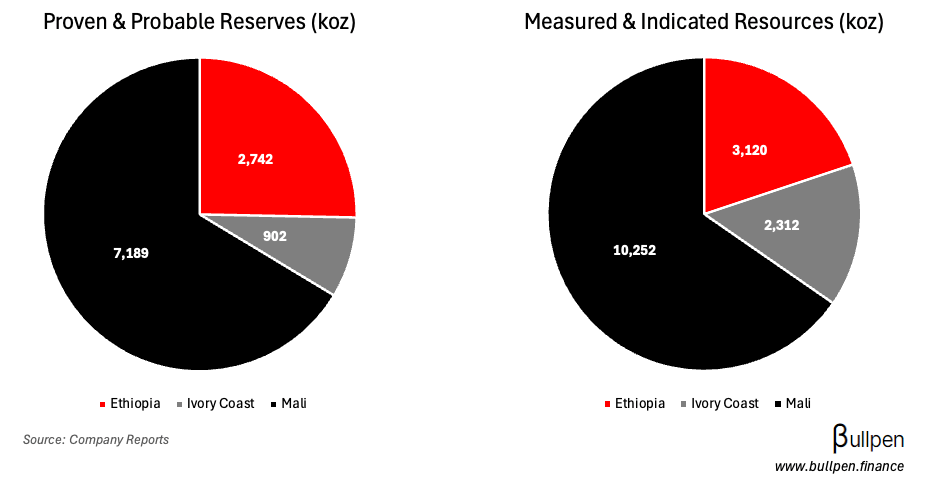

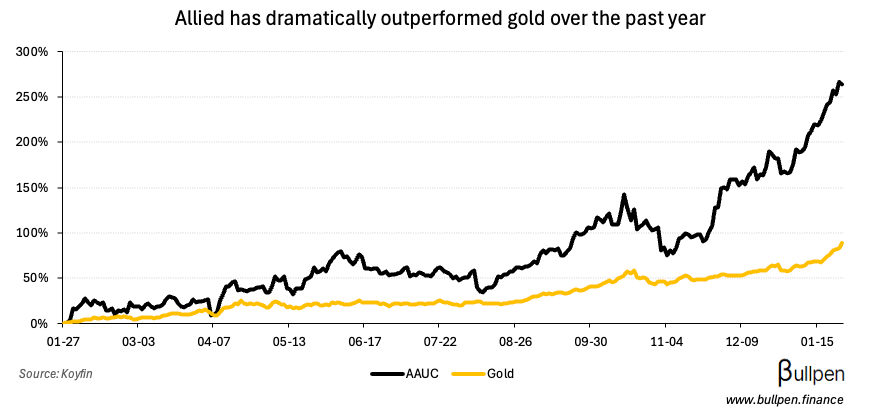

Chinese miner Zijin Gold announced a $5.5B deal to buy Allied Gold, representing a ~30% premium to last month’s VWAP but skinnier versus current trading - given the crazy run in metals to start the year.

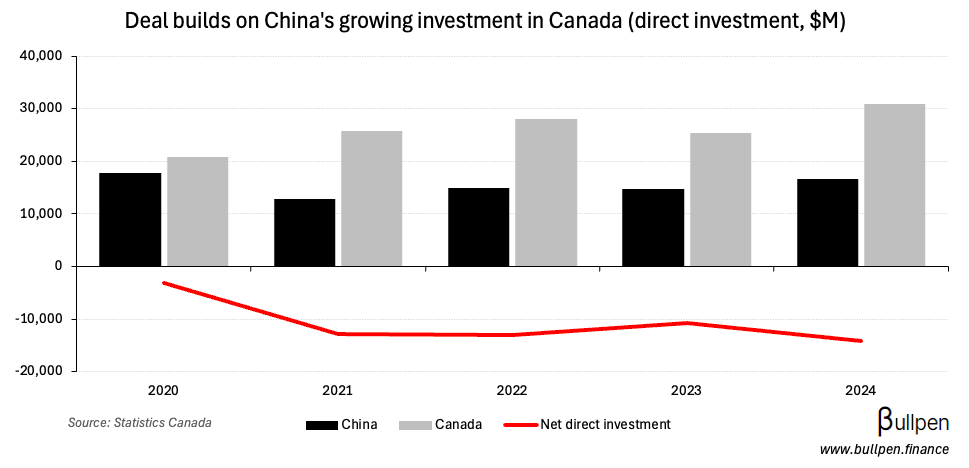

The transaction comes just weeks after the China deal and builds on a number of Canadian takeouts by Zijin, so regulatory approval feels likely here…

… especially considering Carney’s openness to foreign investment, the $220M break fee, and that the only thing Canadian about Allied is its P.O. box - with all of its gold production in Africa.