Last week I spent some time speaking with the executive leadership teams of a bunch of Canadian small caps. Transition was a common theme in most of those conversations, but there’s a few stories I’m keeping an eye on.

VersaBank: in the early innings of a U.S. expansion

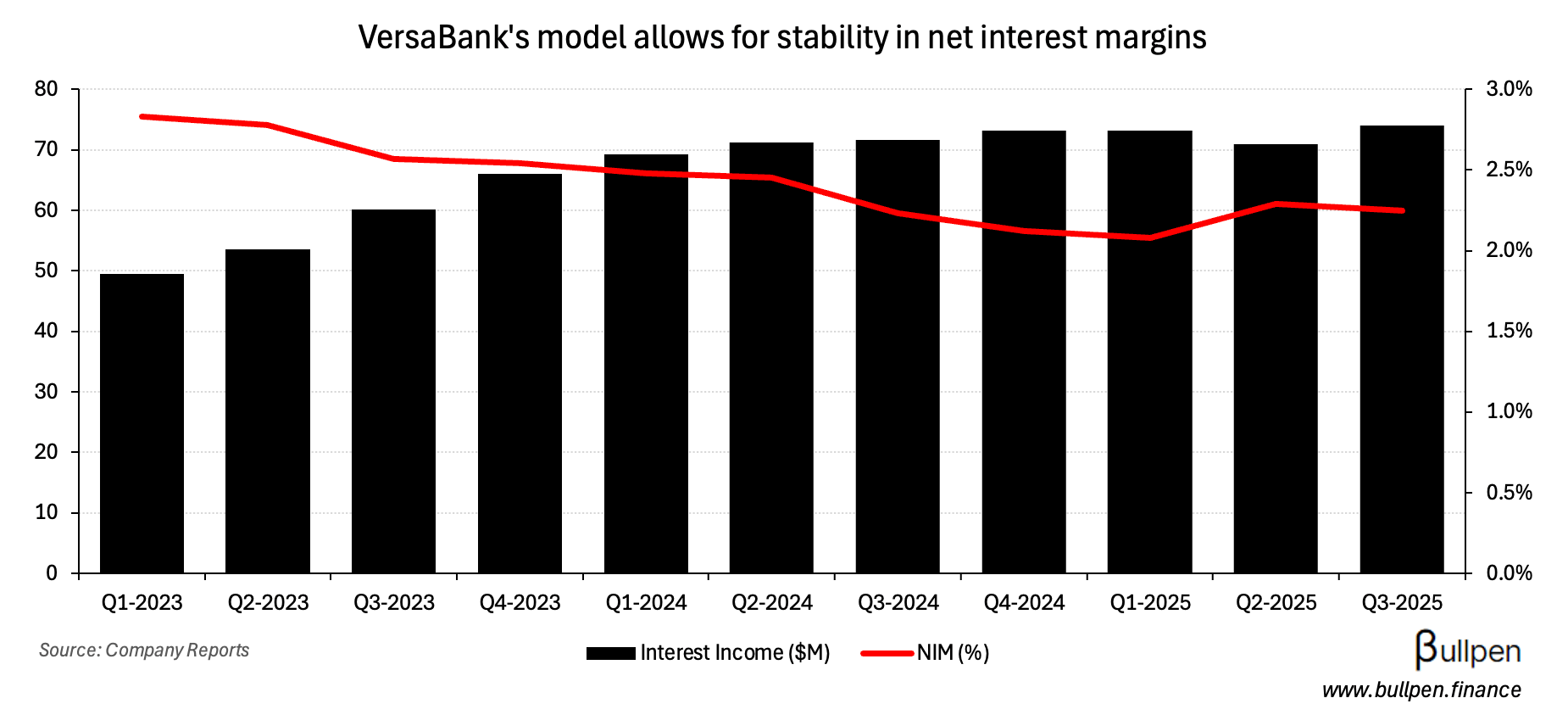

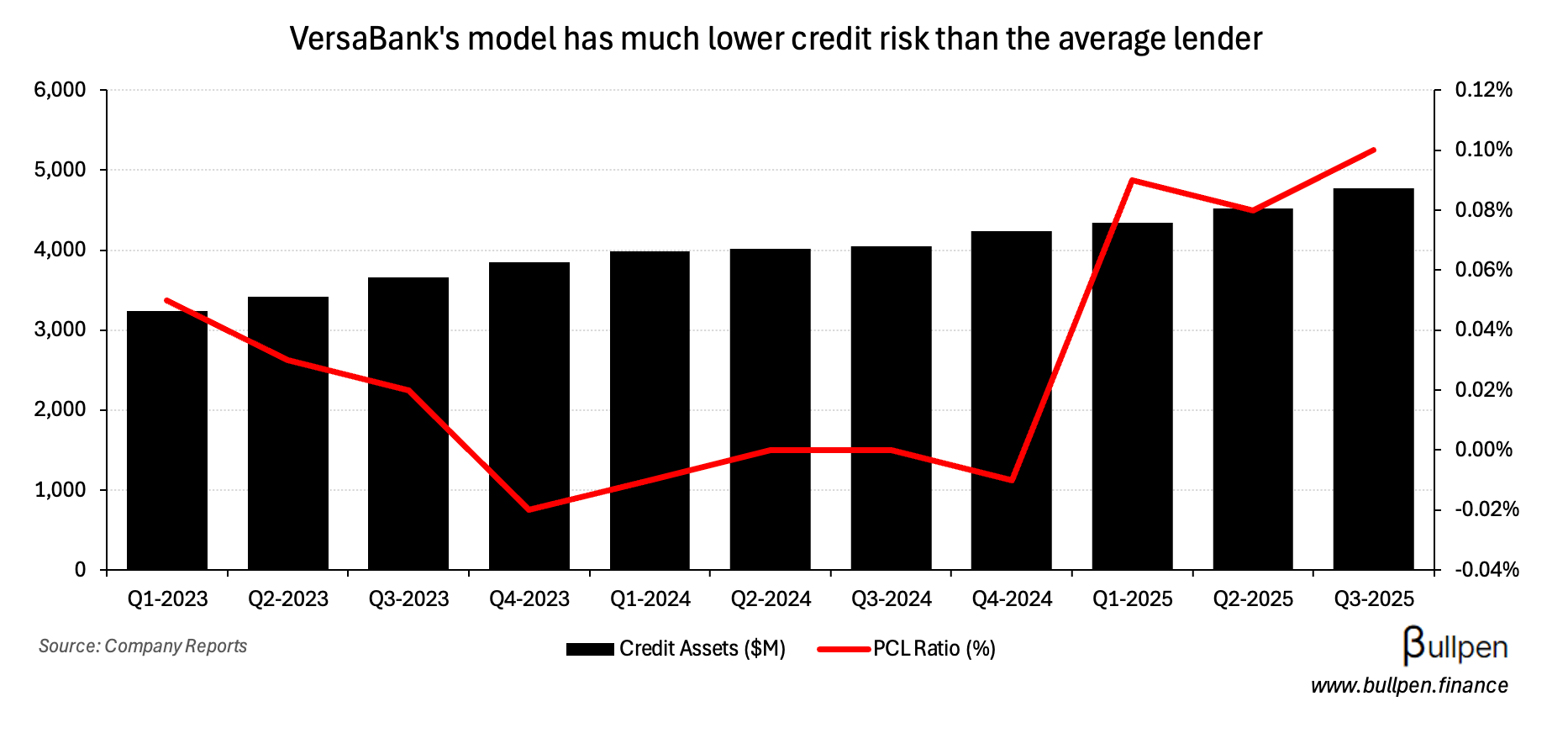

VersaBank (VBNK) isn’t your typical lender, operating without a branch network or origination business. Instead, it leverages deposit brokers and partners with POS lenders - reliably capturing a ~250 bps spread…

… and limiting credit risk, with every partner maintaining cash collateral and VersaBank retaining the ability to put delinquent loans back to the originator.

