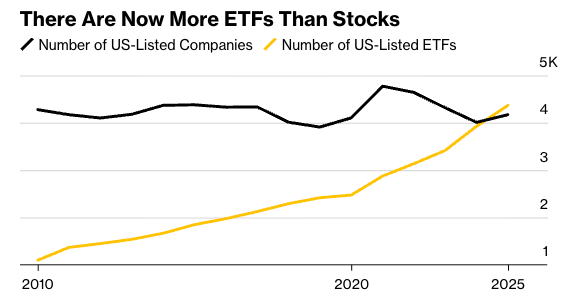

There are now more publicly listed ETFs than companies in North America, driving increased competition for capital among issuers. While that could pressure the economics of asset managers…

… it increases the addressable market for TMX Group (X). As the dominant exchange, TMX benefits from new listings - and the recent addition of Newsfile enables it to upsell communications services.

Prior to that deal, TMX leaned into ETFs with the $850M acquisition of VettaFi - adding 10% to the top-line in fund-focused activity (indexing, distribution, etc.).

Another downstream beneficiary is National Bank (NA), as the dominant Authorized Participant (AP) in Canada. An AP’s role is to ensure the price of the ETF and its underlying NAV are equal, so they print money in periods of volatility.

I’m referring to structured products issuance and trading, equity finance and option and ETF market making. So all three strategies benefited from… intense but short volatility events… that created large but short-lived moves that we were able to capture.

Here’s how: When an ETF is trading at a premium to NAV, the AP will short the ETF and buy the underlying basket - closing the valuation gap.

At the end of trading, the AP will then sell the underlying securities to the issuer in exchange for new ETF units - clearing out its inventory and closing out its short position for a risk-free profit.

If the ETF trades at a discount to its NAV, the same process is done in reverse - with the AP going short the underlying basket and long the ETF…

… which it then sells to the issuer, who “redeems” the ETF shares for the underlying basket, closing out the AP’s short position for more risk-free profit.

The larger the dislocation between price and NAV, the more money is on the table - making National uniquely positioned for volatility among Canadian banks.