|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Carney kills EV mandate

KXS to take advantage of AI sell-off

Celestica runs on big tech CapEx

Canada Goose falls 20% on Q3

HOT OFF THE PRESS

Carney kills EV mandate

Weeks after the EV deal with China, Carney’s replacing the stick with a carrot - dropping the EV mandate in favour of a $2.3B pool for rebates…

… which could stimulate activity in the industry, alongside $3B from the strategic response fund and $1.5B for the country’s EV charging network. Linamar (LNR) looks best-positioned on a relative basis…

… given its large exposure to parts sales in Canada. That split has likely driven some of the outperformance versus peers…

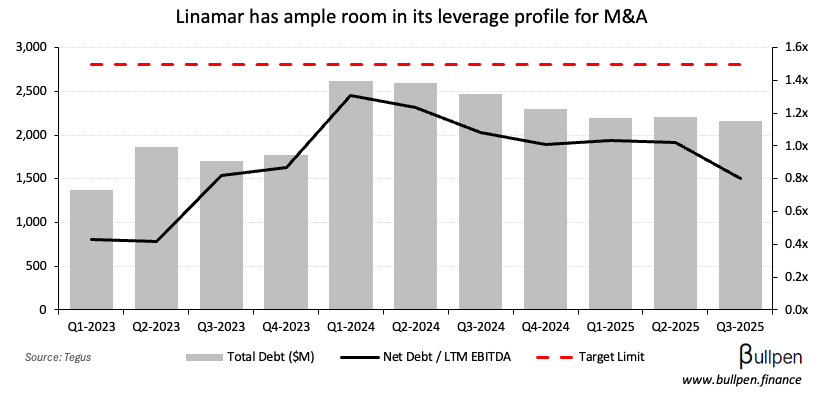

… as has tuck-in M&A, which should continue given the company’s modest leverage profile and stress among smaller, less liquid players.

Should they be able to come out of the industry slowdown stronger, there’s re-rate potential - with the stock trading below its long-term average valuation.

ON OUR RADAR

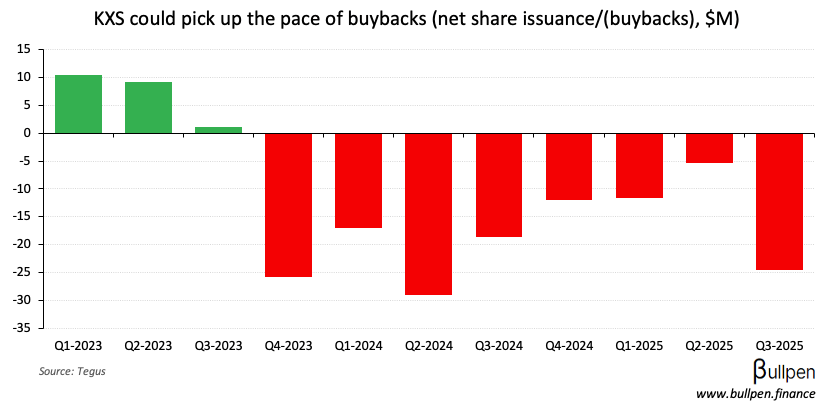

Flagging Kinaxis (KXS) as one of the only tech names up yesterday after an agentic AI release, which comes a day after it shared plans to double the buyback…

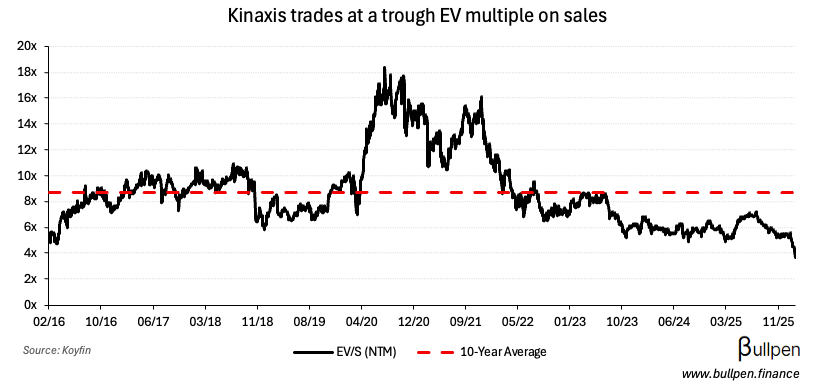

… on the belief that the market is overstating the risks posed by generative AI, which has impaired its valuation alongside most software companies.

