|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

New home prices keep falling

Planet MicroCap recap

Trump ups Canada tariffs by 10%

Hammond gains 30% on data centers

Aecon rises 12% on nuclear win

GURU jumps 12% on Prime Day

HOT OFF THE PRESS

New home prices keep falling

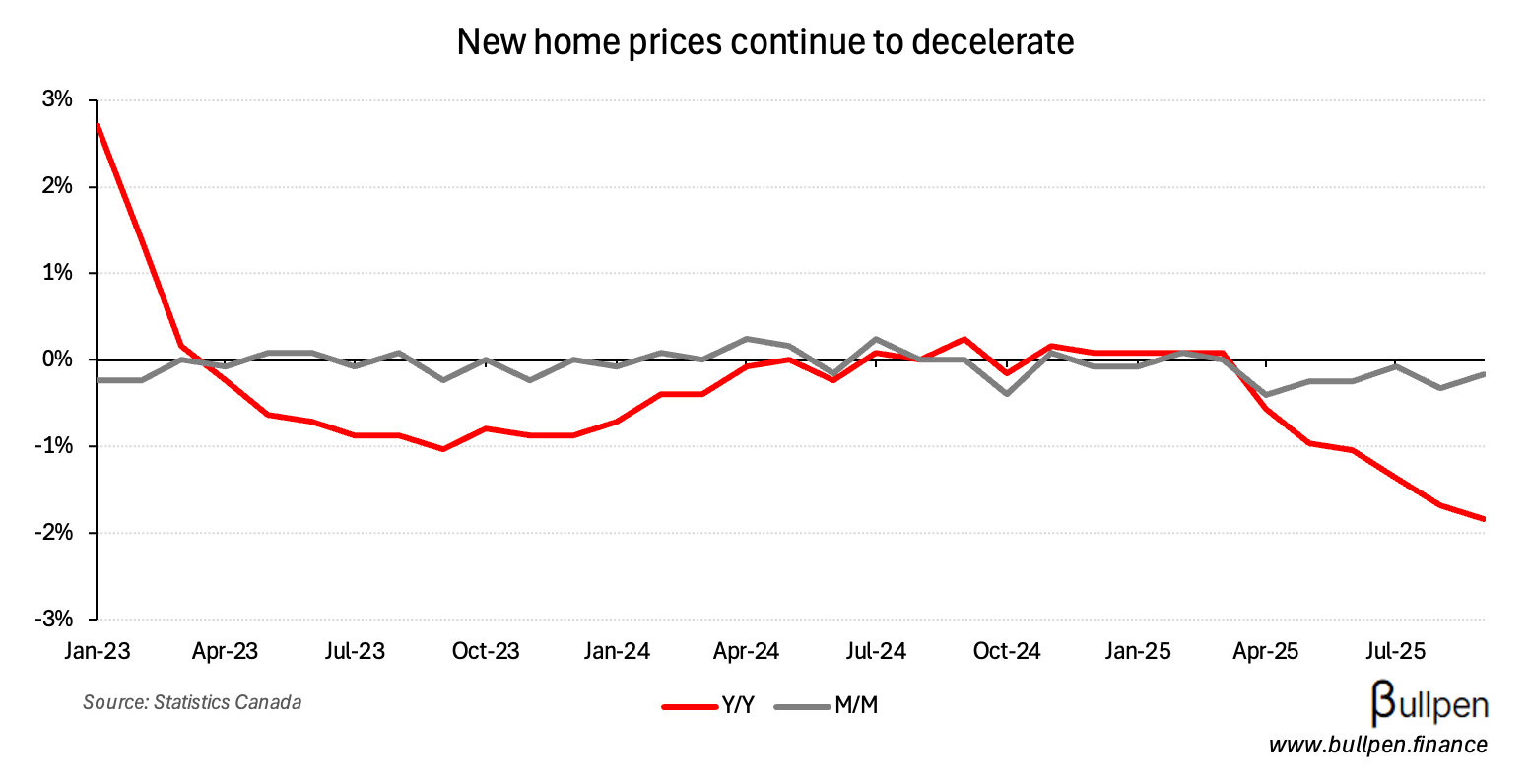

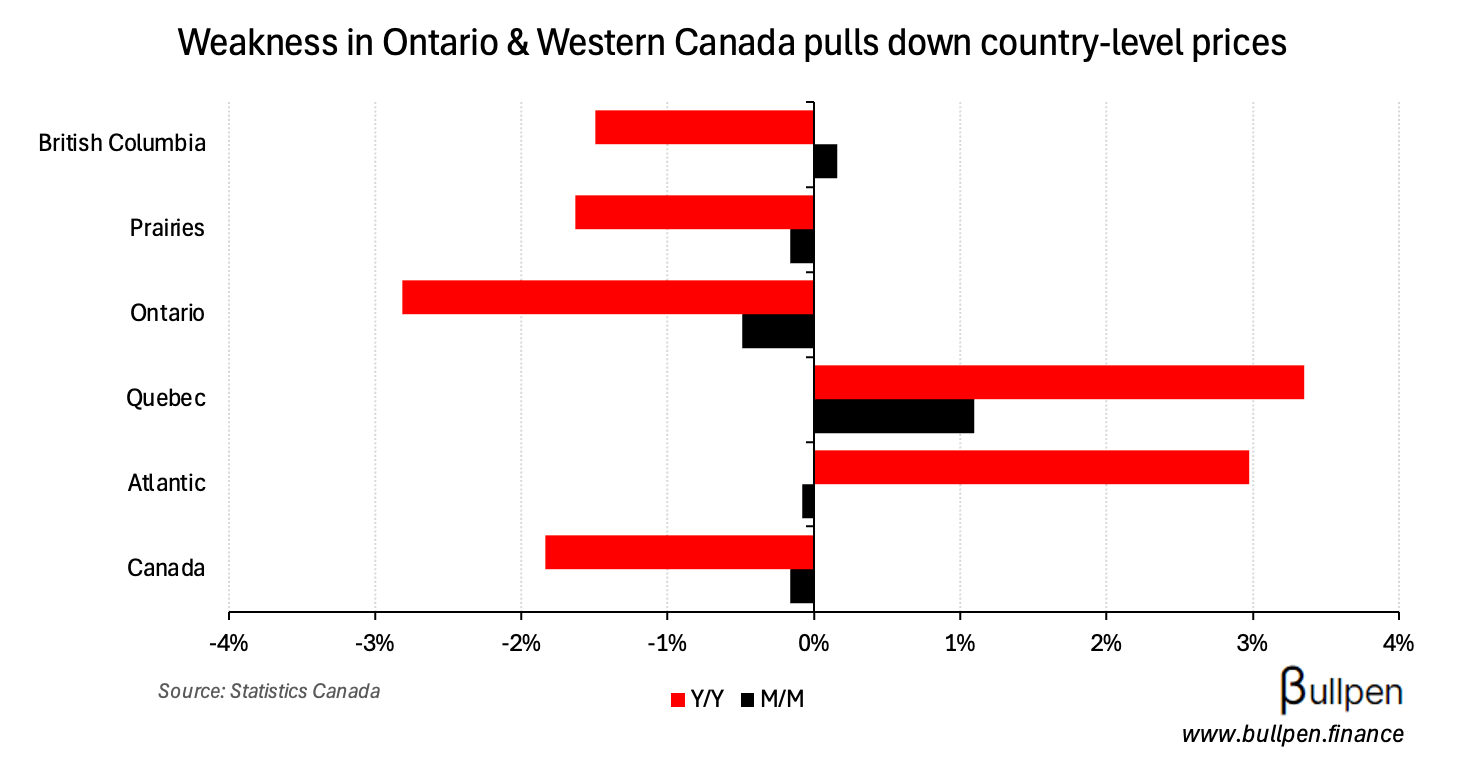

New home prices fell short of estimates in September, declining 0.2% M/M versus expectations for a gain of a similar magnitude - the sixth straight sequential drop.

On a provincial basis, results were mixed - with continued struggles in Ontario and strength in Quebec. Compared to last month, gains in BC reversed trend…

… and could continue, should housing supply remain tight in the province.

