Desjardins is taking Guardian Capital (GCG) off the market in a ~$1.7B deal, growing its platform to $280B of client assets for a hefty 60% premium - as the race to consolidate capital heats up.

The transaction comes a year after Guardian acquired Sterling Capital for ~$100M, boosting its institutional and retail footprint…

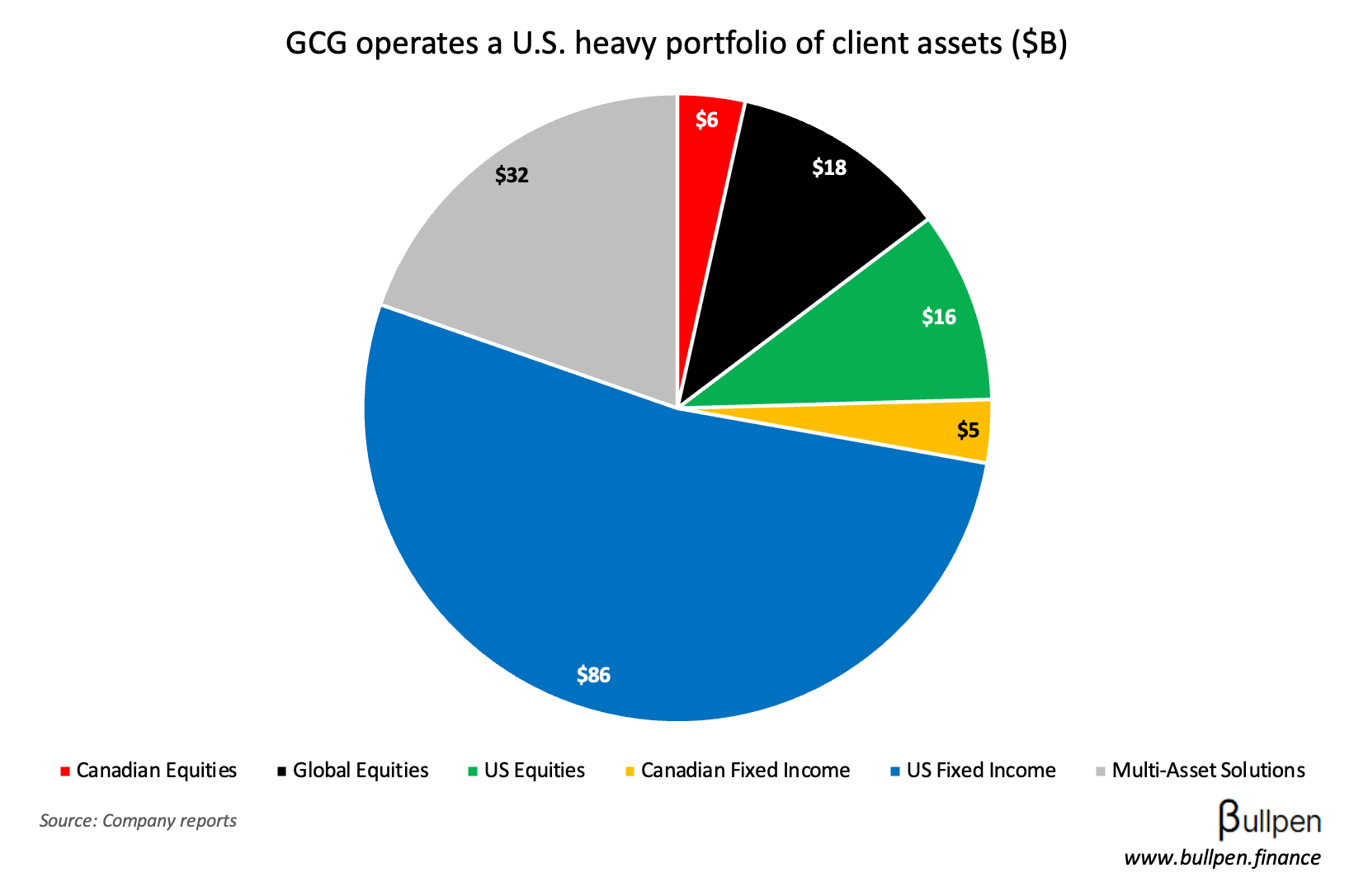

… as well as its U.S. exposure - a key part of the deal for Desjardins, who’s looking to accelerate its global expansion.

Wealth/asset management deals are hitting the wire like clockwork, with iA Financial’s $600M takeout of Richardson Wealth a month ago and BMO’s $625M Burgundy acquisition a month before that. This is a scale game - let’s see who’s next.