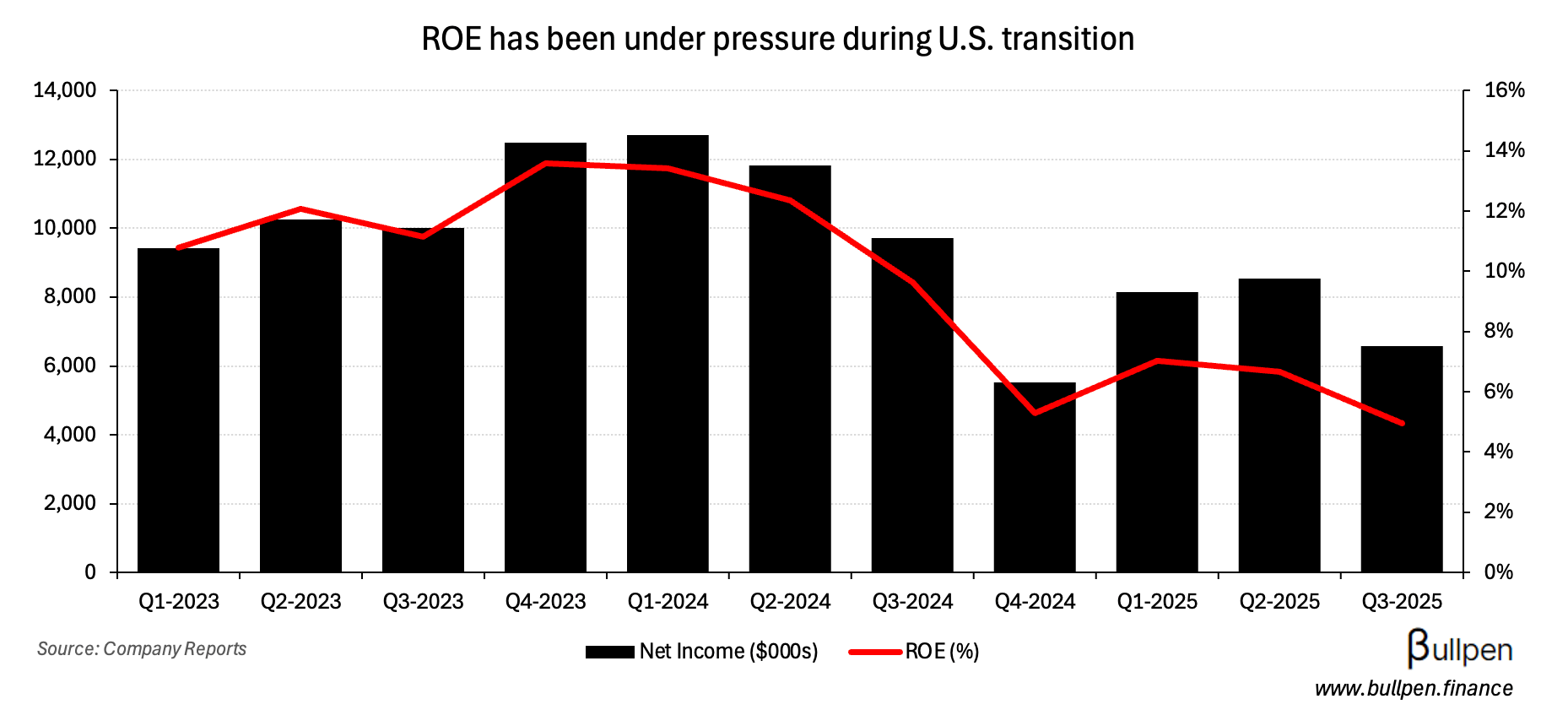

The company is bringing its business model south of the border, a move that dramatically opens up its addressable market but comes with some near-term cost pressure…

