|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Constellation’s 40% drawdown

Stingray’s accretive $175M deal

KITS pops 9% on record sales week

Calian jumps 8% on divestiture hopes

HOT OFF THE PRESS

Can Constellation keep compounding?

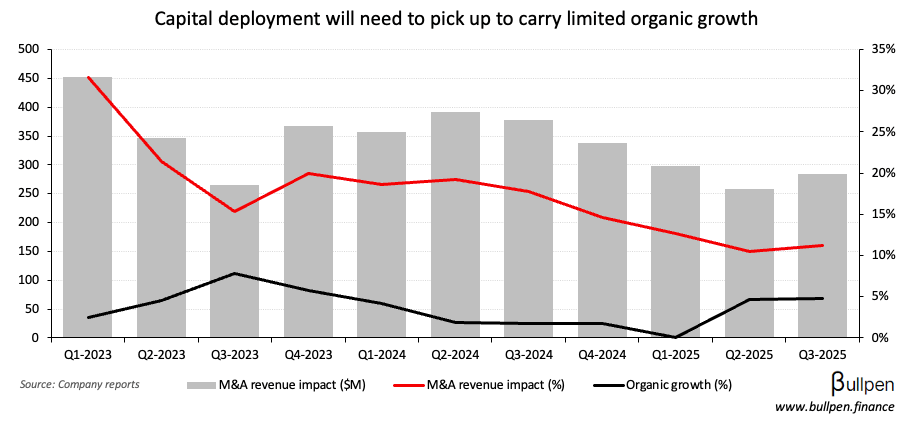

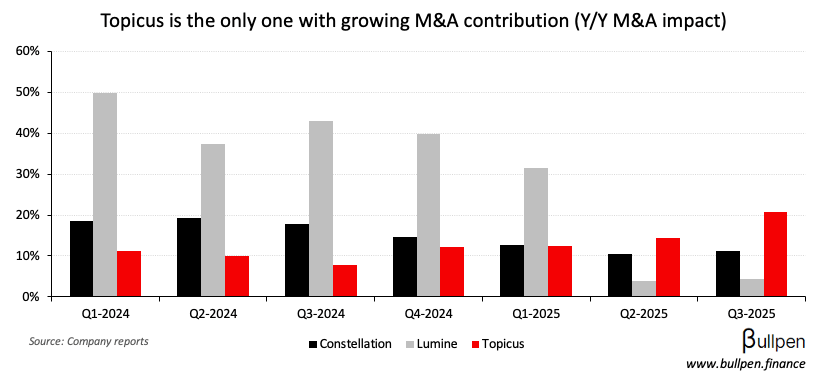

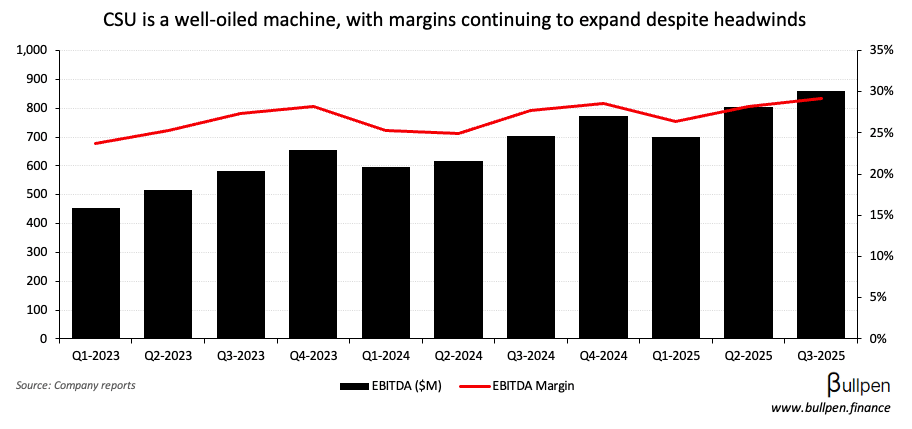

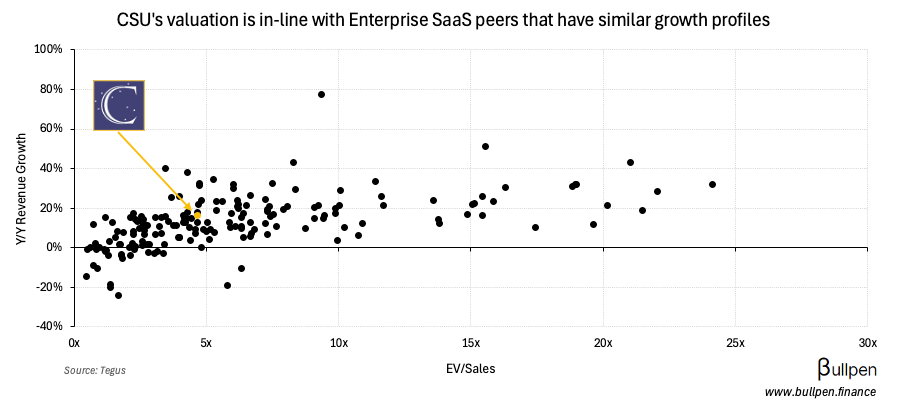

Constellation Software’s (CSU) recent weakness continued after Q3, which beat on earnings but was light on revenue - driven by a slower pace of capital deployment.

