|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

U.S. strikes first trade deal with the UK, Canadian market reacts

BCE finally catches a bid after dividend cut and new funding

American pope for Italian pizza market, fair trade?

Former RioCan CEO is buying despite $200M HBC loss

VNP & LNR up big as worries seem overblown, GSY sells off

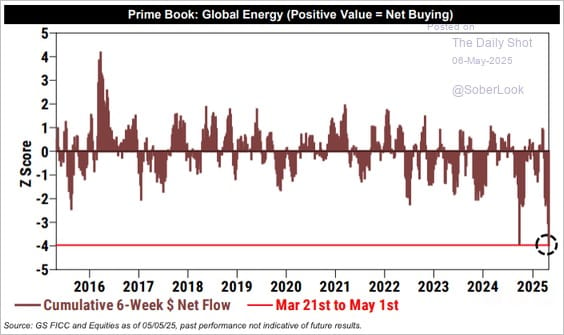

Oil gets back over $60, energy selling has been huge

HOT OFF THE PRESS

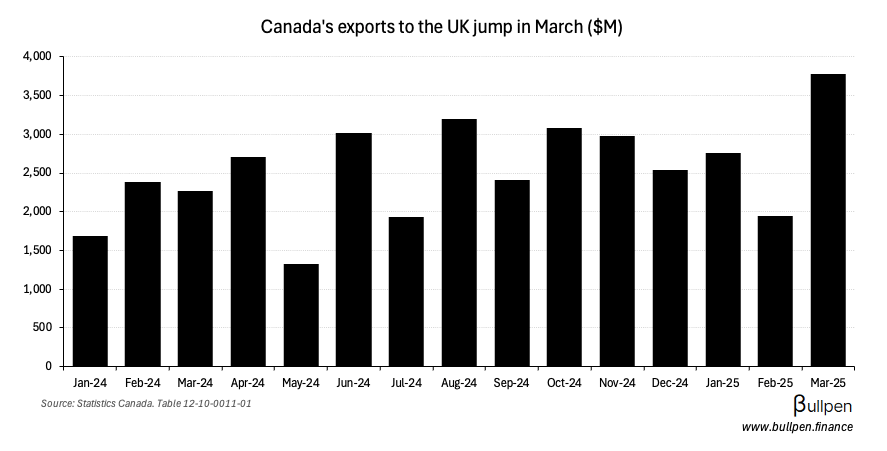

U.S. strikes first trade deal with the UK

It looks like Canada wasn’t the only one looking to do more business with the UK, as Trump announced a deal yesterday that opens up $5B in U.S. export opportunities.

In the context of global trade, this deal isn’t all that important - China is the only one that matters..

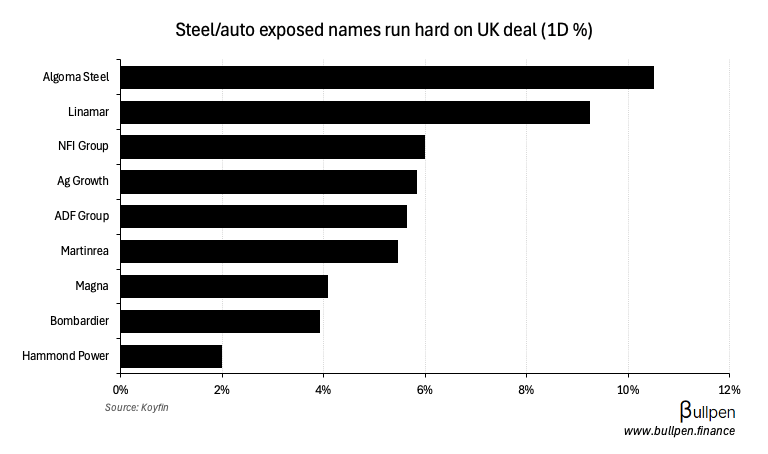

… but in the context of Canadian markets, it sets a precedent for the type of deal that could be struck, with the elimination of steel & aluminum tariffs and softening of auto tariffs starting to get priced in.

If more deals come soon, we’d expect the bid to come back quickly to impacted companies. There’s certainly one person who thinks it’s time to get long:

You better go out and buy stock now. Let me tell you, this country will be like a rocket ship that goes straight up.

