|

|

||||

|

|

||||

|

|

||||

|

|

With Family Day Monday, I’ll be back in your inbox Wednesday. Enjoy the long weekend!

WHAT'S ON TAP

Trump to ease steel & aluminum tax

Building permits beat estimates

Bombardier closes $1.2B jet order

SAP sells Argentina stake for $540M

Engineering names wipe out >$5B

HOT OFF THE PRESS

Trump to ease steel & aluminum tariffs

Late last night the Financial Times reported that Trump plans to relax his 50% tariff on steel and aluminum, a move that could boost Canadian export activity…

… and U.S. trade more broadly if it materializes. While unconfirmed, I wanted to flag this as impacted names could be volatile - let’s see how it develops.

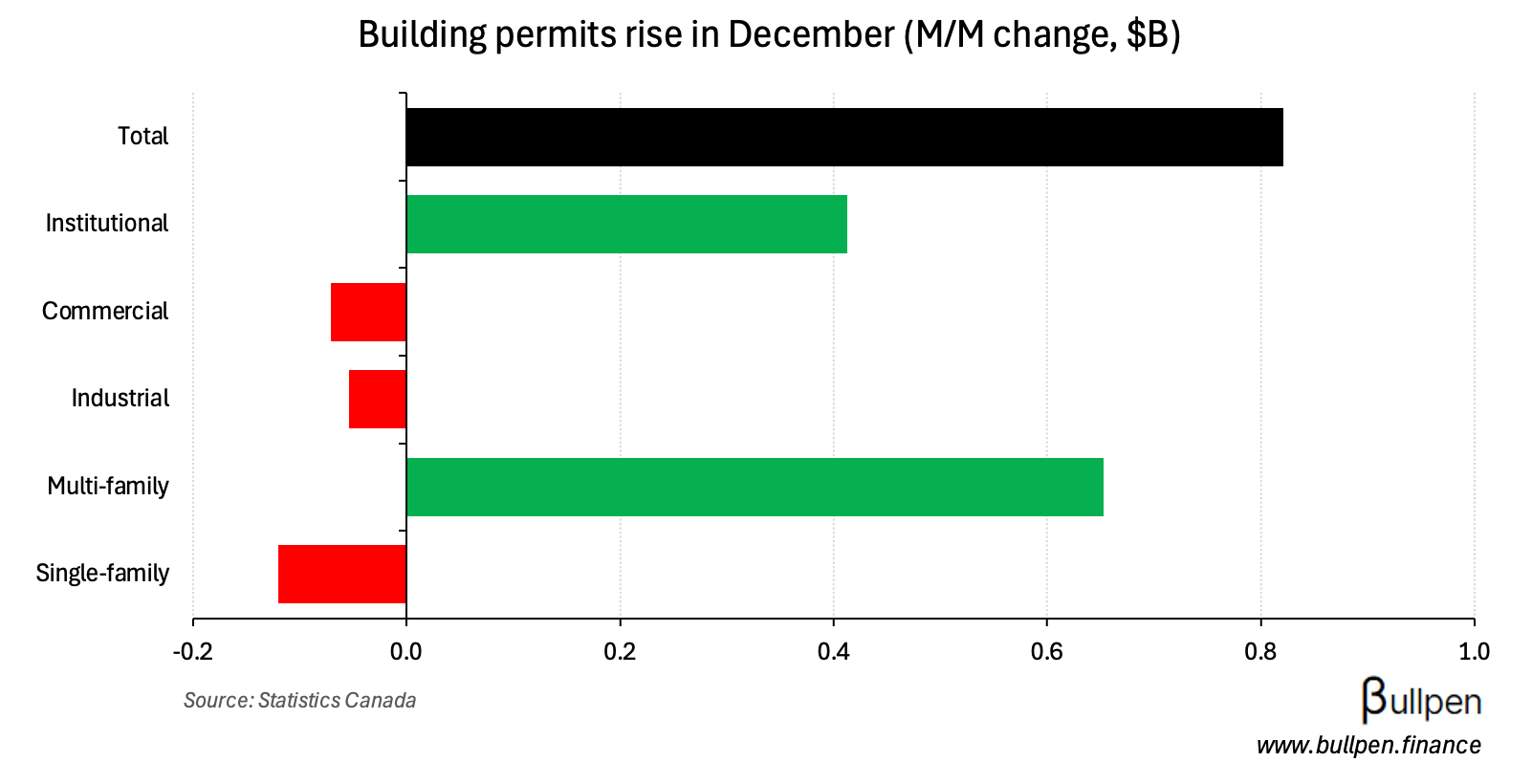

Building permits heat up

December’s building permits rose 7% to $13B, beating expectations for a 5% gain…

… driven by residential construction intentions, which hit $8B thanks to multi-family strength in Ontario (tracking to housing starts) that more than offset weakness in single family activity.

