|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Building permits contract to $12B

Will Carney’s China trip bear fruit?

Mining run sparks financing activity

MFI runs on ‘26 guide and divvy hike

HOT OFF THE PRESS

Building permits miss

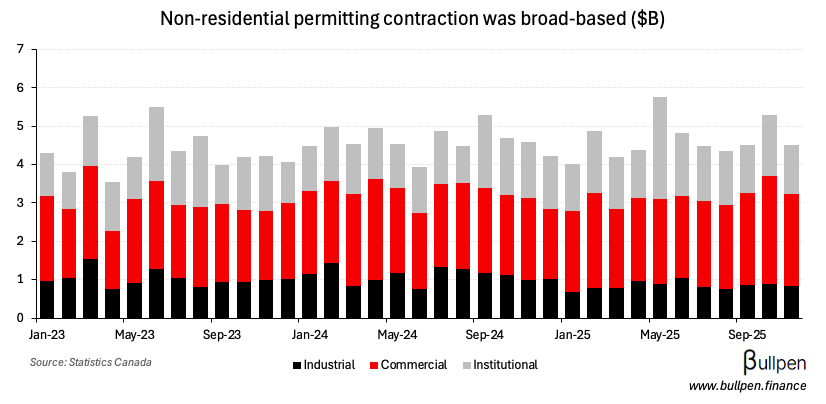

Building permits fell 13% to $12B in November, well below estimates for a 6% drop…

… driven by residential construction intentions, which declined by over $1B (or 12%) on the back of multi-family weakness in Ontario and Quebec - tracking to recent housing start data.

Non-residential permitting was weak too, shedding ~$800M (or 15%) with softness across all categories.

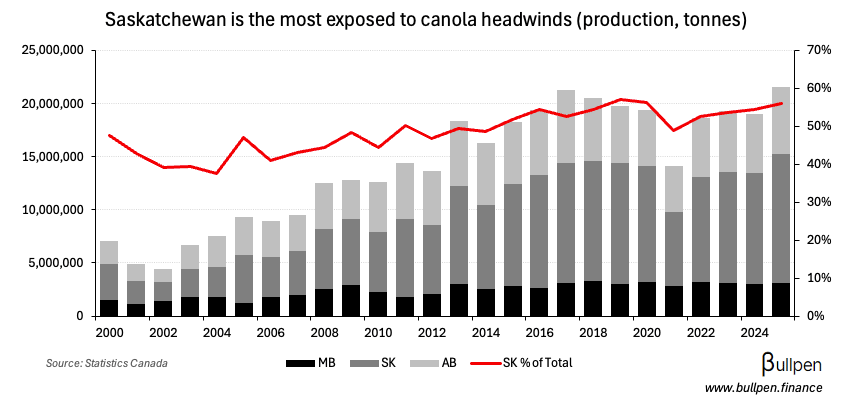

Will Carney’s China trip bear fruit?

By now Carney’s in China, rubbing shoulders with Xi Jinping on the first visit by a PM since 2017. The overarching themes of the trip are increasing trade…

… attracting new capital, and removing Chinese tariffs on Canadian canola. Given its end market importance…

… and the demand destruction the tariffs have already caused…

… I’ll take the under on Chinese concessions, assuming Canada won’t budge on EV tariffs. While some lost demand can be diverted…

… it’s likely the prairies will be feeling the squeeze for some time, Saskatchewan in particular - given it accounts for over half of total production.

With roughly 8% of the province’s workforce in canola farming (~14% including indirect exposure), the impact of prolonged tariffs could be much bigger than trade.

ON OUR RADAR

Flagging the TMX financing stats released yesterday, showing the impact this run in metals prices has had on activity.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Maple Leaf Foods (MFI) got a nice 4% lift on the back of its 2026 guide, which is calling for mid-single digit growth on the top line…

… and ~$530M of EBITDA, supported by continued margin improvement post-pork spinout. With the pork volatility gone…

… and management expectations for another 10% dividend hike, the market has warmed back up to the story.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Troy Andersen | Cdn. Natural (CNQ) | $1.4M |

| Heather Taylor | OR Royalties (OR) | $568K |

| Frederic Ruel | OR Royalties (OR) | $855K |

| Lee Curran | Peyto (PEY) | $330K |

| Crissy Rafoss | Peyto (PEY) | $493K |

| Sean McAleer | Pan American (PAAS) | $286K |

| John Burzynski | Osisko (OM) | $280K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 JPMorgan (JPM) | 4.63 | 4.86 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Blue Ant (BAMI) | AM | - |

| 🇨🇦 Velan (VLN) | AM | - |

| 🇨🇦 Cogeco (CGO) | AM | 2.63 |

| 🇨🇦 Cogeco Comms (CCA) | AM | 2.05 |

| 🇨🇦 Haivision (HAI) | PM | 0.01 |

| 🇺🇸 Bank of America (BAC) | AM | 0.95 |

| 🇺🇸 Citigroup (C) | AM | 1.62 |

| 🇺🇸 Wells Fargo (WFC) | AM | 1.69 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | -13.1% | -6.5% |

| 🇺🇸 Inflation Y/Y | 2.7% | 2.7% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 PPI M/M | 8:30AM | 0.3% |

| 🇺🇸 Retail Sales M/M | 8:30AM | 0.4% |

| 🇺🇸 Existing Home Sales | 10:00AM | 4.2M |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.