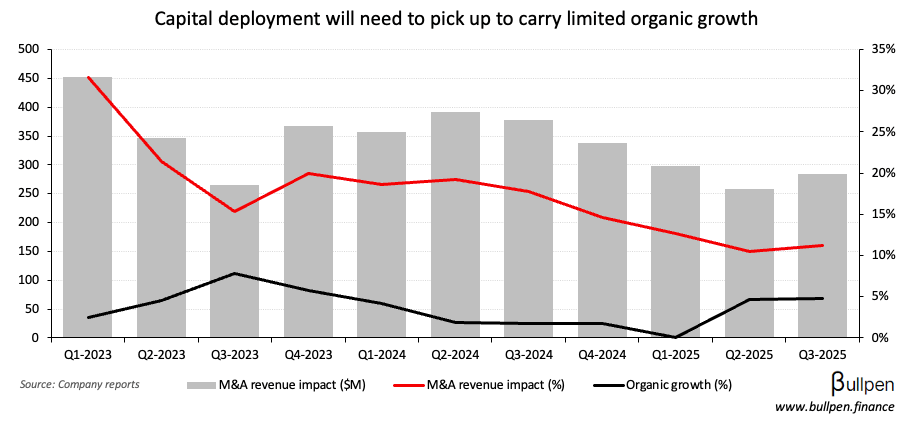

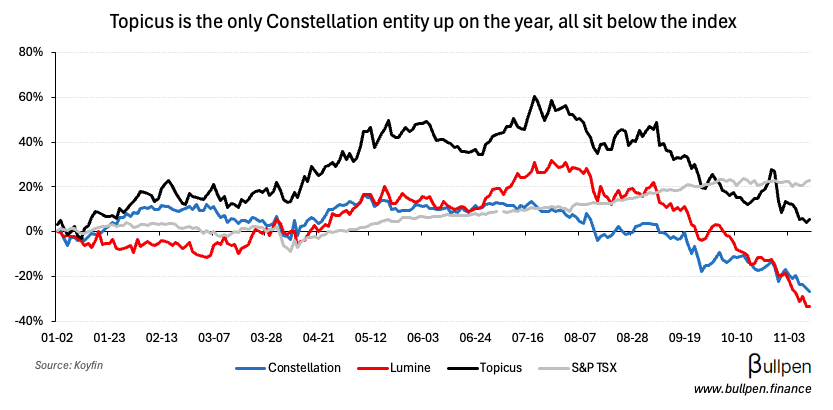

Constellation Software’s (CSU) recent weakness continued after Q3, which beat on earnings but was light on revenue - driven by a slower pace of capital deployment.

While investors seem to be chalking up CSU’s near-40% drawdown to AI risk…

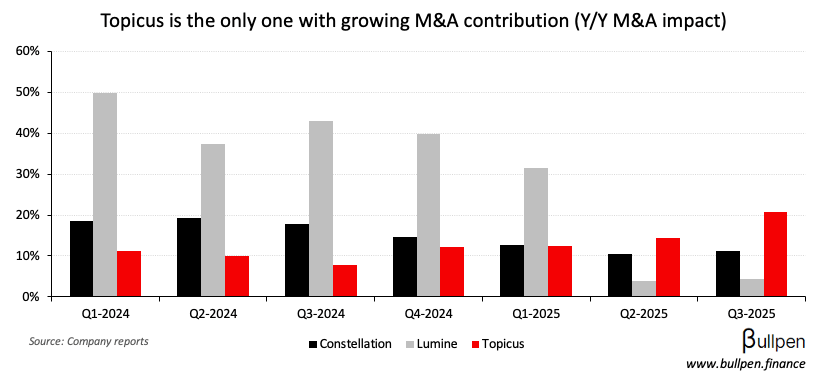

… I’d argue the real threat isn’t in competition for its owned businesses, but in the competition for M&A prospects - with billions in “AI enhancing” capital fighting for the same deals and pushing prices past where CSU is comfortable playing.

