|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

HOT OFF THE PRESS

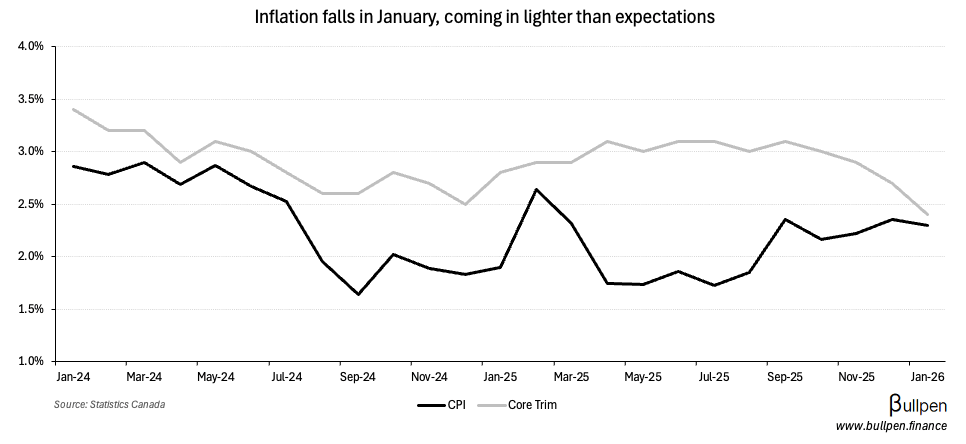

Inflation cools down

Headline inflation of 2.3% came in lighter than expectations, declining from December’s 2.4% print…

… on the back of lower gasoline prices and a slowdown in shelter inflation…

… which fell below 2% for the first time in five years. It’s been a long time coming, with inflation in rent and mortgage interest compressing over the past two years…

… which should continue to offset the short-term surge in food inflation driven by Trudeau’s prior year tax holiday.

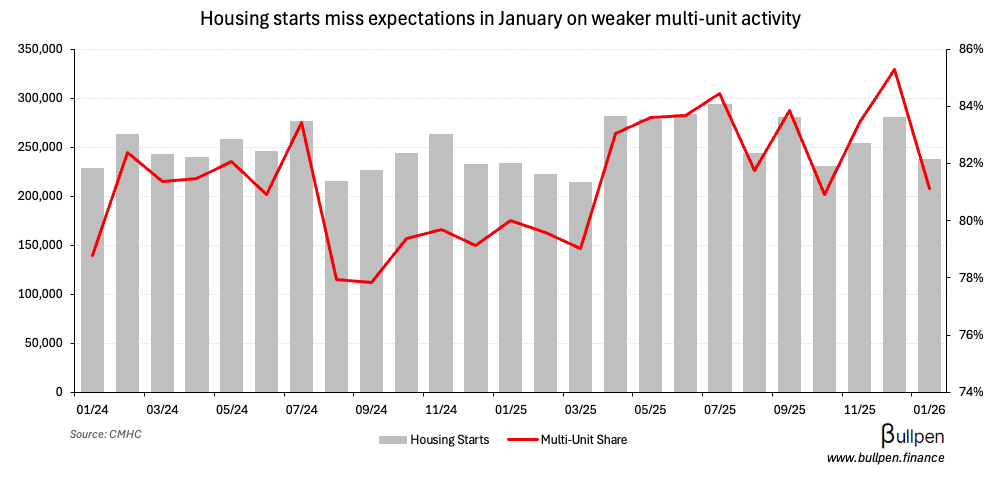

Housing starts miss, inventory builds

Housing starts missed estimates in January, falling to 238K on a decline in multi-unit activity…

… but still up small versus last year, with improvement in Ontario and BC offsetting relative weakness in Quebec.

While there’s been some improvement in how long unsold units sit on the market, inventory balances continue to build…

… making a meaningful pickup in new unit construction unlikely in the near-term.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Canadian defence names caught a bid yesterday on the back of Carney’s new Defence Industrial Strategy…

… which outlines the government’s 10-year plan to grow sector revenues and exports by 240% and 50%, respectively - building on the higher spend commitments that got the sector running last year.