Planet MicroCap recap

Last week I spent some time speaking with a bunch of Canadian small caps. A few “transition” stories stuck out to me - for a brief introduction to each of them, check out the link below:

FUNNY BUSINESS

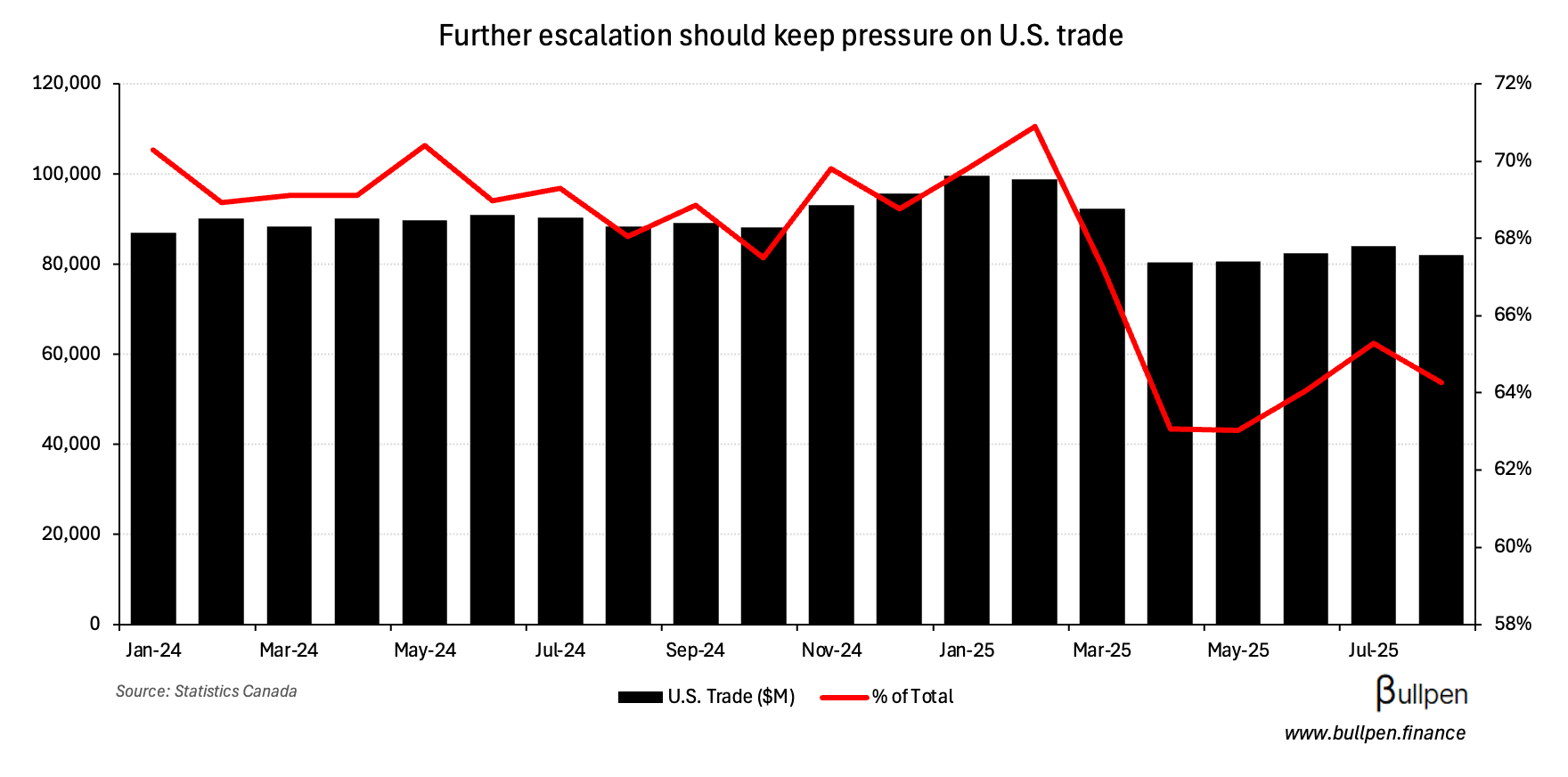

It didn’t take long for Trump to up the ante after pausing trade talks, taking the existing tariffs on Canada up by another 10%…

… let’s see if it has any impact on future cross-border trade prints.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

