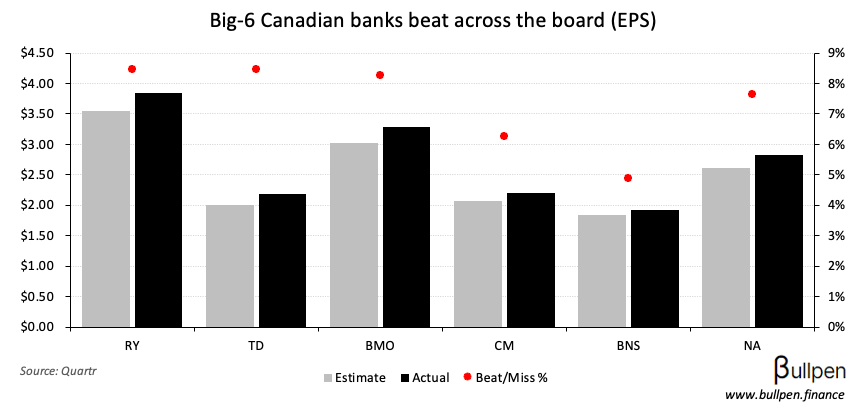

While Canadian banks posted another strong quarter, underpinned by continued capital markets strength and improved credit outlooks - a number of deals in the sector stole the spotlight…

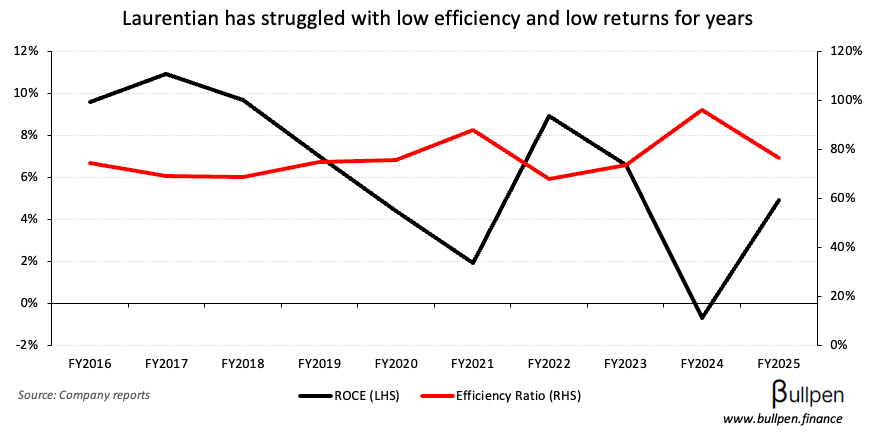

… starting with two transactions to put Laurentian Bank (LB) out of its misery. Fairstone Bank is the ultimate buyer, paying $1.9B - or 0.7x book value…

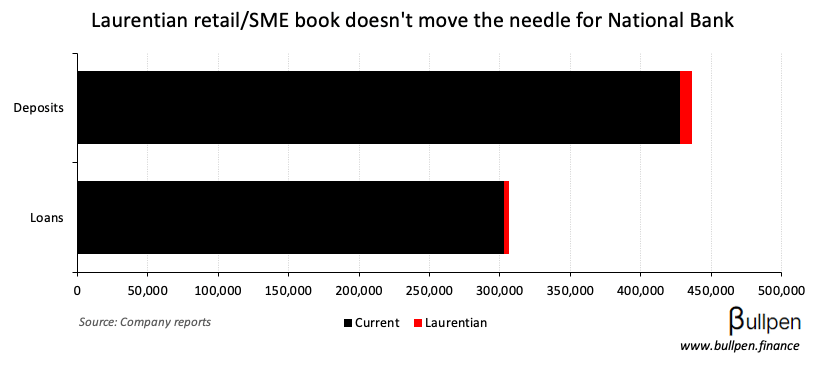

… but only for the commercial book, with National Bank (NA) swooping in to buy its retail and SME portfolio. The lack of interest in acquiring the entire platform is likely why LB’s 2023 strategic review ended in no takeout…

… and with the retail/SME book only offering 1-2% accretion for NA, the deal is a bit of a nothingburger.

