If Primaris REIT’s (PMZ-U) strategy wasn’t clear two years ago…

But right now, there’s a window of time during which a lot of properties that would have generally as a statement, not have been available for acquisition over the last 20 years that are available today and so we’re really focused on acquiring these scarce and highly attractive market-leading shopping centers.

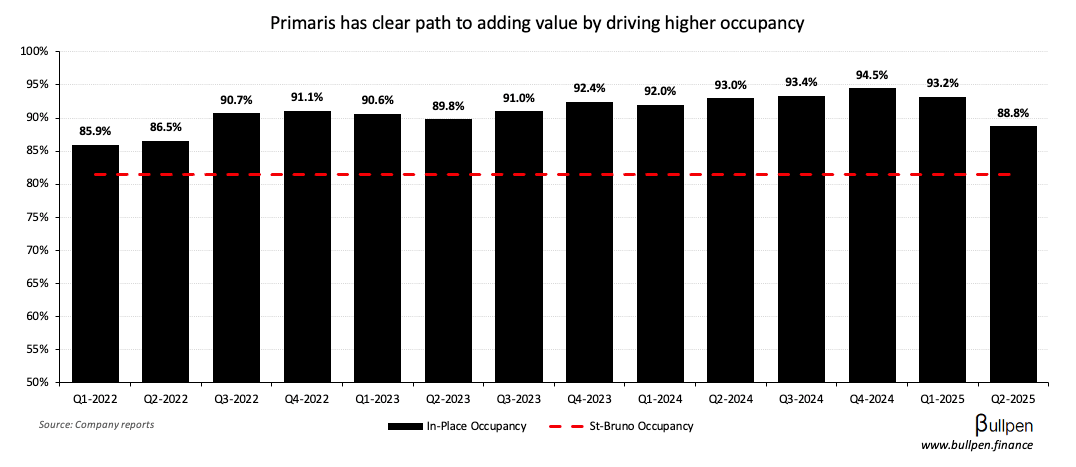

… it sure as hell is clear now, with the company buying Cadillac Fairview’s St-Bruno Mall for $565M ($320M cash, $245M equity) - a deal that looks exactly like its $400M Lime Ridge Mall buy in June. The new asset has low occupancy…

… driven by the HBC bankruptcy - an event management argues is value accretive in the medium to long-term. I tend to agree, given HBC was worse on rent than the friend you let crash on your couch for “just a week”…

… but it’ll take time and money to play out - with a 3-year, $150M plan to repurpose or re-lease the space. The market doesn’t love the ~$150M bought deal that came in addition to the deal financing, but think longer term. PMZ is upgrading its portfolio…

… at a time when retail sales are choppy and pensions want out of malls - better than buying in a hot market. With most of Cadillac Fairview’s remaining 14 malls presenting the same “HBC opportunity”, PMZ might not be done yet.