|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Housing starts beat, inventory builds

Auto slowdown hits manufacturing

Chartwell’s M&A spree continues

Clairvest buys MGM Ohio for $550M

Cineplex sells digital media for $70M

HOT OFF THE PRESS

Housing starts beat, inventory builds

Housing starts beat in September, rising to 279K versus estimates for 255K - rebounding after a weak August print.

On a Y/Y basis gains were broad-based, with supply adds in Alberta and Ontario more than offsetting weakness in BC.

Unit absorption trended lower after two months of recovery, indicating the slowdown in construction was the primary driver rather than demand improvements…

… that will be needed in order to clear out housing inventory, which reversed last month’s draw - driven by a longer time on the market for mutli-family units.

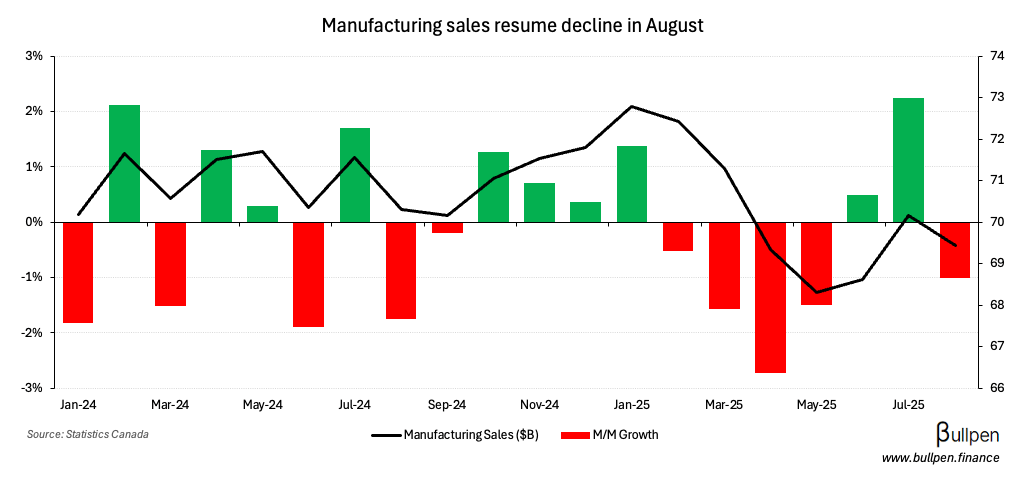

Auto slowdown hits manufacturing sales

Manufacturing sales of ~$69B fell 1% in August, ahead of estimates for a 1.5% drop but reversing from July’s gain due to a 6% decline in transportation equipment...

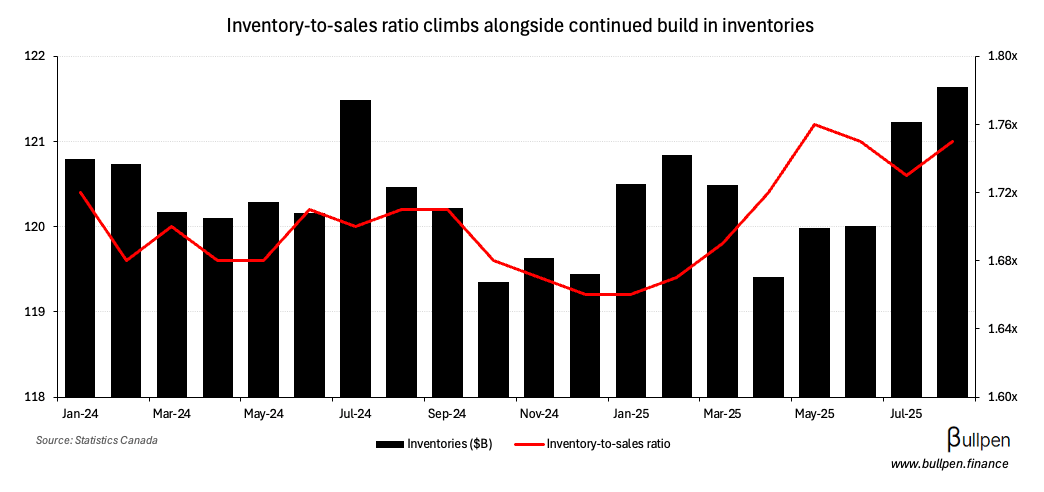

… which could hit future results too, with Stellantis shifting Jeep production from Brampton to Illinois. Inventories reached a two-year high, driven by finished goods…

