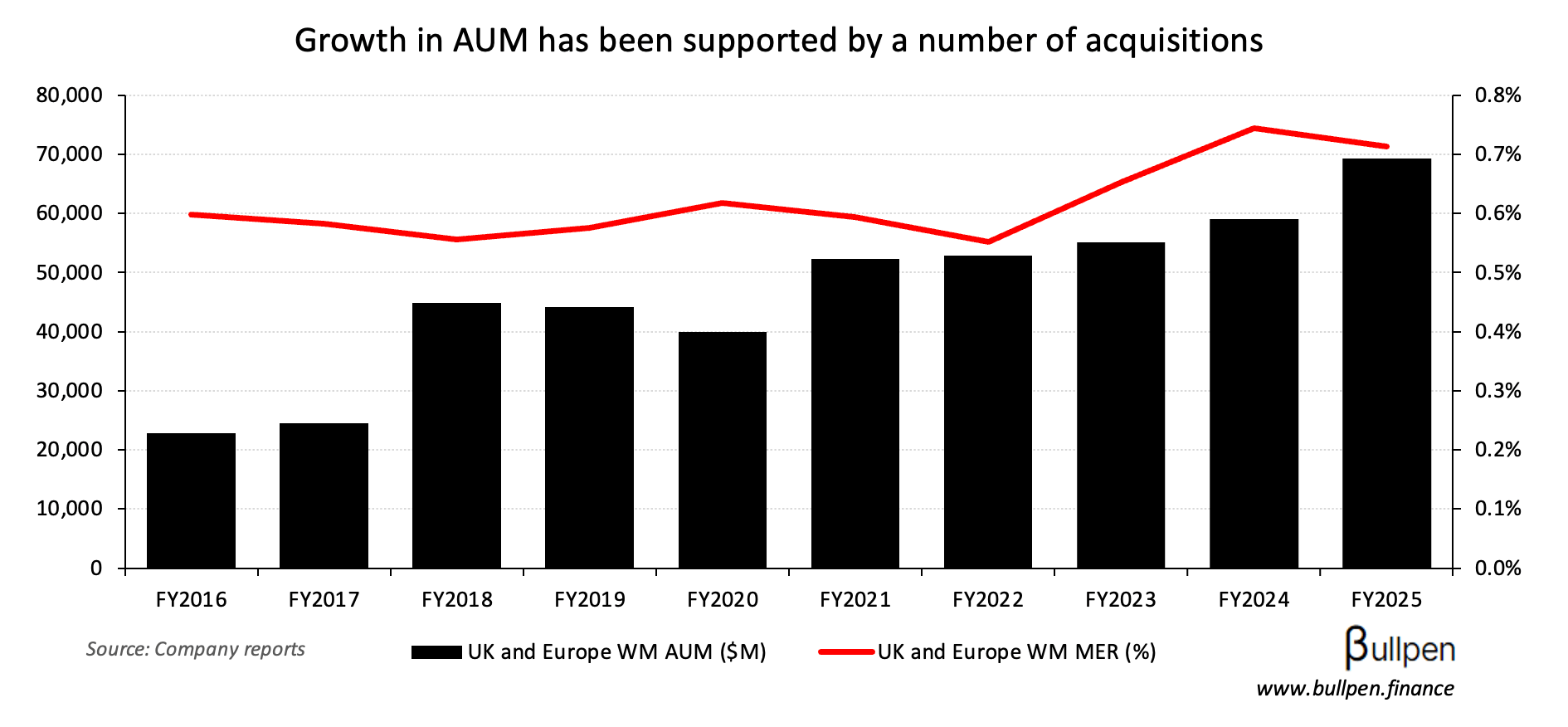

Canaccord Genuity (CF) is rumoured to be weighing the sale of its UK wealth business, sending shares up 14%. Should a deal materialize, it would follow a series of transactions that brought AUM above $70B…