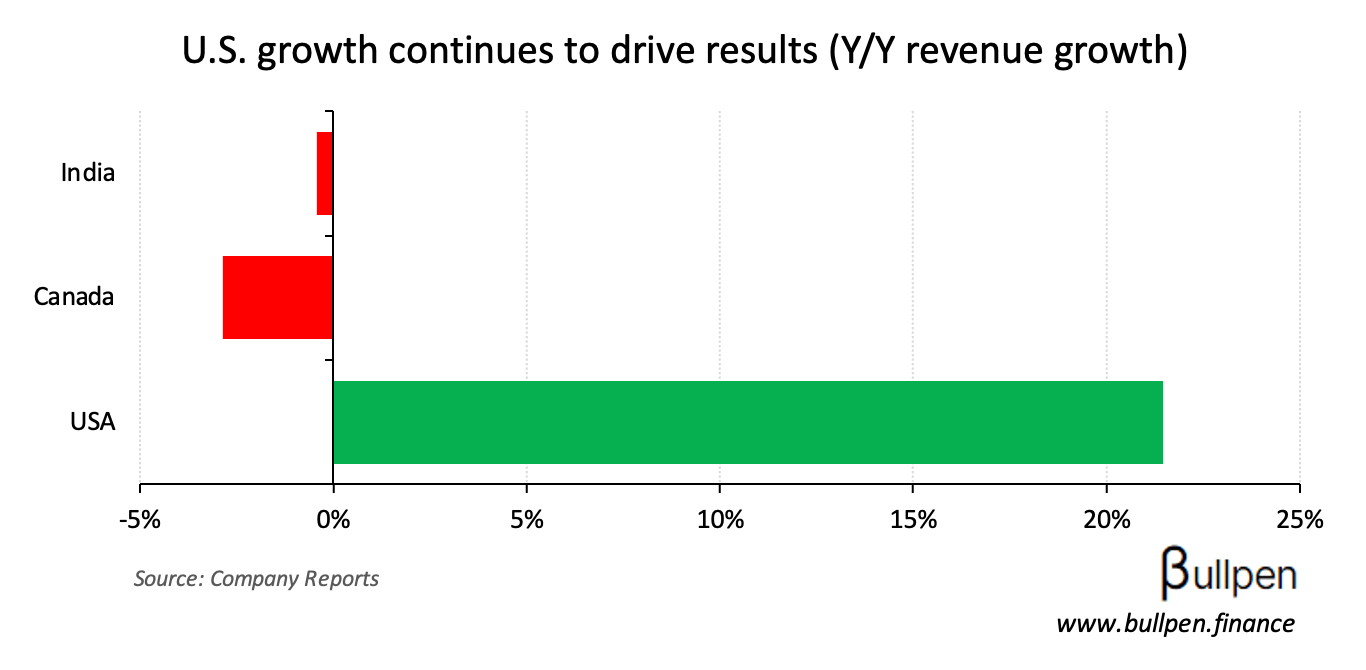

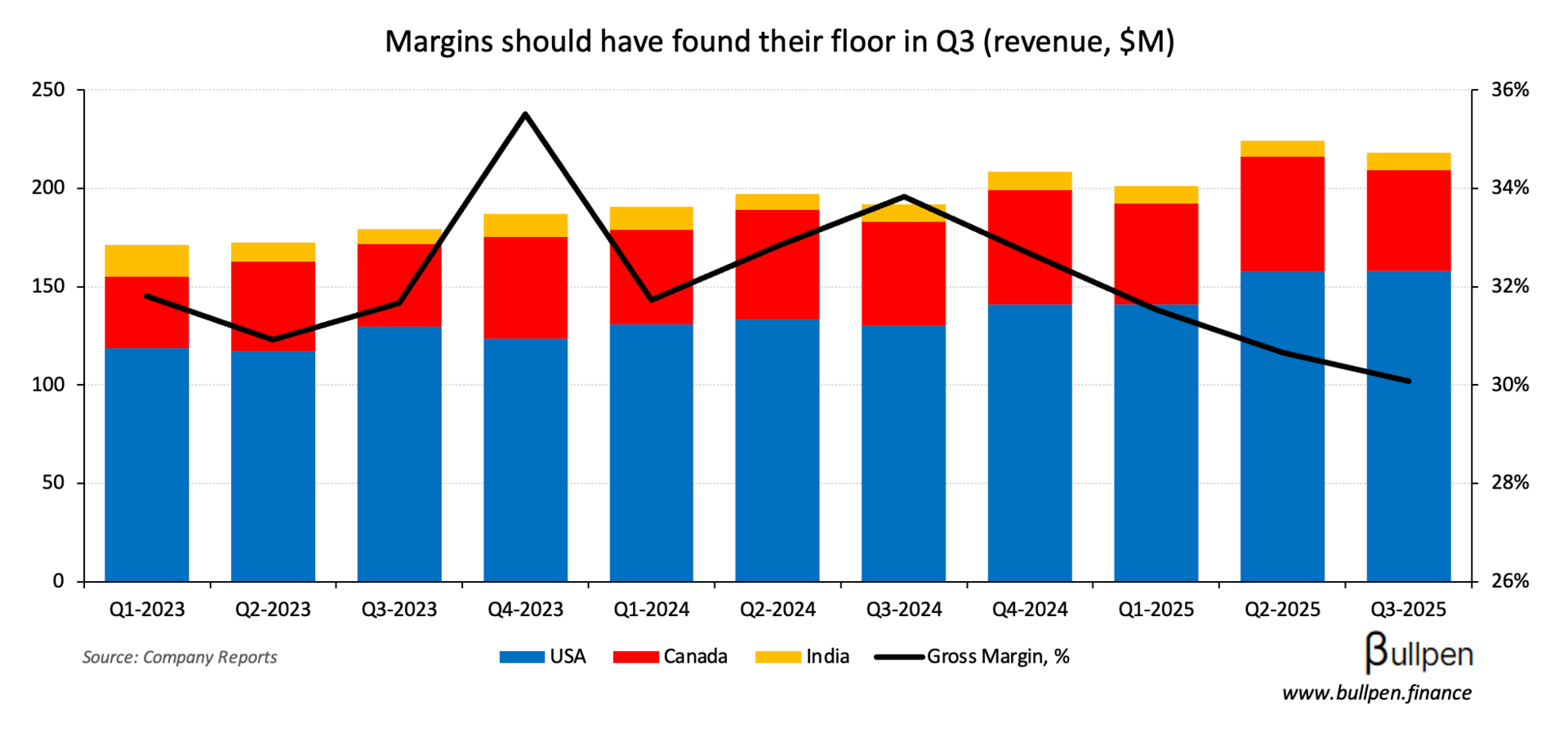

Hammond Power (HPS-A) ripped nearly 30% on its Q3 print, which beat on revenue thanks to significant U.S. growth…

… but missed on earnings, as tariff impacts pressure margins. That should be short-lived, as management’s price increase should improve profitability in Q4…

… as should its data center backlog, which comes at much higher volume than a typical order - enabling efficiency gains in the manufacturing process.

So what we see in a lot of other industries, we will do a design, and there will be a handful, maybe 2, 3, maybe 6 transformers for that project… you may see hundreds of the same design for some data center buildup.

