|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

PPI beats and trends continue

Extendicare announces $570M deal

Brookfield’s $100B AI infra target

Altus group runs on new strategy

HOT OFF THE PRESS

PPI beats and trends continue

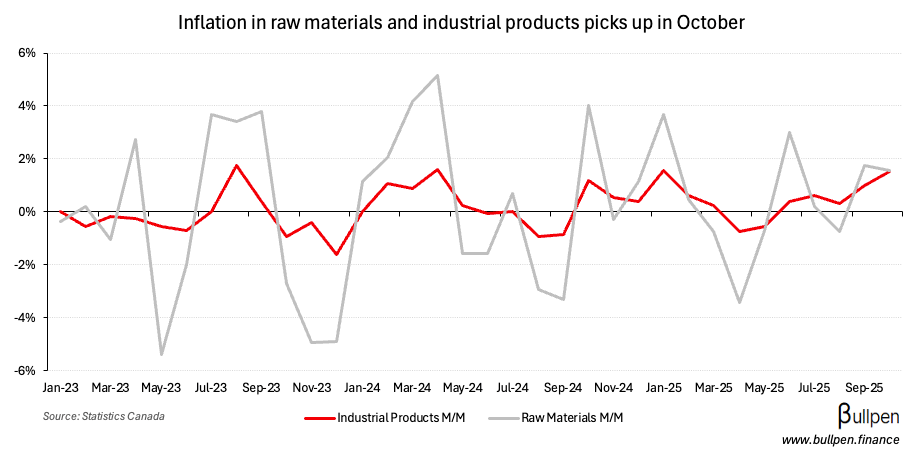

Industrial product prices rose 1.5% in October, the fifth straight sequential gain and well ahead of expectations…

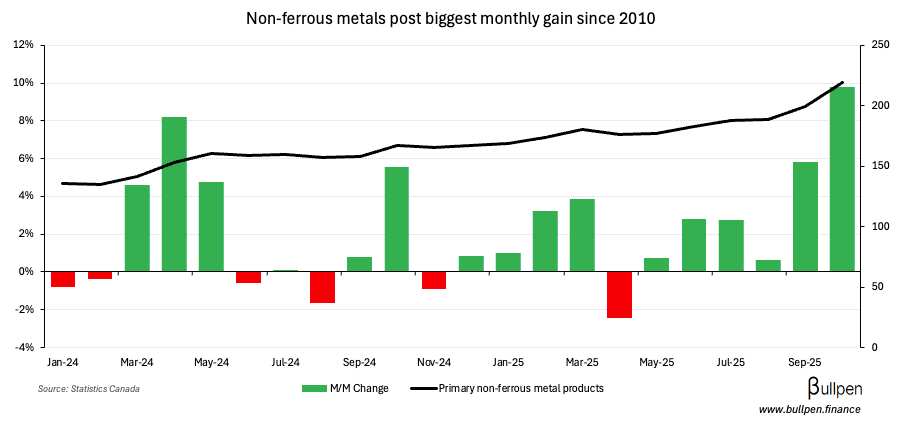

… driven by precious metals and copper, which rose ~10% - the largest M/M jump since 2010 and the tenth in eleven months.

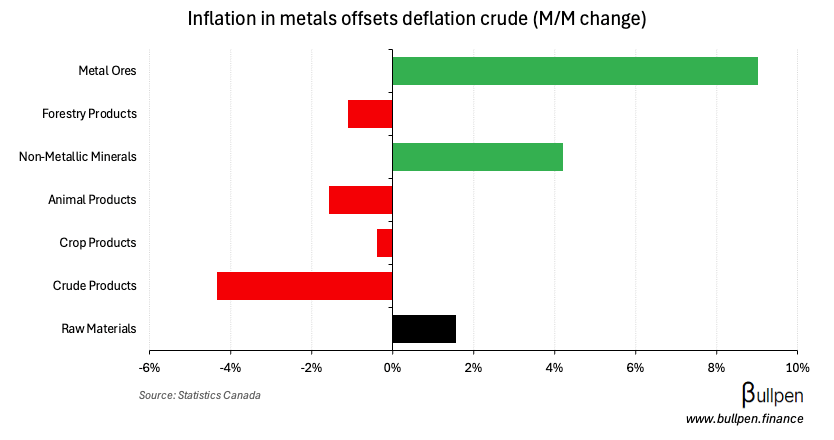

Similar dynamics played out in raw materials, with big gains in metal ores offsetting weakness in crude products…

