|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Brookfield & Cameco’s $80B deal

Wealthsimple hits $10B valuation

MEG deal gets over the line

Kiwetinohk gets bought for $1.4B

Celestica keeps AI trade going

HOT OFF THE PRESS

Brookfield & Cameco’s $80B nuclear deal

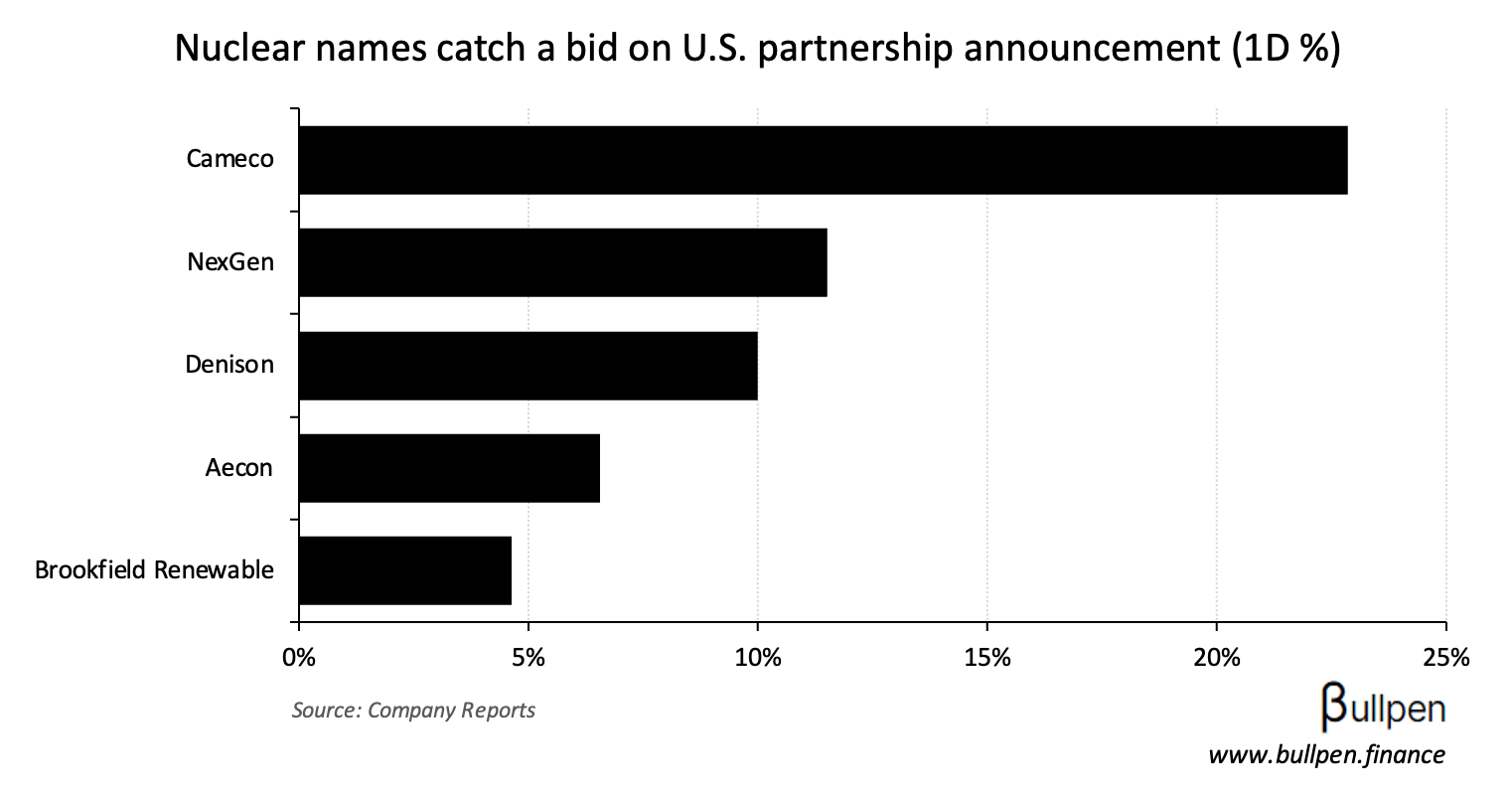

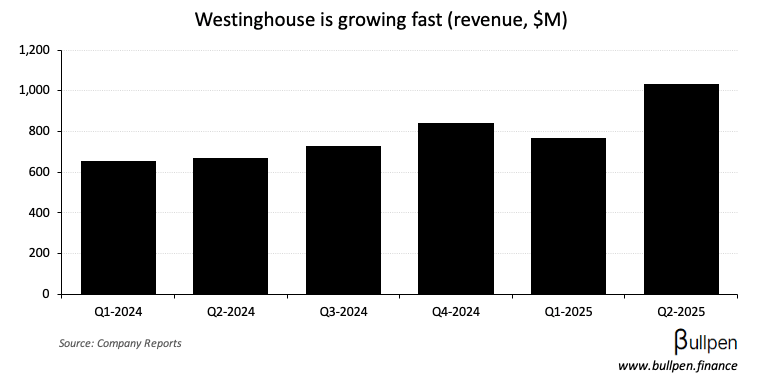