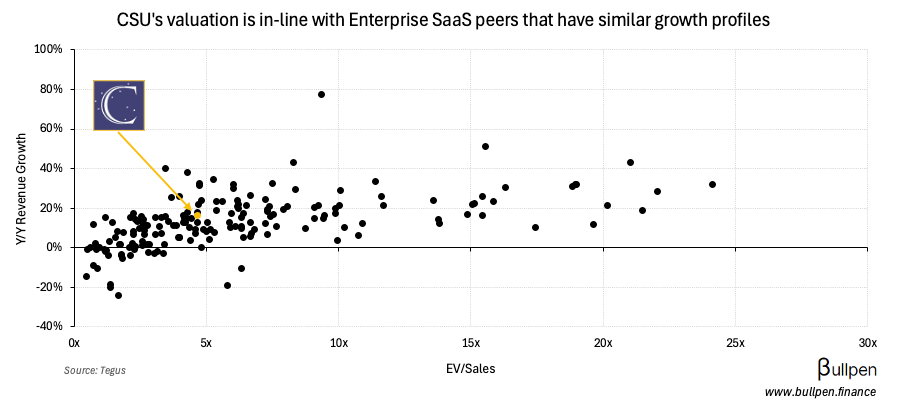

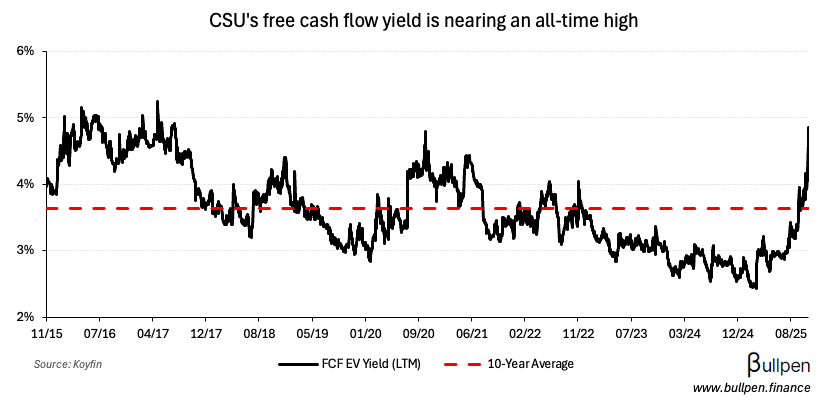

Add in Mark Leonard’s departure and you’ve got a perfect storm, driving a sell-off that makes the stock look cheap on any historical measure…

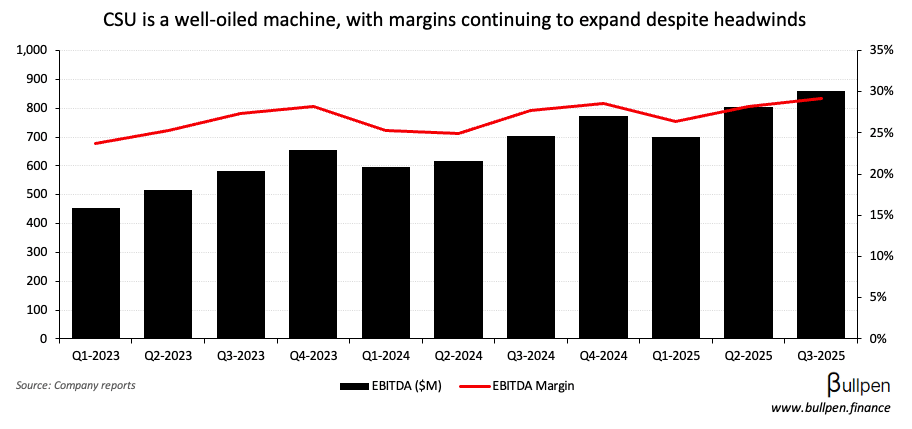

… despite continued margin expansion and execution.

With the “Constellation cult” premium now gone, it might be time to sharpen your pencils on this one.