|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Population stalls, NPR outflows grow

Job vacancies can’t find a floor

Trump wants a piece of LAC

STEP gets another takeout bid

HOT OFF THE PRESS

Population stalls as NPR outflows grow

Population growth stalled in Q2, with less than 50K added. At 0.1%, Q/Q growth hit an all-time low for a second quarter (ex-COVID) but improved slightly over the prior period…

… supported by immigration, which has held steady in recent quarters at ~100K - nearing the government’s 400K per year target.

The trend continues in the non-permanent category, which posted its third straight outflow and the second largest on record…

… which should keep going, with the current total sitting ~940K above Carney’s 5% goal. That should take a bite out of Canada’s younger demographic…

… driving a re-acceleration of population aging and reinforcing the M&A ambitions for senior living names like Chartwell (CSH) and Sienna (SIA).

Job vacancies can’t find a floor

Payroll employment gained 0.1% in July, with gains in healthcare, education, and finance offsetting continued weakness in manufacturing…

… but that growth came at the expense of job vacancies, which fell 4% M/M and are off 15% versus last year.

Combined with the latest unemployment print, this hardly inspires confidence in the labour market - with 3.3 job seekers per available seat, the highest since 2017 excluding the pandemic.

FUNNY BUSINESS

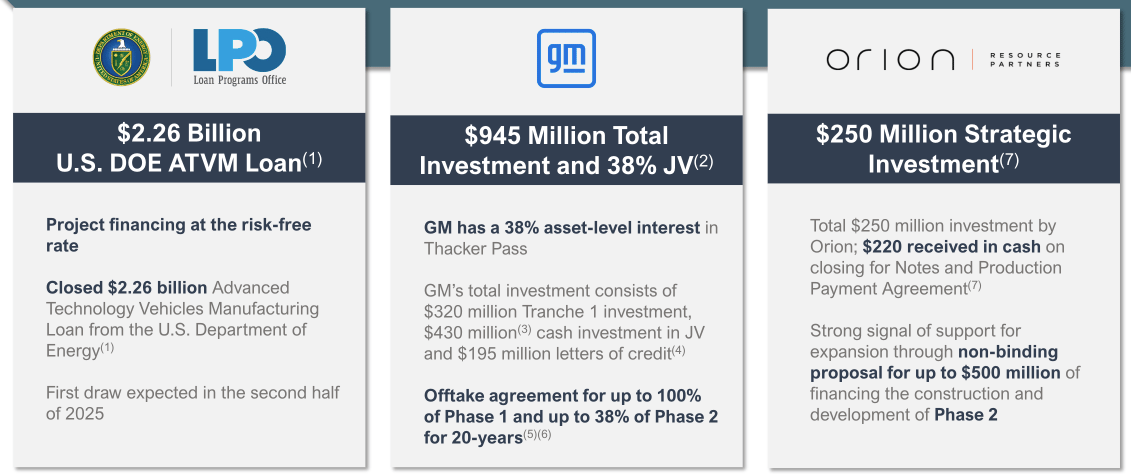

Lithium Americas (LAC) has more than doubled since word broke that Trump wants up to 10% of the company, whose Thacker Pass project is the largest planned lithium mine in the West. If recent deals with Intel and MP Materials are any indication…

… this one isn’t really up for discussion - especially considering its $2.3B DOE loan hangs in the balance.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

STEP Energy Services (STEP) rose 27% on an upgraded $5.50/share bid from ARC Financial, after its previous $5 bid fell through. At nearly 3.5x NTM EBITDA, the deal values STEP well above the range public markets are willing to pay…

… and it isn’t all that surprising, given the weak oil price environment that’s driven M&A activity historically. STEP management has pointed to the impact cheap barrels have had on both client activity and margins…

This has further constrained demand in an oversupplied market. In response, we are seeing service prices come down, which places additional pressure on already compressed margins.

… which has shown up in the financials.

I called out STEP as one of two future targets after Trican’s $230M acquisition on a thesis that remains the same today: energy services names need to get bigger or get bought to weather the storm. The other one? Calfrac (CFW) - still public…

… but there’s sharks in the water! Let’s see.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Boris de Vries | Franco-Nevada (FNV) | $238K |

| Francois Poirier | TC Energy (TRP) | $7.5M |

| Peter Thomson | Thomson (TRI) | $4.8M |

| Eric Boyko | Stingray (RAY) | $404K |

| Patrick Dovigi | GFL Env. (GFL) | $12.6M |

| Kenneth Pickering | Taseko (TKO) | $1.2M |

| Bryce Hamming | Taseko (TKO) | $499K |

| Manfred Walt | Killam (KMP) | $177K |

| Shannon Joseph | Tamarack (TVE) | $102K |

| John Burzynski | Aya Gold (AYA) | $122K |

| Benoit La Salle | Aya Gold (AYA) | $123K |

| Sime Armoyan | Morguard (MRT) | $466K |

Flagging the buying at Aya Gold & Silver (AYA), which comes after a short report alleged the company is inflating resource estimates. Management denied the claims, and the buying is a vote of confidence that I’m sure GSY shareholders are waiting for.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Blackberry (BB) | 0.04 | 0.01 |

| 🇨🇦 Vecima (VCM) | -0.05 | 0.08 |

| 🇨🇦 WildBrain (WILD) | 0.04 | 0.02 |

| 🇺🇸 Costco (COST) | 5.87 | 5.80 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Weekly Earnings Y/Y | 3.3% | - |

| 🇺🇸 Durable Goods M/M | 2.9% | -0.5% |

| 🇺🇸 GDP Q/Q | 3.8% | 3.3%% |

| 🇺🇸 Jobless Claims | 218K | 235K |

| 🇺🇸 Existing Home Sales | 4.00M | 3.96M |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | 8:30AM | 0.1% |

| 🇺🇸 Core PCE Price M/M | 8:30AM | 0.2% |

| 🇺🇸 Personal Income M/M | 8:30AM | 0.3% |

| 🇺🇸 Personal Spending M/M | 8:30AM | 0.5% |

| 🇺🇸 Consumer Sentiment | 10:00AM | 55.4 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.