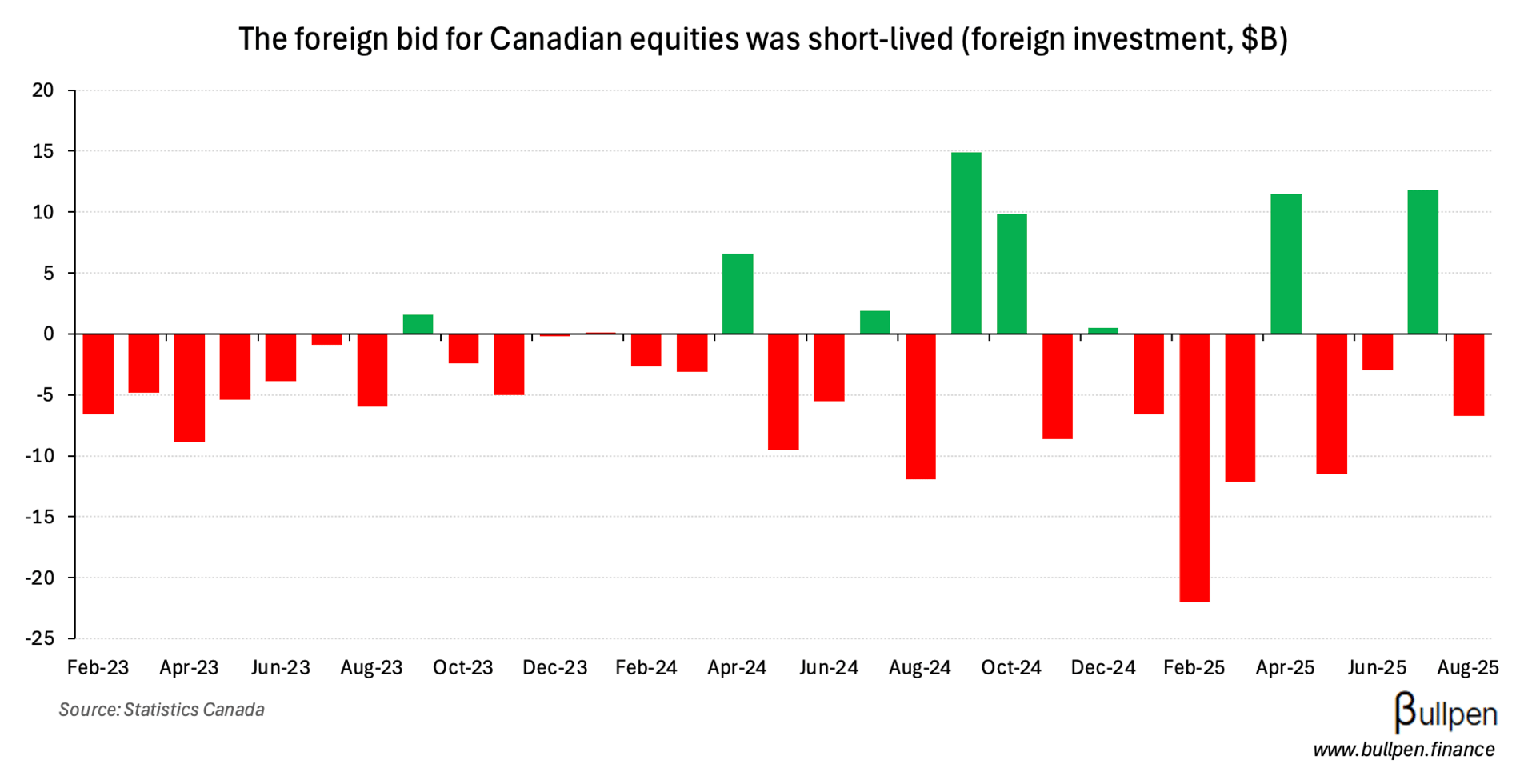

The opposite played out in Canadian markets, with foreign investors dumping $7B of equity exposure…