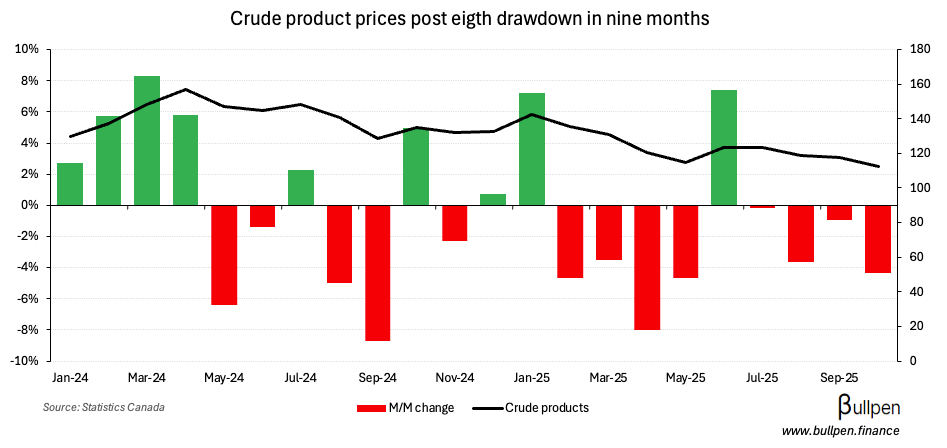

… which have edged down in eight of the last nine prints.

Extendicare’s $570M home health deal

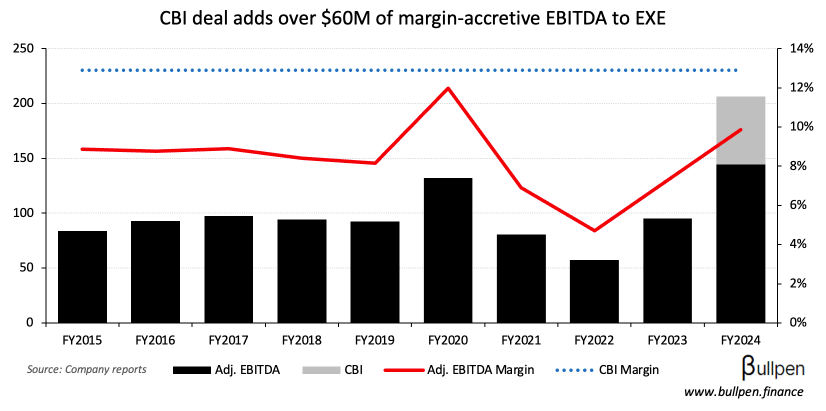

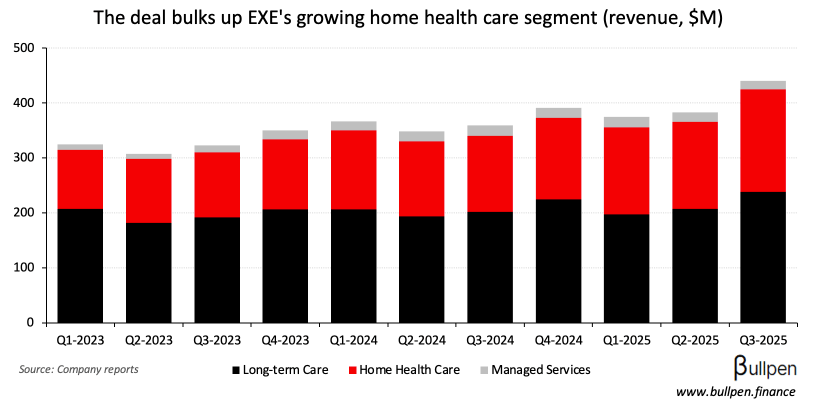

Extendicare (EXE) announced a splashy $570M acquisition of CBI Home Health, adding $62M of EBITDA at better economics than its base business…

… and showing continued execution of its home health care M&A pipeline, after buying Closing the Gap for $75M in Q3.