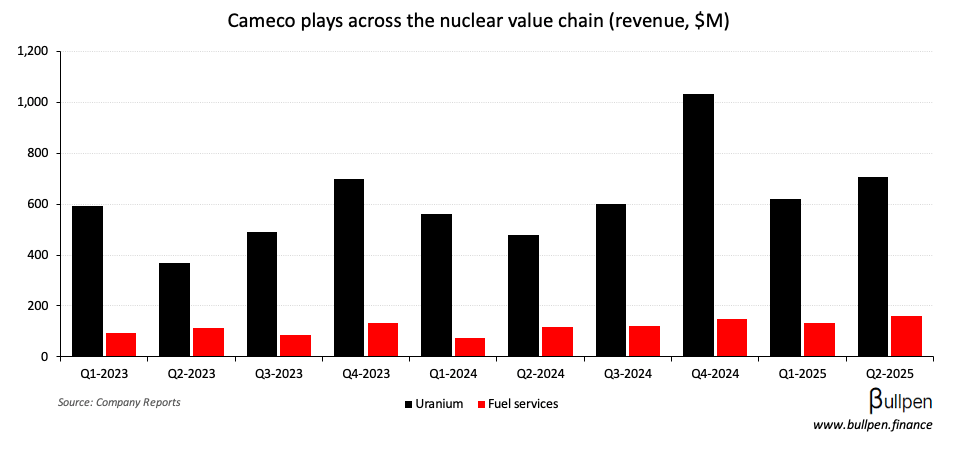

The nuclear theme is on fire, with Brookfield and Cameco announcing a strategic partnership with the U.S. government to accelerate an $80B+ build out of Westinghouse reactors.

With the two companies collectively owning Westinghouse (roughly 50/50), the news represents a huge financial tailwind…