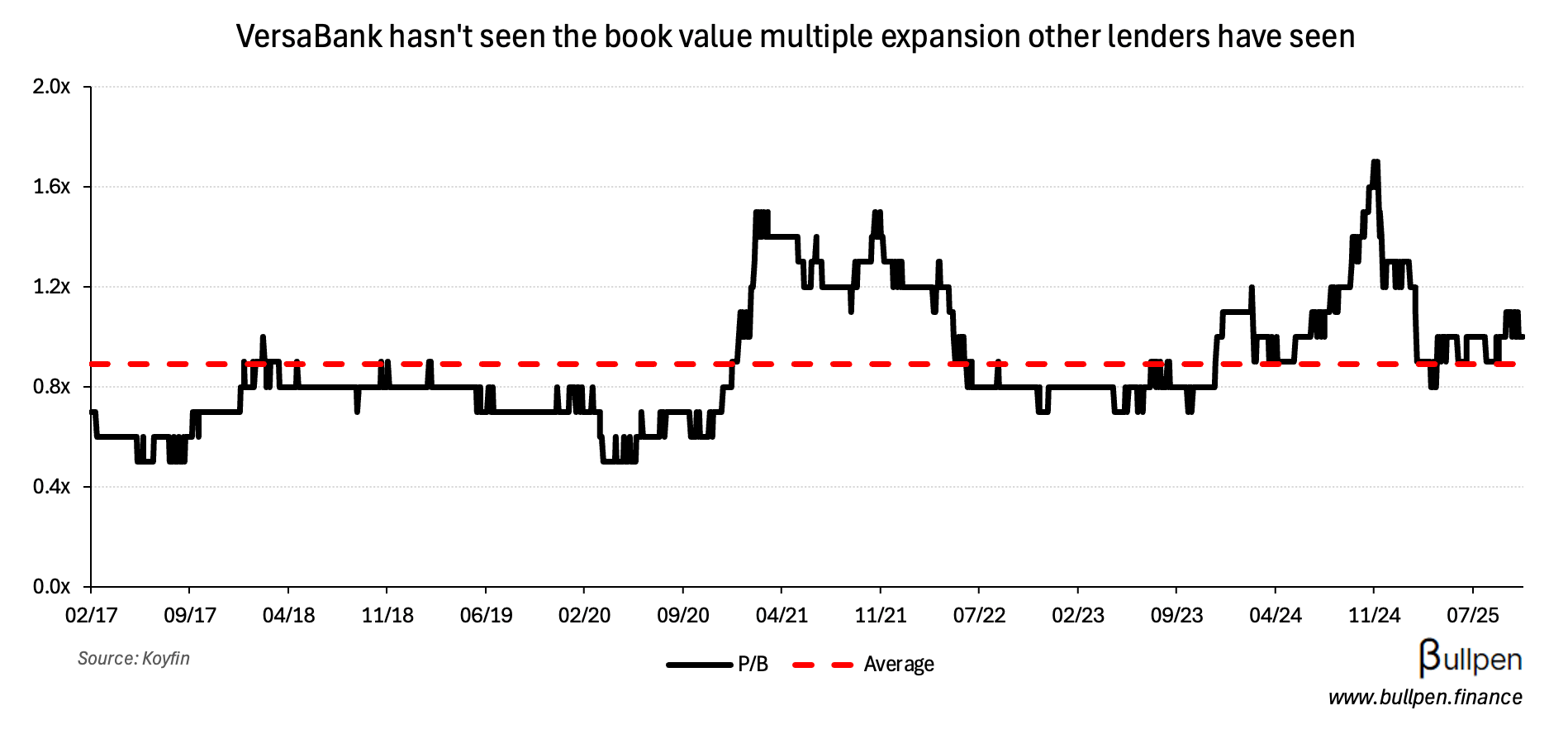

… that’s weighed on shares. Once the transition is complete, VBNK’s economics should return to normal and have upside from there - making its valuation interesting.

