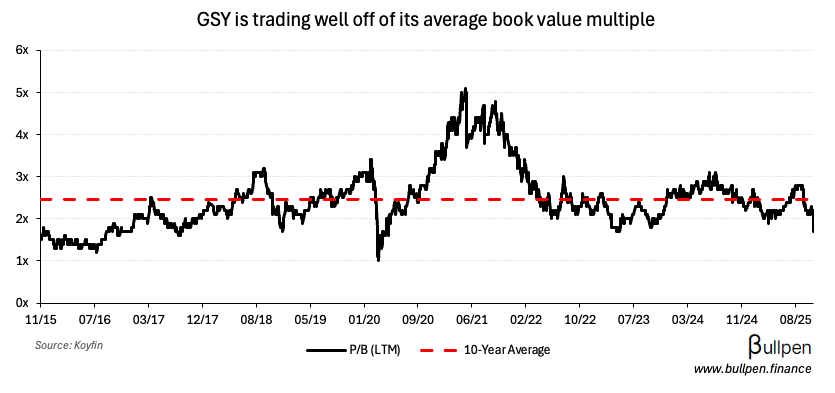

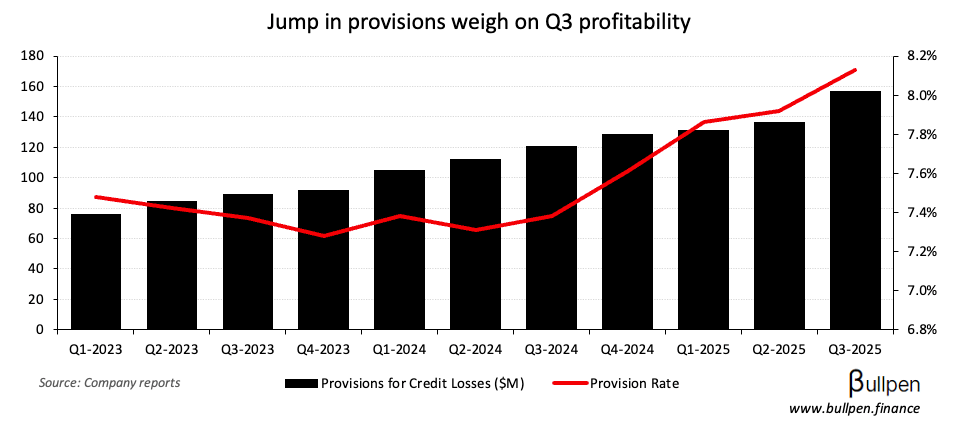

goeasy (GSY) extended its post-short report drawdown to over 35% following Q3 results, which beat on the top-line but missed big on earnings - driven by increased provisioning activity...

… to cushion against some negative credit migration in the quarter.

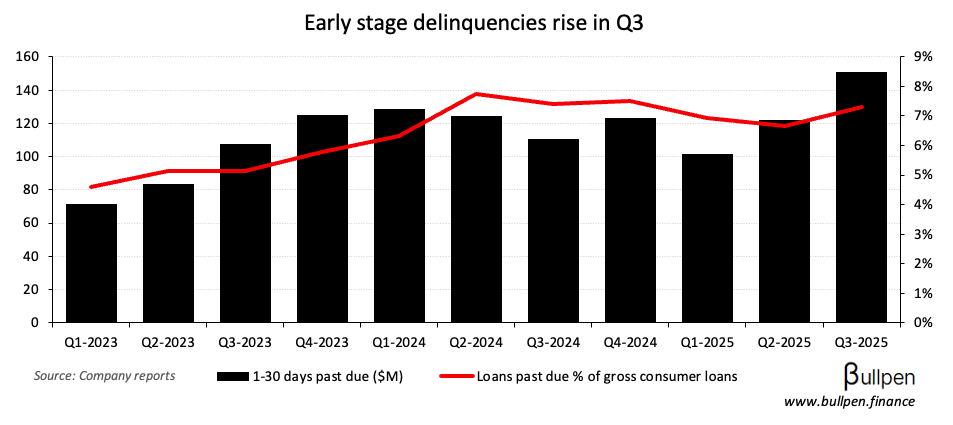

Management indicated the tougher credit backdrop should persist, as unemployment remains elevated and economic growth slows…

… we can continue to expect to see elevated delinquency levels while we work to assist our customers during these periods of uncertainty…

… which naturally shows up in subprime loan books first. With that and some general unease following a series of auto lending blowups, investors will likely wait for evidence of a turnaround before coming back to GSY.