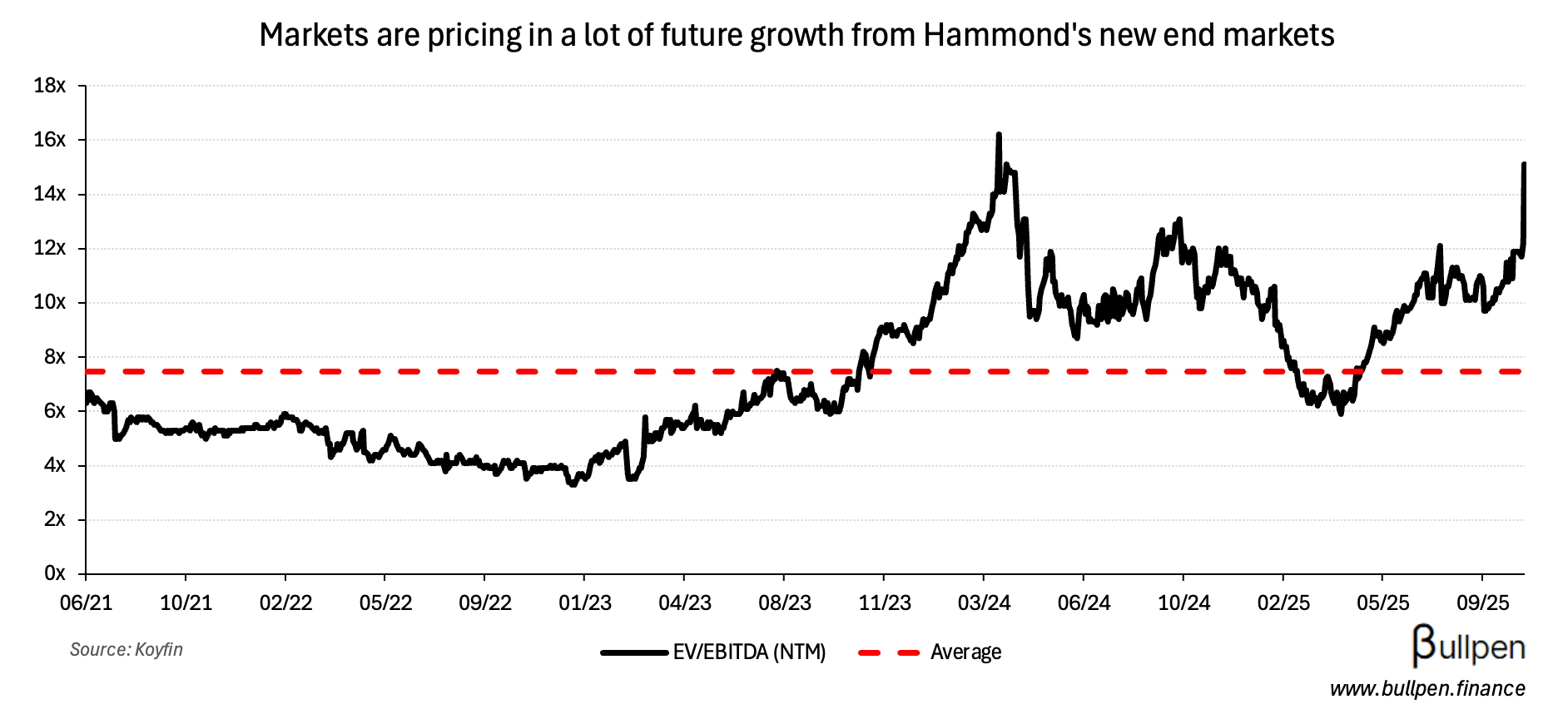

That’s what drove the price action, with the company announcing orders representing over 50% of its already growing backlog…

… increasing the market’s expectations and supporting multiple expansion as the data center theme gets priced in.

Aecon (ARE) added 12% on the back of another nuclear win - this time for the design, planning, and construction of four SMRs in Washington. With another eight to win in the buildout, growth in the segment isn’t slowing down…

… and with support from Carney’s nation-building agenda, neither is the backlog.

Up roughly 40% since highlighting the founder’s insider buying, Aecon is finally trading at the premium it deserves.

