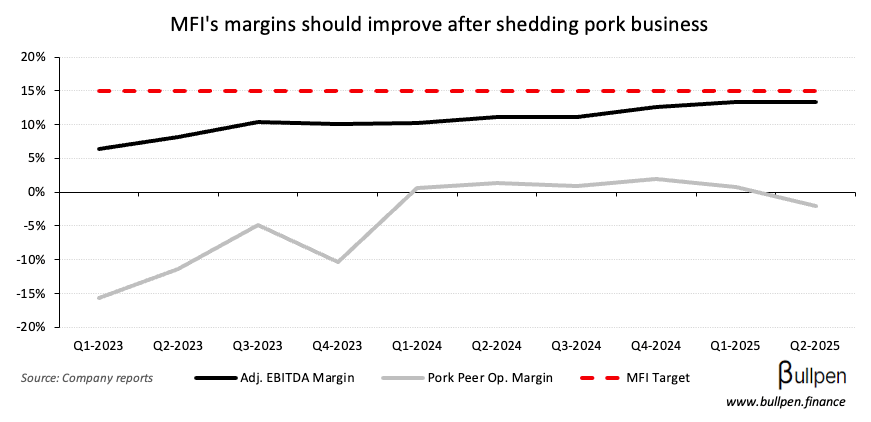

Maple Leaf Foods (MFI) has completed the spin-out of its pork business, Canada Packers (CPKR) - a move investors expect will drive margin expansion…

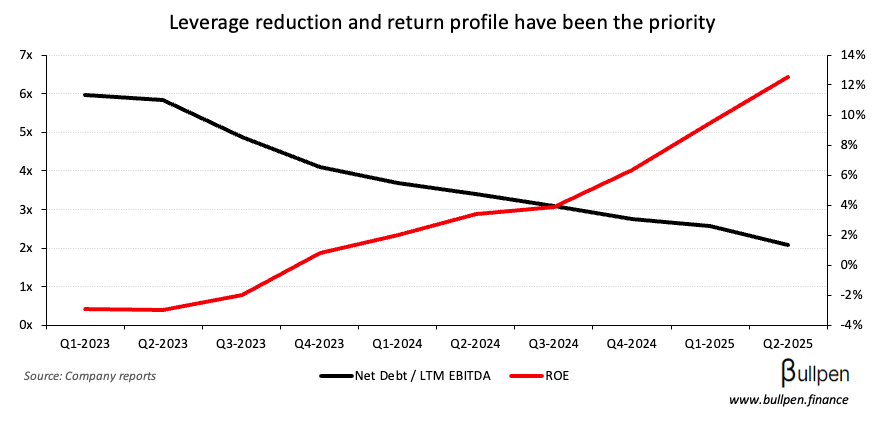

… and further leverage reduction, which should support continued improvement in MFI’s return profile.