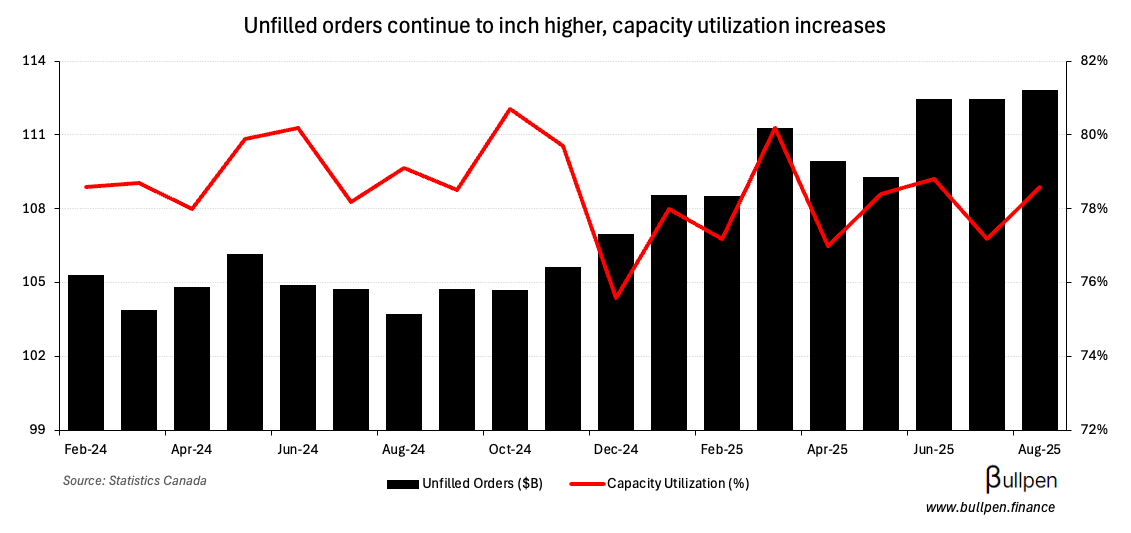

… which tracks to the continued rise in unfilled orders - led by aerospace products.

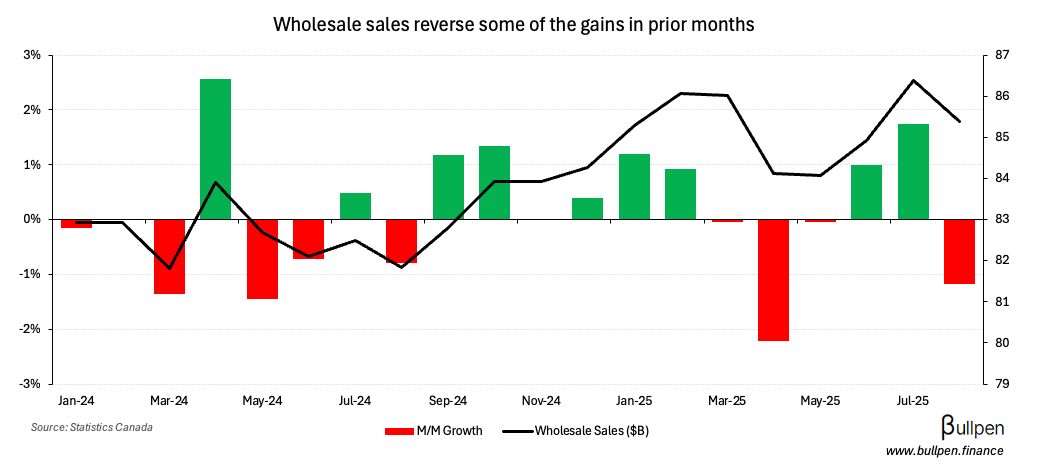

The weak print flowed through to wholesale sales, which fell 1.2% on a near-10% drop in motor vehicles and parts - underscoring the hidden complexities of China’s proposed tariff truce.