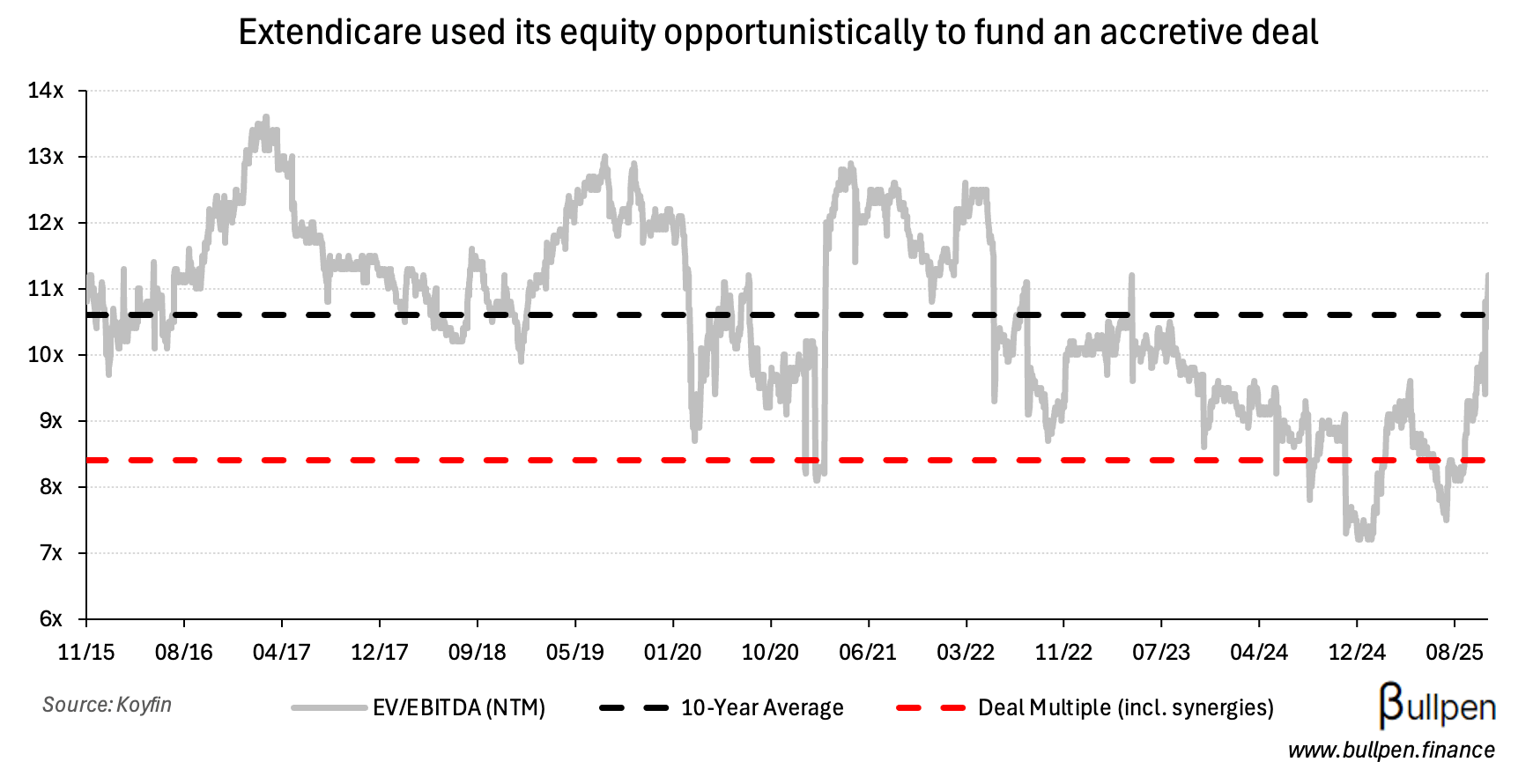

Including ~$7M of synergies, the deal math checks out at 8.4x EBITDA - well below current trading which allows EXE to fund $200M of the bid by raising equity…

