|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Inflation misses, food accelerates

Manufacturing sales jump

Housing starts miss, inventory falls

Artis pivots with reverse takeover

HOT OFF THE PRESS

Inflation misses, food accelerates

Headline inflation of 1.9% came in just shy of estimates, moving higher from July’s 1.7% but moderating on a core basis…

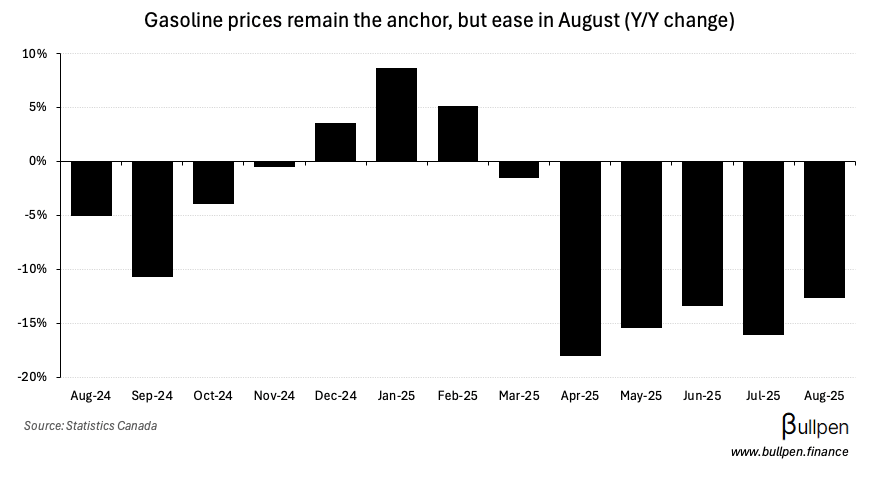

… with gas prices posting a smaller Y/Y decline than in previous months…

… resulting in a less material slowdown in the transportation category. In the food category, inflation continues to heat up…

… with prices at the counter up 3.5% compared to last August…

… carried by meat prices, which are 7% higher on the back of a 13% jump in the cost of beef. The amount of steak I ate last weekend won’t help the next print.

With this being the last big data point before today’s rate decision, odds of a cut are now over 90%.

Manufacturing sales jump

If there’s any data point in favour of holding rates, it’s manufacturing sales - which gained 2.5% M/M, beating estimates and accelerating from June’s gain thanks to higher activity in transportation equipment and petroleum products.

With the improvement, the inventory-to-sales ratio moved down to 1.72x despite an inventory build…

… and it made its way through to wholesale sales, which rose for the third straight month to $86B.

Housing starts miss, inventory falls

Housing starts missed in August, falling to 246K versus estimates for 278K - down 16% versus July, the first decline in five months.

On a Y/Y basis gains were pretty broad-based, with starts in BC doing the heavy lifting and more than offsetting some slight weakness in Ontario and Alberta.

Unit absorption picked up for a second straight month, indicating the continued slowdown in construction might be helping the housing market find its footing…

… which is further supported by the first inventory draw in six months and a flattening out of the time unabsorbed units sit on the market.

With Build Canada Homes looking to add supply to the tune of 500K per year, that dynamic may be tough to hold.

FUNNY BUSINESS

Artis REIT (AX-U) has shed 8% since announcing its reverse takeover of RFA Capital which if approved, will result in a new public entity - RFA Financial. Leading up to the deal, Artis had been divesting assets…

… which looks set to continue - as the combined company looks to recycle capital from property sales into loan growth. Tough pill to swallow for shareholders, knowing the best use of their investment is in funding another…

… but as evidenced by the InterRent takeout and H&R review, public markets aren’t paying up for REITs. I’ll wait for more detail before passing judgement.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

DIRTT Environmental Solutions (DRT) popped 18% on $20M of new deals with existing clients like Google and Alina Health. Management highlighted a $329M backlog in the press release, 6% higher than Q2.

GURU Organic Energy (GURU) extended its post-earnings run to 90%, further closing the gap to larger energy drink peers.

Intermap Technologies (IMP) fell 6% on its filing of a base shelf prospectus that allows it to issue up to $100M of equity in the next ~2 years. With the stock up 40% since Stifel launched coverage in July, it looks like a deal is coming down the pipe.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Crissy Rafoss | Peyto (PEY) | $110K |

| Derick Czember | Peyto (PEY) | $184K |

| Ramon Zanders | Topicus (TOI) | $1.3M |

| Ryan Swedburg | Eldorado (ELD) | $181K |

| Neil O'Brien | Luca (LUCA) | $1.1M |

| Colin Gruending | Enbridge (ENB) | $285K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 NanoXplore (GRA) | -0.06 | -0.01 |

NanoXplore (GRA) missed estimates in Q4 and announced the company’s founder would be stepping down from the CEO seat - could be a tough day of trading.

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Sangoma (STC) | PM | 10.7M |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Housing Starts | 246K | 278K |

| 🇨🇦 Inflation Y/Y | 1.9% | 2.0% |

| 🇨🇦 Core Inflation Y/Y | 2.6% | 2.7% |

| 🇺🇸 Retail Sales M/M | 0.6% | 0.2% |

| 🇺🇸 Export Prices M/M | 0.3% | 0.0% |

| 🇺🇸 Import Prices M/M | 0.3% | -0.1% |

| 🇺🇸 Industrial Prod. M/M | 0.1% | -0.1% |

| 🇺🇸 Inventories M/M | 0.2% | 0.2% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Foreign Security Buys | 8:30AM | -1.3B |

| 🇨🇦 BoC Rate Decision | 9:45AM | 2.5% |

| 🇺🇸 Building Permits | 8:30AM | 1.37M |

| 🇺🇸 Housing Starts | 8:30AM | 1.37M |

| 🇺🇸 Fed Rate Decision | 2:00PM | 4.25% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.