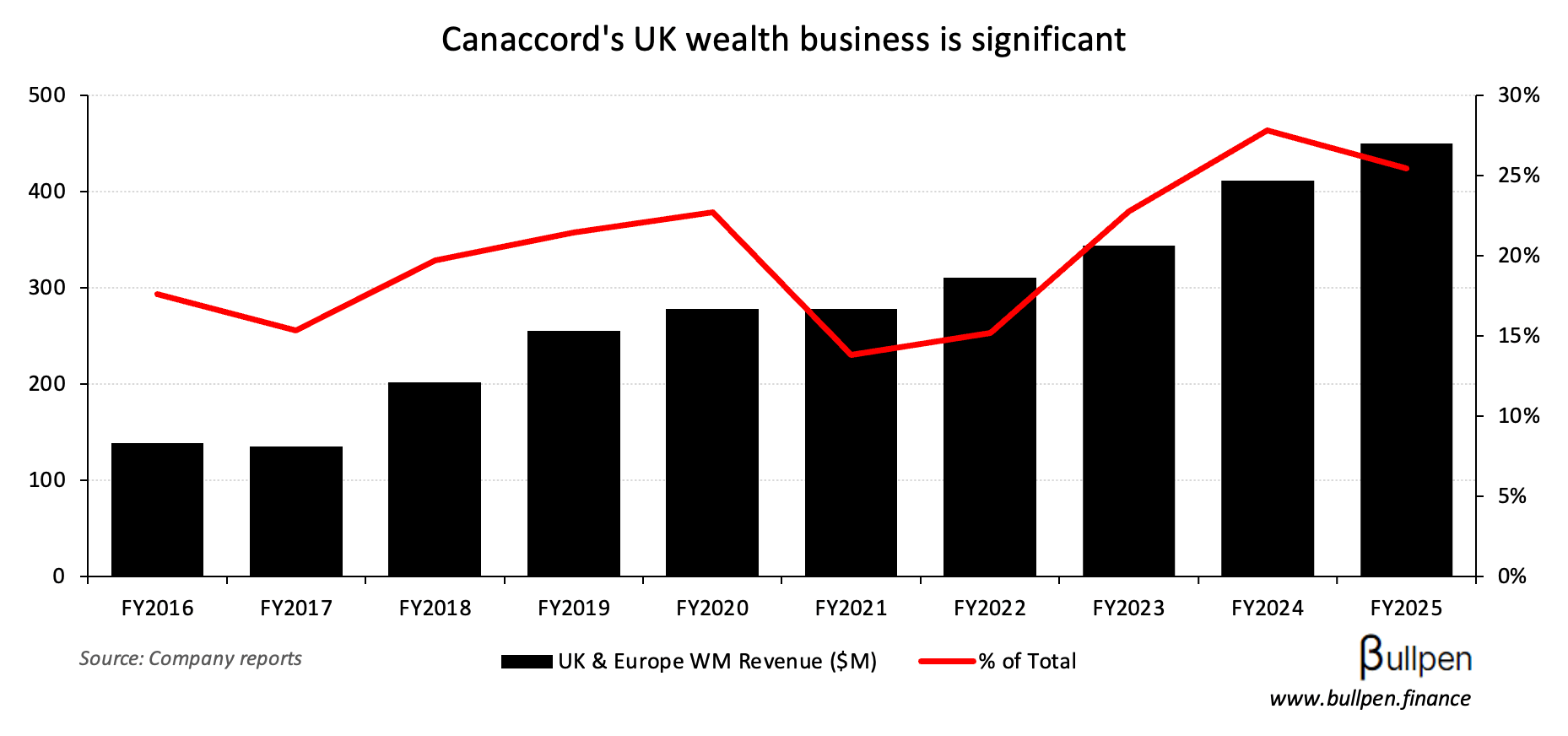

… which if done at a similar multiple to BMO’s $625M Burgundy deal, would put the price tag around £1B - in-line with a 12-16x multiple on last year’s EBITDA. At a quarter of CF’s revenue, the deal would be material…

… but assuming an adequate price, I’d like it. Everybody’s scrambling for scale in the industry, as evidenced by the $1.7B Guardian and $600M Richardson deals. That makes for a great off ramp for anyone not looking to play the same game.