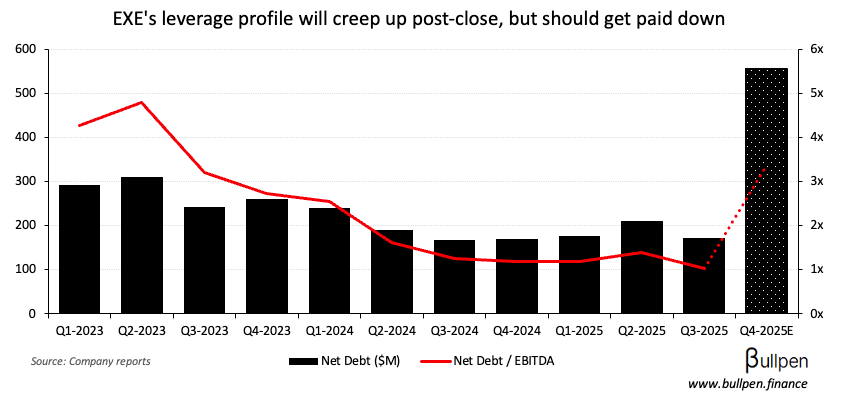

… and taking on additional debt for the rest, with management pointing to pro-forma leverage of 3.3x that should be paid down in short order…

… opening the door for more activity.

We continue to see M&A as an opportunity to augment our strong organic growth, particularly where there is an opportunity to diversify service mix and geography.

FUNNY BUSINESS

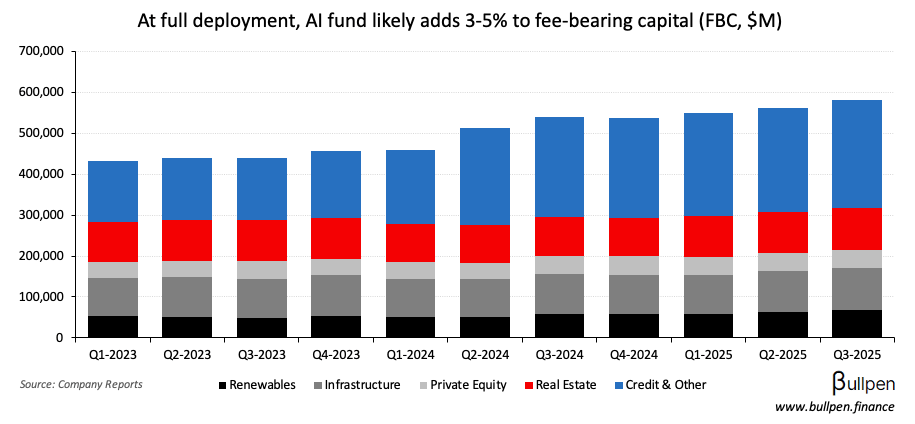

Brookfield (BAM) launched its $100B AI Infrastructure program Wednesday, backed by a dedicated fund it hopes to raise $10B for (see recent $5B Bloom deal). While the headline number is big, BAM is bigger…

... at $580B of fee-bearing capital. With project level debt financing ~70% of most deals, that leaves ~$30B of new equity capital managed in BAM’s infra strategy. Assuming the co-invest portion of that negotiates a 50% haircut on fees…

