|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Current account deficit hits $21B

Employment falls, vacancies rise

Guardian Capital goes for $1.7B

Plantro goes activist on Calian

EQB falls 11% on earnings

HOT OFF THE PRESS

Current account deficit hits $21B in Q2

Q2’s balance of payments data hammers home the trade war impact, with the current account deficit hitting a record $21B on lower exports south of the border…

… and foreign portfolio divestment of $17B accelerating to levels not seen since 2007 - as investors reduce exposure due to uncertainty.

If there was a bright spot in the print, it was in corporate investment - which showed a recovery in the activity of Canadian firms abroad (profit reinvestment, M&A) and a continued appetite from foreign (mostly U.S.) corporates to allocate capital here.

Employment falls, vacancies rise

Payroll employment declined 0.2% in June, led by declines in manufacturing - which has shed nearly 2% YTD as challenges to trade impact job creation.

Job vacancies improved slightly, climbing 2.5% M/M to 492K…

… but remain down big Y/Y - with an 11% drop that’s been magnified by a 9% jump in unemployment over the same time frame.

Guardian capital goes for $1.7B

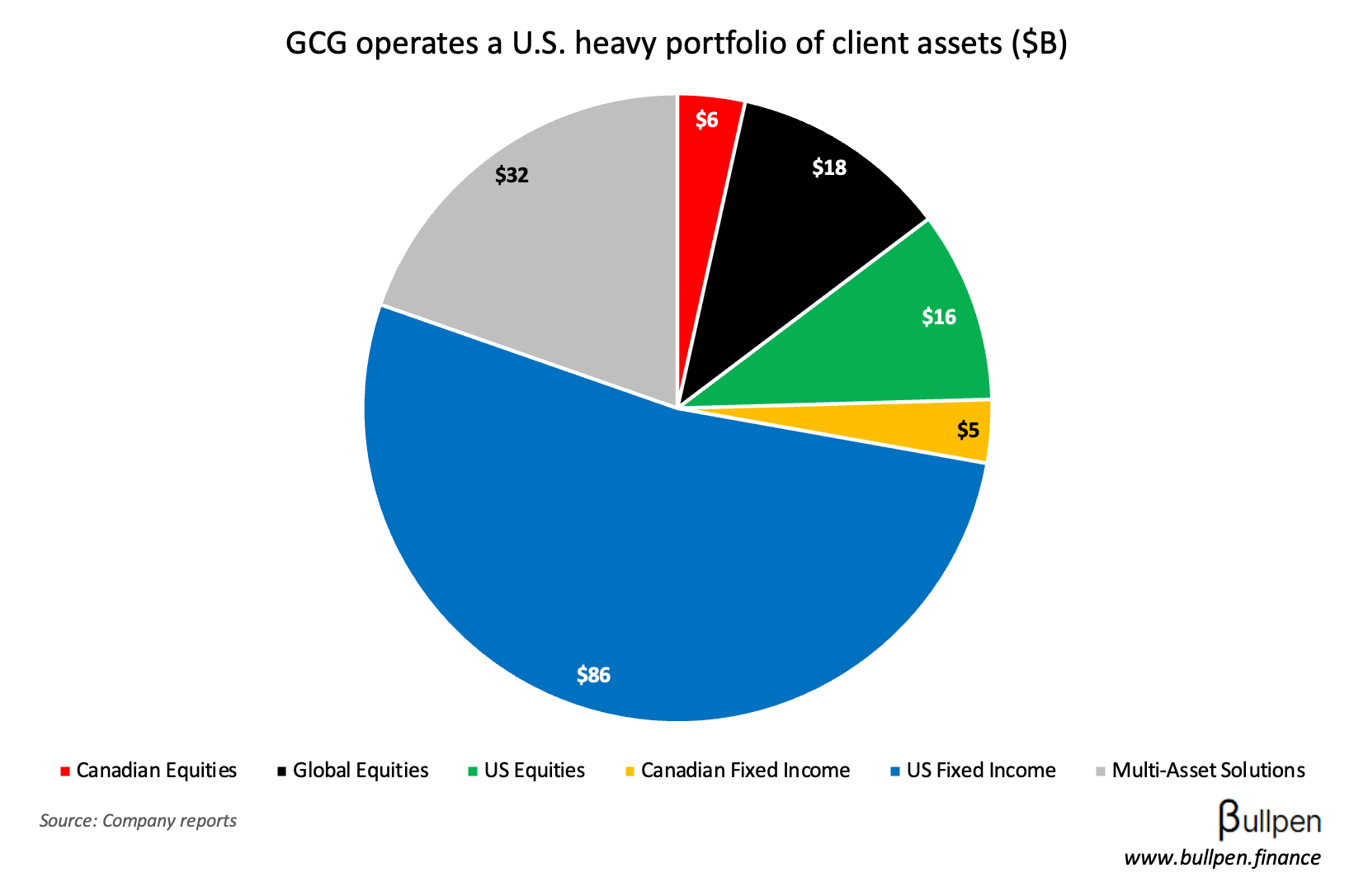

Desjardins is taking Guardian Capital (GCG) off the market in a ~$1.7B deal, growing its platform to $280B of client assets for a hefty 60% premium - as the race to consolidate capital heats up.

The transaction comes a year after Guardian acquired Sterling Capital for ~$100M, boosting its institutional and retail footprint…

… as well as its U.S. exposure - a key part of the deal for Desjardins, who’s looking to accelerate its global expansion.

Wealth/asset management deals are hitting the wire like clockwork, with iA Financial’s $600M takeout of Richardson Wealth a month ago and BMO’s $625M Burgundy acquisition a month before that. This is a scale game - let’s see who’s next.

FUNNY BUSINESS

After its very vocal activist campaign on Dye & Durham, Plantro is back at it - taking aim at Calian Group (CGY) with a “leaked” letter to management…