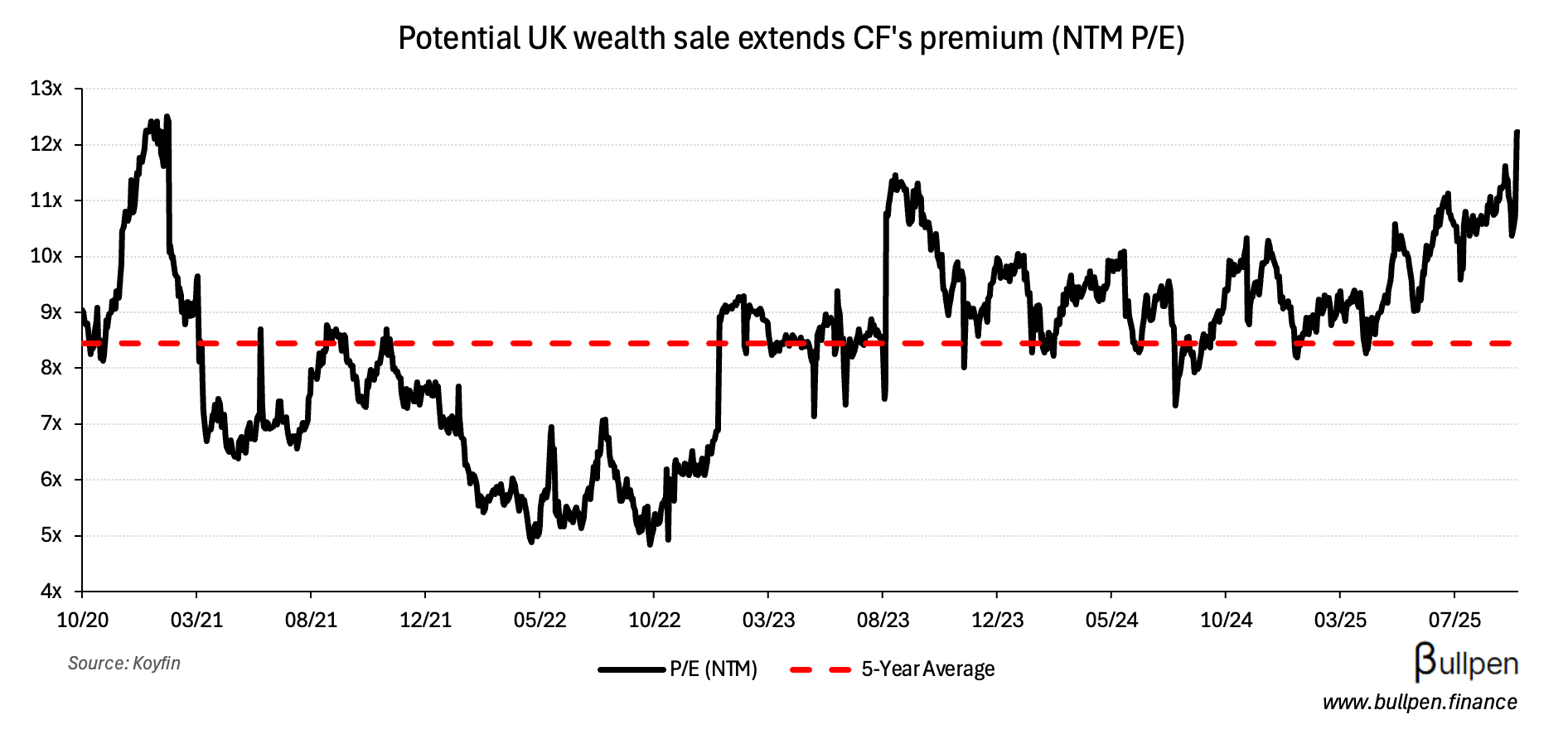

Zigging when the market is zagging, with the same conviction that makes Strathcona (SCR) and Primaris (PMZ-U) interesting - and with a liquidity preference for minority owner HPS easing in 2026…

We have an ability to take them out. We have to come up with hundreds of millions of dollars to do that. So that’s a very good option. We could IPO the company. We could sell the company.

… an official deal might not be so far away.