|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Auto sector hits manufacturing sales

China talks shift to energy

Velan falls 20% on Birch Hill sale

Haivision runs 13% on record Q4

HOT OFF THE PRESS

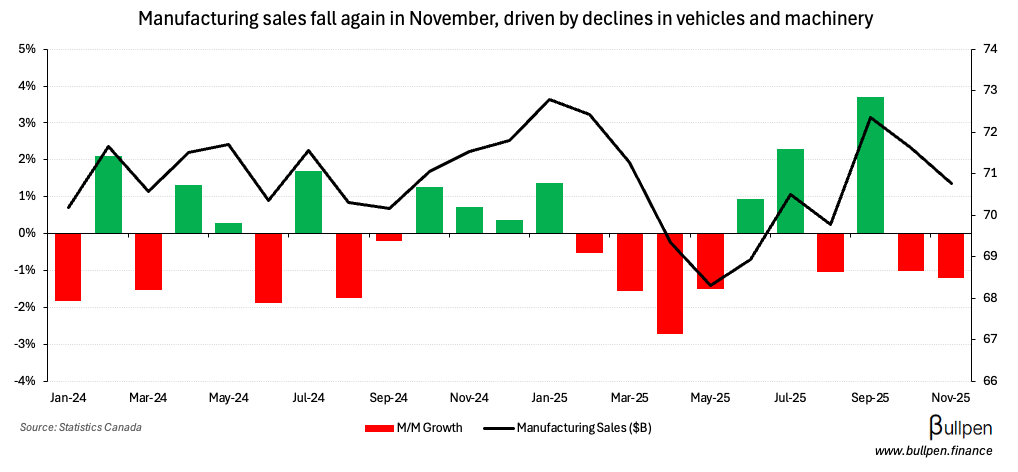

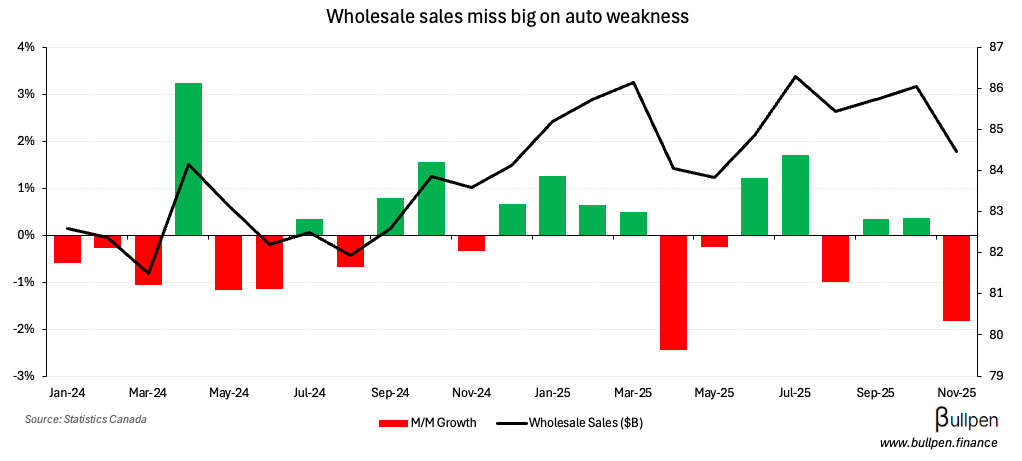

Auto sector weighs on manufacturing sales

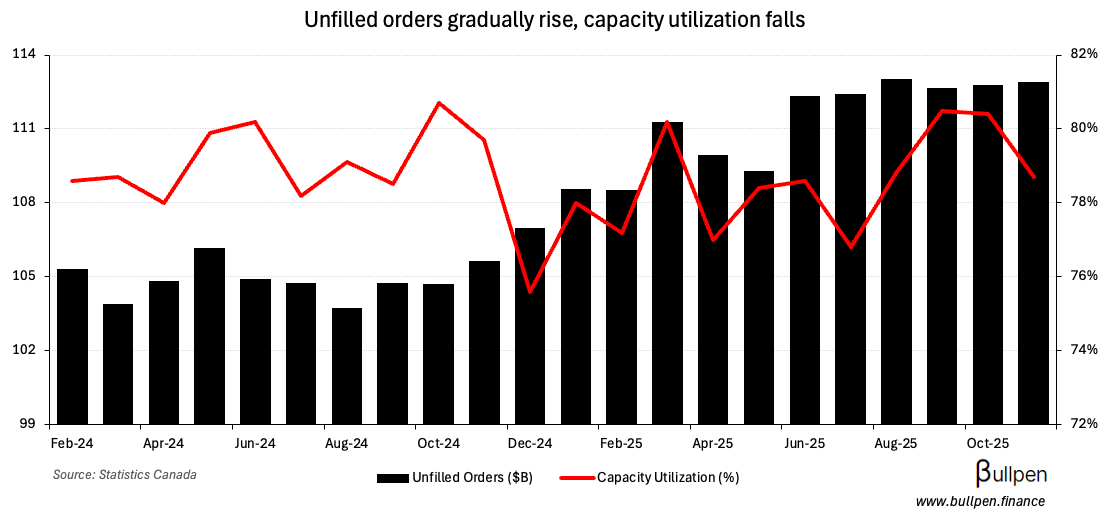

Manufacturing sales of ~$71B in November missed estimates slightly, falling 1.2% M/M on the back of weaker vehicle (down 16%) and parts (down 6%) sales…

… which drove a ~2% decline in wholesale sales, the second largest over the past two years (up 0.1% excl. automotive).