Andrew Peller: a market leader right-sized post-COVID

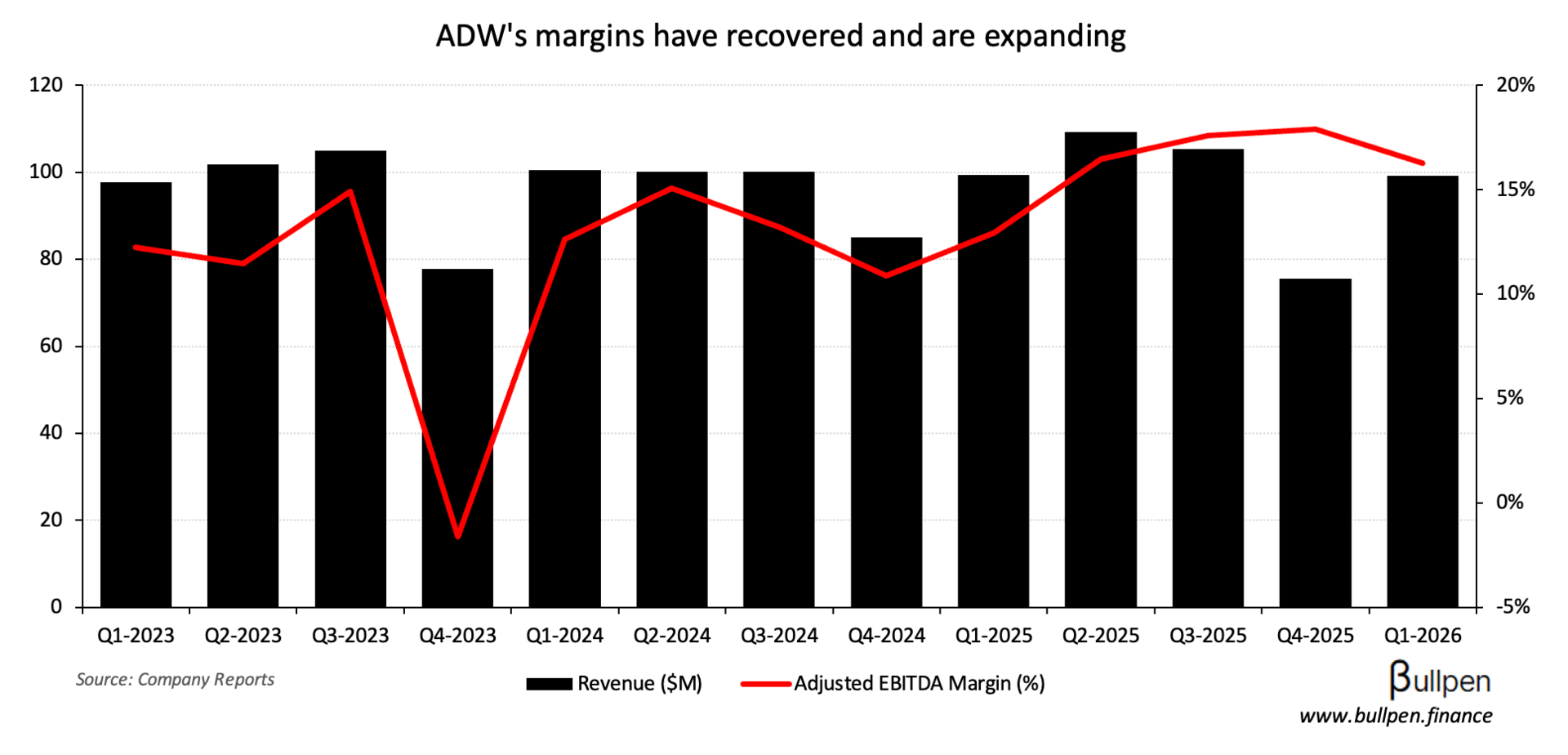

Andrew Peller (ADW-A) is a Canadian leader in wine production and has steadied the ship out of COVID, with an expanding margin profile…

… and reduction in leverage, providing operational flexibility and opening the door for tuck-in M&A.

