|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Here’s what we have on tap for you in this Morning Meeting:

Trade tensions continue, soft Canadian jobs data, and banks are “cautiously optimistic” at RBC conference

HBC files for creditor protection after 355 years in Canada

MDA posts strong Q4 results and runs 17% on Friday

AQN falls 10% on earnings and finishes Friday in the green?

TRADE WAR MONITOR

One thing’s for sure, global leaders continue to give us a reason to keep this section in the newsletter. Here’s what happened since the last one:

Canada unveils a $6.5B tariff relief package to cushion businesses, including $5B to help exporters diversify markets, $500M in low-interest loans, and $1B for agricultural support.

Mark Carney will take the PM seat, so he’s got next on the trade situation. Many are hoping his change in negotiating style will get us closer to a resolution.

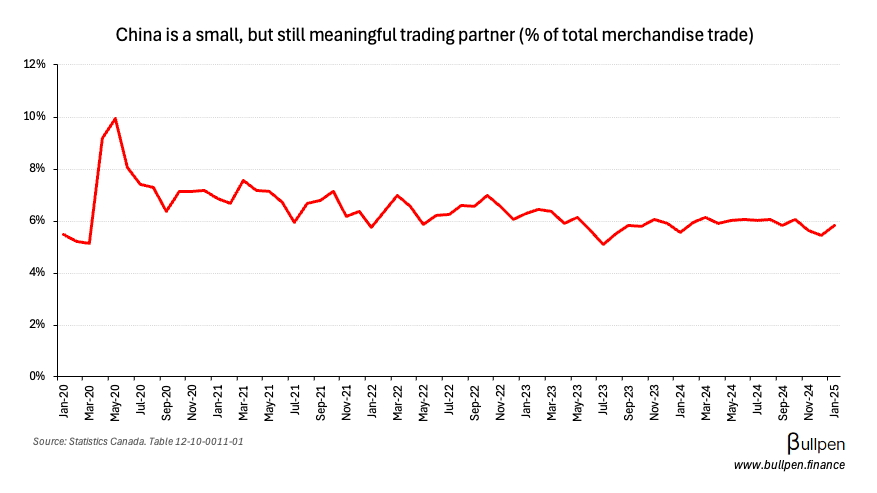

China enters the chat with a 100% tariff on certain Canadian cooking oils ($1B worth of goods), and a 25% tariff on aquatic products and pork ($1.6B worth of goods). It’s small in scope, but it’s the signal that matters - March 20th is the day they go into effect.

Our framework for navigating the trade war: https://www.bullpen.finance/content/51

HOT OFF THE PRESS

Canadian jobs data was soft, rate cut coming?

The February jobs data came in flat at 1.1K adds, down from January’s 76K gain and well below the ~20K forecast. The split was less favourable, with ~20K full-time losses offset by part-time gains.

The unemployment rate held steady at 6.6% and average unemployment duration inched higher to 21.9 weeks, while the participation rate fell slightly to 65.3%.

Despite a lack of material deterioration, markets are pricing another rate cut from the BoC come Wednesday, as trade risks remain a labour market overhang.

RBC financials conference: cautiously optimistic

We tuned into RBC’s annual financials conference last week, where bank exec teams had the chance to reiterate messaging from Q1 results. Here were the key themes:

Uncertain times ahead, which hurts some segments and helps others

Non-lending products to drive profit growth

Automation investment to help strategic cost management and internal optimization, as most banks are digesting acquisitions (RBC & HSBC Canada, NA & CWB, TD & Cowen)

For a recap of this earnings season from the banks, read our full piece: https://www.bullpen.finance/content/47