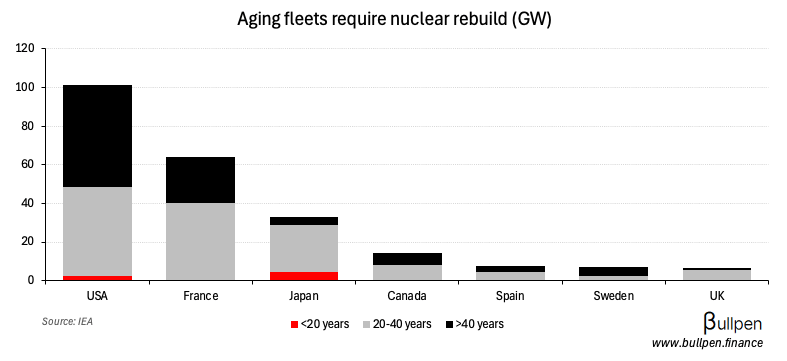

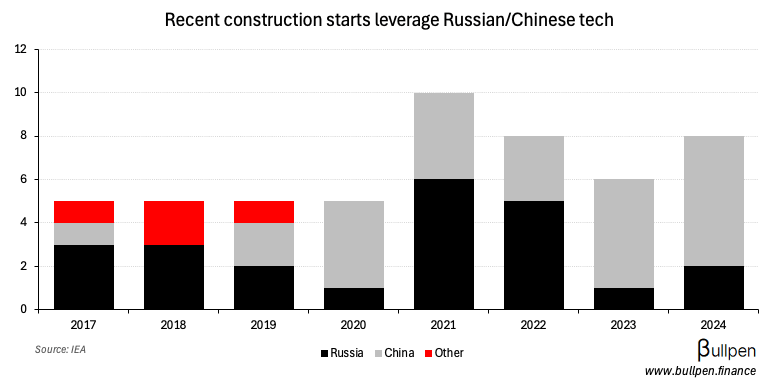

… but for America, the partnership is a matter of national security - with an aging nuclear fleet that needs to be rebuilt…

… leveraging in-country technology, considering the volatile geopolitical backdrop. That’s positive for construction names like Aecon (ARE), who partner with Westinghouse…

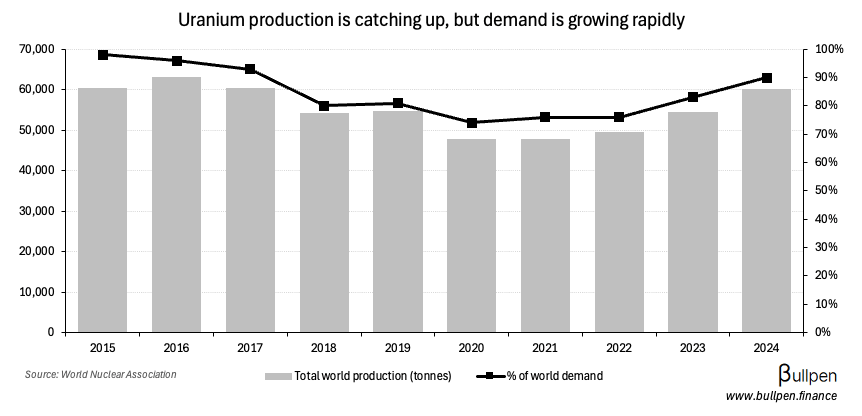

… and it also improves the fundamental case for uranium miners, who aren’t meeting current demand as is…

… and will need to ramp up production to keep pace with future nuclear capacity. As we’ve said before, Cameco is the cleanest way to play nuclear…

… while Brookfield is showing up all over AI infrastructure, with a $5B partnership with Bloom Energy announced two weeks ago.

Wealthsimple hits $10B valuation

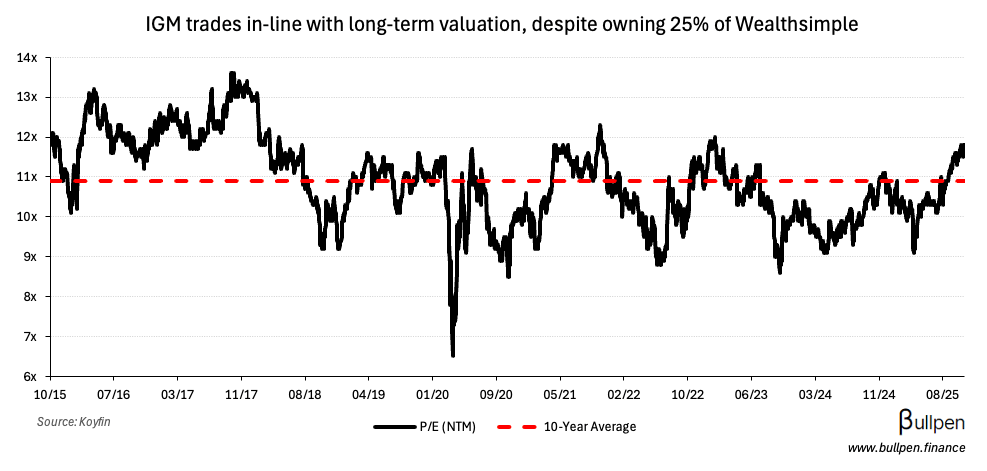

On Monday Wealthsimple closed a $750M equity raise, valuing the company at $10B. While most look to Power Corp. (POW) for exposure, given it has the largest position in dollar terms…