… urging a full or partial sale of the company, specifically its underperforming IT segment - so CGY can focus on the generational defense setup in front of it.

Calian responded, and then announced a buyback program for up to 10% of the float - which Plantro immediately shot down as a bad use of capital. Things could get messy here, but there’s plenty of room for multiple expansion.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Jean-Christophe Gallagher | Bombardier (BBD) | $2.0M |

| Paul Sislian | Bombardier (BBD) | $2.0M |

| Trevor Wagil | Cdn. Natural (CNQ) | $324K |

| Paul Galbraith | Jamieson (JWEL) | $289K |

| Christopher Snowden | Jamieson (JWEL) | $3.9M |

| Dale Mah | Endeavour (EDR) | $1.3M |

| Andrew Brown | B2Gold (BTO) | $111K |

| Elizabeth McGregor | B2Gold (BTO) | $145K |

Flagging the selling at Bombardier (BBD), which follows its recent $2B deal.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

EQB Inc. (EQB) fell 11% on earnings, which missed estimates by nearly 20% - driven by margin compression…

… and continued challenges in credit quality - counter to what we’ve seen from the other Canadian banks this quarter.

Combined with a tough outlook and new leadership, EQB’s return profile should remain under pressure in the near-term.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 CIBC (CM) | 2.16 | 2.00 |

| 🇨🇦 TD Bank (TD) | 2.20 | 2.03 |

| 🇺🇸 Dell Tech (DELL) | 2.32 | 2.29 |

| 🇺🇸 Autodesk (ADSK) | 2.62 | 2.45 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Laurentian (LB) | AM | 0.72 |

| 🇨🇦 BRP Inc. (DOO) | AM | 0.46 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Current Account | -21.2B | -19.4B |

| 🇨🇦 Weekly Earnings Y/Y | 3.7% | - |

| 🇺🇸 Jobless Claims | 229K | 230K |

| 🇺🇸 Pending Home Sales M/M | -0.4% | -0.1% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 GDP M/M | 8:30AM | 0.1% |

| 🇨🇦 Budget Balance | 11:00AM | - |

| 🇺🇸 Core PCE Price M/M | 8:30AM | 0.3% |

| 🇺🇸 PCE Price M/M | 8:30AM | 0.2% |

| 🇺🇸 Income M/M | 8:30AM | 0.4% |

| 🇺🇸 Spending M/M | 8:30AM | 0.5% |

| 🇺🇸 Chicago PMI | 9:45AM | 46 |

| 🇺🇸 Consumer Sentiment | 10:00AM | 58.6 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.