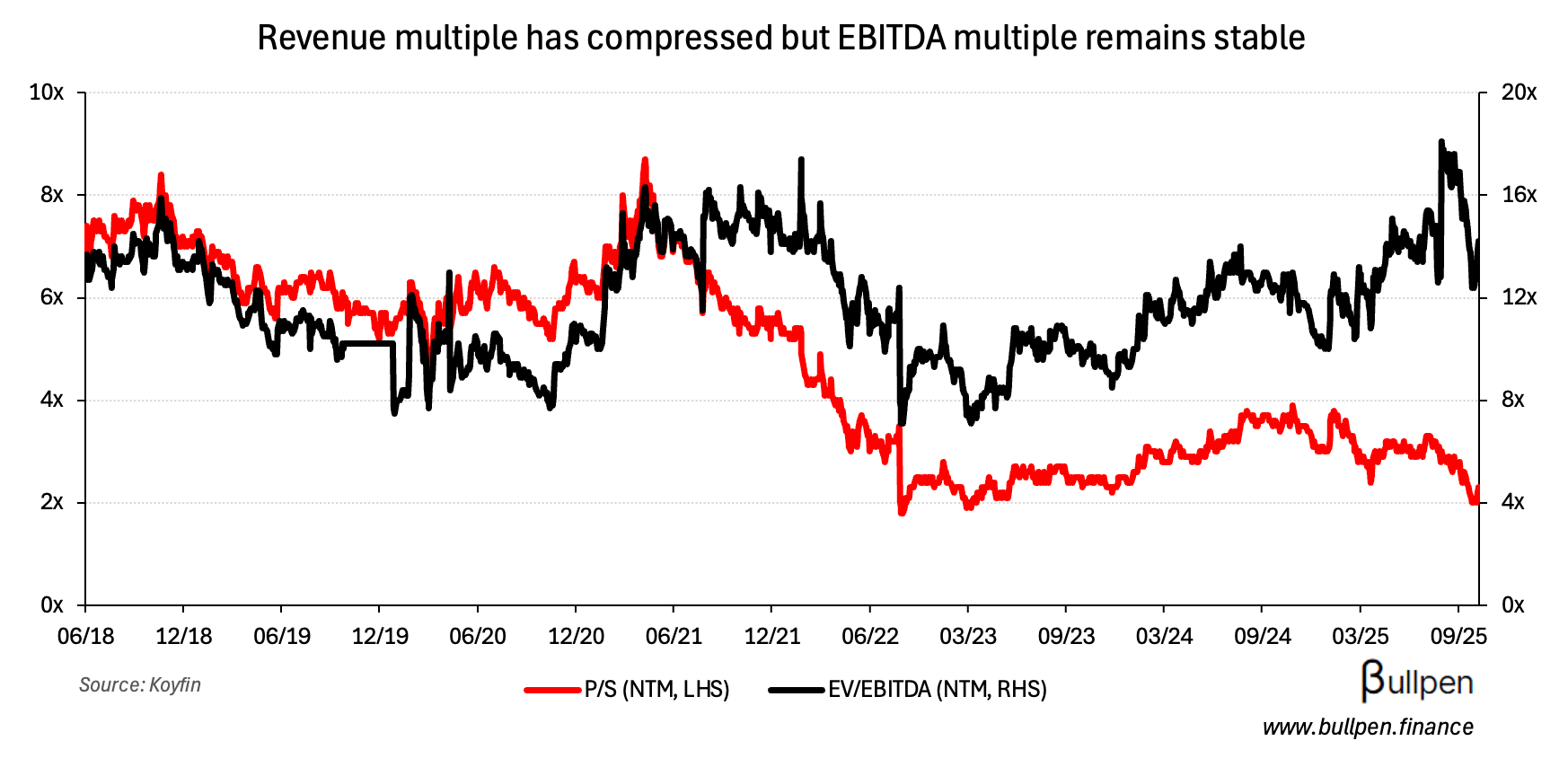

Despite the turnaround and a small but present “Buy Canada” tailwind, ADW trades significantly below its long-term average valuation - representing meaningful upside if it can keep executing and unlocking value through asset sales.