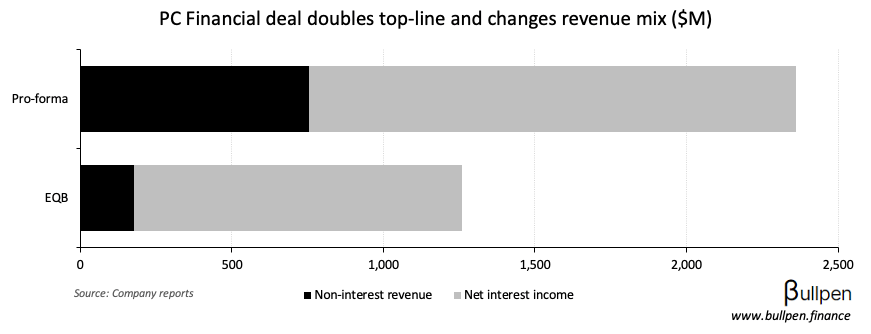

More interesting is EQB’s $800M purchase of PC Financial from Loblaw, which could go either way. The deal quadruples EQB’s customer base, nearly doubles revenue, provides a new source of deposits, and adds a physical network…

… but it was funded by equity after a post-Q3 sell off, with Loblaw taking a 17% stake and two board seats (they might be the real winner).

Despite the 1.15x book value multiple paid, management is calling for mid-single-digit EPS accretion in year one (cost/funding synergies) - with future upside from cross-selling opportunities.

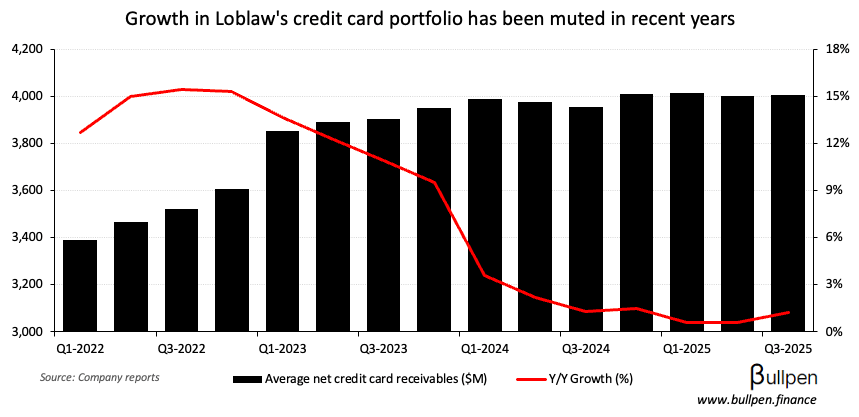

Those will take execution to materialize, as will restarting growth in the acquired portfolio…

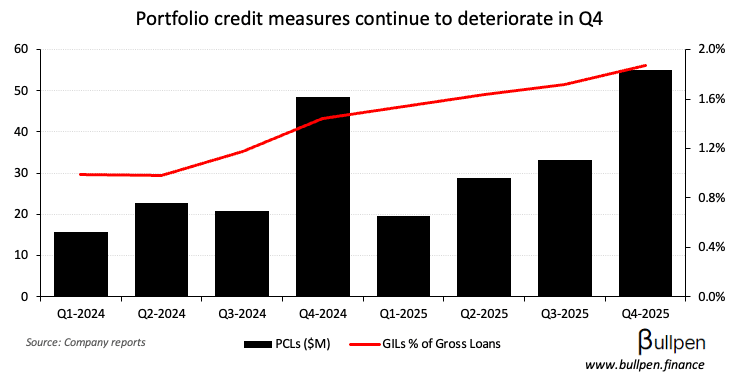

… and managing credit risk, with the deal more than doubling PCLs - which have been a source of investor concern lately.

The market has taken the deal well (up >10%) but time will tell - if nothing else, you can’t hate the new CEO taking a big swing early.