|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

PMI shows signs of recovery

Manulife’s $1B private credit push

Employee front-runs 500 PRs

Mullen Chairman makes a rare buy

CMG falls 20% on dividend cut

HOT OFF THE PRESS

PMI shows signs of economic recovery

The Ivey Purchasing Managers Index came in hotter than expectations at 55.8, the largest M/M expansion of purchasing activity since last July.

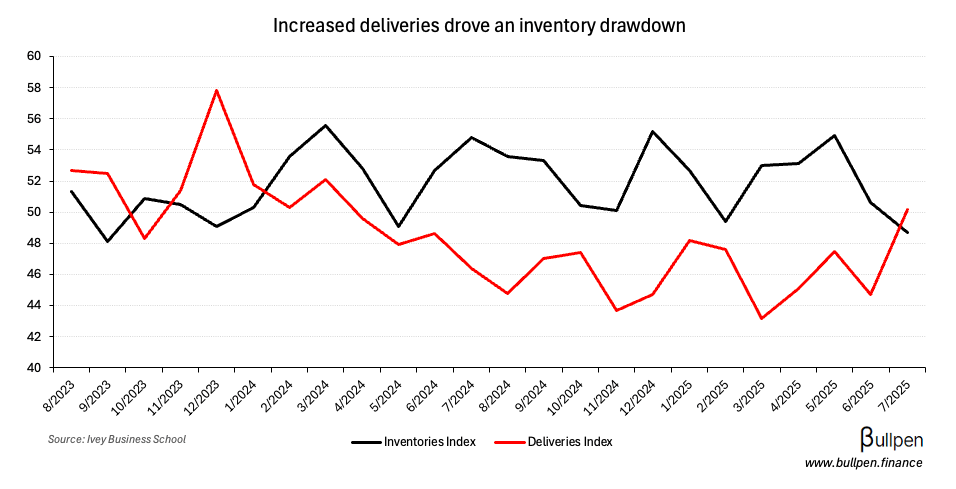

The strength was likely driven by restocking, as an increase in deliveries contributed to an inventory draw during the month.

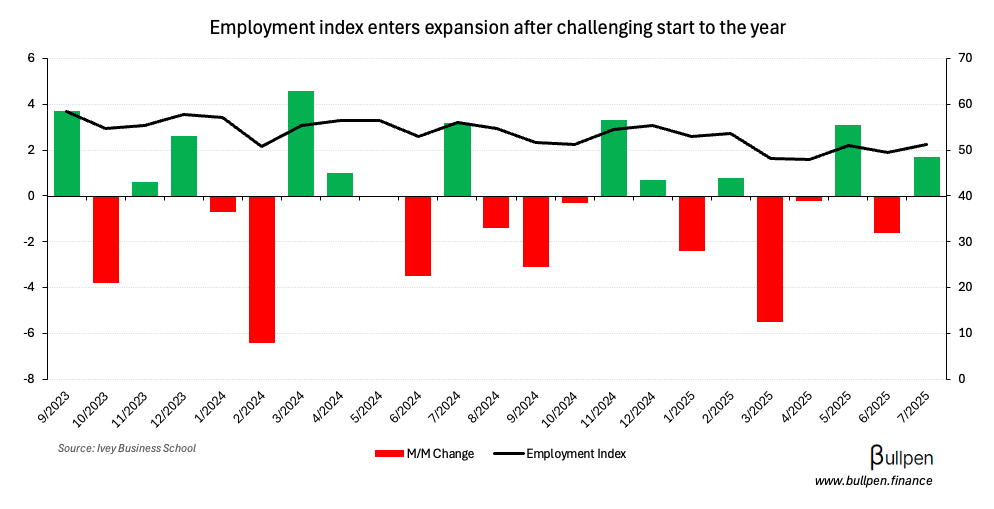

Employment also improved, following contractions in three of the last four months amid challenging labour market conditions.

All in, a strong print - and one that’s supportive of a rebound in GDP for July.