Sylogist: a legacy business in transition

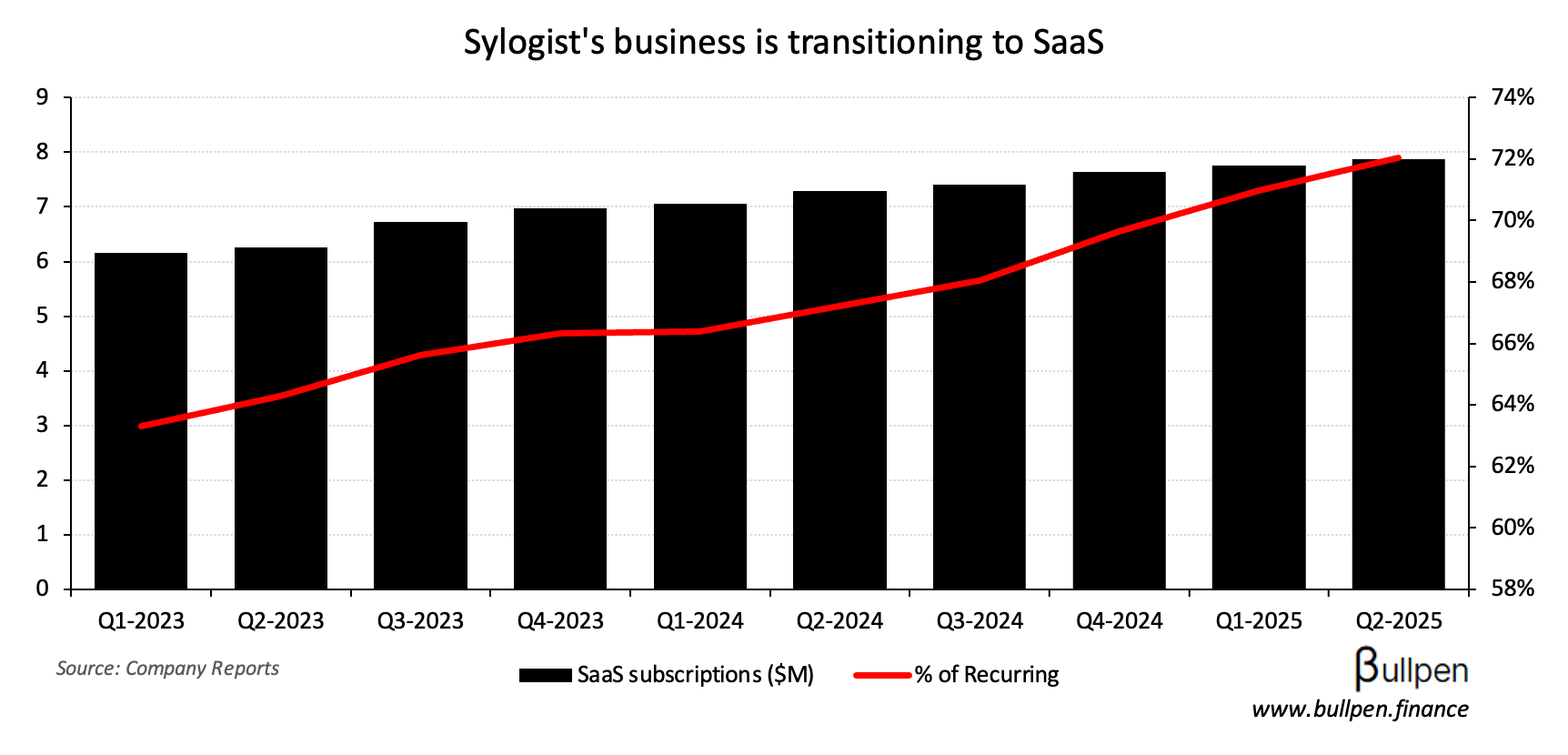

Sylogist (SYZ) is software provider to the non-profit and public sector, and it’s in the middle of transitioning towards a SaaS model…

… and away from its legacy business, with revenue steadily declining in its maintenance and professional service segments.