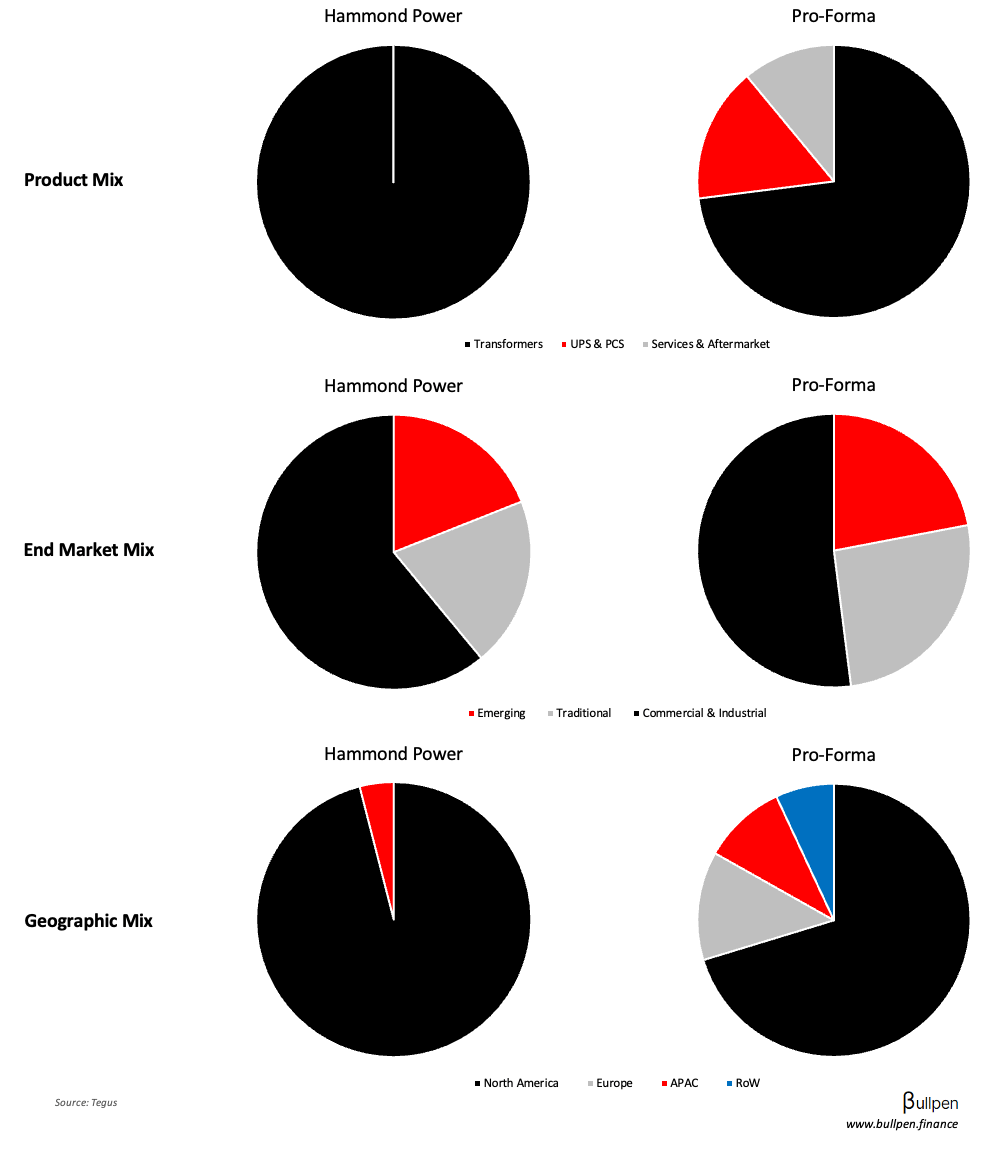

Hammond Power (HPS) was down 5% on its $365M acquisition of AEG Power, a deal that adds 37% to the top line…

… and diversifies its product, end market, and geographic mix. While the sell-off was likely debt-driven, with net leverage climbing to 2.7x post-close…