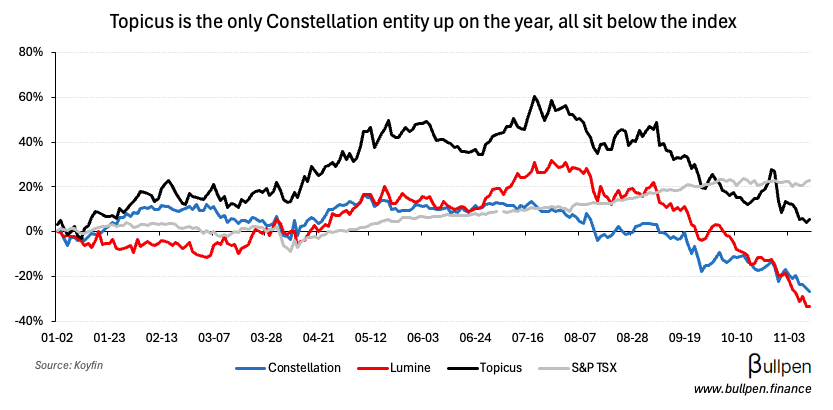

While investors seem to be chalking up CSU’s near-40% drawdown to AI risk…

… I’d argue the real threat isn’t in competition for its owned businesses, but in the competition for M&A prospects - with billions in “AI enhancing” capital fighting for the same deals and pushing prices past where CSU is comfortable playing.

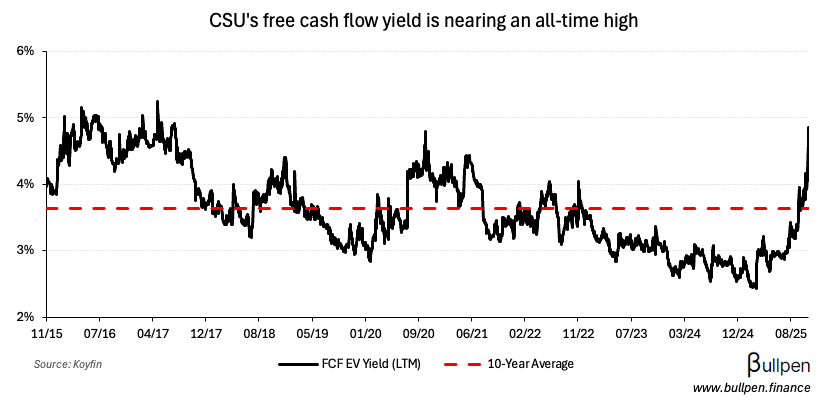

Add in Mark Leonard’s departure and you’ve got a perfect storm, driving a sell-off that makes the stock look cheap on any historical measure…

… despite continued margin expansion.

With the “Constellation cult” premium now gone, it might be time to sharpen your pencils on this one.

Stingray’s $175M deal

It should be a good day for Stingray (RAY-A), with Q2 results beating expectations and coming with the $175M acquisition of TuneIn - adding ~$30M of EBITDA to its broadcasting segment...

… and expanding its U.S. footprint alongside the company’s DMI acquisition a couple weeks ago.

The two deals track to recent commentary…

The tuck-ins are focused on cars… you’ll see some other acquisitions in that segment. And the second one is to expand our retail media network in the U.S.

… and at sub-6x EBITDA before $10M of synergies, the market should react positively to Stingray’s execution.