FUNNY BUSINESS

Chartwell Retirement (CSH-U) is keeping busy, announcing three more acquisitions in Quebec for $315M and a development project in Calgary - adding ~1K units at similar occupancy levels to the portfolio.

The deal follows expansions of similar size across Ontario and Quebec in July and is unlikely to be the last, with management showing no intention of taking its foot off the gas on M&A:

While we have been successful sourcing high quality acquisitions over the last 24 months, we have also been busy laying the groundwork to build an important pipeline of future acquisition opportunities…

With the reduction in non-permanent residents restarting population aging…

… I’m starting to think retirement homes are our best shot at hitting Carney’s target of 500K starts per year.

ON OUR RADAR

Flagging Clairvest Group’s $546M acquisition of MGM Northfield Park, as it doubles down on its core strategy. It’s the firm’s 17th investment in the space and with 46% of its portfolio tied to the sector, CVG is an under the radar gaming play…

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

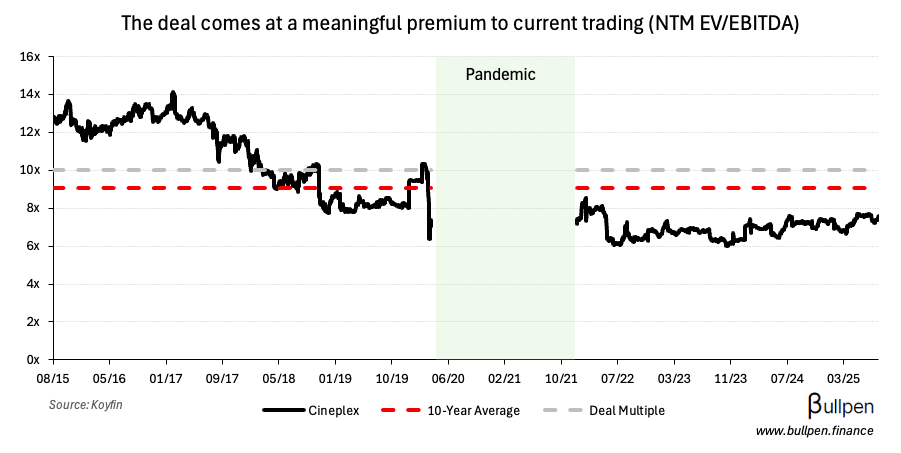

Cineplex (CGX) was up 5% following the $70M divestiture of its place-based media business. It’s small, given it represents less than half of the total media business…

… which is only ~10% of Cineplex’s top line. While the proceeds should only have a modest impact on the company’s leverage profile and buyback program…

… that’s not what got the market excited. At ~10x EBITDA, the deal is priced more than two turns above where CGX trades today - leaving investors wondering how else the company could unlock value from here.

Endeavour Silver (EDR) ran nearly 7% after announcing commercial production at its Terronera mine in Mexico. The company expects silver grades to come in below its current production profile…

… but to move upward by mid-2026 when higher grade zones are accessed. With the metal up 87% YTD, it’s a good time to bring production online.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Luis Durant | Fortuna (FVI) | $966K |

| Douglas Fraser | Gatekeeper (GSI) | $317K |

| Denys Lapointe | BRP Inc. (DOO) | $3.6M |

| Norman MacDonald | G Mining (GMIN) | $1.2M |

| Ryan Beedie | Oceanic Iron (FEO) | $179K |

Flagging the selling at Gatekeeper Systems (GSI), which comes on the back of a ~400% YTD run driven by some big contract wins and a broad bid for security. Combined with $6.4M of selling from the founder a month ago, these are the first meaningful sales on record.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇺🇸 Charles Schwab (SCHW) | 1.31 | 1.25 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇺🇸 American Express (AXP) | AM | 3.98 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Housing Starts | 279K | 255K |

| 🇺🇸 Philly Mftg. Index | -13 | 10 |

| 🇺🇸 NAHB Housing Index | 37 | 33 |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Foreign Security Buys | 8:30AM | 11.6B |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.