… a shift from Hammond’s ultra-conservative approach to financing is necessary to fuel the next leg of growth - which could see the stock re-rate to larger, more diversified peers if it can stick the landing.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Ryan Adair | Int. Petroleum (IPCO) | $1.2M |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Canaccord (CF) | 0.36 | 0.28 |

| 🇨🇦 SSR Mining (SSRM) | 0.88 | 0.58 |

| 🇨🇦 TFI Int. (TFII) | 1.09 | 0.85 |

| 🇨🇦 Gibson (GEI) | 0.30 | 0.30 |

| 🇨🇦 iA Financial (IAG) | 3.10 | 3.29 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Bausch (BLCO) | AM | 0.36 |

| 🇨🇦 Kinross (K) | PM | 0.55 |

| 🇨🇦 Triple Flag (TFPM) | PM | 0.32 |

| 🇨🇦 Trican (TCW) | PM | 0.17 |

| 🇨🇦 Nutrien (NTR) | PM | 0.91 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Inflation Y/Y | 2.3% | 2.4% |

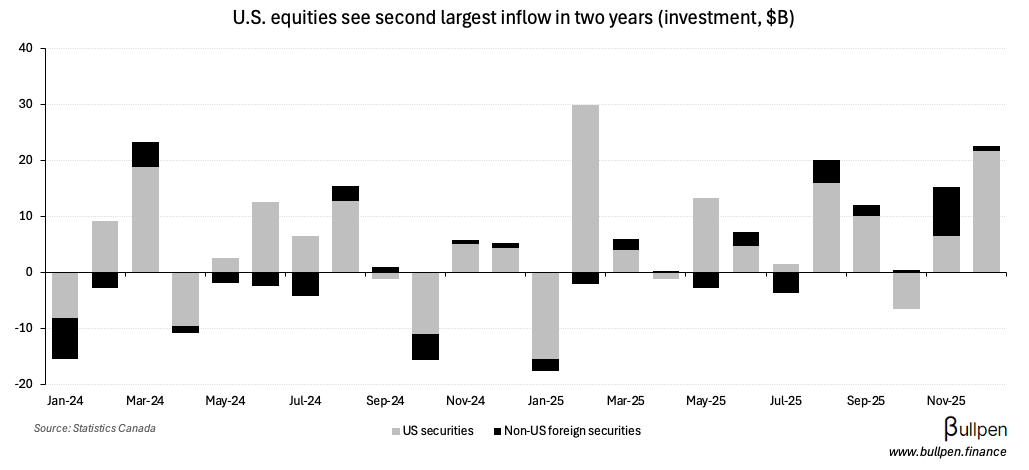

| 🇨🇦 Foreign Security Buys | -5.6B | 14.3B |

On a net basis security flows were down in December, with $5.6B of foreign divestment and $13.1B of Canadian investment abroad…

… led by ~$22B of buying in U.S. equities, the second largest print in two years.

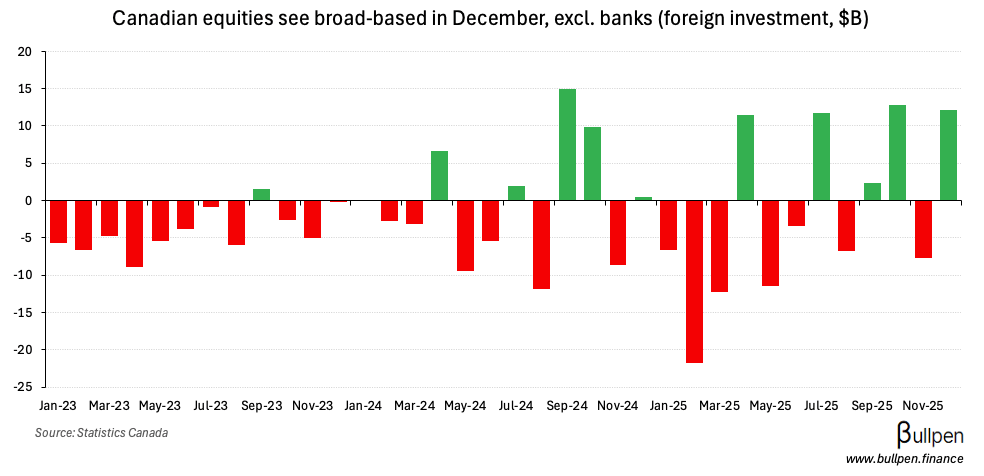

Demand for Canadian equities was strong too, with $12B of broad-based inflows (excl. banks) more than offsetting November’s $8B outflow…

… but falling short of the ~$18B net divestment in Canadian paper, led by record retirements of corporate (~$23B) and federal government (~$15B) debt.

Was this forwarded to you? Join 8,000+ investors reading The Morning Meeting by clicking the button below.