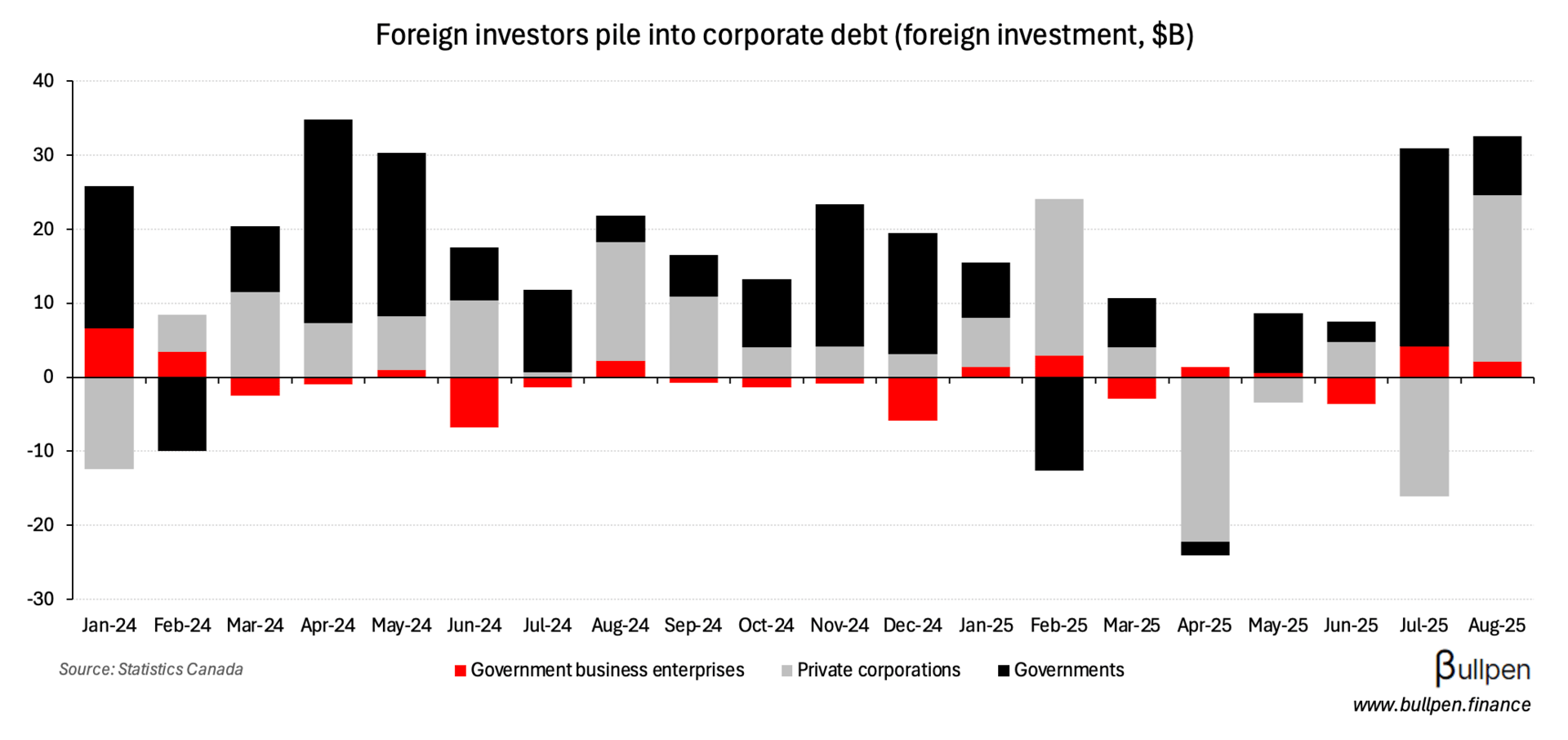

… and adding over $30B of Canadian paper - led by demand for corporate debt.

