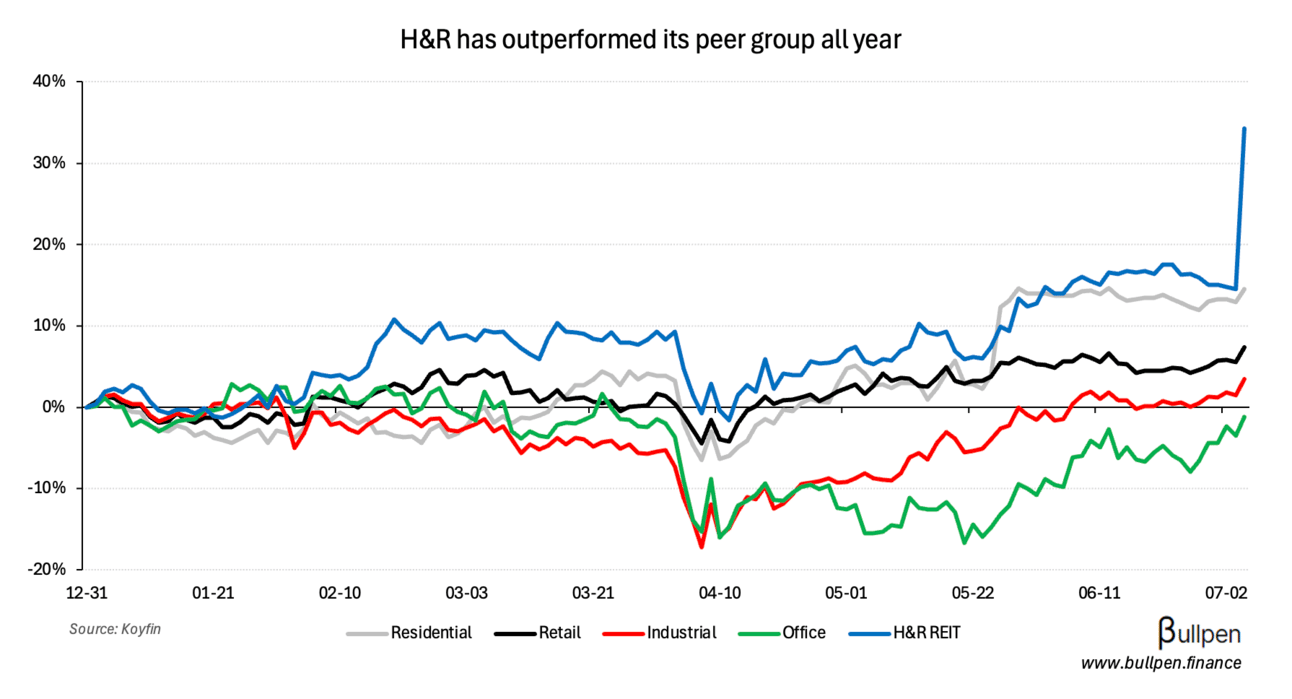

Just a month after the $2B take-private bid for InterRent, it looks like H&R REIT (HR-U) could be next, with management confirming it received a number of offers that a special committee has been evaluating since February, sending the stock up 17%.