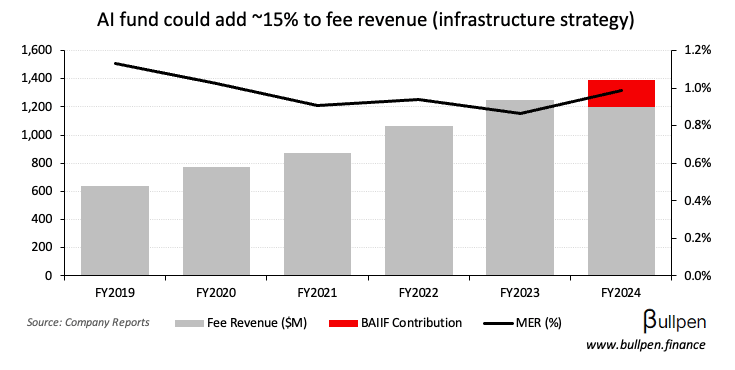

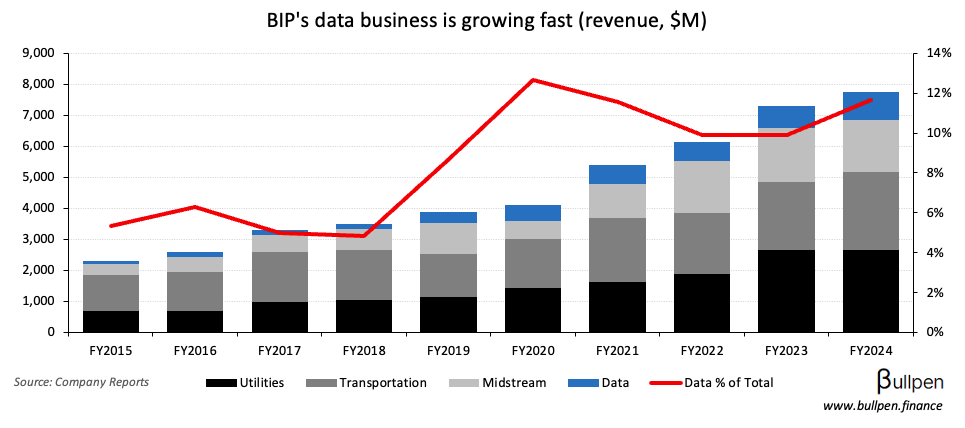

… you’re looking at a $190M bump to fee-based revenue once fully deployed, 15% of what the infra strategy currently generates (4% of total fee revenue). Not huge, but other Brookfield entities will likely get involved, BIP on the data side…

… BEP on the renewable power and nuclear side. Ironically, that would increase the amount of fees paid back to BN/BAM through a separate agreement - a story for another time…

ON OUR RADAR

Torex, Birchcliff, Boardwalk, North West & Choice announce NCIB

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

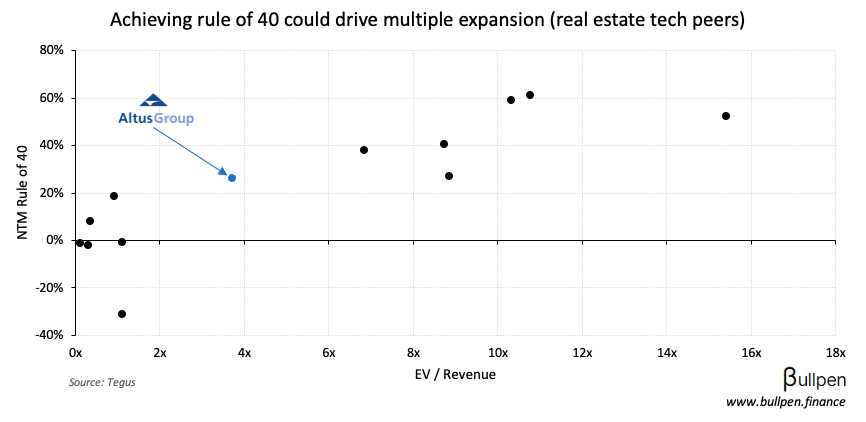

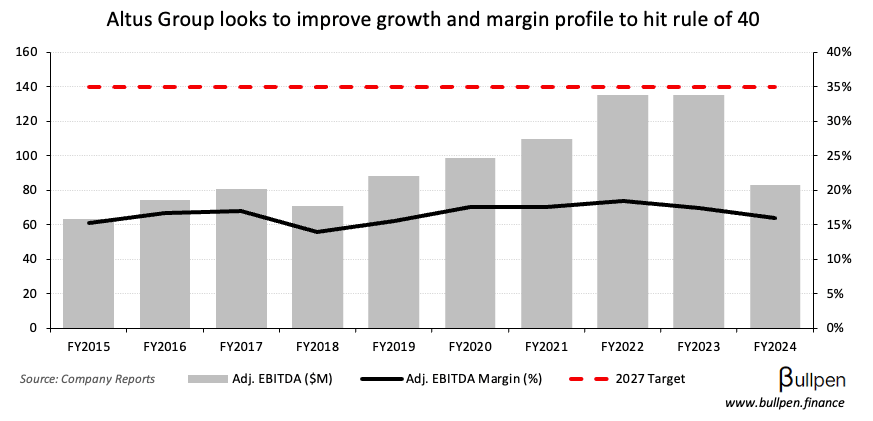

Altus Group (AIF) jumped 5% on its investor day, where the company unveiled a plan to join the rule of 40 club by 2027…

… by pulling top-line growth and EBITDA margins above 8% and 35% from 2% and 18%, respectively. The new targets seem pretty ambitious…