Agri-food is step one of Mexico expansion

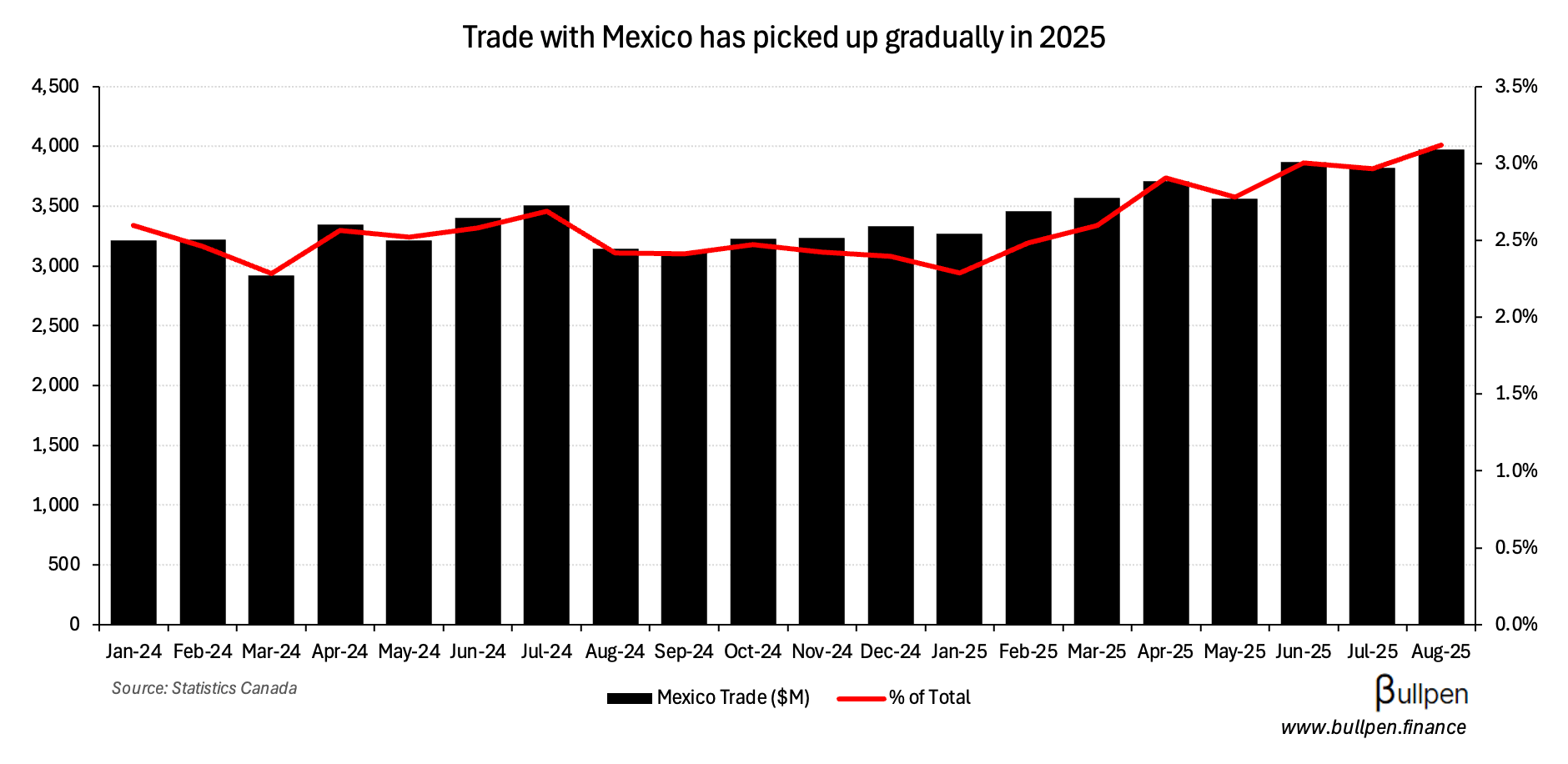

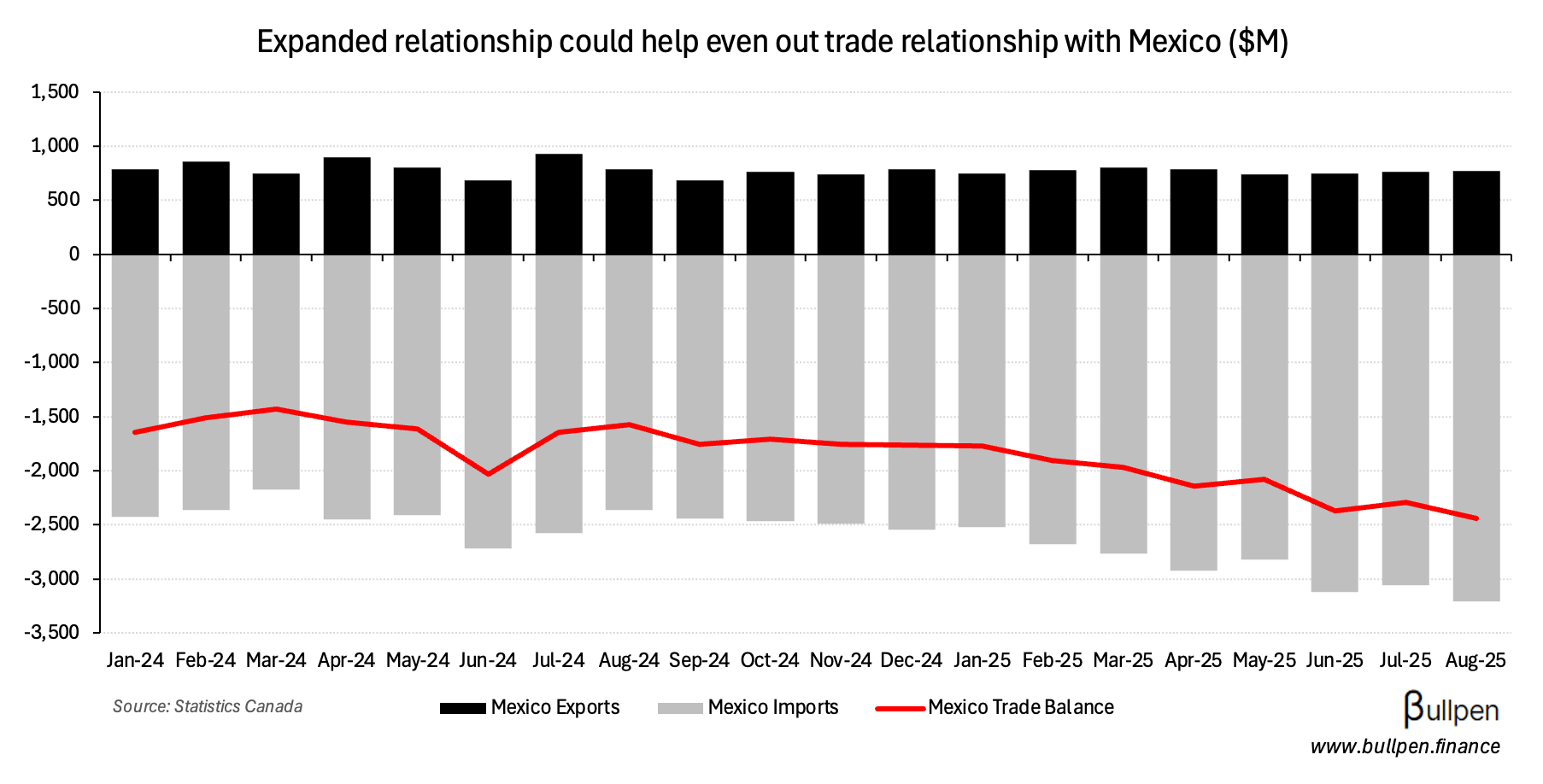

After announcing intentions to grow our relationship with Mexico a month ago, priority number one has been set - expanding our trade in agri-food products. That should drive continued share growth…

… and importantly, reduce the lopsidedness of the current relationship - given Mexico is a big net importer of food.

They’re also a buyer of canola, which could offer marginal relief as we try to sort out the China relationship.

FUNNY BUSINESS

Following fraud at Tricolor and First Brands, we might have another auto bankruptcy…

… with rumours that PrimaLend, who provides financing to auto dealerships, is insolvent. Would be the third in as many weeks… we’re following it closely.