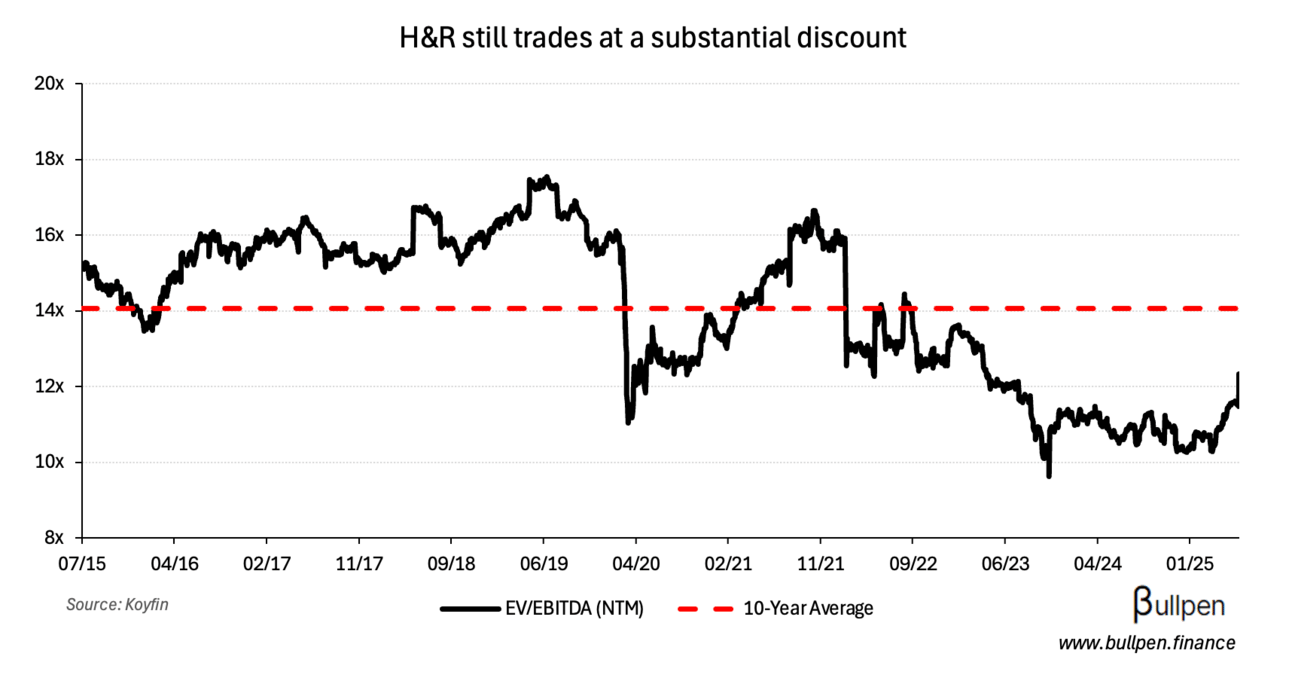

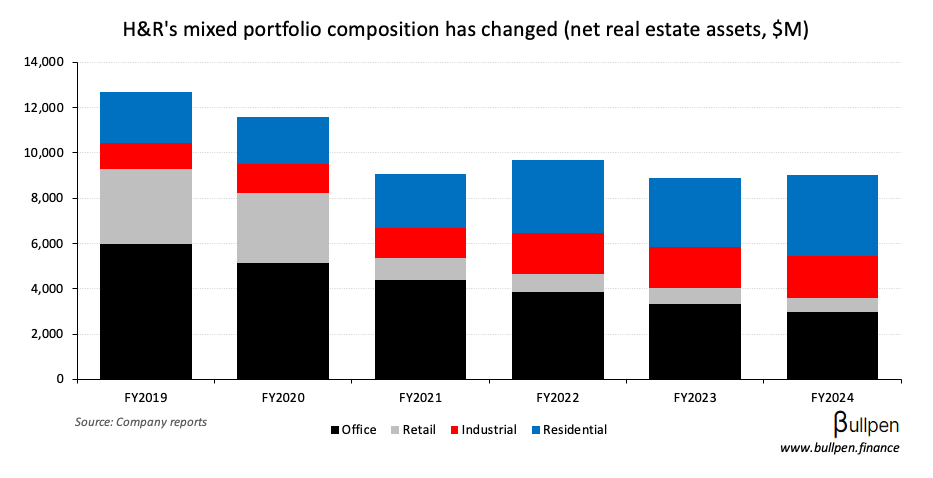

Even with Friday’s jump, H&R trades at a near-40% discount to its reported NAV of $20.62/unit, likely owing to the complexity of its portfolio - with a sizeable residential, industrial, and office footprint…

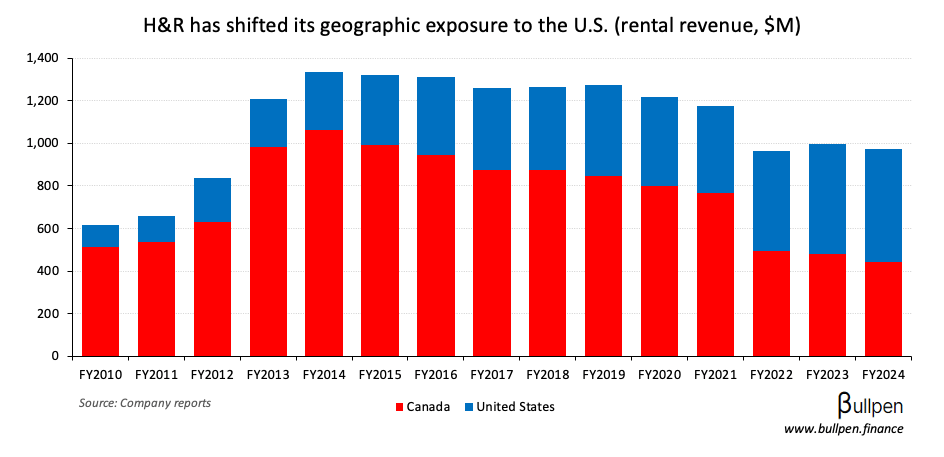

… and mixed geographic exposure.

While a buyer would probably need a discount to NAV, there’s still plenty of upside in a takeout scenario. A partial sell-down of the office and retail assets could also unlock value, accelerating the company’s multi-year portofolio transformation.