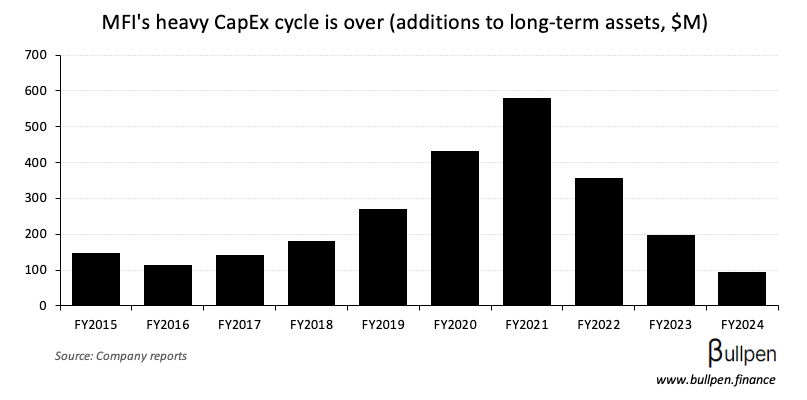

With its heavy CapEx cycle now over…

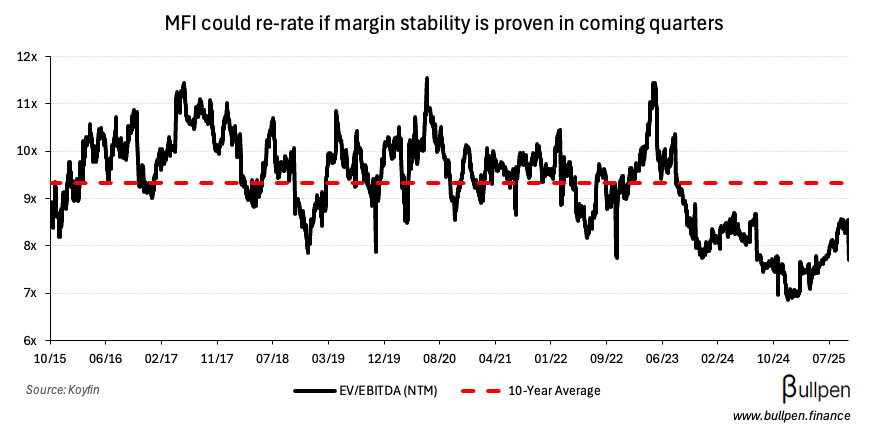

… proof of execution and the stability coming from this pork carve-out could drive a multiple re-rate for MFI.

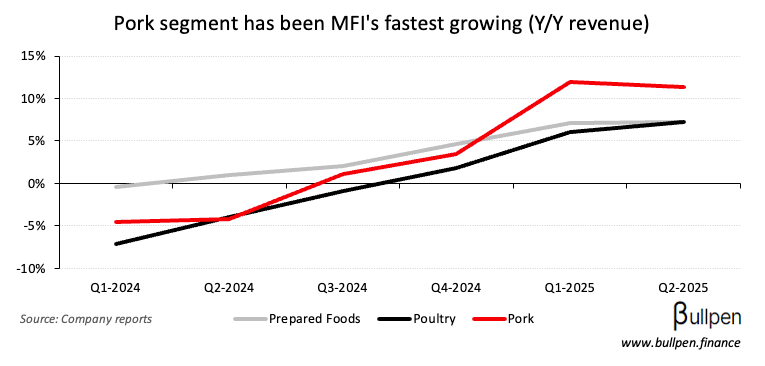

If nothing else, the separation was opportunistic - with Canada Packers being Maple Leaf’s fastest growing segment…

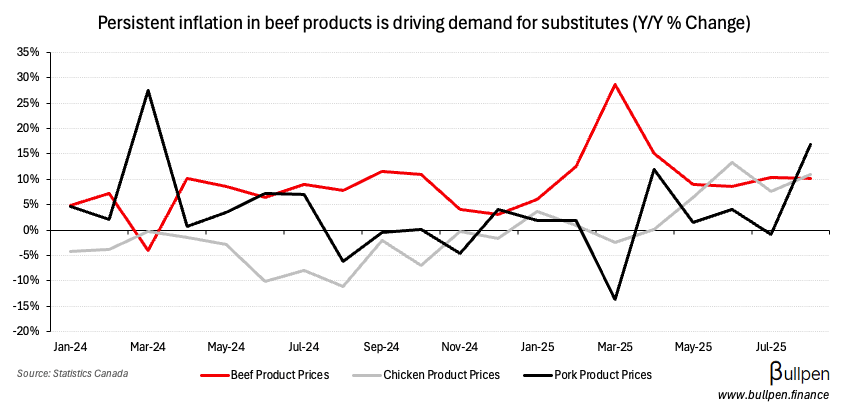

… driven by persistent inflation in beef, which has shifted demand to substitutes like pork…

