|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Auto manufacturing recovers

H&R REIT looks to carve out $2.6B

AFN drops 40% on delayed filing

CES Energy keeps taking share in Q3

Superior falls 20% on reduced guide

HOT OFF THE PRESS

Auto manufacturing recovers

Manufacturing sales of ~$72B rose 3.3% in September, beating expectations for a 2.8% increase thanks to a 9% rebound in transportation equipment…

… after the category weighed on last month’s print. The transportation recovery chewed through some inventory - which held steady at ~$122B in aggregate…

… and it contributed to the drawdown in unfilled orders, as capacity utilization in the industry rose ~9% driven by a return to full production at auto assembly plants.

Overall, a solid print that powered a 0.6% rise in wholesales sales - beating expectations for a flat reading.

H&R looks to carve out $2.6B of assets

H&R REIT (HR-U) fell 10% after announcing a conclusion to its review with no viable bids. Instead of a takeout, the portfolio will get carved up - with management highlighting $2.6B of upcoming sales…

… that should shrink its Canadian footprint, given 3.4M square feet of retail and office exposure was moved to held for sale - attracting a $482M write down. The sales should tighten H&R’s focus on the U.S. residential and industrial markets…

… and give the company the liquidity it needs to meet >$2B of debt maturities through 2027 and return capital to shareholders.

FUNNY BUSINESS

Ag Growth International (AFN) fell 40% on Friday after management pulled guidance and delayed filing Q3 results for the second time in as many weeks…

… related to issues closing the books on its operations in Brazil. The segment has been key to AFN’s international growth…

… particularly on the commercial side…

We are extremely encouraged about the performance that we’re seeing down in Brazil on the Commercial segment… we did see revenues in Q1 versus prior year, up over 100%.

… so any disruptions could materially impact performance in the segment - magnifying the growth headwinds AFN’s farm unit is facing from tariffs.

That’s the fundamental worry, but the big question mark is if there’s a regulatory concern here. With a new 60-day filing target set by management…

… AFN should be choppy until we find out.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

CES Energy Solutions (CEU) continues to outperform the industry, jumping 16% on a Q3 that beat on revenue despite a falling rig count - thanks to continued market share gains in North America.

The EBITDA print came in above expectations too, partly due to product mix - but also driven by more enduring factors like cost discipline and accretive M&A…

… that should support healthy free cash flow generation. With leverage sitting well within management’s target range, the company will keep hitting the buyback…

… despite meaningful multiple expansion from April lows, with management highlighting the room between current trading and the 9x forward EBITDA multiple ChampionX was taken out at.

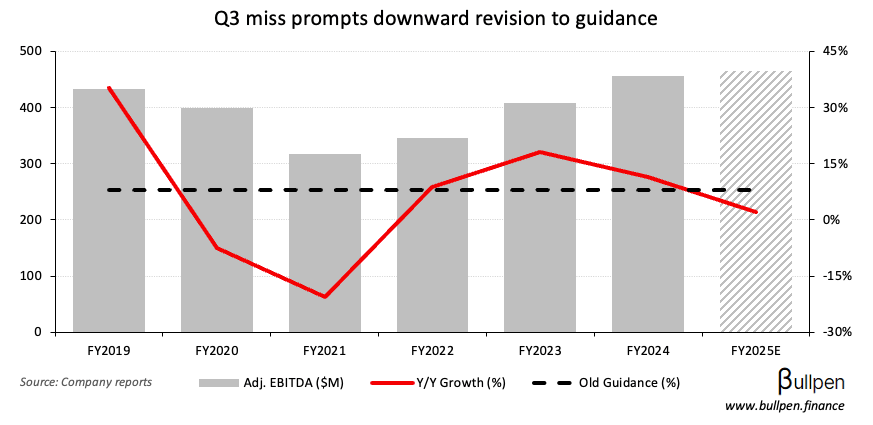

Superior Plus (SPB) fell over 20% on its Q3 results, which missed big on EBITDA and prompted management to reduce its full-year guide to 2% growth from 8%…

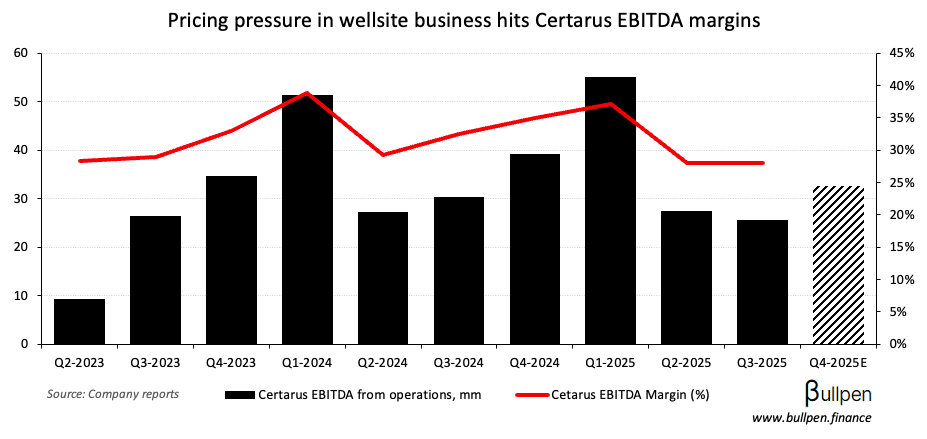

… due in large part to its Certarus business - which is facing intense competition and lower wellsite pricing in compressed natural gas.

