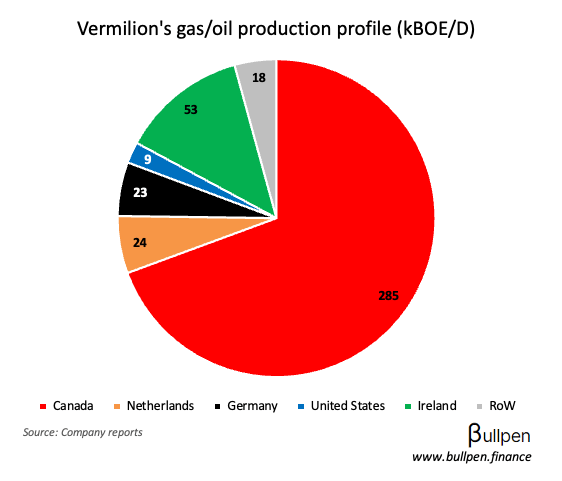

Vermilion (VET) was up 4% after divesting its U.S. footprint for $120M. The transaction follows the sale of its Manitoba and Saskatchewan assets for $415M two weeks prior, as the company focuses on its core Western Canada/Europe footprint.

Combined, the two sales shed 16K barrels per day of production and 40M barrels of proven reserves in an effort to reduce leverage, a major focus of late in the Canadian oil patch.