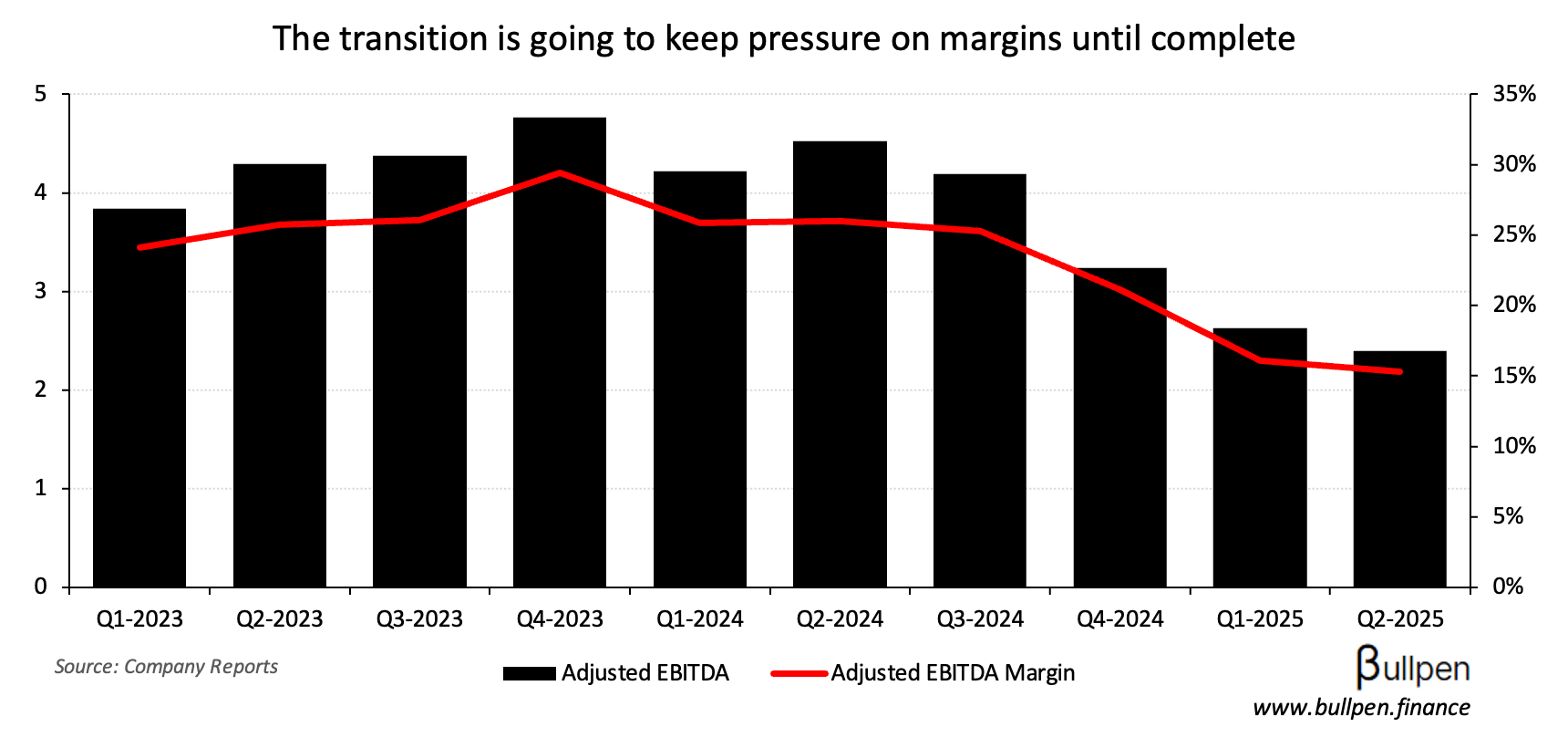

During the transition, SYZ is maintaining headcount across the business - resulting in margin pressure that will persist in the near-term…

… but should subside. The market isn’t buying it yet, but if the company can stick the landing - improved profitability and a return to growth could bring the bid back.