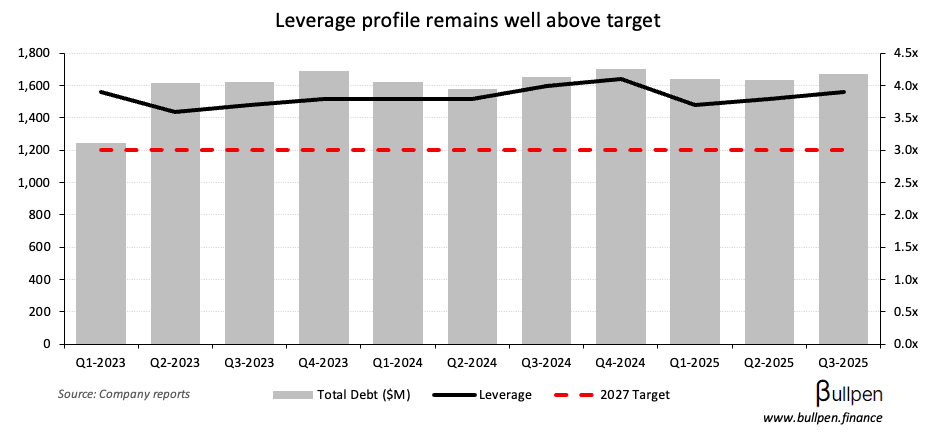

The softer EBITDA outlook pushes SPB’s leverage reduction plans to the right, with management expecting to end the year around 4x - a full turn above its 2027 target.

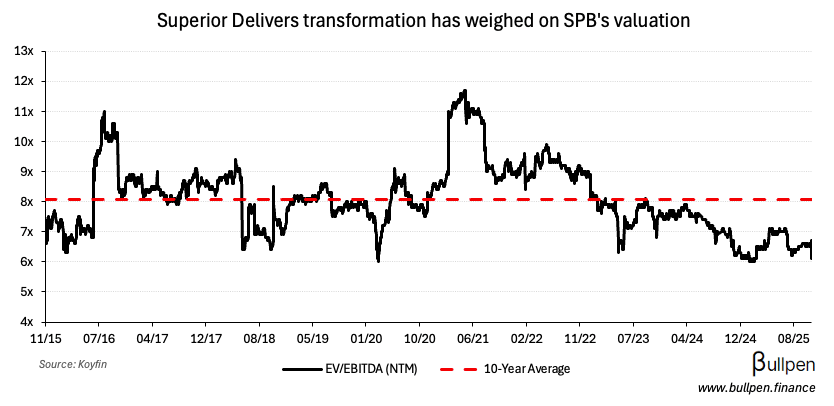

It also pushes out the expected EBITDA boost from the company’s “Superior Delivers” initiative, which has weighed on shares since it was announced alongside a dividend cut last year.

Bottom line: transformations aren’t easy, but trading at a trough multiple… it’s tough to imagine the floor isn’t near.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| David Appel | goeasy (GSY) | $5.3M |

| Troy Andersen | Cdn. Natural (CNQ) | $1.4M |

| Jay Froc | Cdn. Natural (CNQ) | $930K |

| Thomas Gallo | Equinox (EQX) | $2.3M |

| Julie Godin | CGI Inc. (GIB) | $2.0M |

| David Saperstein | TFI Int. (TFII) | $566K |

| Graham Shuttleworth | Barrick (ABX) | $7.2M |

| Darian Rich | Barrick (ABX) | $6.5M |

| Andrea Jalbert | TC Energy (TRP) | $1.1M |

| Haig Poutchigian | Saputo (SAP) | $587K |

| Barton Demosky | Bombardier (BBD) | $2.9M |

| William Brennan | Altus (AIF) | $2.3M |

| Edward Sonshine | RioCan (REI) | $921K |

| William Kosich | Total Energy (TOT) | $182K |

| Jonah Wibergh | BCE Inc. (BCE) | $161K |

| Louis Vachon | BCE Inc. (BCE) | $323K |

EARNINGS

FRIDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 George Weston (WN) | 1.37 | 1.30 |

| 🇨🇦 MDA Space (MDA) | 0.35 | 0.34 |

| 🇨🇦 Keyera (KEY) | 0.40 | 0.47 |

| 🇨🇦 CES Energy (CEU) | 0.18 | 0.21 |

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Mftg. Sales | 3.3% | 2.8% |

| 🇨🇦 Wholesale Sales M/M | 0.6% | 0.0% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Inflation M/M | 9:30AM | 0.2% |

| 🇺🇸 NY Mftg. Index | 9:30AM | 6.1 |

Was this forwarded to you? Join 2,000+ investors reading The Morning Meeting by clicking the button below.