That softness also showed up in inventories, which inched higher on the back of a 1.4% rise in transportation equipment…

… while capacity utilization in the category fell over 6%. If that dynamic holds…

China talks shift to oil

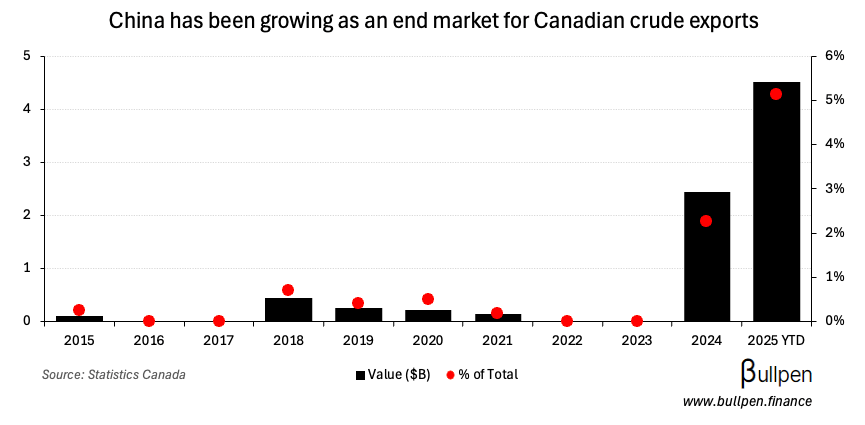

While Carney’s trip hasn’t resulted in any dropped tariffs, energy could help move the needle - with China looking for reliable sources of crude oil…

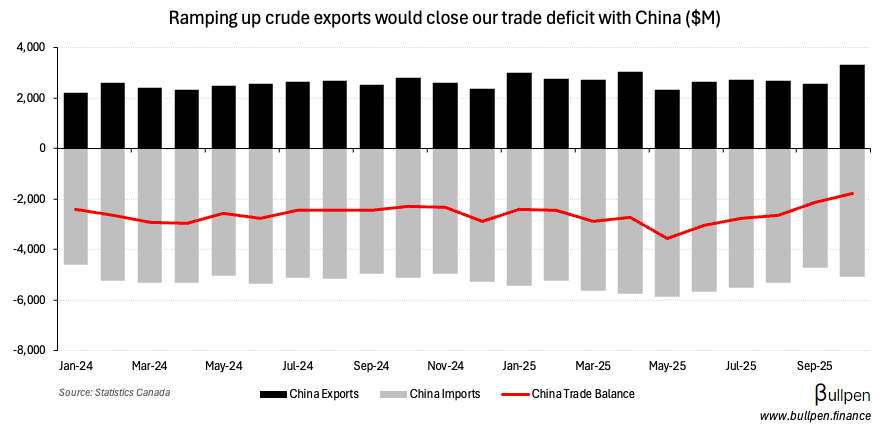

… at the same time Canada weighs the risk of Venezuelan oil displacing U.S. exports. Increasing the flow of Canadian crude east would narrow the trade deficit we consistently run with China…

