|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Here’s what we have on tap for you in this Morning Meeting:

Tariffs are implemented on both sides, discussions progress

Ontario building permits come in soft, but beat expectations

Canadian takeouts are rising due to U.S. interest, companies need to unlock hidden value before it's too late

In mining: gold nears $3,000/oz, FM up big on positive geopolitical developments in Panama

TRADE WAR MONITOR

In the back half of the week, the trade situation was all about action:

U.S. steel & aluminum tariffs went into effect on Wednesday for all Canadian exports

Canada’s retaliatory tariffs on $30B of U.S. imports went into effect yesterday

Doug Ford sat down with Howard Lutnick in D.C. yesterday and came out of the meeting “extremely positive” about the road ahead for the Canada-U.S. relationship

Notably, Algoma Steel (ASTL) had its earnings call yesterday and had this to say:

The implementation of tariffs on Canadian steel and aluminum imports has introduced even more uncertainty… we expect the Canadian government’s swift and appropriate response will support the industry as we weather the impact… we believe rational dialogue will prevail between these two close allies.

Our framework for navigating the trade war: https://www.bullpen.finance/content/51

HOT OFF THE PRESS

Ontario weighs on building permit data

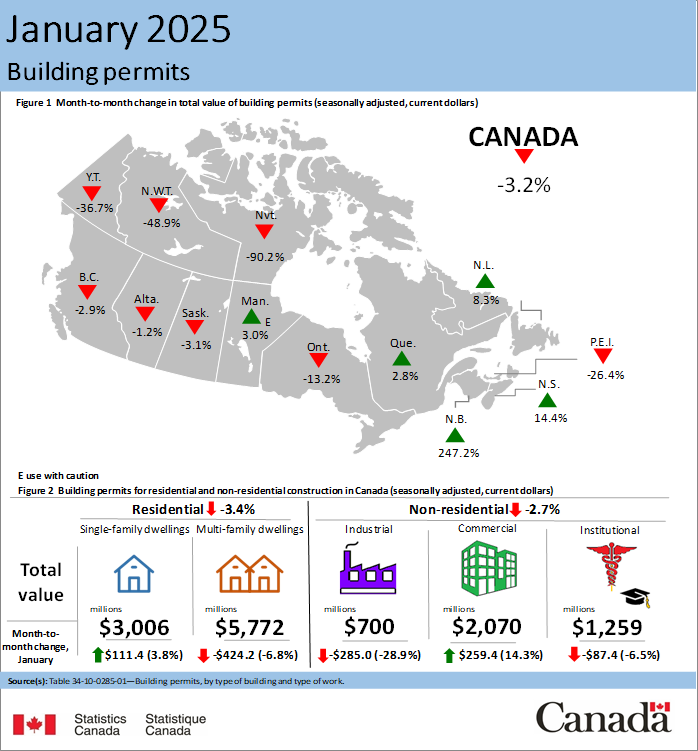

Yesterday we got building permit data for January, which came in at -3.2% M/M, above expectations of a 5% decline after a hot December. We have to give StatCan props here (rare!) for this nice visual summary.

Ontario was the anchor in both residential and non-residential permitting, with multi-family representing a ~$750M drag on results and another ~$200M hit from industrial.

We saw some trend confirmation in other provinces too, with continued strength in Quebec and Nova Scotia offset by declines in B.C.

Look at New Brunswick punching above its weight! Huge gains for a province of its size, driven by multi-family activity in Moncton and Fredericton on the residential side, and in institutional permitting on the non-residential side.

Of the REITs, Killam (KMP-U) looks well-positioned should that continue, with ~20% of its NOI coming from the province and another 32% coming from Nova Scotia.

M&A landscape: Canada is for sale

Thanks to a pickup in large take-private transactions (>$1B), deal making activity jumped in 2024. With the $10B takeout of Innergex in February, it looks like 2025 could have more big ticket buys in store.

But who’s doing the buying?

Based on 20 recent takeouts we looked at, U.S. private equity was the main culprit (half of the total). There’s a pretty easy explanation as to why that is.

A weaker loonie makes the Canadian universe more attractive for a U.S. buyer…

… as do Canadian market valuations, which have decoupled from world valuations since the pandemic.

Now trade tensions might put a lid on U.S. interest in the near-term, but if Canadian companies keep getting picked off, can we really blame them?

I mean, look at the funding environment we’ve had in recent years:

No good way to say it.. it’s ugly. If access to capital is easier in private markets, it’s just business.

Thankfully, tapping private markets isn’t the only way we’re seeing Canadian companies unlock value.

Take GFL Environmental (GFL) for example. It operates two distinct segments: solid waste and environmental services (ES) - unique compared to other waste companies, meaning it’s not as easy for the market to value.

Instead of accepting a discount, GFL tells the market what it’s worth by selling a partial stake in its ES business for $8B to Apollo, at >16x EBITDA.

The market listens, re-rating the company to trade in-line with the deal multiple.

It’s the public company equivalent of that friend who tells you he can hit his driver 300. It’s one thing to say it, another thing to see it!