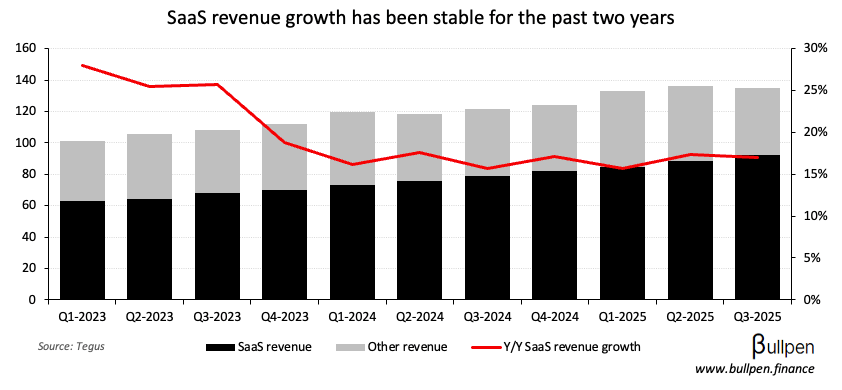

Management frames the new technology as additive to its core offering, which is deeply entrenched in supply chain operations. With Y/Y growth stabilizing in the mid-teens…

… it’s tough to argue that positioning for now.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

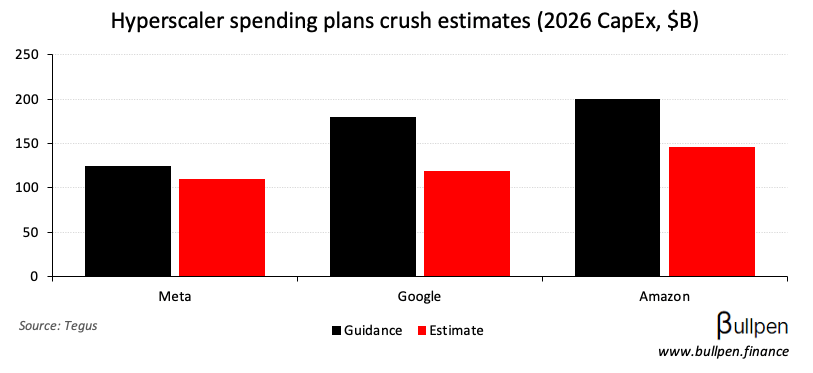

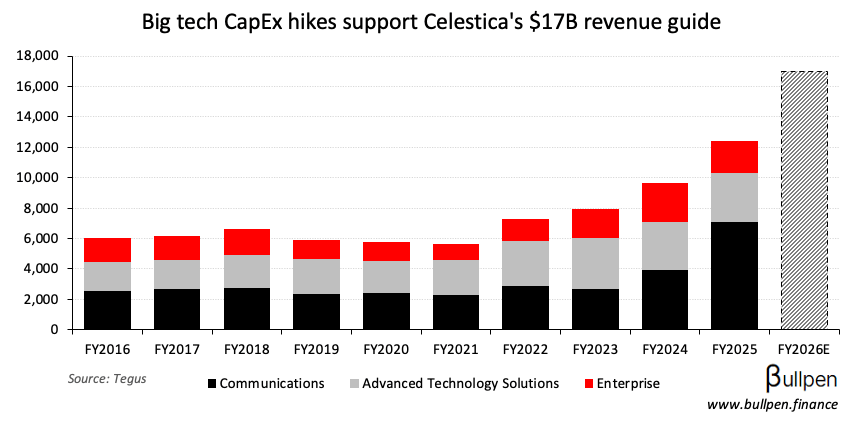

Celestica (CLS) was up over 6% on the back of elevated CapEx spending plans from the hyperscalers - with Meta, Google, and Amazon guiding way above estimates…

… supporting management’s recent guidance bump to $17B in revenue, with 50% Y/Y growth in its communications segment…