ON OUR RADAR

Major Drilling & Total Energy Services announce NCIBs

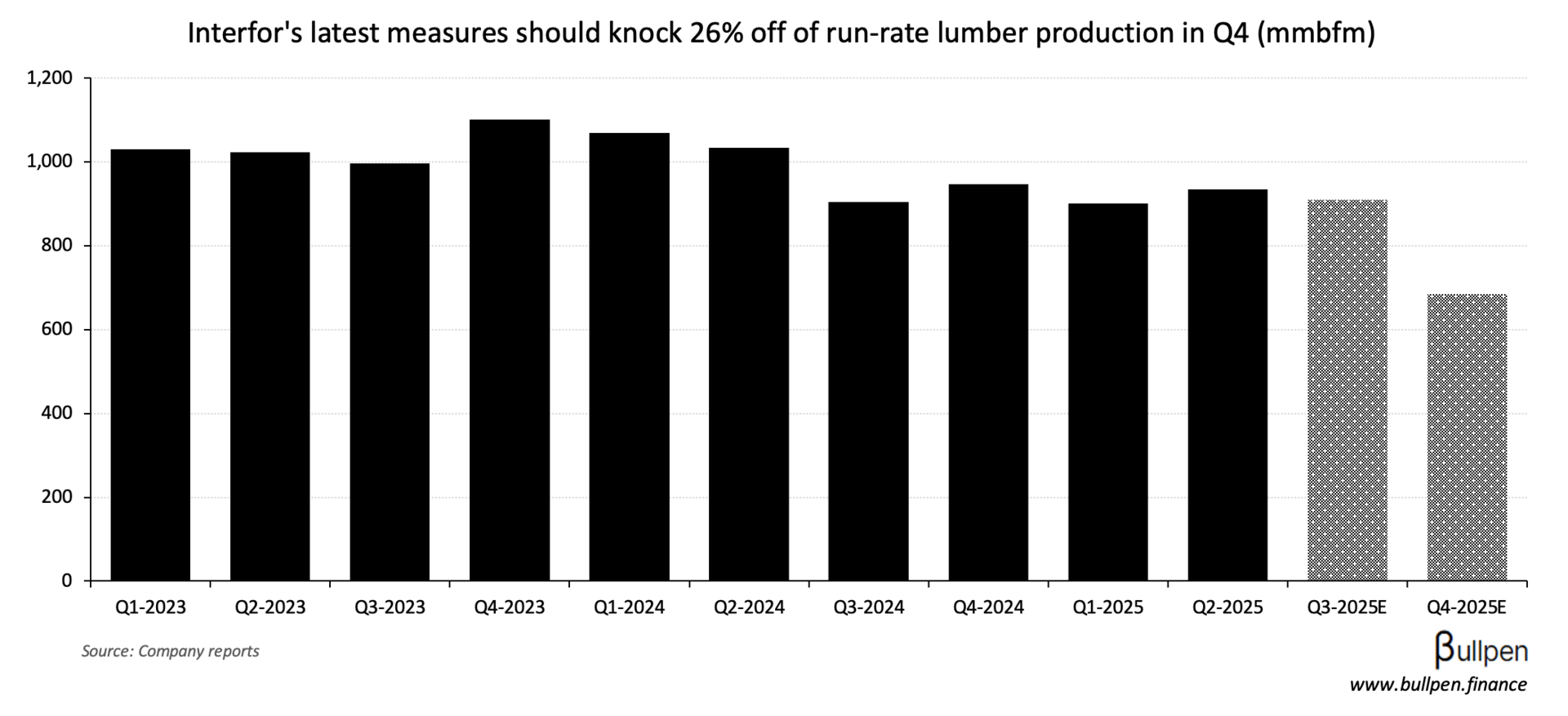

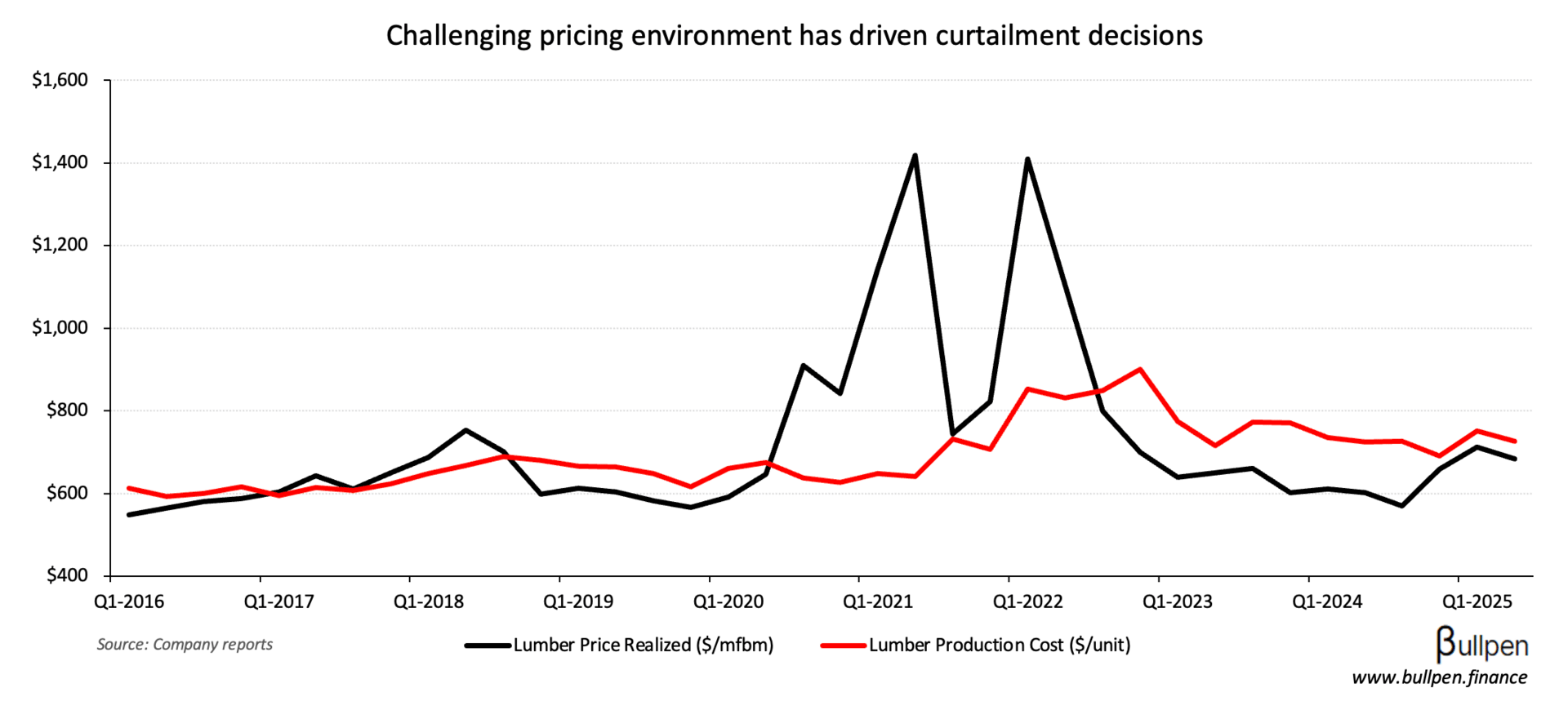

Flagging the second lumber production cut from Interfor (IFP), nearly doubling its original cut and taking its Q4 production down by 250M board feet…

