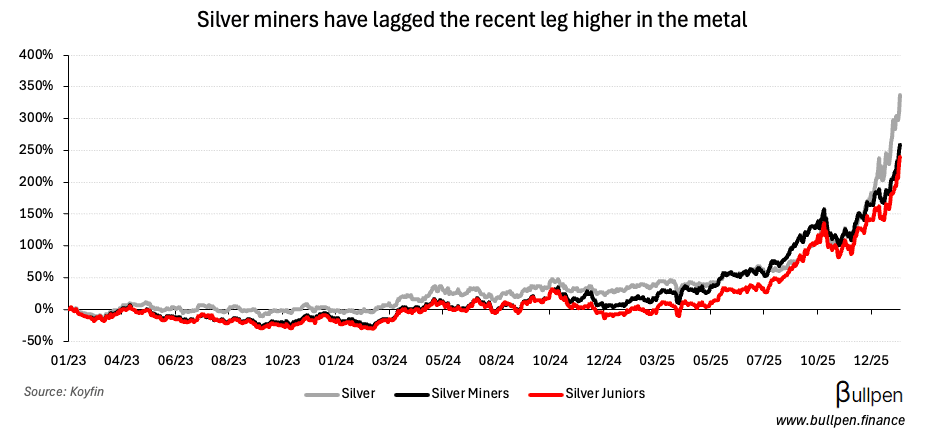

Miners are notching new highs day after day, but the extent of this performance relative to the underlying commodity shows a clear distinction in the market’s perception of longevity.

While silver has doubled since November, the producers are starting to lag - indicating the market isn’t buying the sustainability of current price action…

… like it is with gold, where producers have meaningfully outperformed the metal over the same period…

… driven by the geopolitical backdrop, fears of currency debasement, and ongoing central bank accumulation.

Those forces have staying power, but are less structural in nature than the setup for copper - with many calling for a growing supply gap as power infrastructure, AI, and defense spending drive demand for decades to come.

With the miners more than doubling copper’s performance in recent years, it’s clear the market is underwriting longer-duration cash flows - rather than a cyclical or speculative margin expansion.