|

|

||||

|

|

||||

|

|

||||

|

|

Annnnnd we’re back! Planned on starting to publish again next week, but then a sitting President and Canadian apartment REIT got taken private so here we are. We’ll ease into it as newsflow is light, but from here you can expect us in your inbox M/W/F.

WHAT'S ON TAP

Venezuela’s impact on Canadian oil

Minto goes private for $2.3B

GDI goes private for $860M

Silver names keep on ripping

HOT OFF THE PRESS

Are Venezuelan crude concerns overblown?

Canadian oil producers have taken it on the chin since Maduro’s capture…

… driven by concerns that a revival of Venezuela’s oil industry could pull capital away from Canada and reduce U.S. reliance on our product.

As this excellent post lays out, replacing Canadian export capacity would require nearly $1T and ten years - but that doesn’t mean the sell-off isn’t justified. As net new barrels hit the gulf coast…

… some Canadian heavy oil could be displaced (incrementally), putting pressure on WCS prices and producer profitability.

Minto to go private in $2.3B deal

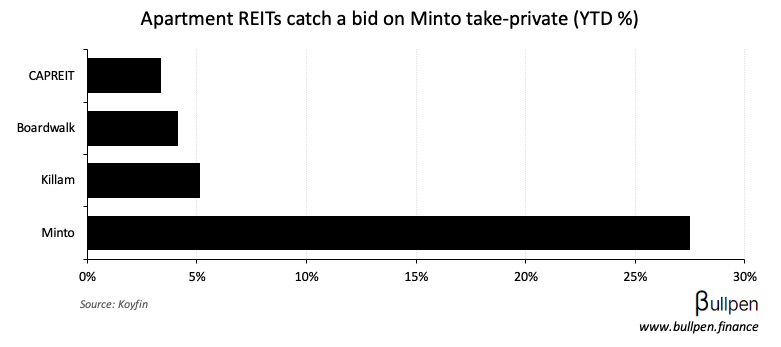

Minto Apartment REIT (MI-U) is the next multi-family REIT to go in a $2.3B deal led by Crestpoint and Minto Group, leaving three main Canadian players in public markets after InterRent’s take-private.

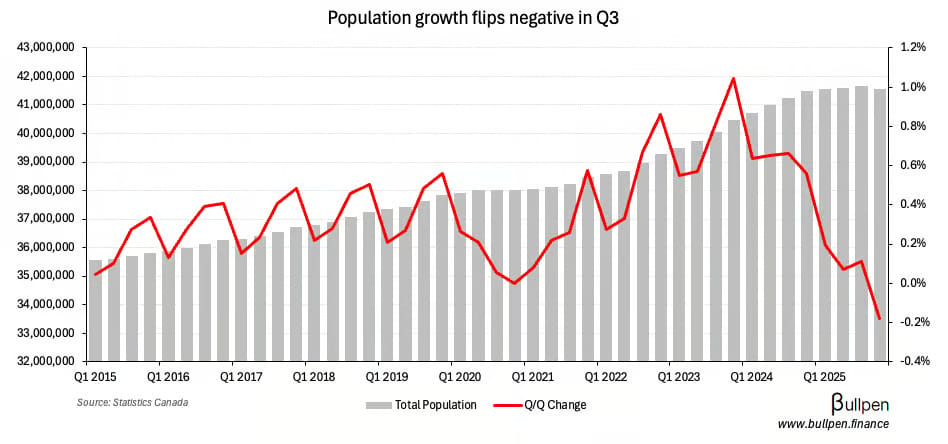

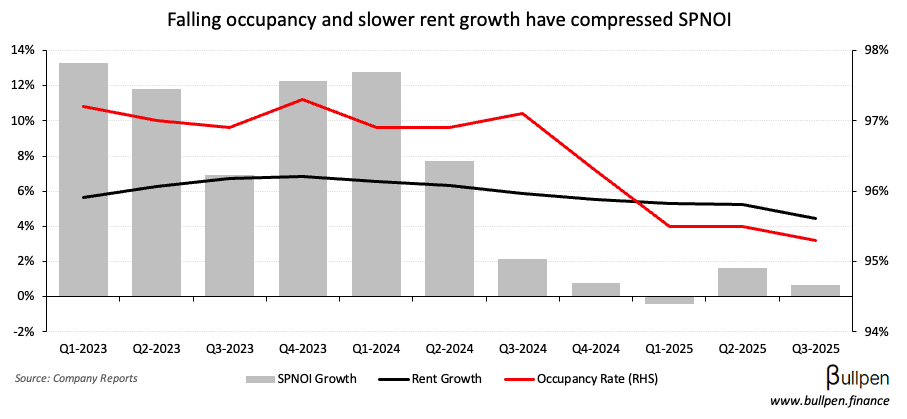

The transaction comes after slowing NOI growth, as headwinds to population…

… and multi-unit absorption have pressured occupancy and rents, presenting an opportunity for private capital to step in.