We acquired and funded Wealthsimple, not as a venture capital flip, but as a strategic asset that would represent a material part of the Power Corp. and IGM franchises over the long term.

… IGM Financial (IGM) has the largest position in relative terms, with a ~25% stake that represents nearly 20% of its current market cap (versus ~10% for POW). With IGM’s investment growing much faster than its base business…

… and a seemingly reasonable valuation…

… the name likely has more torque than POW for investors betting on Wealthsimple’s continued success.

FUNNY BUSINESS

After a second bump in the purchase price, Cenovus Energy’s ~$8.6B takeout of MEG Energy looks to be complete - but not before Strathcona took a pound of flesh…

… giving its vote in exchange for CVE’s Vawn thermal asset and some undeveloped lands for $75-150M, depending on oil prices. With the asset producing ~$50M in cash flow annually, Adam Waterous’ dealmaking ability is back on display.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

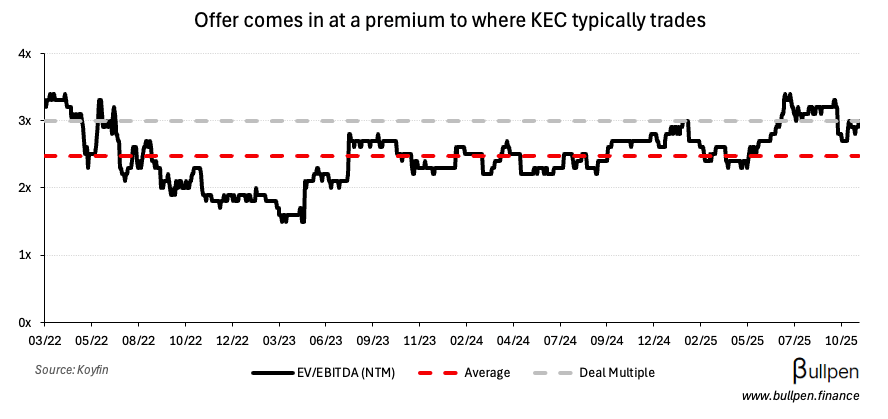

Kiwetinohk Energy (KEC) gained 10% after a $24.75/sh takeout bid from Cygnet, valuing the natural gas producer at $1.4B - or ~3x NTM EBITDA.

Among other notable names, the acquirer is backed by ARC Financial - the same firm behind the $400M take-private of STEP Energy. With crude prices in the toilet bowl…

… we could see more takeouts in the patch.