If the above link won’t work, try this: https://www.bullpen.finance/content/60

FUNNY BUSINESS

ON OUR RADAR

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Gold is nearing US$3,000/oz! We highlighted in February that despite such strong commodity performance, producer multiples haven’t budged. If the street pulls in higher gold prices, forecasts should get a nice bump, meaning producers could have a leg up if they maintain current multiples. With production costs well below gold prices for most names, the sector should be spitting out A LOT of cash flow.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

First Quantum Minerals (FM) was up ~15% today (on >4x daily avg volume) after Panama's President announced a review of the shuttered Cobre Panama mine and authorized the export of 120,000 metric tons of copper concentrate. This development could lead to the mine's reopening (closed since late 2023), which previously accounted for 40% of First Quantum's sales and 1% of global copper output (and ~5% of Panama’s GDP!).

Propel Holdings (PRL) reported a solid Q4 on Wednesday, with annual revenue of $450M up 42% Y/Y and net income surging 67% Y/Y to $46M. The 13% selloff was on guidance though, as management revised its ROE expectations lower to account for equity issued for acquisitions (QuidMarket deal added US$80M to PRL’s equity base).

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| David Harquail | Franco-Nevada (FNV) | $1.7M |

| Sandip Rana | Franco-Nevada (FNV) | $1.3M |

| Randy Toone | AltaGas (ALA) | $1.9M |

| Corine Bushfield | AltaGas (ALA) | $5.5M |

| Chris Vollmershausen | Agnico Eagle (AEM) | $2.2M |

| Jean Robitaille | Agnico Eagle (AEM) | $1.2M |

| Dominique Girard | Agnico Eagle (AEM) | $1.5M |

| Darrell Chambliss | Waste Connections (WCN) | $2.6M |

| Robert Julien | NorthWest (NWH) | $2.0M |

| Stephen Smith | EQB Inc. (EQB) | $7.2M |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 AtkinsRealis (ATRL) | 0.56 | 0.78 |

| 🇨🇦 Biosyent (RX) | 2.2M | 2.0M |

| 🇨🇦 Empire (EMP-A) | 0.62 | 0.62 |

| 🇨🇦 Sylogist (SYZ) | 0.03 | 0.07 |

| 🇨🇦 Village Farms (VFF) | -11.5M | -3.5M |

| 🇨🇦 HLS Therapeutics (HLS) | -0.10 | -0.09 |

| 🇨🇦 Medical Facilities (DR) | 21.2M | 21.0M |

| 🇨🇦 Kelt Exploration (KEL) | 0.07 | 0.30 |

| 🇨🇦 Ballard (BLDP) | -0.27 | -0.13 |

| 🇨🇦 Calfrac Well (CFW) | -0.01 | -0.02 |

| 🇨🇦 Haivision (HAI) | 28.2M | 30.4M |

| 🇨🇦 NFI Group (NFI) | 0.11 | 0.04 |

| 🇨🇦 Mattr (MATR) | -0.02 | -0.04 |

| 🇨🇦 Sagicor (SFC) | 0.20 | 0.25 |

| 🇨🇦 Wheaton (WPM) | 0.44 | 0.44 |

| 🇨🇦 ADENTRA (ADEN) | 0.50 | 0.56 |

| 🇺🇸 Dollar General (DG) | 1.68 | 1.50 |

| 🇺🇸 DocuSign (DOCU) | 0.86 | 0.85 |

AtkinsRéalis (ATRL) had mixed results, with some big moving parts:

Revenue beat expectations by 8%, coming in at $2.6B (+14% Y/Y) on the back of robust nuclear demand (up 67% Y/Y)

EPS for Q4 was $0.56, missing estimates of $0.78 mainly due to higher SG&A expenses and weaker performance in lump-sum turnkey projects

Sold the remaining ~7% stake in Highway 407 ETR for $2.8B, marking the shift to a pure-play engineering model

Reported 26% Y/Y growth in the services backlog of $17.2B (up from $13.7B last year)

With the nuclear theme rocking, and long-term backlog support from projects like high speed rail, ATRL could command a premium for a while.

Empire (EMP-A) reported flat adj. EPS of $0.62 despite a small bump in revenue Y/Y, causing the stock to sell off >4%. Less efficient earnings conversion in low growth names = multiple compression.

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 illumin (ILLM) | AM | 0.5M |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | -3.2% | -5.0% |

| 🇺🇸 PPI M/M | 0.0% | 0.3% |

| 🇺🇸 Core PPI M/M | -0.1% | 0.3% |

| 🇺🇸 PPI Y/Y | 3.2% | 3.3% |

| 🇺🇸 Core PPI Y/Y | 3.4% | 3.5% |

| 🇺🇸 Jobless Claims | 220K | 225K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Manufacturing Sales M/M | 7:30AM | 2.0% |

| 🇨🇦 New Vehicle Sales | 7:30AM | - |

| 🇨🇦 Wholesale Sales M/M | 7:30AM | 1.9% |

| 🇺🇸 Consumer Sentiment | 9:00AM | 63.1 |