Hudson’s Bay Bankrupt? A Cautiona-Retail

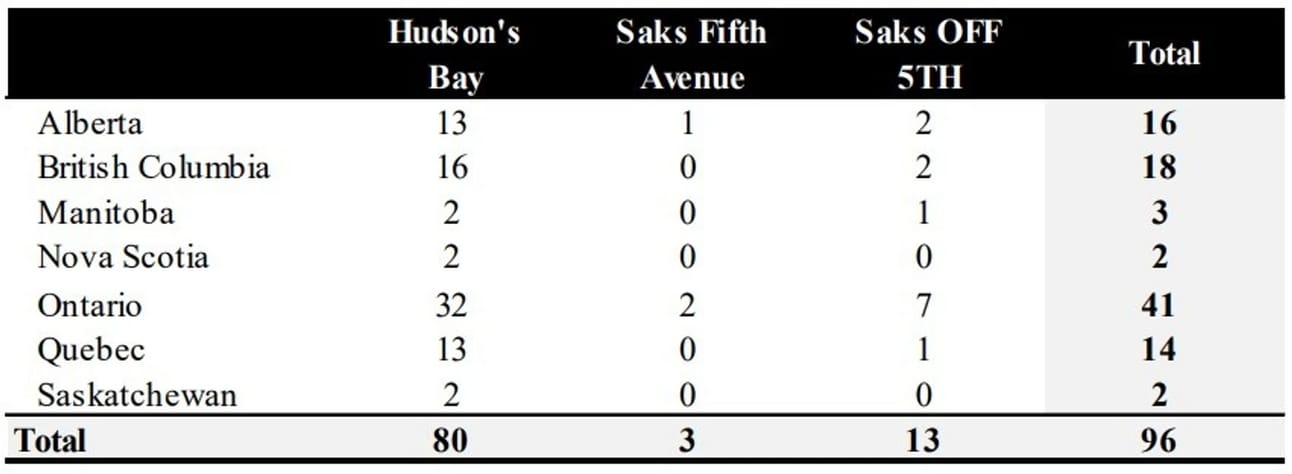

After 355 (!) years of operating in Canada, HBC’s Canadian division filed for creditor protection on Friday. Things get messy after 3.5 centuries:

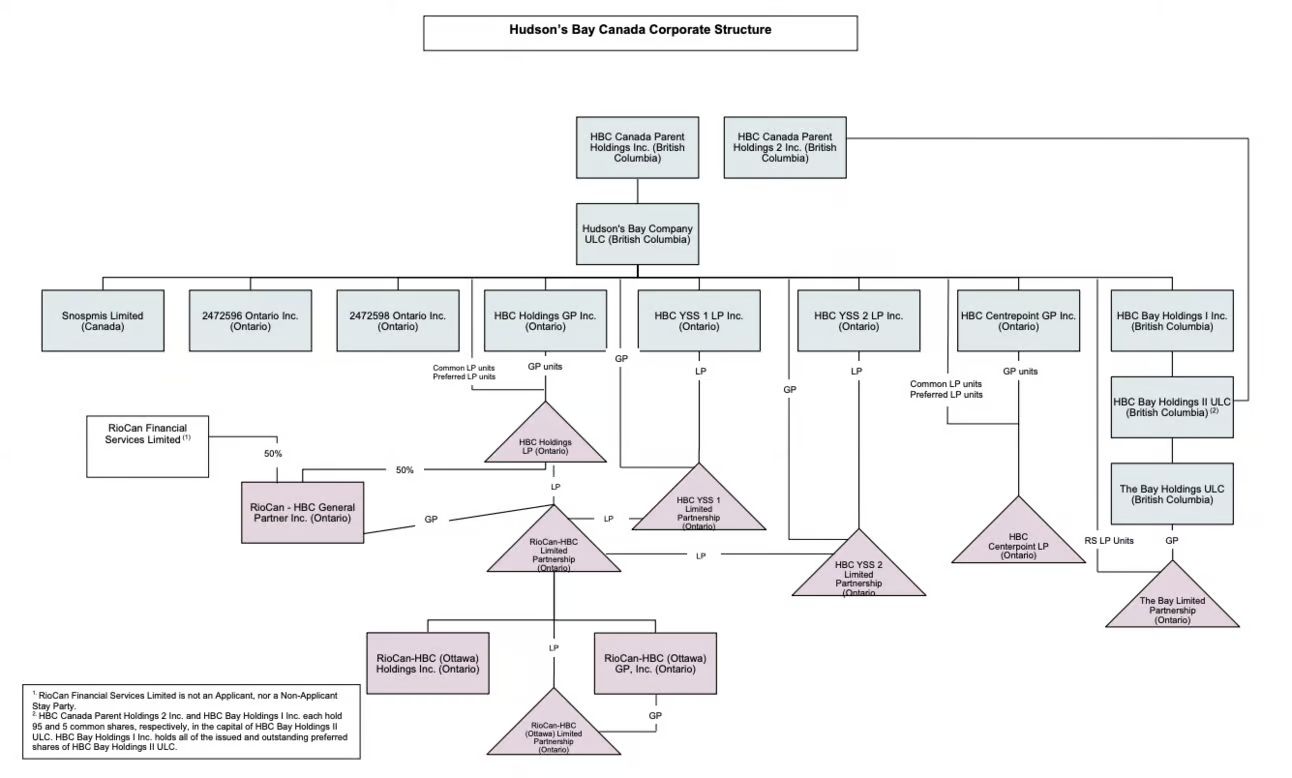

HBC Canada’s corporate structure

Bankruptcy rumours have been swirling HBC for years now, after a number of legal disputes related to missed rent payments during the pandemic.

In our view, it’s pretty clear the company has been actively pursuing a pivot from Canada to U.S. luxury for over a decade. I mean look at this timeline:

Date | Event |

|---|---|

2012 | HBC goes public on the TSX |

2013 | US$2.9B acquisition of Saks Fifth Avenue |

2015 | C$2B JV formed with RioCan to monetize HBC’s Canadian real estate |

2020 | HBC goes private in C$1.1B deal led by chairman Richard Baker |

2021 | Spins off saks.com as a separate e-commerce company, raising US$500M |

2024 | US$2.65B acquisition of Neiman Marcus Group and formation of Saks Global (U.S. luxury arm) |

They raised all their money in Canada, spent it in the U.S., and then legally separated the two. That’s like taking money from your spouse, giving it to your affair partner, and then getting a divorce (we don’t condone this behaviour)!

Ethics of the move aside, which companies have exposure to the second-order impacts of a potential default here?

Source: pre-filing report

Banks should be relatively insulated, but retail REITs could feel it a little more, as we explore in the full piece.

If the above link won’t work, try this: https://www.bullpen.finance/content/56

FUNNY BUSINESS

Who’s next?

ON OUR RADAR

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

MDA Space (MDA) crushed expectations (up 18% on Friday!) with satellite contracts driving explosive growth:

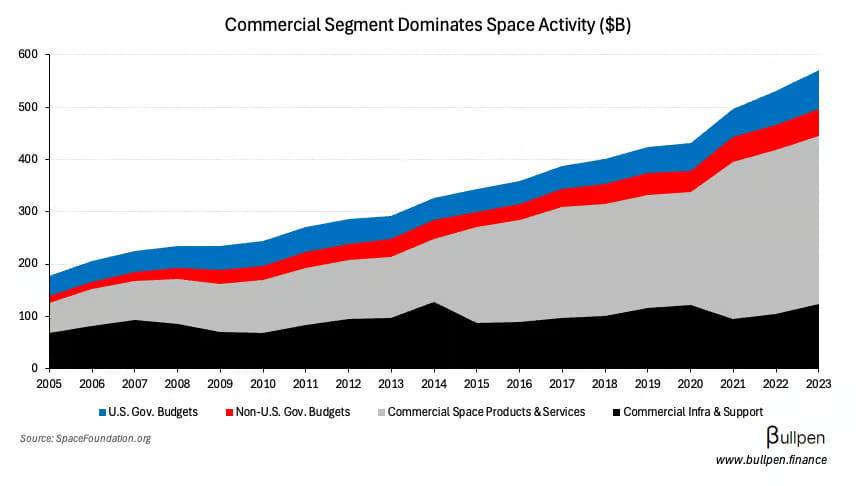

Top-line: up 69% Y/Y to $347M, smashing the street at $319M. The Satellite Systems unit (+160% Y/Y) carried the quarter, powered by work on Telesat’s Lightspeed network and Globalstar’s new constellation.