Same demand, less supply - let’s see how the remaining REITs perform from here.

GDI heads for the exit in $860M transaction

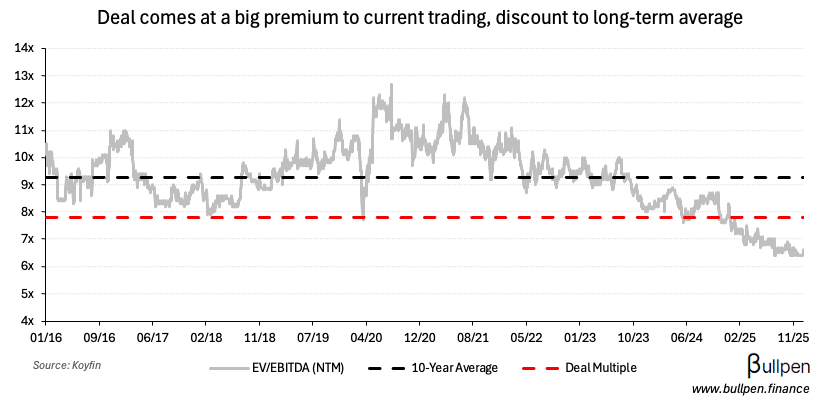

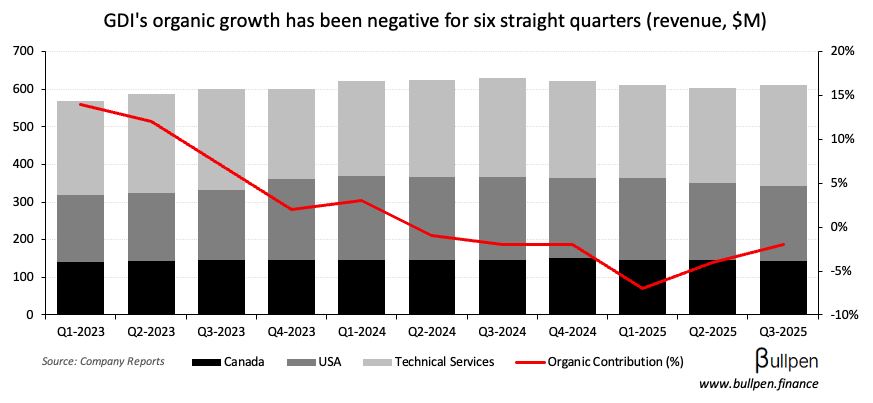

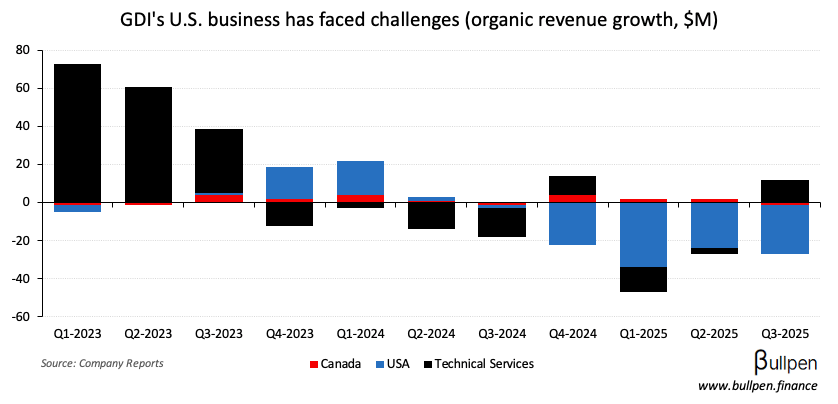

After a >30% drawdown over the last three years, GDI Integrated Facility Services (GDI) is also heading for the exit in an ~$860M transaction led by Birch Hill. The price tag equates to just under 8x NTM EBITDA, a 25% premium…

… but over a full turn below its long-term average multiple, driven by six straight quarters of negative organic growth…

… caused mainly by a 75% reduction in a large U.S. contract beginning in 2024.

