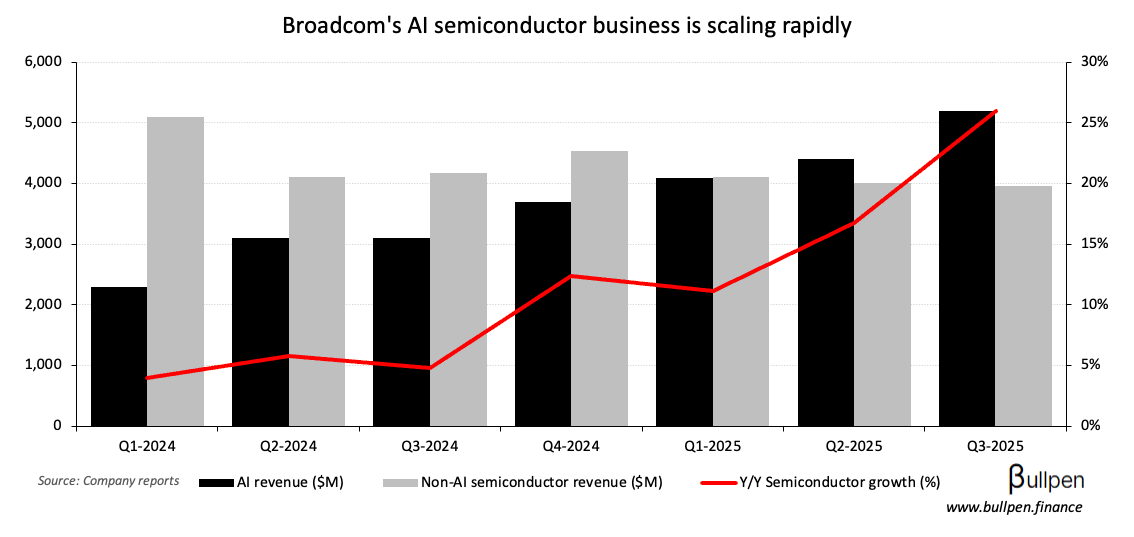

Celestica (CLS) was up 10% on a read-through from Broadcom’s Q3, which beat estimates thanks to strong performance in its AI semiconductor business…

… and came with even stronger guidance - with management calling for 66% Y/Y growth in Q4 and a material improvement versus its original 50-60% guide for 2026.

… we’re seeing the growth rate accelerate as opposed to just remain steady at that 50%, 60%. We are expecting and seeing 2026 to accelerate more than the growth rate we see in 2025.

Supporting that guide are continued share gains at the hyperscalers and a rumoured $10B deal with OpenAI, which was immediately reflected in analyst estimates for Broadcom - but not for Celestica.

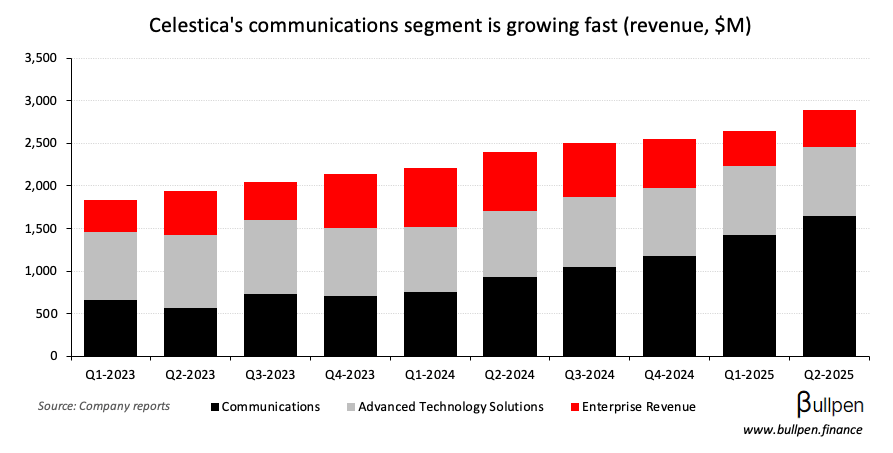

Given much of Celestica’s communications business is built around Broadcom chips, it’s reasonable to assume that higher guidance should flow through…

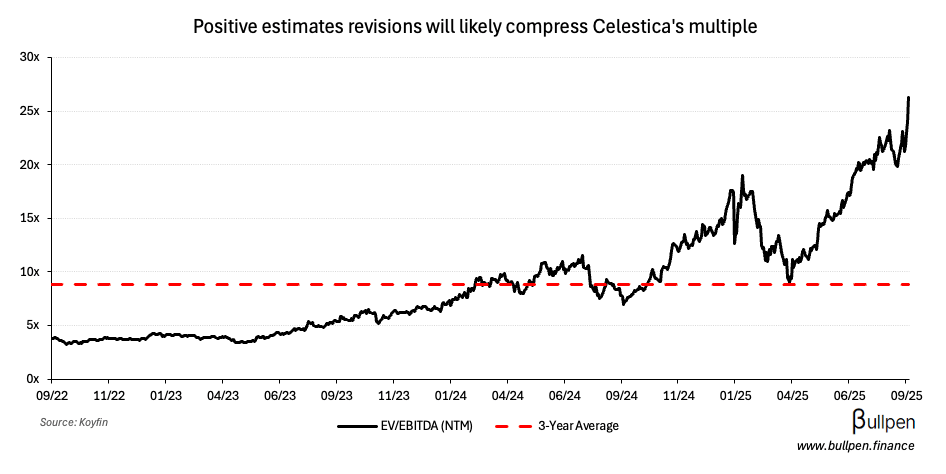

… and positive estimates revisions should follow - making Celestica’s premium multiple a little more palatable.