… driven by economic uncertainty and continued weakness in lumber prices.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

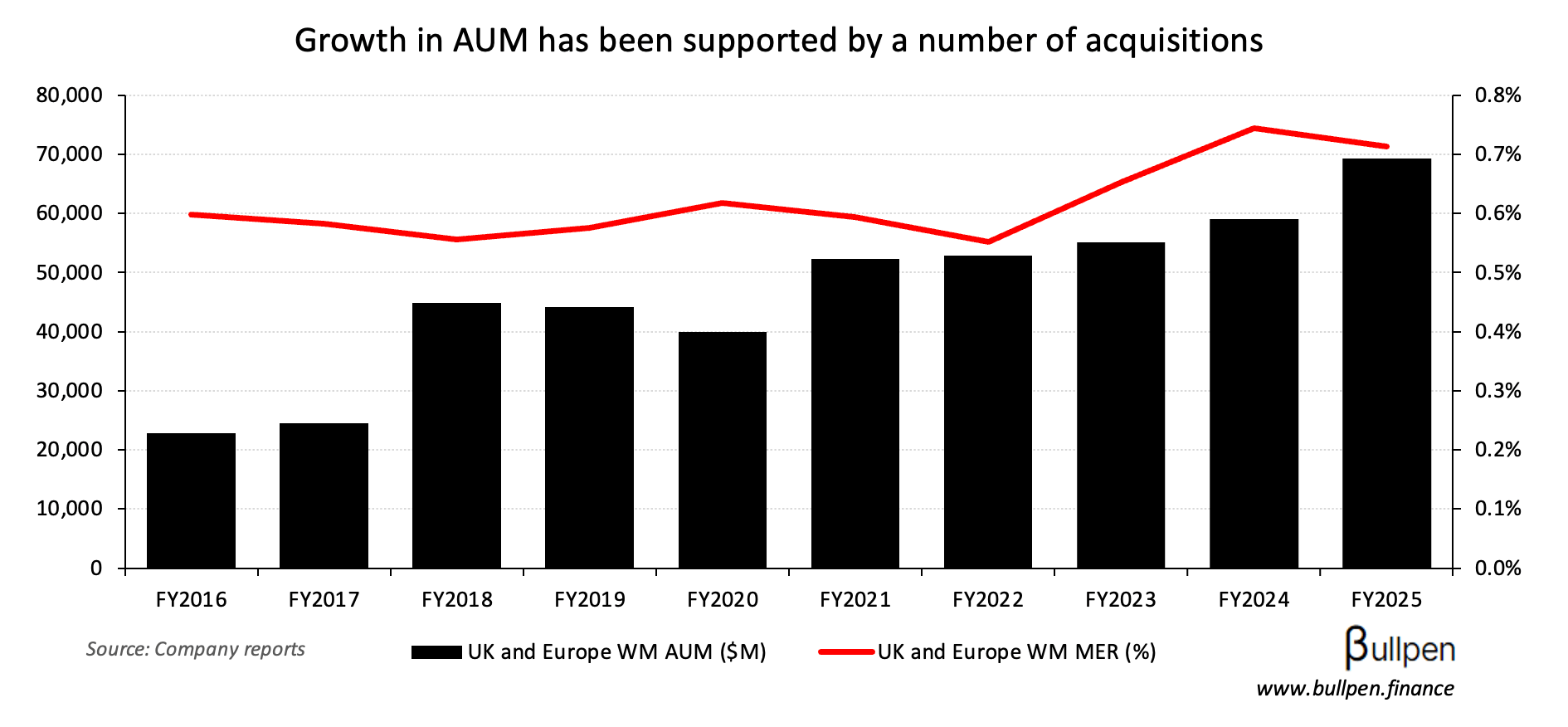

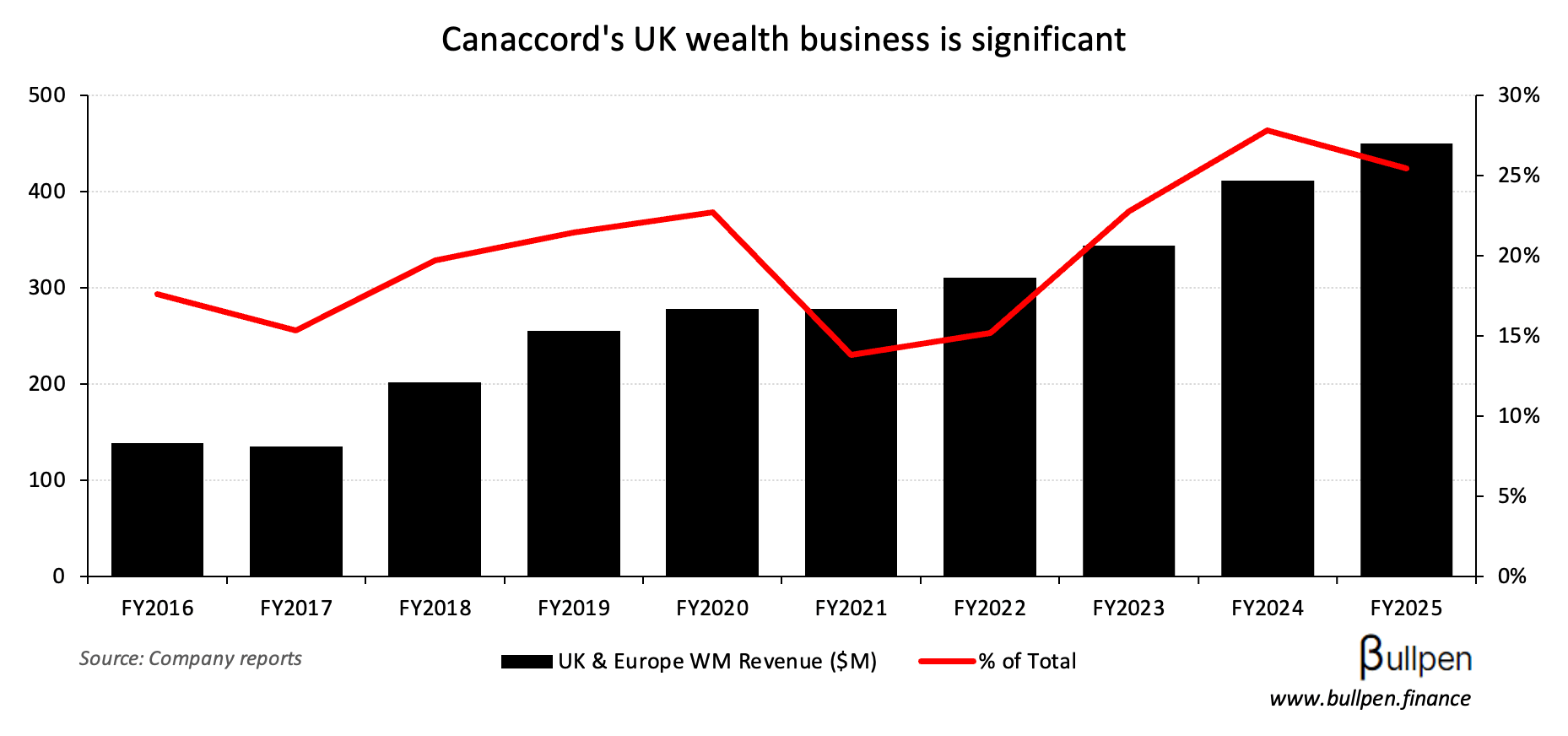

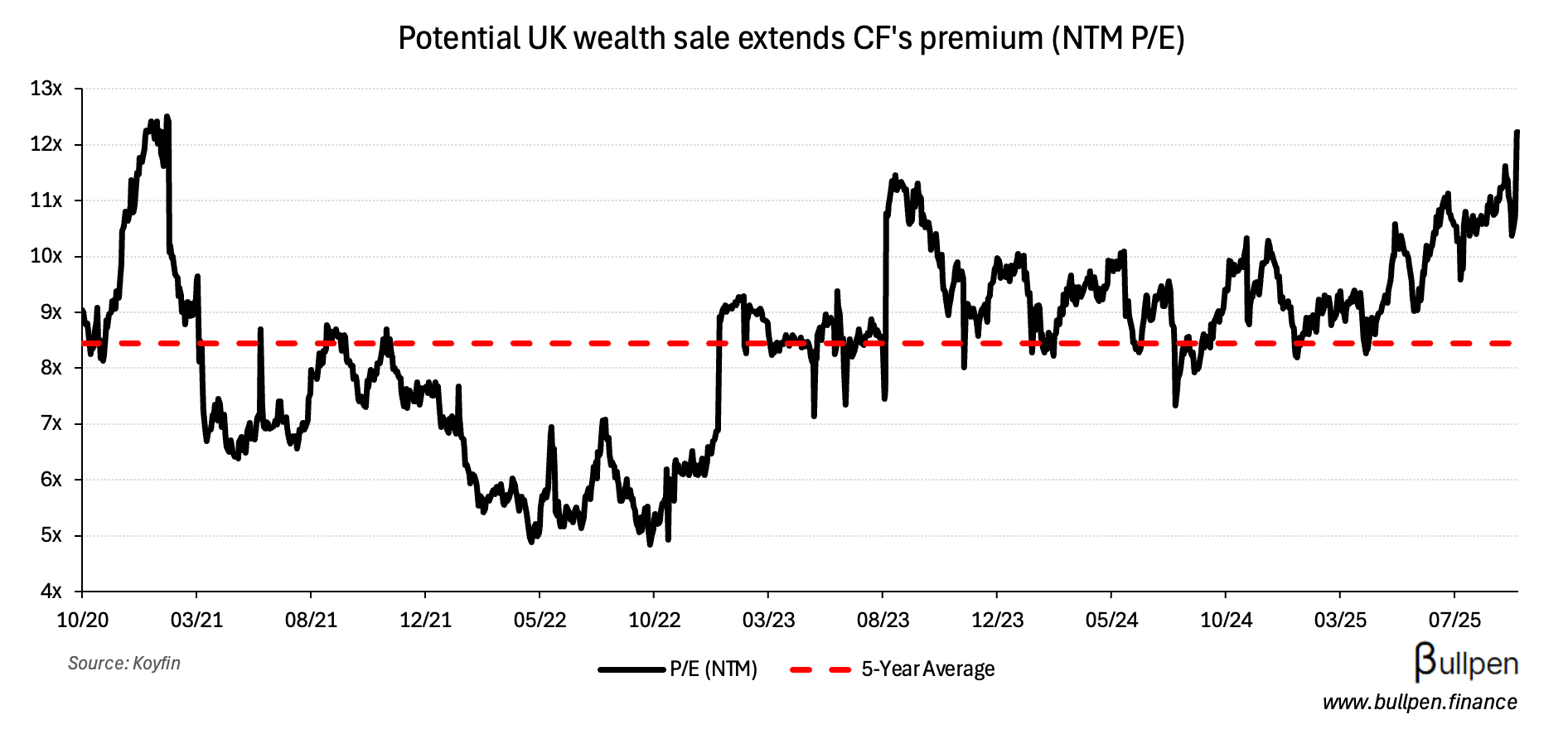

Canaccord Genuity (CF) is rumoured to be weighing the sale of its UK wealth business, sending shares up 14%. Should a deal materialize, it would follow a series of transactions that brought AUM above $70B…

… which if done at a similar multiple to BMO’s $625M Burgundy deal, would put the price tag around £1B - in-line with a 12-16x multiple on last year’s EBITDA. At a quarter of CF’s revenue, the deal would be material…