FUNNY BUSINESS

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

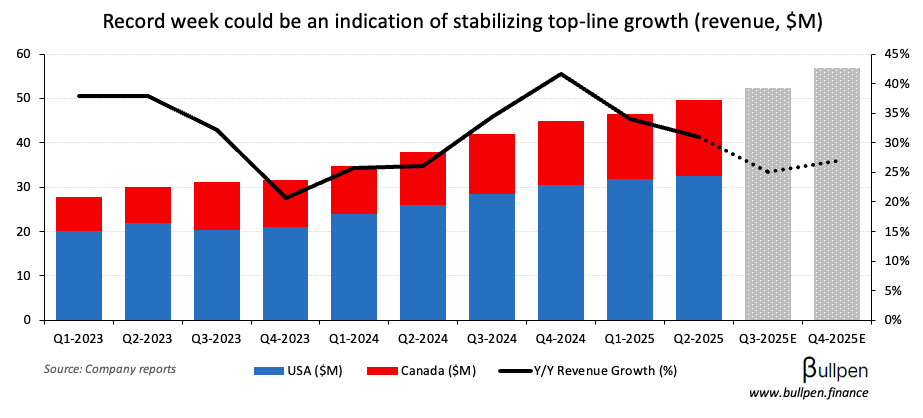

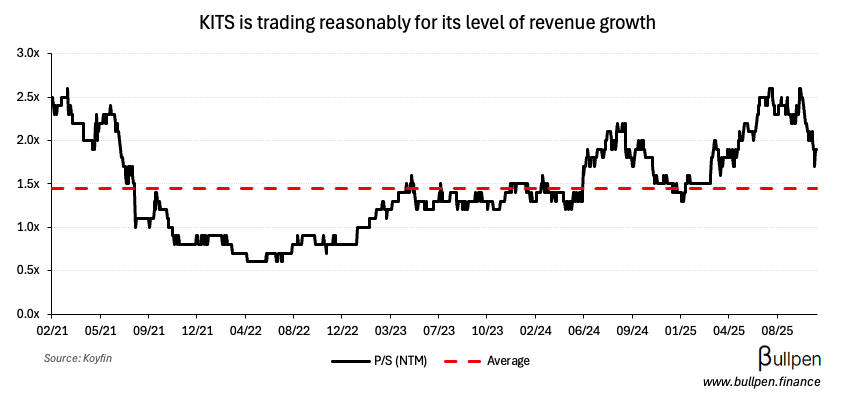

KITS Eyecare (KITS) rebounded 9% on a $4.5M sales week, the highest in the company’s history and up 27% Y/Y - above the 25% growth management pre-released for Q3…

… which led to a >20% drawdown over the following month. Should the release be indicative of what’s to come in Q4, it would represent stabilization around mid-20s top-line growth and likely put a pause on multiple compression…

… with the help of a $2.4M buy from the CEO last week.

Calian Group (CGY) jumped 8% today on news that it entered into an agreement with Plantro (activist) that should accelerate a board refresh and non-core divestitures. The stock has lagged its defense peers…

… despite having huge exposure to both military spend…

… and Canada - two factors that make the company uniquely positioned for the coming wave of defense investment.

The reason for that underperformance is its IT segment, which has seen negative growth and margin compression in recent quarters and is likely on the table.

At ~30% of revenue and ~20% of EBITDA, carving it out would reduce earnings volatility and simplify the story - driving a re-rate if they can get a fair price… let’s see.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Herpreet Lamba | IGM Financial (IGM) | $334K |

| Gerard Schut | Vermilion (VET) | $127K |

| David Wong | Thomson Reuters (TRI) | $636K |

| Pauline Dhillon | Cargojet (CJT) | $500K |

| Ajay Virmani | Cargojet (CJT) | $1.0M |

Flagging the buying at Cargojet (CJT), which are the first meaningful open market purchases since 2022. They follow weakness in shares after an ugly Q3 and new CEO announcement that together, have pushed CJT to a trough valuation.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Aya Gold (AYA) | 0.09 | 0.09 |

| 🇨🇦 Martinrea (MRE) | 0.52 | 0.47 |

| 🇨🇦 CAE Inc. (CAE) | 0.23 | 0.20 |

| 🇨🇦 Altius (ALS) | 0.17 | 0.13 |

| 🇨🇦 Stingray (RAY-A) | 0.32 | 0.31 |

| 🇨🇦 Finning (FTT) | 1.17 | 1.03 |

| 🇨🇦 Chemtrade (CHE-U) | 0.38 | 0.38 |

| 🇨🇦 Extendicare (EXE) | 51M | 38M |

| 🇨🇦 CCL Ind. (CCL-B) | 1.21 | 1.16 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Loblaw (L) | AM | 0.68 |

| 🇨🇦 Boyd Group (BYD) | AM | 0.64 |

| 🇨🇦 Hudbay (HBM) | AM | 0.06 |

| 🇨🇦 Linamar (LNR) | PM | 2.41 |

| 🇨🇦 ECN Capital (ECN) | PM | 0.08 |

| 🇨🇦 Manulife (MFC) | PM | 1.04 |

| 🇨🇦 Element Fleet (EFN) | PM | 0.45 |

| 🇨🇦 Power Corp. (POW) | PM | 1.33 |

| 🇨🇦 Pollard (PBL) | PM | 2.81 |

| 🇨🇦 Mattr (MATR) | PM | 0.14 |

| 🇨🇦 K-Bro Linen (KBL) | PM | 0.80 |

| 🇨🇦 G Mining (GMIN) | PM | 0.46 |

| 🇨🇦 Northland (NPI) | PM | 0.10 |

| 🇨🇦 Bird (BDT) | PM | 0.60 |

| 🇨🇦 Pan American (PAAS) | PM | 0.50 |

| 🇨🇦 Taseko (TKO) | PM | 0.03 |

ECONOMIC DATA

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Building Permits M/M | 9:30AM | 1.0% |

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.