Bottom-line: Net income jumped 86% Y/Y to $25M ($0.20 EPS, in-line with estimates), while adjusted EPS hit $0.28 (+22% Y/Y). Strong execution on the backlog and higher-margin projects lifted adjusted EBITDA 68% Y/Y to $71M.

Backlog hit a record $4.4B (+42% Y/Y), and after the quarter they landed a $1.1B Globalstar deal for 50+ satellites. We followed that deal with some research into the commercial space race, where we highlighted MDA as a long-term winner.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Geoff Martin | CCL Industries (CCL) | $1.1M |

| Sean Washchuk | CCL Industries (CCL) | $1.0M |

| Jocelyn Perry | Fortis (FTS) | $4.4M |

| James Reid | Fortis (FTS) | $1.3M |

| Gary Smith | Fortis (FTS) | $2.5M |

| Chester See | Lundin (LUG) | $2.5M |

| Philip Witherington | Manulife (MFC) | $6.3M |

| Stephen Smith | EQB (EQB) | $3.1M |

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 MDA Space (MDA) | 0.28 | 0.27 |

| 🇨🇦 Algonquin (AQN) | 0.06 | 0.09 |

| 🇨🇦 Atrium (AI) | 0.26 | 0.23 |

| 🇨🇦 AltaGas (ALA) | 0.76 | 0.71 |

| 🇨🇦 Total Energy (TOT) | 41M | 48M |

| 🇨🇦 Black Diamond (BDI) | 0.16 | 0.14 |

| 🇨🇦 Canfor (CFP) | -0.73 | -0.39 |

| 🇨🇦 Artis REIT (AX-U) | 46M | 39M |

| 🇨🇦 Constellation (CSU) | 17.80 | 19.60 |

Algonquin (AQN) posted weak Q4 2024 results, with adj. EPS of $0.06 missing the $0.09 forecast, with higher interest costs (+$55M Y/Y), depreciation (+$42M Y/Y), and tax impacts weighing on results. The lack of guidance was another negative, though it’s expected in a few months after the new CEO settles in.

The dip was bought: the stock sank 10% at the open but ended the day green on 3x the daily average volume, indicating there may be a floor being put under this thing in the near-term.

The company is focused on ROE improvement (currently mid-5s vs. 9.2% allowed), which would improve earnings and warrant multiple expansion if it comes, as we wrote about previously: https://www.bullpen.finance/content/27

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Franco-Nevada (FNV) | AM | 0.89 |

| 🇨🇦 Nexus REIT (NXR-U) | AM | 30M |

| 🇨🇦 Frontera (FEC) | AM | - |

| 🇨🇦 NorthWest REIT (NWH-U) | AM | - |

| 🇨🇦 Pollard (PBL) | PM | 0.54 |

| 🇨🇦 Enghouse (ENGH) | PM | 0.37 |

| 🇨🇦 Alaris (AD-U) | PM | 0.68 |

| 🇺🇸 Oracle (ORCL) | PM | 1.49 |

| 🇺🇸 Vail Resorts (MTN) | PM | 6.31 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 6.6% | 6.7% |

| 🇨🇦 Participation Rate | 65.3% | - |

| 🇨🇦 Employment Change | 1K | 20K |

| 🇨🇦 Full Time Change | -20K | - |

| 🇨🇦 Part Time Change | 21K | - |

| 🇨🇦 Hourly Wages Y/Y | 4.0% | - |

| 🇨🇦 Capacity Utilization | 79.8% | 79.3% |

| 🇺🇸 Non Farm Payrolls | 151K | 160K |

| 🇺🇸 Unemployment Rate | 4.1% | 4.0% |

| 🇺🇸 Participation Rate | 62.4% | - |

| 🇺🇸 Hourly Wages Y/Y | 4.0% | 4.1% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Inflation Expectations | 10:00AM | - |