|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

The downstream ETF beneficiaries

GSY’s link to Tricolor’s debt bomb

Insiders add to Artis ahead of RTO

HOT OFF THE PRESS

The downstream beneficiaries of ETFs

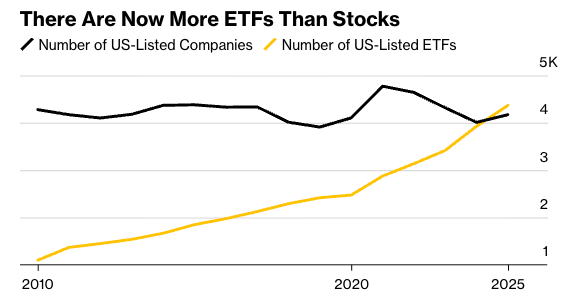

There are now more publicly listed ETFs than companies in North America, driving increased competition for capital among issuers. While that could pressure the economics of asset managers…

… it increases the addressable market for TMX Group (X). As the dominant exchange, TMX benefits from new listings - and the recent addition of Newsfile enables it to upsell communications services.

Prior to that deal, TMX leaned into ETFs with the $850M acquisition of VettaFi - adding 10% to the top-line in fund-focused activity (indexing, distribution, etc.).

Another downstream beneficiary is National Bank (NA), as the dominant Authorized Participant (AP) in Canada. An AP’s role is to ensure the price of the ETF and its underlying NAV are equal, so they print money in periods of volatility.

I’m referring to structured products issuance and trading, equity finance and option and ETF market making. So all three strategies benefited from… intense but short volatility events… that created large but short-lived moves that we were able to capture.

Here’s how: When an ETF is trading at a premium to NAV, the AP will short the ETF and buy the underlying basket - closing the valuation gap.

At the end of trading, the AP will then sell the underlying securities to the issuer in exchange for new ETF units - clearing out its inventory and closing out its short position for a risk-free profit.

If the ETF trades at a discount to its NAV, the same process is done in reverse - with the AP going short the underlying basket and long the ETF…

… which it then sells to the issuer, who “redeems” the ETF shares for the underlying basket, closing out the AP’s short position for more risk-free profit.

The larger the dislocation between price and NAV, the more money is on the table - making National uniquely positioned for volatility among Canadian banks.

FUNNY BUSINESS

The Tricolor bankruptcy is getting more interesting, with reports indicating ~40% of the subprime auto lender’s active loans had collateral backing up another loan.

The news doesn’t help the sentiment around goeasy (GSY), which has grown its subprime auto lending considerably in recent years…

… resulting in meaningful changes to the composition of its loan book, a key point of contention in the recent short report that’s given shares a ~20% haircut.

Importantly, GSY’s auto loans are kept on the books, not securitized and sold like Tricolor’s. But they’re a key part of its funding model, backing a credit facility that lowers its cost of capital and improves returns…

… a strategy that would be challenged if any changes to the risk profile of this part of the portfolio were to materialize.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Jeremy Langford | Artemis (ARTG) | $249K |

| Anne Le Breton | BRP Inc. (DOO) | $802K |

| Kenneth Zinger | CES Energy (CEU) | $302K |

| Vernon Disney | CES Energy (CEU) | $227K |

| Mary Vitale | Dynamite (GRGD) | $406K |

| Ajai Bambawale | TD Bank (TD) | $9.5M |

| Michael Sparks | SSR Mining (SSRM) | $455K |

| Salim Manji | Artis (AX-U) | $340K |

| Blake Hotzel | Gibson (GEI) | $215K |

Flagging the buying at Artis REIT (AX-U), which follows a 17% sell-off linked to its reverse takeover of RFA Capital - a deal that should see the company continue to wind down its real estate holdings.

Between the CEO’s activity and buybacks at the corporate level, Artis has likely found a floor for now.

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 S&P Composite PMI | 53.9 | 53.6 |

| 🇺🇸 S&P Services PMI | 54.2 | 53.9 |

| 🇺🇸 ISM Services PMI | 50.0 | 51.7 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.