… but could require Chinese investment here at home, so they share in the upside of that trade. Carney’s made it clear he’s open to foreign involvement…

… but we’ll see if he’s able to thread this needle without further agitating our much larger partner south of the border.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

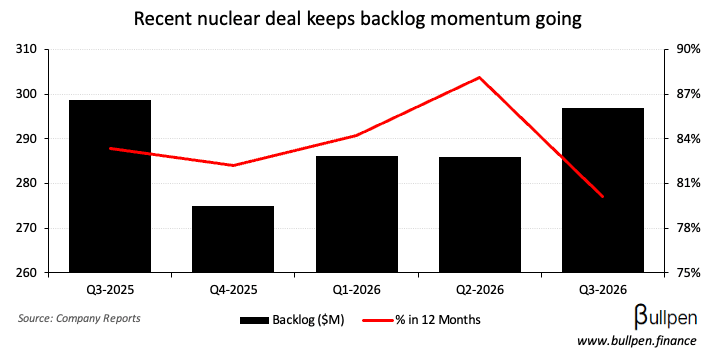

Velan (VLN) got hammered yesterday after announcing Birch Hill would acquire the Velan family’s 72% stake for ~$204M, or $13.10 per share - a ~30% discount to the prior day’s close. With under 10K shares traded daily…

… and over 15M shares to unwind, there’s no easy way to move that block - but the haircut likely feels more like a scalping for investors that expected a takeout after the company’s French unit divestiture. It’s a win for Birch Hill though…

… who will have control (92% of the vote) of a growing backlog supported by nuclear tailwinds. Coming less than a month after its $860M GDI deal, they’re clearly seeing value in Canada right now.

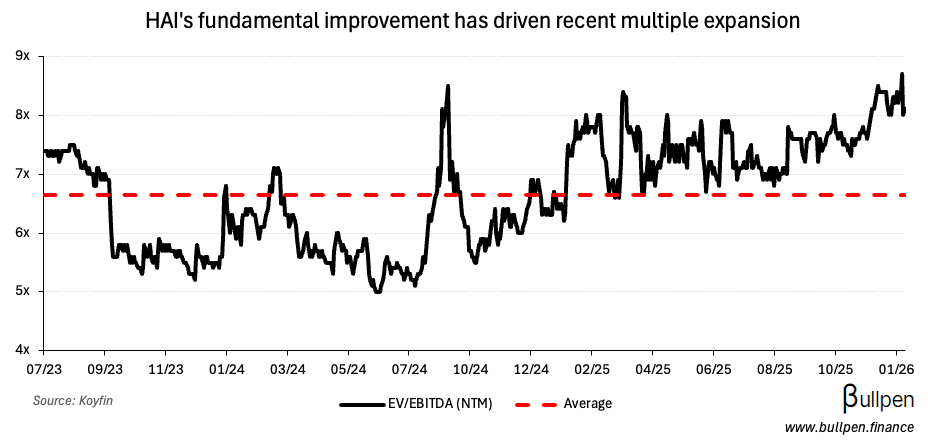

Haivision Systems (HAI) added 13% in yesterday’s session following a strong Q4, which beat estimates on a record $40M of revenue - up over 30% Y/Y…

… which should continue, with management guiding to double-digit growth (>$150M) on the back of strong end market demand.

I’ve never seen such a level of activity in the market ever… from border security to police enforcement, to government security, to defense, to NATO being forced to increase their budget significantly. We’re just seeing it everywhere.

Should the company be able to execute, it likely has years of runway ahead of it - on both fundamentals and valuation.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| John Risley | MDA Space (MDA) | $3.1M |

| Mitchell DeBelser | TerraVest (TVK) | $1.9M |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Richelieu (RCH) | 0.46 | 0.46 |

| 🇨🇦 Blackline (BLN) | -0.01 | -0.01 |

| 🇨🇦 Velan (VLN) | 0.14 | - |

| 🇺🇸 Morgan Stanley (MS) | 2.68 | 2.42 |

| 🇺🇸 Goldman Sachs (GS) | 14.01 | 11.80 |

| 🇺🇸 BlackRock (BLK) | 13.16 | 12.20 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales M/M | -1.2% | -1.1% |

| 🇨🇦 Wholesale Sales M/M | -1.8% | 0.1% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Housing Starts | 8:15AM | 260K |

| 🇨🇦 Foreign Security Buys | 8:30AM | - |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.