Non-residential permitting helped out too, with a $400M gain in institutional intentions (mostly Ontario) carrying small drawdowns in commercial and industrial.

Bombardier closes a $1.2B jet order

Bombardier (BBD) announced a $1.2B, 40 aircraft order with purchase options that could take that to $4.7B. The deal builds on a $2B order last year and will add anywhere from 7-27% to its $17B backlog…

… which underpins the company’s 2026 guide for continued growth in deliveries.

Execution on that backlog should be the primary driver of performance from here, assuming there’s not a whole lot more room for multiple expansion.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

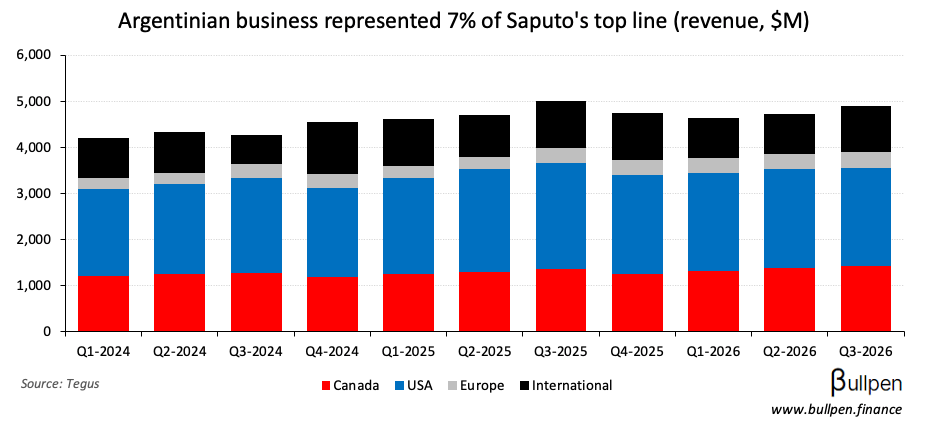

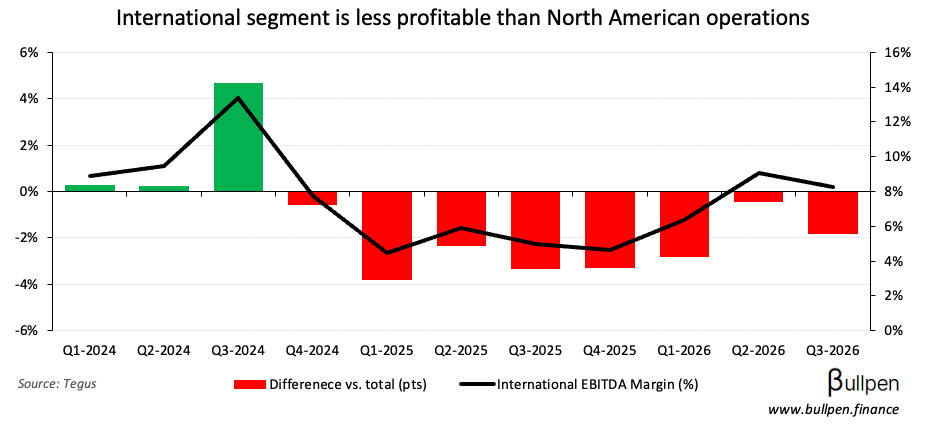

Saputo (SAP) was up 4% yesterday after selling 80% of its Argentina business for $540M. At ~7% of revenue, the divestiture isn’t overly material…

… but it should reduce margin volatility and free up some capital for reinvestment in the company’s core geographic footprint.

