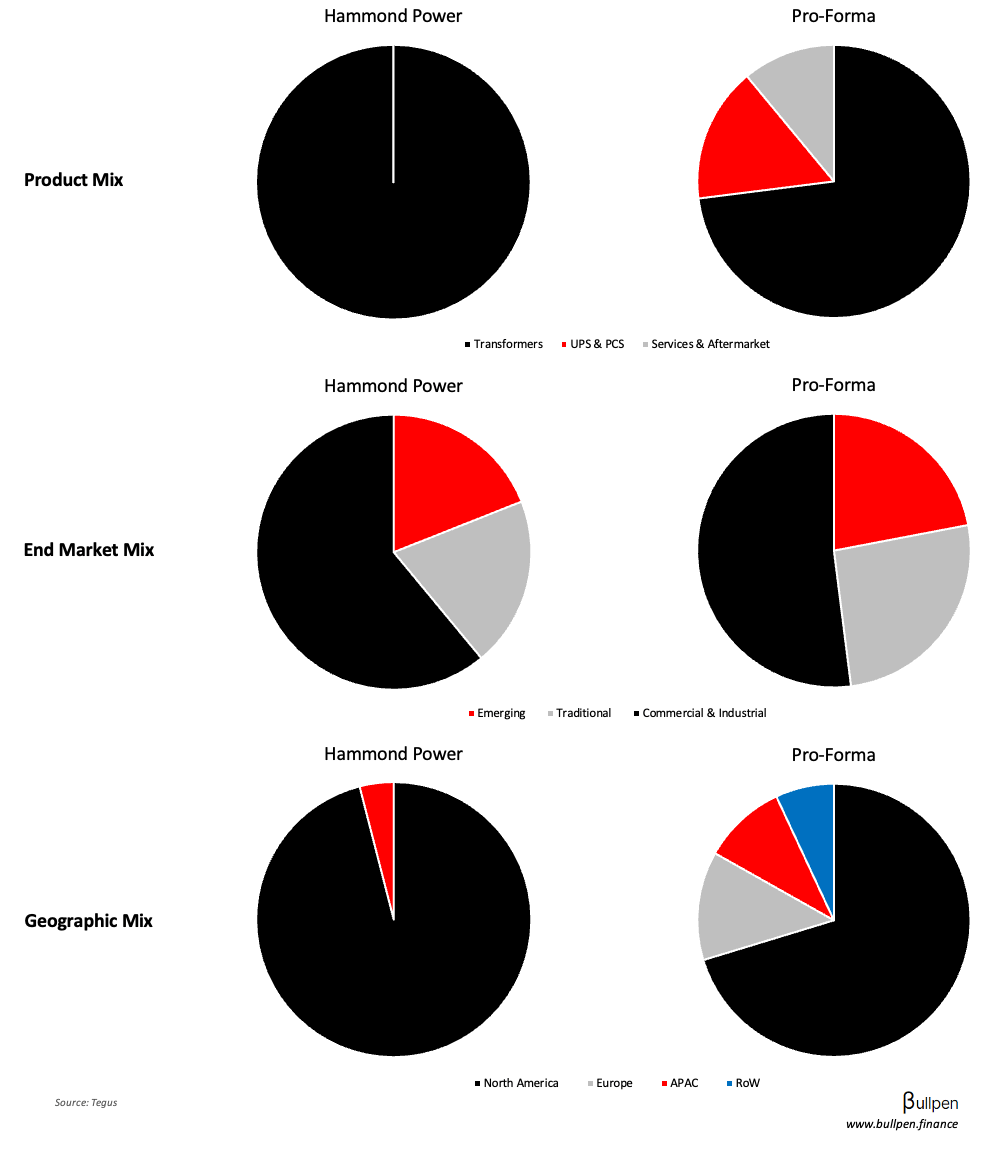

Hammond Power (HPS) was down 5% on its $365M acquisition of AEG Power Solutions, a deal that adds 37% to the top line…

… and diversifies its product, end market, and geographic mix. While the sell-off was likely debt-driven, with net leverage climbing to 2.7x post-close…

… a shift from Hammond’s ultra-conservative approach to financing is necessary to fuel the next leg of growth - which could see the stock re-rate to larger, more diversified peers if it can stick the landing.