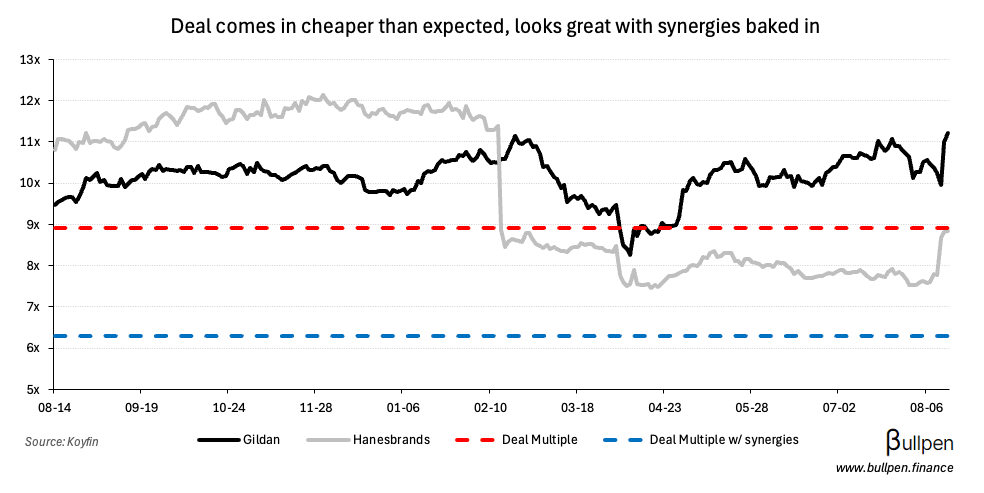

It didn’t take long for the rumour of Gildan’s $5B bid for Hanes to materialize… and better than expected too - with a lower $4.4B price tag representing an 8.9x EBITDA multiple (6.3x post-synergies) that the market rewarded with a 15% bump in shares.

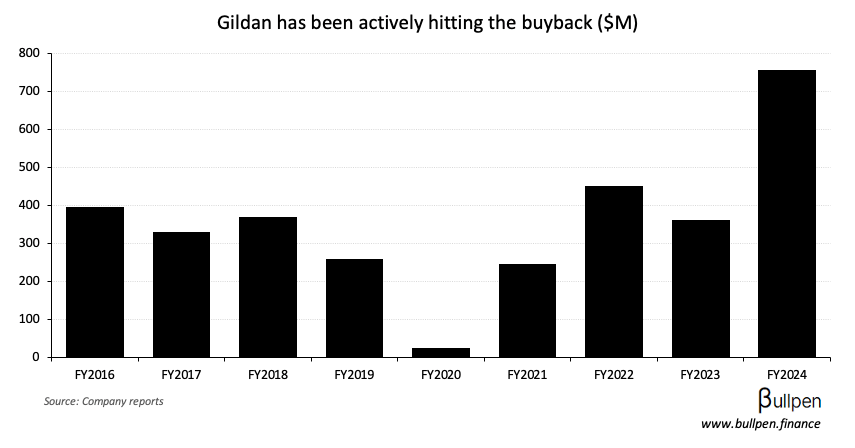

Gildan elected to finance nearly 90% of the equity value with stock - keeping pro-forma leverage at a modest 2.6x, which management expects to get back below 2x shortly with the help of a buyback pause and divestiture of HBI’s Australian unit.

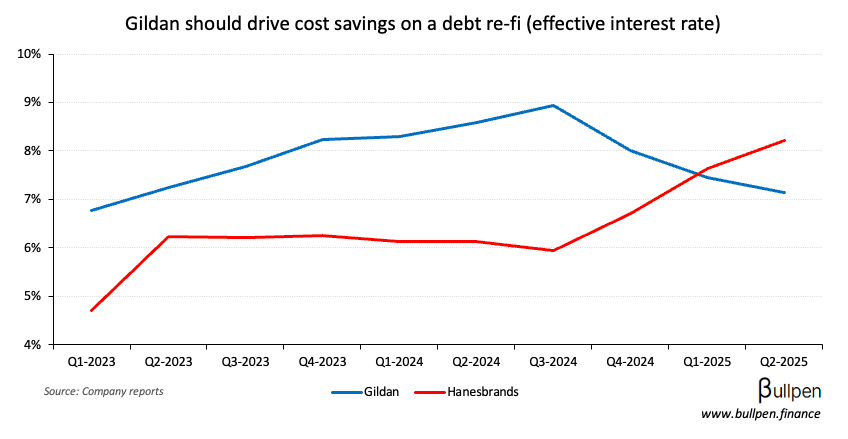

Purchase price: check, financing package: check, strategic rationale: interesting. Cost savings are pegged at ~$200M via higher capacity utilization, overlap in the product mix & manufacturing footprint, and debt refinancing…

… supporting its 3-year guidance for ~20%/yr EPS growth. The combined company is more balanced, both in the products it makes and the path those products take to market.

But most interesting for the long-term investor is how management frames why this transaction works:

… and contrary to what Hanes has been doing, investing in their brand, Gildan has been investing in low-cost vertically integrated manufacturing… that’s where all of our capital has gone in.

Gildan’s manufacturing expertise is the durable advantage - it’s the heartbeat of retail. If it can digest this deal well, don’t be surprised to see it acquire more extremities in the future…