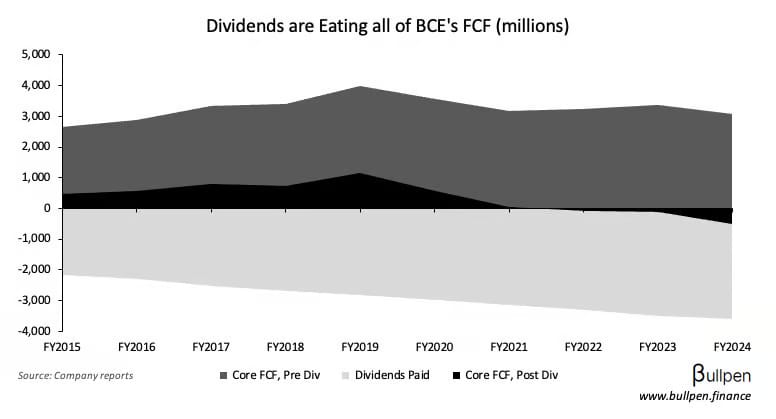

Bell jumps on dividend cut & new funding

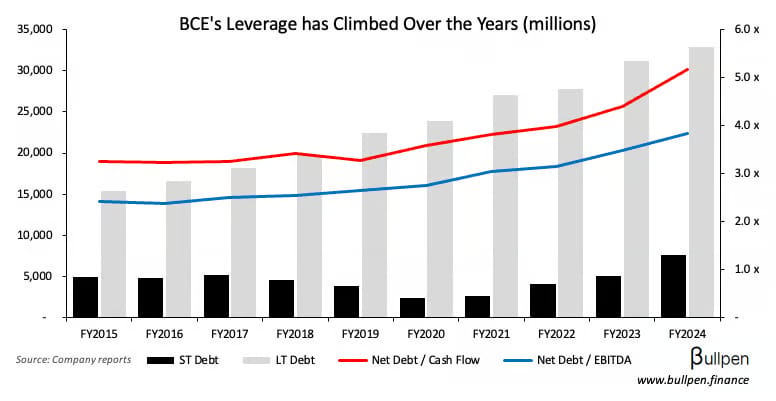

We wrote in February that BCE shares would likely be range bound until it addressed a few elephants in the room, including the dividend policy and acquisition integration.

Both were addressed alongside results, with a near-60% dividend cut and a partnership with PSP for the future growth of Ziply Fiber.

The >$1.5B in financing from PSP and off-balance sheet structure (BCE owns 49% of the JV) should help ease pressure on the leverage profile, which has been a source of concern for investors in recent years.

With shares finishing yesterday up 5%, the door’s been cracked open for institutional money to take another look - we think a management shakeup could kick it down.

To catch up on the story, read this: https://www.bullpen.finance/content/33

FUNNY BUSINESS

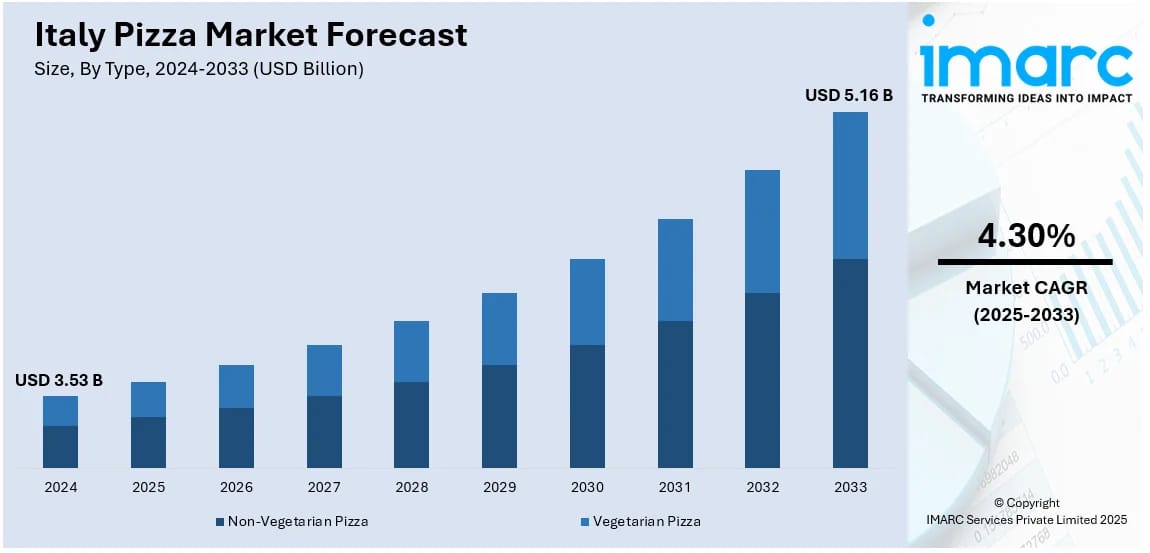

Robert Prevost, now Pope Leo XIV, is the first American in history to hold the catholic leadership position after being elected yesterday. Let’s see if Italy gets a special tariff exemption now - they may have to make some concessions…

According to IMARC, the Italian pizza market clocked in at $3.5B last year and is forecasted to exceed $5B by 2033.