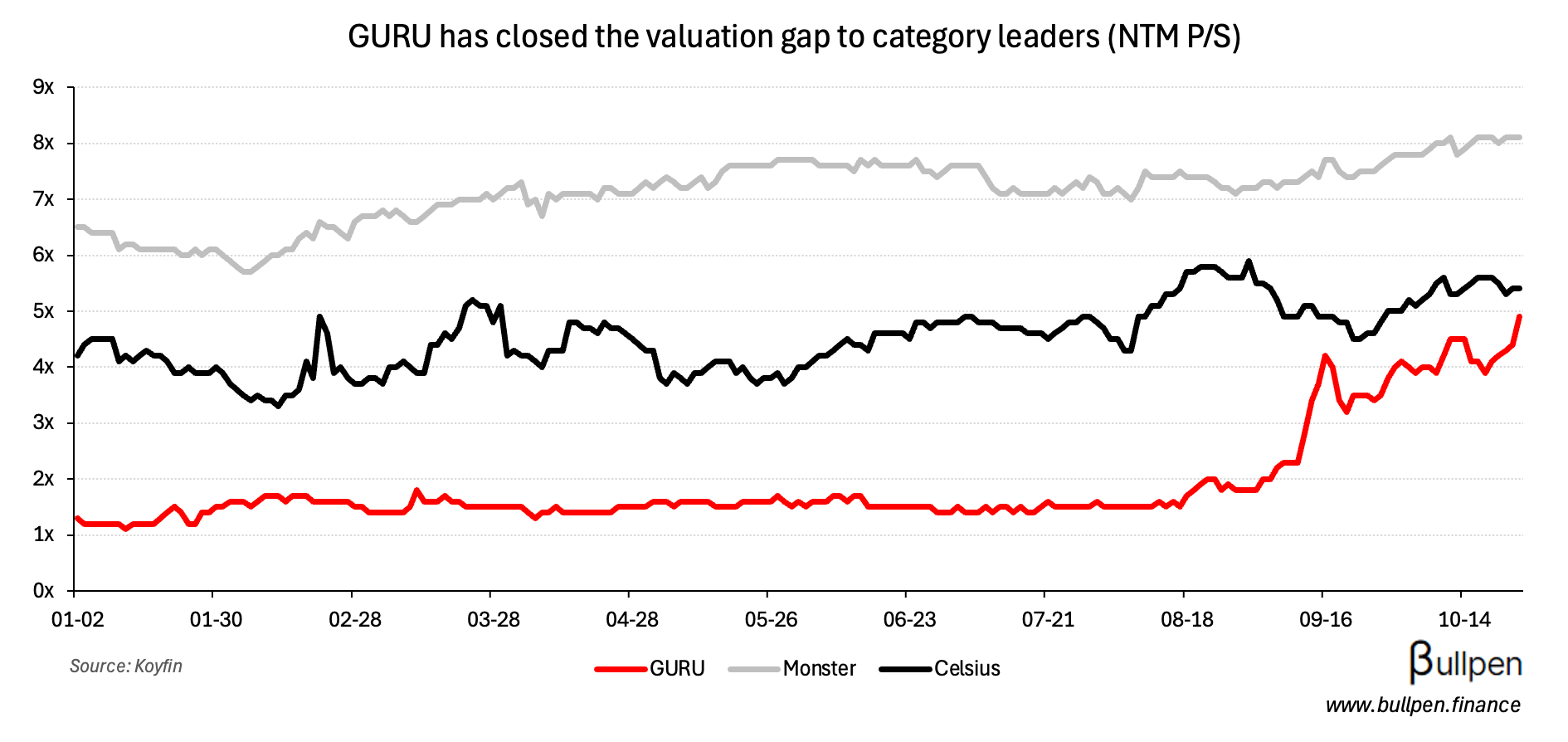

GURU Energy (GURU) gained 12% after its Prime Day results, which built off of its strong Q3 results - with 42% and 11% Y/Y growth in the U.S. and Canada, respectively.

That compares to a 6% gain and 4% decline across all energy drinks, showing GURU is taking share. While revenue is growing off a small base, it’s been enough to close the valuation gap to the category leaders.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Guy Grenier | Richelieu (RCH) | $257K |

| Neil O'Brien | NGEx Minerals (NGEX) | $3.2M |

| Pippa Morgan | Aritzia (ATZ) | $565K |

| Karen Kwan | Aritzia (ATZ) | $465K |

| Jennifer Wong | Aritzia (ATZ) | $5.6M |

| David Kelly | Cardinal (CJ) | $328K |

| Minh Tran | BRP Inc. (DOO) | $2.0M |

| Jaroslav Dostal | Ucore (UCU) | $259K |

| Dean Shillington | Zedcor (ZDC) | $9.4M |

| Ross Jennings | Millennial (MLP) | $280K |

Flagging the selling at Zedcor (ZDC), which comes a few days after Dean Swanberg’s $6M sale - following the tape on this one.

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 P&G (PG) | 1.99 | 1.90 |

| 🇺🇸 HCA (HCA) | 6.96 | 5.73 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 TMX Group (X) | AM | 0.49 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 New Home Price M/M | -0.2% | 0.2% |

| 🇺🇸 Inflation M/M | 0.3% | 0.4% |

| 🇺🇸 Inflation Y/Y | 3.0% | 3.1% |

| 🇺🇸 Consumer Sentiment | 53.6 | 55.0 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.