… but assuming an adequate price, I’d like it. Everybody’s scrambling for scale in the industry, as evidenced by the $1.7B Guardian and $600M Richardson deals. That makes for a great off ramp for anyone not looking to play the same game.

Zigging when the market is zagging, like Strathcona (SCR) with oil and Primaris (PMZ-U) with malls - and with a liquidity preference for CF’s minority partner HPS easing in 2026…

We have an ability to take them out. We have to come up with hundreds of millions of dollars to do that. So that’s a very good option. We could IPO the company. We could sell the company.

… an official deal might not be so far away.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| James Gowans | Trilogy (TMQ) | $1.1M |

| Andrew Brown | B2Gold (BTO) | $221K |

| Sebastien Martel | BRP Inc. (DOO) | $30.7M |

| Christopher Emerson | Pan American (PAAS) | $208K |

| Marcia Smith | Aritzia (ATZ) | $537K |

| Ian Ross | Major Drilling (MDI) | $644K |

| David Fennell | G Mining (GMIN) | $13.2M |

| Ryan Beedie | Oceanic Iron (FEO) | $113K |

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 A&W Food (AW) | 0.62 | 0.58 |

| 🇺🇸 American Express (AXP) | 4.14 | 3.98 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 PrairieSky (PSK) | PM | 0.22 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Foreign Security Buys | 25.9B | 11.6B |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 PPI M/M | 8:30AM | - |

| 🇨🇦 Raw Materials M/M | 8:30AM | - |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.