Manulife’s $1B private credit push

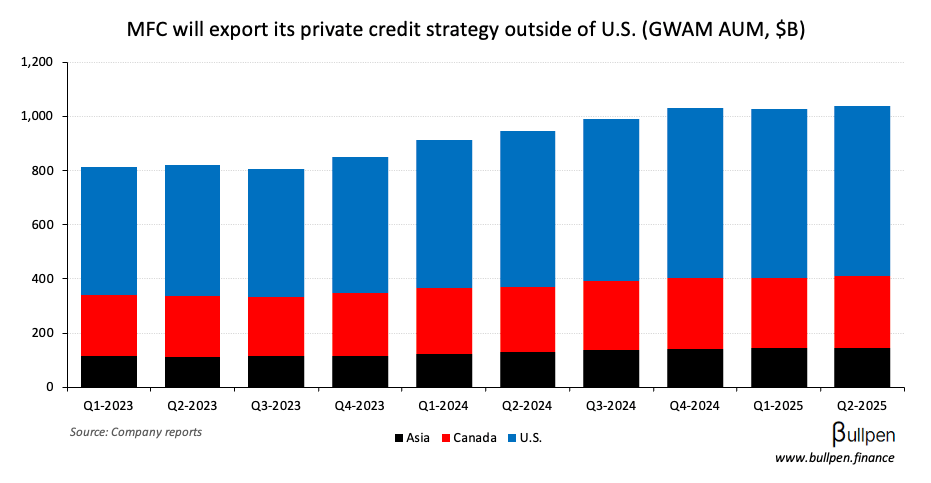

Alongside its earnings results, Manulife (MFC) announced the ~$1.2B acquisition of a 75% stake in Comvest - a U.S. private credit platform with ~$20B of AUM. Compared to MFC’s ~$1T under management, the transaction is small…

… but meaningful in the context of private credit, where MFC only has $5B today. Management likes the category, highlighting expected market runway…

… this is a market that’s expected to double in the next 4 to 5 years in terms of potential opportunity.

… and distribution opportunities across MFC’s global footprint as factors in favour of continued AUM growth.

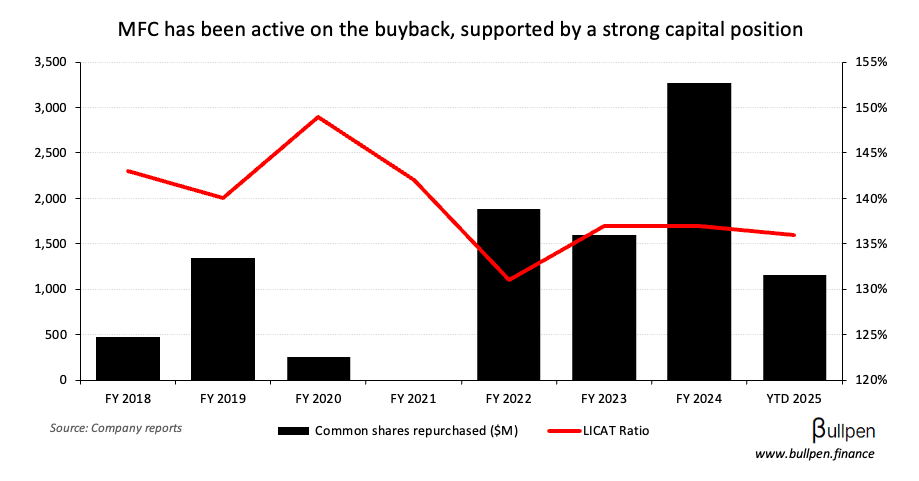

The market seems unconvinced for now, sending the stock down 4% - as sub-1% EPS accretion from the deal likely has investors wondering: why doesn’t Manulife just buy back stock (~2% accretion)?

My take: this is a more defensive acquisition than management is letting on. Private credit is hot and Manulife is late to the party. If clients have to get that exposure elsewhere…

… private credit is a fast-growing and in high demand strategy from our clients.

… the door opens for the new manager to pull additional capital away from MFC. The deal rationale isn’t near-term accretion, it’s avoiding the longer-term dilution that comes from not meeting client needs.