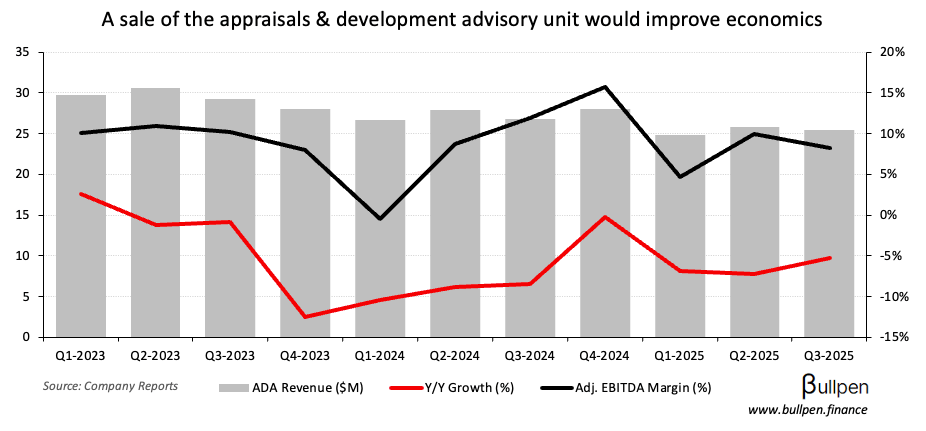

… but should look more achievable after the sale of its appraisals (signed LOI), development advisory, and select analytics businesses - units that weighed on Q3 results and management views as non-core.

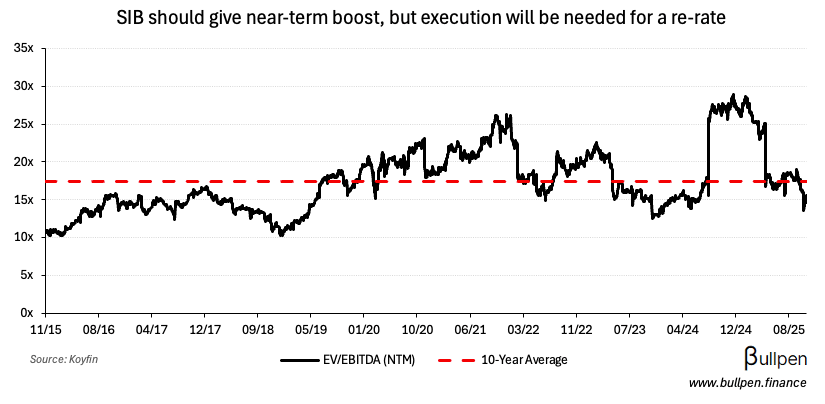

While the divestitures could be catalysts, yesterday’s rally was likely driven by the company’s planned $350M substantial issuer bid. Priced in the $50-57 per share range, the SIB sets a near-term floor on AIF…

… but after that’s filled, attention turns back to execution. If shares don’t react to fundamental improvement, private equity might take a swing - given the growth → profitability transition is their sweet spot.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Pablo Mir | Lundin (LUG) | $1.3M |

| Riley Frame | Peyto (PEY) | $595K |

| Bryce Hamming | Taseko (TKO) | $187K |

| Scott Stauth | Cdn. Natural (CNQ) | $2.4M |

| Charles Pellerin | Calfrac (CFW) | $2.3M |

| Christopher Virostek | West Fraser (WFG) | $103K |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Real Matters (REAL) | 46M | 46M |

| 🇺🇸 Walmart (WMT) | 0.62 | 0.60 |

| 🇺🇸 Intuit (INTU) | 3.34 | 3.09 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 PPI M/M | 1.5% | 0.3% |

| 🇨🇦 Raw Materials M/M | 1.6% | 0.6% |

| 🇺🇸 Non Farm Payrolls | 119K | 50K |

| 🇺🇸 Unemployment Rate | 4.4% | 4.3% |

| 🇺🇸 Existing Home Sales | 4.10M | 4.08M |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 New Home Prices M/M | 9:30AM | 0.0% |

| 🇨🇦 Retail Sales M/M | 9:30AM | -0.7% |

| 🇺🇸 Consumer Sentiment | 11:00AM | 50.5 |

Was this forwarded to you? Join 3,000+ investors reading The Morning Meeting by clicking the button below.