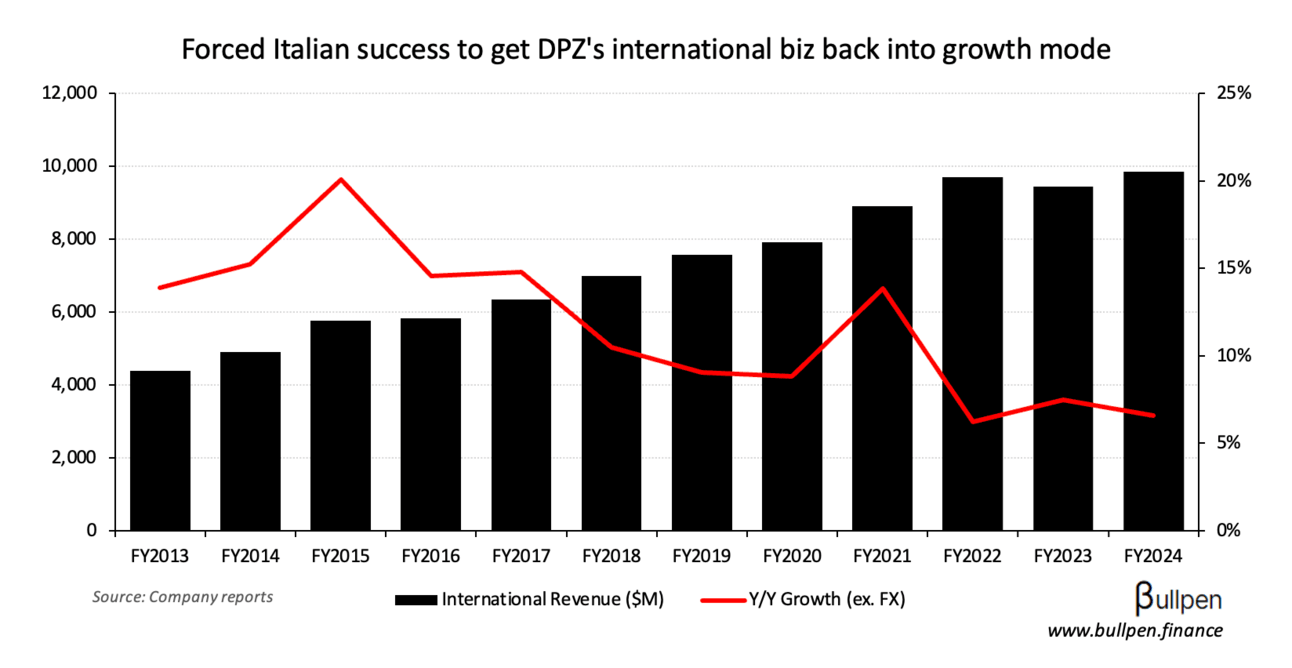

Sure, Domino’s tried and failed in the Italian market already, but they were missing one key ingredient - a government mandate to make it succeed. 🤌

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Donald Clow | Extendicare (EXE) | $199K |

| Edward Sonshine | RioCan (REI-U) | $337K |

| Alison Reed | CGI Inc. (GIB-A) | $290K |

| George Cope | CGI Inc. (GIB-A) | $1.2M |

| Gilles Labbe | CGI Inc. (GIB-A) | $146K |

| Willard Upchurch Jr. | Gildan (GIL) | $471K |

| Rhodri Harries | Gildan (GIL) | $1.3M |

| Juan Contreras | Gildan (GIL) | $231K |

| Steve Stein | Black Diamond (BDI) | $231K |

| Frank Herbert | Eldorado (ELD) | $337K |

| Christine Ohta | Eldorado (ELD) | $152K |

Flagging the RioCan buy, which comes from the former CEO - clearly he thinks REI can shrug off the $209M investment loss they took on HBC. We flagged the potential for a write down in March… here’s a quick reminder of the exposure:

Company | HBC Properties | Total Properties |

|---|---|---|

Primaris (PMZ-U) | 9 | 27 |

RioCan (REI-U) | 4 | 168 |

Morguard (MRT-U) | 2 | 45 |

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

5N Plus (VNP) was up 12% on strong results. This is a name we’ve been highlighting as a beneficiary from space investment and the results confirm it, with 37% Y/Y revenue growth on strength in space solar and renewable energy.