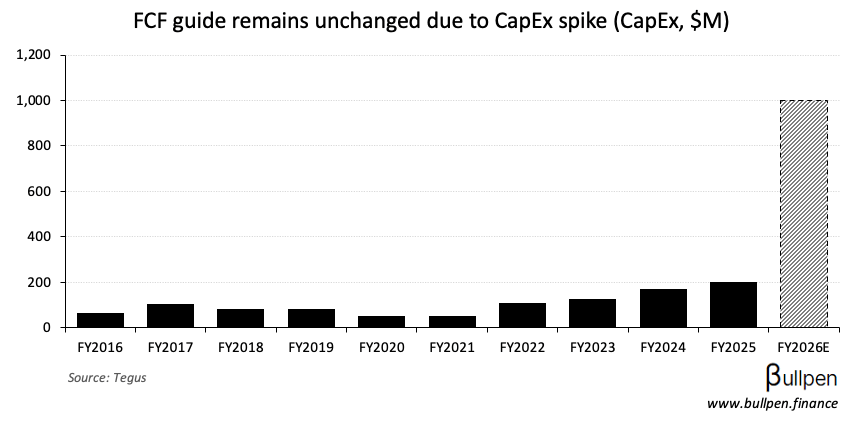

… but the company left its FCF guide flat, driven by a $1B CapEx target of its own - cost of doing business in an AI boom.

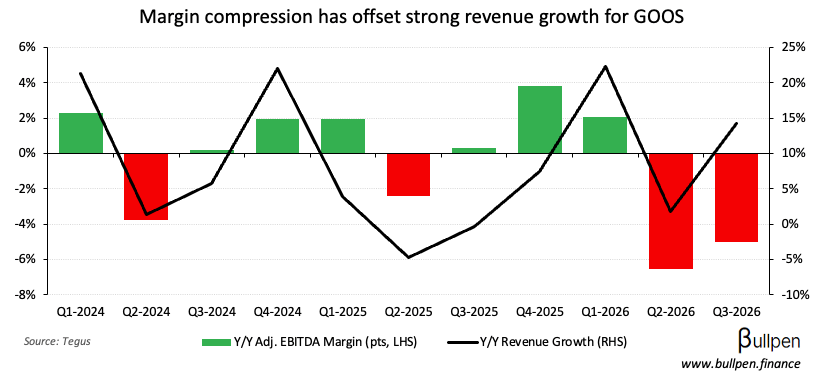

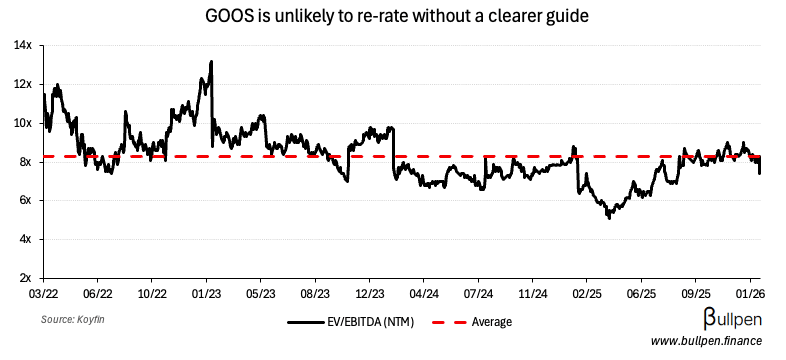

Canada Goose (GOOS) was off nearly 20% after releasing a Q3 that beat on revenue but missed big on profitability, driven by the second straight month of SG&A driven margin compression…

… and a lack of concrete guidance, which investors will likely need to warm back up to the name given recent volatility and the Bain Capital overhang.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 BCE Inc. (BCE) | 0.69 | 0.62 |

| 🇨🇦 Lightspeed (LSPD) | 0.15 | 0.15 |

| 🇨🇦 Rogers Sugar (RSI) | 0.19 | 0.14 |

| 🇨🇦 Thomson Reuters (TRI) | 1.07 | 1.06 |

| 🇨🇦 Canada Goose (GOOS) | 1.43 | 1.65 |

| 🇨🇦 Barrick (ABX) | 1.04 | 0.88 |

| 🇨🇦 TMX Group (X) | 0.60 | 0.55 |

| 🇨🇦 Saputo (SAP) | 0.57 | 0.54 |

| 🇨🇦 ARC Resources (ARX) | 0.55 | 0.41 |

| 🇺🇸 Amazon (AMZN) | 1.95 | 1.95 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 JOLTs Openings | 6.5M | 7.2M |

| 🇺🇸 Jobless Claims | 231K | 212K |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 8:30AM | 6.8% |

| 🇨🇦 Employment Change | 8:30AM | 7K |

| 🇨🇦 Ivey PMI | 10:00AM | 49.7 |

| 🇺🇸 Consumer Sentiment | 10:00AM | 55 |

Was this forwarded to you? Join 7,000+ investors reading The Morning Meeting by clicking the button below.