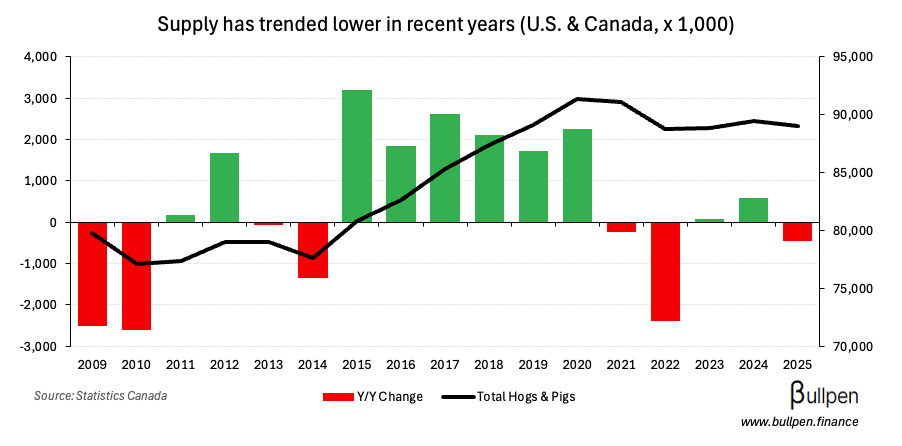

… at a time when supply hasn’t kept pace, pushing prices higher…

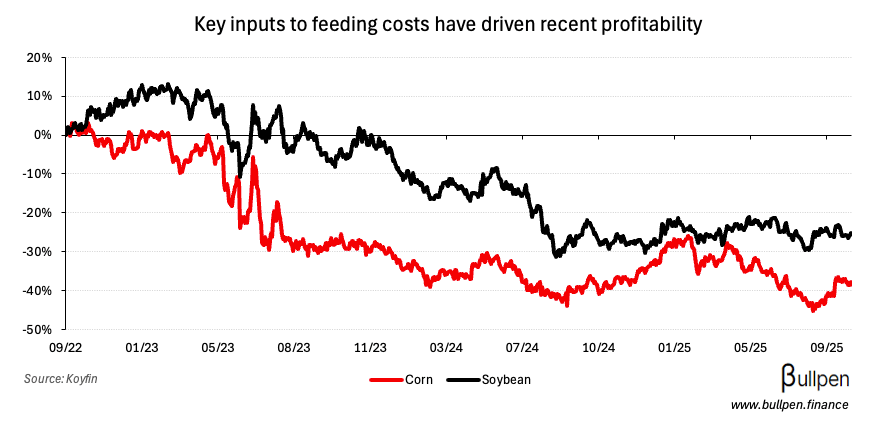

… while key feed inputs like corn and soybean have gone in the opposite direction.

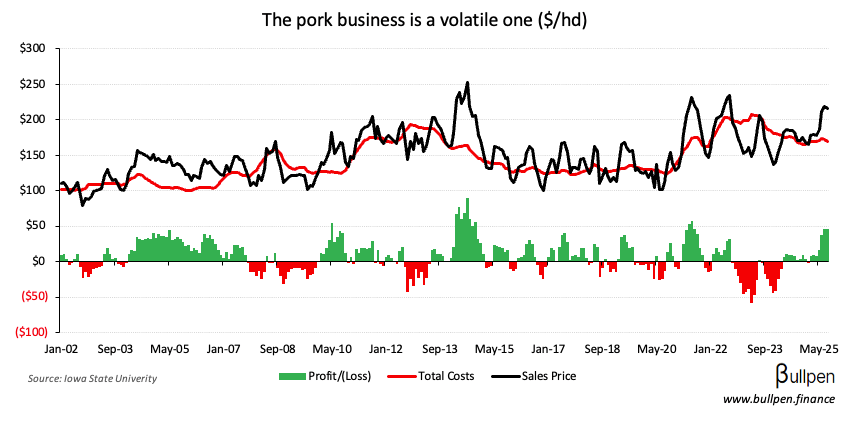

That’s driven a period of strong profitability, making it a perfect time to market a standalone entity. But as history has shown, pork is a cyclical business…

… and with shares down 12% in the first day of trading, my fingers are crossed that we don’t end up with a replay of Telus Digital. If we do, MFI could “bring home the bacon” when the cycle turns.