Linamar (LNR) ripped 9% on auto optimism and a strong print, with EPS of $2.76 beating estimates of $2.44.

goeasy (GSY) fell 7% on an earnings miss. Revenue of $392M was up 10% Y/Y but missed the street’s $399M, while EPS of $3.53 missed big versus estimates of $4.20 on lower consumer loan yields and increased credit provisioning to buffer against potential loan losses.

EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 BCE Inc. (BCE) | 0.69 | 0.62 |

| 🇨🇦 Canadian Tire (CTC-A) | 2.00 | 1.24 |

| 🇨🇦 Hydro One (H) | 0.60 | 0.54 |

| 🇨🇦 Maple Leaf (MFI) | 0.43 | 0.27 |

| 🇨🇦 Shopify (SHOP) | 0.25 | 0.26 |

| 🇨🇦 Emera (EMA) | 1.28 | 1.02 |

| 🇨🇦 MDA Space (MDA) | 0.29 | 0.26 |

| 🇨🇦 Cascades (CAS) | 0.13 | 0.14 |

| 🇨🇦 Canadian Natural (CNQ) | 1.16 | 1.08 |

| 🇨🇦 Brookfield (BN) | 0.98 | 0.89 |

| 🇨🇦 Enerflex (EFX) | 0.32 | 0.29 |

| 🇨🇦 Cenovus (CVE) | 0.47 | 0.42 |

| 🇨🇦 Altus Group (AIF) | 0.19 | 0.19 |

| 🇨🇦 Jamieson (JWEL) | 0.14 | 0.11 |

| 🇨🇦 ECN Capital (ECN) | 0.03 | 0.04 |

| 🇨🇦 IGM Financial (IGM) | 1.00 | 1.03 |

| 🇨🇦 GDI Services (GDI) | 1.02 | 0.23 |

| 🇨🇦 Franco Nevada (FNV) | 1.07 | 1.00 |

| 🇨🇦 NFI Group (NFI) | 0.02 | 0.03 |

| 🇨🇦 Lassonde (LAS-A) | 3.60 | 2.97 |

| 🇨🇦 Sun Life (SLF) | 1.62 | 1.71 |

| 🇨🇦 Doman Materials (DBM) | 0.27 | 0.10 |

| 🇨🇦 Pembina (PPL) | 0.80 | 0.77 |

| 🇨🇦 Definity (DFY) | 0.79 | 0.69 |

| 🇨🇦 Interfor (IFP) | -0.68 | -0.28 |

| 🇨🇦 Wheaton (WPM) | 0.55 | 0.51 |

| 🇨🇦 CES Energy (CEU) | 0.20 | 0.20 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Air Canada (AC) | AM | -0.54 |

| 🇨🇦 Docebo (DCBO) | AM | 0.22 |

| 🇨🇦 Algonquin (AQN) | AM | 0.10 |

| 🇨🇦 Enbridge (ENB) | AM | 0.95 |

| 🇨🇦 Cineplex (CGX) | AM | -0.34 |

| 🇨🇦 Fiera Capital (FSZ) | AM | 0.22 |

| 🇨🇦 Total Energy (TOT) | AM | 52.0M |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇺🇸 Continuing Claims | 1,879K | 1,890K |

| 🇺🇸 Jobless Claims | 228K | 230K |

| 🇺🇸 Nonfarm Productivity Q/Q | -0.8% | -0.7% |

| 🇺🇸 Labour Costs Q/Q | 5.7% | 5.1% |

| 🇺🇸 Wholesale Inventory M/M | 0.4% | 0.5% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇨🇦 Unemployment Rate | 7:30AM | 6.8% |

| 🇨🇦 Employment Change | 7:30AM | 2.5K |

| 🇨🇦 Full Time Change | 7:30AM | - |

| 🇨🇦 Part Time Change | 7:30AM | - |

| 🇨🇦 Participation Rate | 7:30AM | - |

| 🇨🇦 Hourly Wages Y/Y | 7:30AM | - |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Oil closed back over $60 on the UK/U.S. trade deal. With huge selling in energy over the past year, the tide could turn quickly on this trade if deals keep coming, as highlighted in our look at Canadian oil producers.