With the current CEO retaining his position and Birch Hill’s track record of monetizing take-privates via IPO (like Sleep Country), it might not be the last time we see GDI in public markets.

ON OUR RADAR

Published while away:

Other news:

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

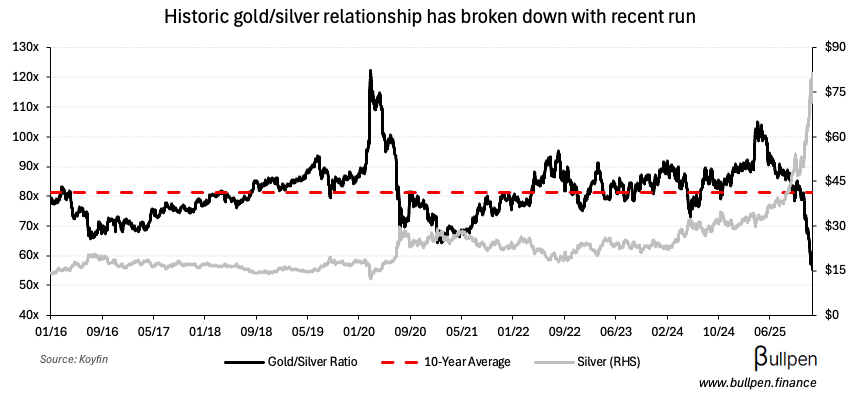

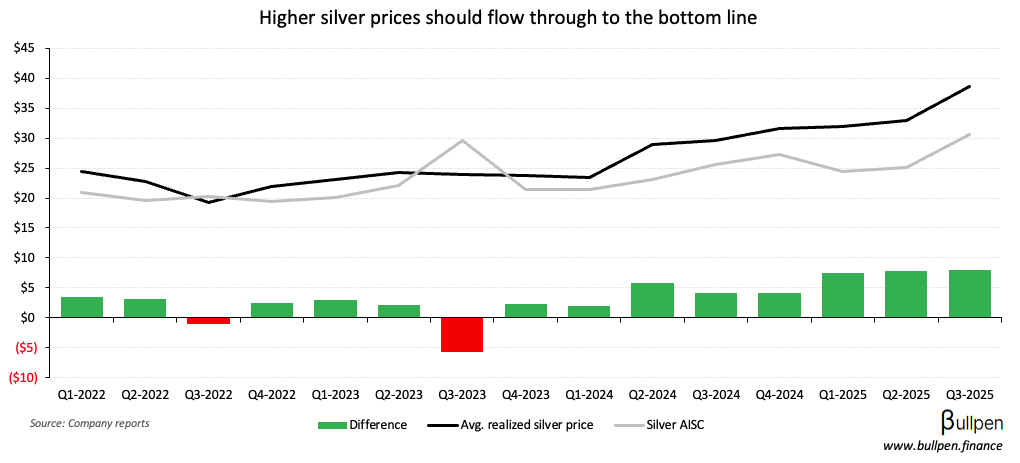

Endeavour Silver (EDR) and other silver producers ran hot on the back of the metal’s continued run (+175% in the last year).

Up ~40% in the past month alone, the sustainability of this price action is unclear. Should it hold, EDR’s already strong economics will look even better - especially considering its Terronera mine recently hit commercial production.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| John Risley | MDA Space (MDA) | $692K |

| Michael Deal | First Majestic (FR) | $319K |

| Jonathan Awde | Hemlo (HMMC) | $453K |

| Michael Rees | Peyto (PEY) | $217K |

| Todd Burdick | Peyto (PEY) | $122K |

| Mike Rose | Tourmaline (TOU) | $148K |

ECONOMIC DATA

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Ivey PMI | 10:00AM | 49.5 |

| 🇺🇸 ISM Services PMI | 10:00AM | 52.3 |

| 🇺🇸 Job Openings | 10:00AM | 7.64M |

| 🇺🇸 Factory Orders M/M | 10:00AM | -1.2% |

Was this forwarded to you? Join 4,000+ investors reading The Morning Meeting by clicking the button below.