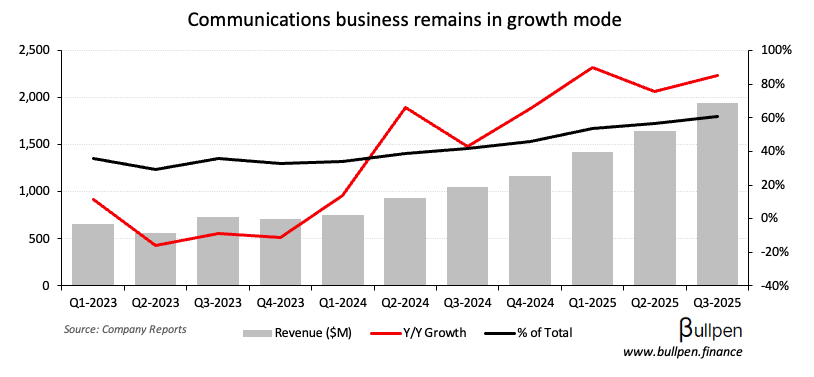

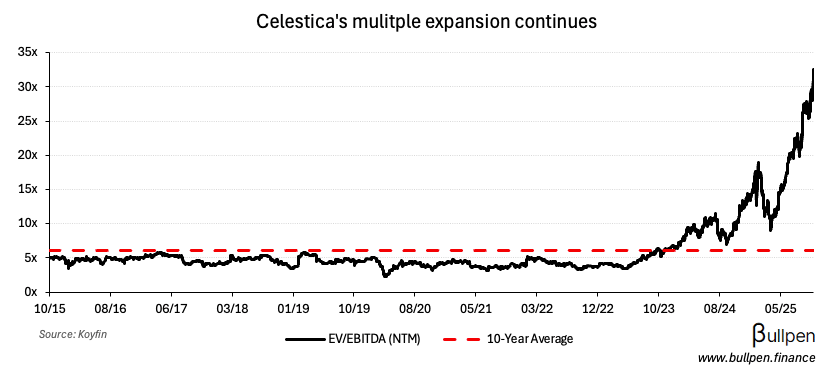

Celestica (CLS) jumped 7% on its Q3, which beat estimates on the back of >80% Y/Y growth in its communications segment…

… prompting a bump to 2025 guidance and supporting management’s >30% growth target for 2026. With key channel partners like Broadcom seeing huge growth…

… we work closely and proactively with our technology partners, aligning years ahead of time on next-generation product roadmaps, enabling us to be early to market and deploying leading-edge solutions for our customers.

… and data center spend showing no signs of slowing down, AI-enabling hardware (Celestica, Hammond, etc.) continues to be the trade despite elevated valuations.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Dean Shillington | Zedcor (ZDC) | $12.9M |

| Dean Swanberg | Zedcor (ZDC) | $6.5M |

| Todd Ingledew | Aritzia (ATZ) | $2.9M |

| Veronica Foley | Precision (PD) | $176K |

| Marcel Teunissen | Parkland (PKI) | $408K |

| Chad Graves | Parkland (PKI) | $513K |

| Robert Espey | Parkland (PKI) | $1.0M |

More selling at Zedcor (ZDC)… that’s ~$35M over the last week.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 TMX Group (X) | 0.52 | 0.49 |

| 🇨🇦 New Gold (NGD) | 0.18 | 0.18 |

| 🇨🇦 First Quantum (FM) | -0.02 | 0.18 |

| 🇨🇦 Centerra (CG) | 0.33 | 0.25 |

| 🇨🇦 Trican (TCW) | 0.15 | 0.16 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Bausch + Lomb (BLCO) | AM | 0.16 |

| 🇨🇦 Gildan (GIL) | AM | 0.98 |

| 🇨🇦 Capital Power (CPX) | AM | 0.99 |

| 🇨🇦 Tamarack (TVE) | AM | 232M |

| 🇨🇦 Canadian Pacific (CP) | PM | 1.11 |

| 🇨🇦 Cogeco (CGO) | PM | 2.08 |

| 🇨🇦 Cogeco Comms (CCA) | PM | 1.94 |

| 🇨🇦 Primaris (PMZ-U) | PM | 81.1M |

| 🇨🇦 Aecon (ARE) | PM | 0.45 |

| 🇨🇦 Aris Mining (ARIS) | PM | 0.33 |

| 🇨🇦 Allied (AP-U) | PM | 90.5M |

| 🇨🇦 Alamos (AGI) | PM | 0.36 |

| 🇨🇦 Ivanhoe (IVN) | PM | 0.01 |

| 🇨🇦 Agnico (AEM) | PM | 1.93 |

| 🇨🇦 Timbercreek (TF) | PM | 0.17 |

ECONOMIC DATA

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 BoC Rate Decision | 9:45AM | 2.25% |

| 🇺🇸 Fed Rate Decision | 2:00PM | 4.0% |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.