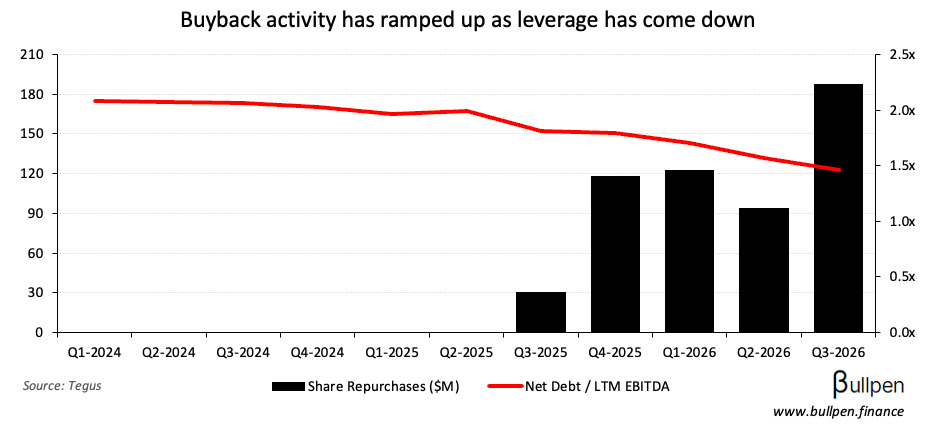

With leverage being a non-issue, buybacks are likely another use of proceeds…

… which could support continued multiple expansion towards Saputo’s long-term average valuation.

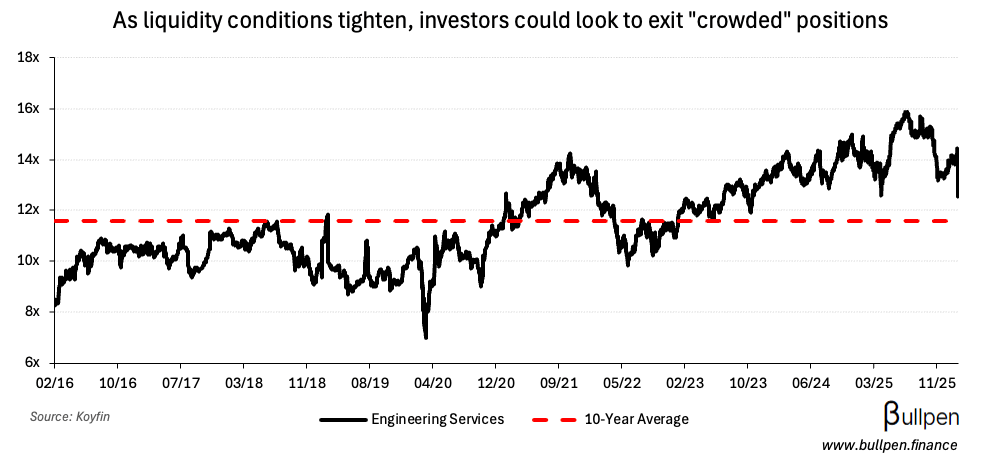

Anything touching engineering services got smoked yesterday on heavy volumes, wiping out >$5B in aggregate market cap…

… with no fundamental catalyst. Given recent market volatility, it’s possible the move is more mechanical in nature - as funds reduce exposure to crowded positions.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Lisa Olsen | ARC Resources (ARX) | $179K |

| Margaret McKenzie | PrairieSky (PSK) | $251K |

| Ryan McLeod | ATS Corp. (ATS) | $166K |

| David Rae | DPM Metals (DPM) | $970K |

More insider buying at ARC Resources (ARX)… that’s now ~$2M of buying in the four days following the sell-off.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 IGM Financial (IGM) | 1.27 | 1.20 |

| 🇨🇦 CAE Inc. (CAE) | 0.34 | 0.30 |

| 🇨🇦 Trisura (TSU) | 0.75 | 0.72 |

| 🇨🇦 Definity (DFY) | 0.99 | 0.94 |

| 🇨🇦 Agnico (AEM) | 2.70 | 2.65 |

| 🇨🇦 Bombardier (BBD) | 4.80 | 3.40 |

| 🇨🇦 Fortis (FTS) | 0.90 | 0.85 |

| 🇨🇦 Calian (CGY) | 1.03 | 0.91 |

| 🇨🇦 Russel Metals (RUS) | 0.55 | 0.53 |

| 🇨🇦 Mullen (MTL) | 0.15 | 0.21 |

| 🇨🇦 Brookfield (BN) | 0.67 | - |

| 🇨🇦 Keyera (KEY) | 0.55 | 0.42 |

| 🇨🇦 Telus (T) | 0.20 | 0.25 |

| 🇨🇦 Air Canada (AC) | 0.65 | 0.30 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Hydro One (H) | AM | 0.37 |

| 🇨🇦 Magna (MG) | AM | 1.80 |

| 🇨🇦 TC Energy (TRP) | AM | 0.91 |

| 🇨🇦 Enbridge (ENB) | AM | 0.78 |

| 🇨🇦 Colliers (CIGI) | AM | 2.45 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 Jobless Claims | 227K | 222K |

| 🇺🇸 Existing Home Sales | 3.9M | 4.2M |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Inflation Y/Y | 8:30AM | 2.5% |

Was this forwarded to you? Join 7,000+ investors reading The Morning Meeting by clicking the button below.