FUNNY BUSINESS

A software developer at a newswire service is going to jail for front-running 500 press releases. Either it started innocently, and seeing winner after winner pass through their system eroded his willpower…

… or he knew the money was there and took a page out of Matt Damon’s book in ‘The Departed’… I don’t know which would be funnier.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| David Malinauskas | Toromont (TIH) | $517K |

| Joel Couture | Toromont (TIH) | $598K |

| Karen Gosse | Fortis (FTS) | $238K |

| Carol-Ann P.T. | Agnico (AEM) | $890K |

| Joan Sproul | FirstService (FSV) | $1.1M |

| Wade Burton | Fairfax (FFH) | $15.5M |

| George Patrick | VersaBank (VBNK) | $153K |

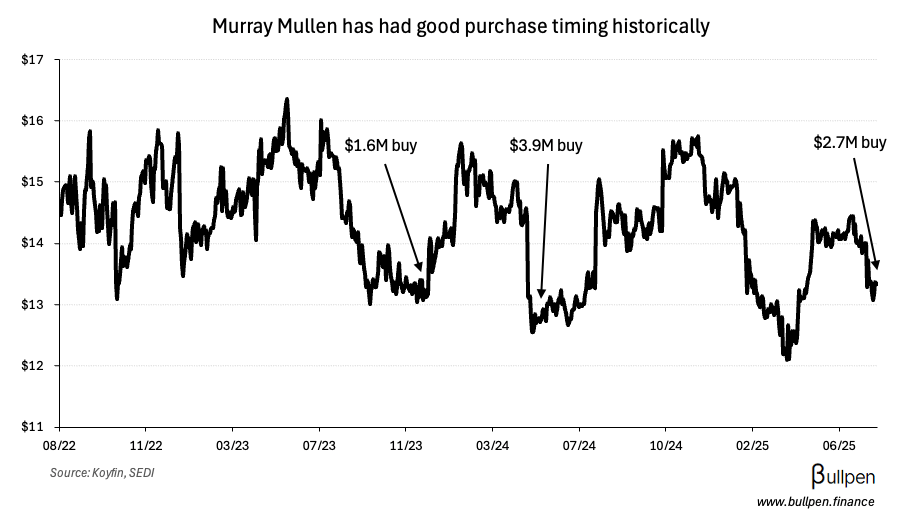

| Murray Mullen | Mullen (MTL) | $1.3M |

Flagging the Mullen Group (MTL) buy here, as Murray (Chairman) doesn’t pull the trigger often, but he’s called the bottom pretty well historically:

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

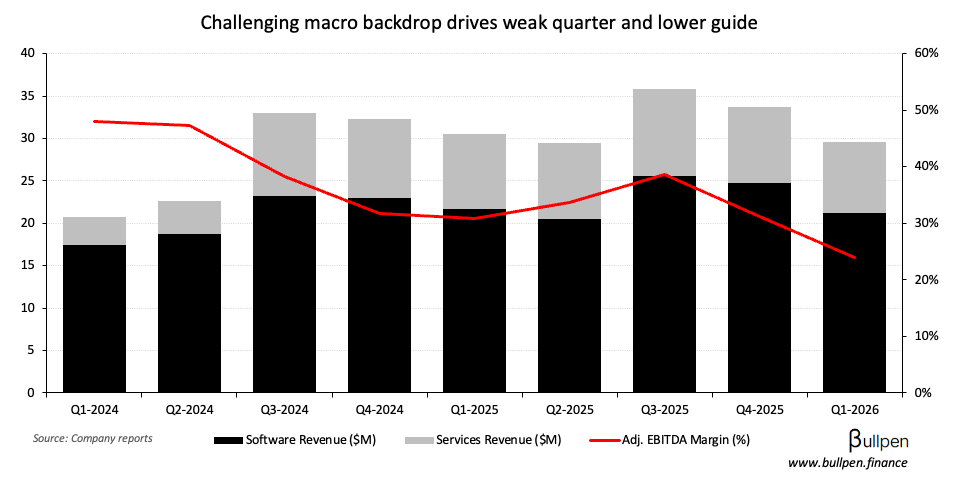

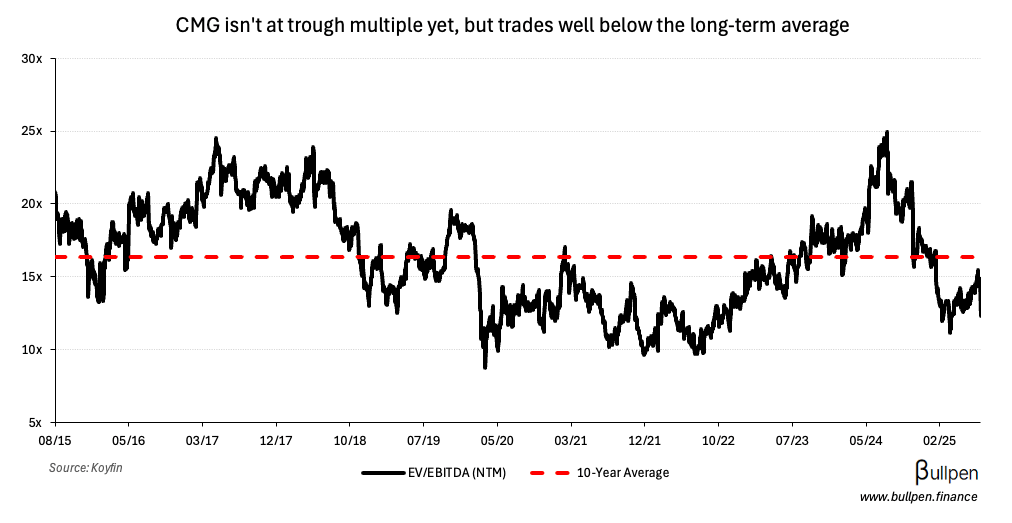

Computer Modelling Group (CMG) fell nearly 20% on earnings, which came up short on both revenue and profit with organic revenue growth down 15% Y/Y, leading to margin compression and a lower full-year guide.

With management pointing to the loss of a long-time client and cutting the dividend 80% to support its acquisition pipeline, this feels like a kitchen sink quarter. Down 40% YTD, let’s see where CMG finds its floor.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 BCE Inc. (BCE) | 0.63 | 0.71 |

| 🇨🇦 Canadian Tire (CTC) | 3.57 | 3.93 |

| 🇨🇦 MDA Space (MDA) | 0.38 | 0.30 |

| 🇨🇦 Maple Leaf (MFI) | 0.56 | 0.46 |

| 🇨🇦 ATS Corp. (ATS) | 0.41 | 0.42 |

| 🇨🇦 AtkinsRealis (ATRL) | 0.80 | 0.72 |

| 🇨🇦 Cascades (CAS) | 0.19 | 0.19 |

| 🇨🇦 Keyera (KEY) | 0.35 | 0.40 |

| 🇨🇦 Stella-Jones (SJ) | 1.91 | 1.78 |

| 🇨🇦 Enerflex (EFX) | 179M | 145M |

| 🇨🇦 Brookfield (BN) | 0.88 | - |

| 🇨🇦 Quebecor (QBR) | 605M | 610M |

| 🇨🇦 Leon's (LNF) | 0.46 | 0.46 |

| 🇨🇦 Jamieson (JWEL) | 0.40 | 0.35 |

| 🇨🇦 Altus Group (AIF) | 0.50 | 0.35 |

| 🇨🇦 Power Corp. (POW) | 1.38 | 1.29 |

| 🇨🇦 OpenText (OTEX) | 0.97 | 0.83 |

| 🇨🇦 Lassonde (LAS-A) | 5.03 | 5.00 |

| 🇨🇦 Saputo (SAP) | 0.40 | 0.38 |

| 🇨🇦 Russell (RUS) | 1.07 | 1.03 |

| 🇨🇦 Trisura (TSU) | 0.76 | 0.71 |

| 🇨🇦 Sun Life (SLF) | 1.79 | 1.77 |

| 🇨🇦 High Liner (HLF) | 0.38 | 0.41 |

| 🇨🇦 Pembina (PPL) | 0.62 | 0.66 |

| 🇨🇦 Wheaton (WPM) | 0.63 | 0.59 |

| 🇨🇦 CES Energy (CEU) | 0.18 | 0.18 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Docebo (DCBO) | AM | 0.22 |

| 🇨🇦 Emera (EMA) | AM | 0.65 |

| 🇨🇦 Algonquin (AQN) | AM | 0.04 |

| 🇨🇦 dentalcorp (DNTL) | AM | 0.16 |

| 🇨🇦 Boralex (BLX) | AM | 0.07 |

| 🇨🇦 Constellation (CSU) | PM | 21.10 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Ivey PMI | 55.8 | 55.2 |

| 🇺🇸 Jobless Claims | 226K | 221K |

| 🇺🇸 Continuing Claims | 1,974K | 1,950K |

| 🇺🇸 Consumer Credit Change | 7.4B | 7.0B |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 8:30AM | 7.0% |

| 🇨🇦 Employment Change | 8:30AM | 13.5K |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.