|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

YTD trade deficit nears $30B

PMI crushes estimates

Primaris buys another CF mall

Dye & Durham jumps on $145M sale

KITS falls despite solid Q3 results

HOT OFF THE PRESS

Trade deficit nears $30B

August’s $6.3B trade deficit was the seventh straight, tracking below estimates of $5.5B and widening versus July’s $3.8B…

… largely due to gold, which carried imports to a 0.9% M/M gain…

… and contributed to a 3% decline in exports alongside continued weakness in industrial machinery, vehicles, and forestry.

The latter has been topical of late, with additional softwood lumber tariffs imposed by the U.S. driving production cuts and decimating exports (down ~25%)…

… which contributed to the first drop in U.S. activity in four months.

International exports weren’t there to pick up the slack, falling 2% - the third straight decline led by weakness in the EU and China.

PMI crushes estimates

The Ivey Purchasing Managers Index came in better than expectations at 59.8, the strongest M/M expansion in over a year…

… which drove inventories higher alongside a continued slowdown in deliveries.

The employment index leveled out after a large contraction in August, indicating manufacturing employment might find a floor in Friday’s jobs print.

FUNNY BUSINESS

If Primaris REIT’s (PMZ-U) strategy wasn’t clear two years ago…

But right now, there’s a window of time during which a lot of properties that would have generally as a statement, not have been available for acquisition over the last 20 years that are available today and so we’re really focused on acquiring these scarce and highly attractive market-leading shopping centers.

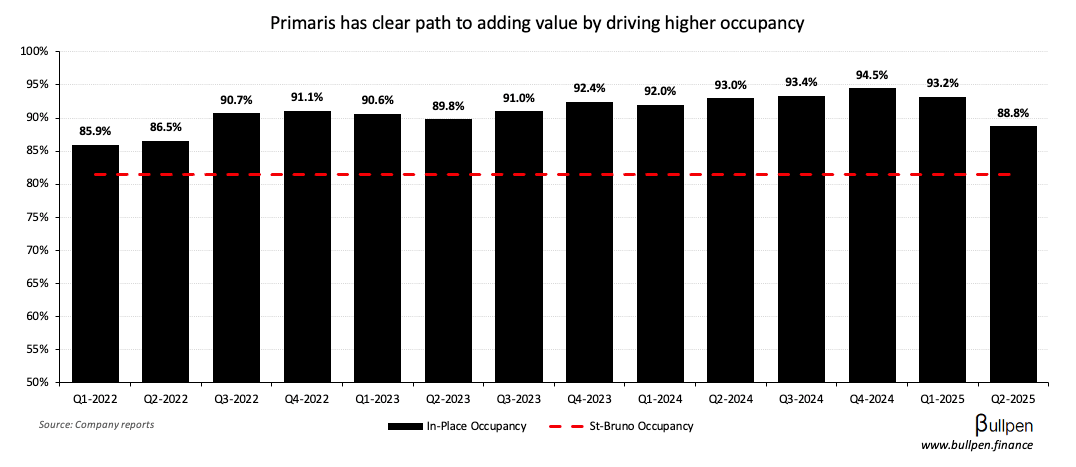

… it sure as hell is clear now, with the company buying Cadillac Fairview’s St-Bruno Mall for $565M ($320M cash, $245M equity) - a deal that looks exactly like its $400M Lime Ridge Mall buy in June. The new asset has low occupancy…

… driven by the HBC bankruptcy - an event management argues is value accretive in the medium to long-term. I tend to agree, given HBC was worse on rent than the friend you let crash on your couch for “just a week”…

… but it’ll take time and money to play out - with a 3-year, $150M plan to repurpose or re-lease the space. The market doesn’t love the ~$150M bought deal that came in addition to the deal financing, but think longer term. PMZ is upgrading its portfolio…

… at a time when retail sales are choppy and pensions want out of malls - better than buying in a hot market. With most of Cadillac Fairview’s remaining 14 malls presenting the same “HBC opportunity”, PMZ might not be done yet.

ON OUR RADAR

Calian Group & Precision Drilling announce CEO changes

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Gatekeeper Systems (GSI) added another 20% on continued contract momentum, with a $7.5M video + data deal announced yesterday, just a week after its largest school bus deal ever.

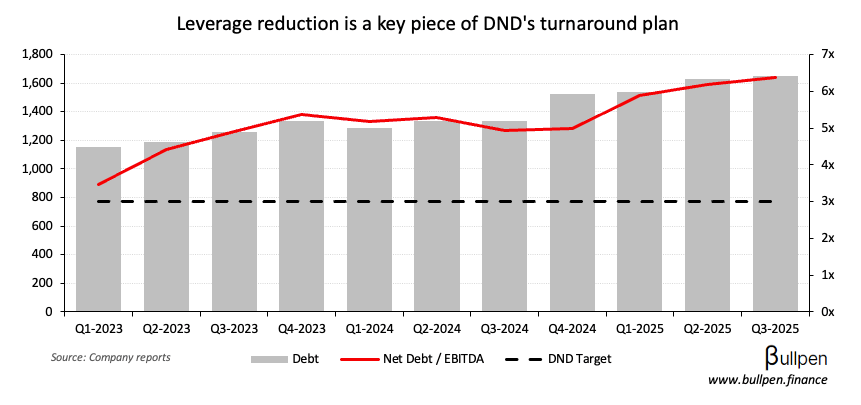

Dye & Durham (DND) was up 4% on its $146M divestiture of Credas Technologies, a UK-based provider of identity verification and AML solutions. While it will shed some top-line growth in the UK…

… the deal is initial proof the company is refocusing, pausing M&A and selling non-core assets - with all proceeds going towards leverage reduction.

With the stock cut in half this year amid continued activism, investors are waiting for more evidence before warming up to the story.

KITS Eyecare (KITS) fell 8% on its preliminary Q3 results, which were strong at 25% Y/Y revenue growth…

… and 5% adj. EBITDA margins, as the operating leverage inherent in KITS’ business model starts to show with scale.

With the stock doubling this year, investors were likely looking for a big beat - feels like a breather rather than a change in the thesis.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Stephen Laut | Cdn. Natural (CNQ) | $264K |

| Brenda Balog | Cdn. Natural (CNQ) | $205K |

| Andrew Brown | B2Gold (BTO) | $1.1M |

| Jonathan Cherry | Perpetua (PPTA) | $354K |

| Josee Perreault | BRP Inc. (DOO) | $1.0M |

| Russell Hallbauer | Taseko (TKO) | $203K |

EARNINGS

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Firan (FTG) | PM | 8.1M |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Balance of Trade | -6.3B | -5.5B |

| 🇨🇦 Exports | 60.6B | - |

| 🇨🇦 Imports | 66.9B | - |

| 🇨🇦 Ivey PMI | 59.8 | 51.2 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 FOMC Minutes | 2:00PM | - |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.