|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Copper tariffs to join steel & aluminum at 50%

Federal spending is under scrutiny

Royal Gold bids $5B for two Canadian royalty platforms

Andrew Hider: the 450M dollar man

InterRent is one step closer to takeout

WELL and VHI jump ~10%

HOT OFF THE PRESS

Copper tariffs to join steel & aluminum at 50%

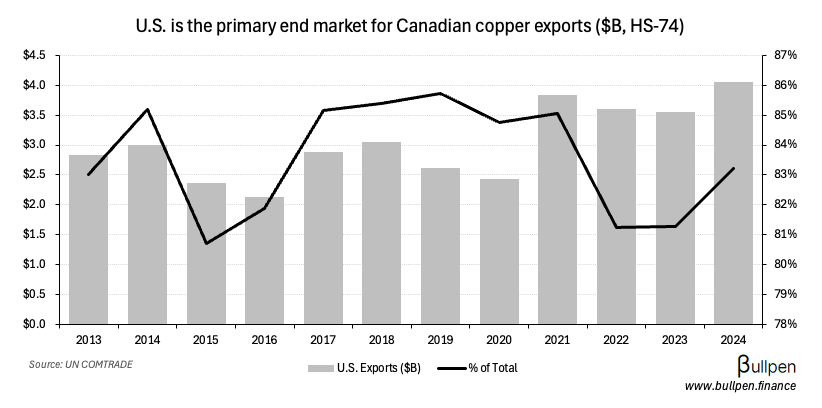

Copper closed yesterday up nearly 10% on news that Trump would implement 50% tariffs on all imports, a move that impacts Canada more than most.

In the near-term, expect a pull-forward in copper exports. In the medium-term, expect higher costs to hit the consumer. In the long-term, Canada may have to diversify its trading partners (the U.S. is roughly half of total exports).

Federal spending gets put under microscope

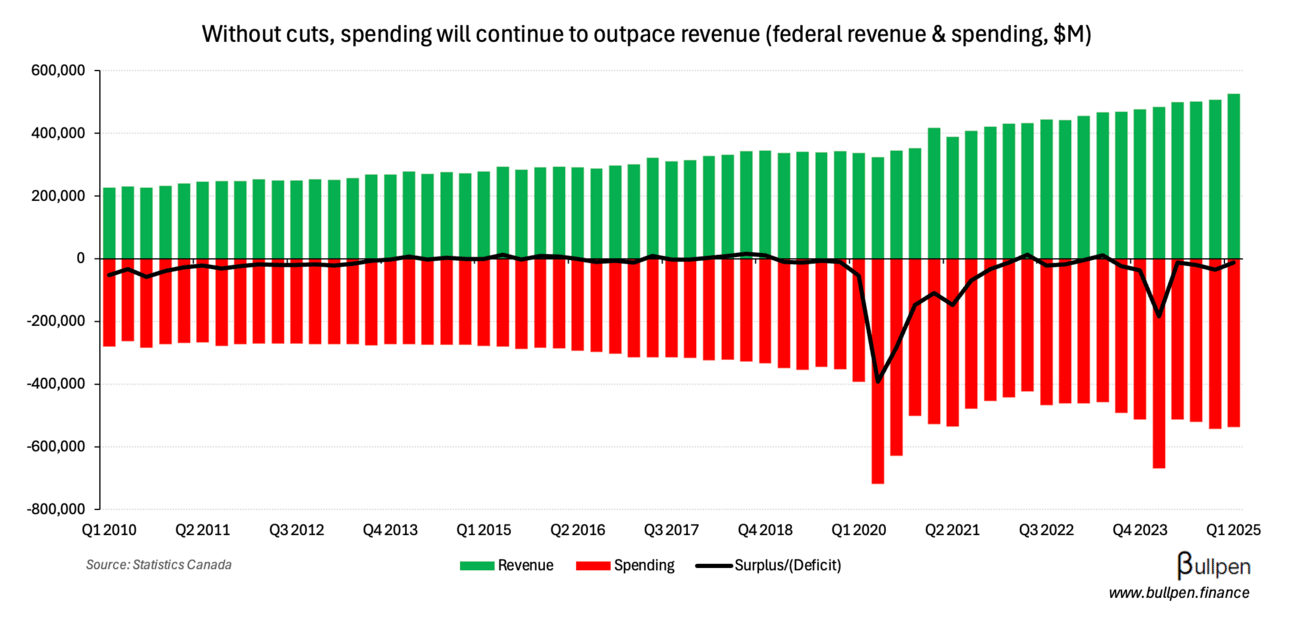

Government officials have been told to find change in the couch cushions to pay for Carney’s $150B defense commitment, targeting a 7.5% reduction in spend next year and scaling to 15% by 2029. While some savings could come in the form of layoffs…

… there’s some real fat to trim in non-defense expenditures, which run at nearly $90B annualized - up from $60B pre-COVID.

Without a serious effort to reverse overspending, expect bigger deficits… but I’m sure there’s $10B+ of absolute waste in these numbers that can get ripped out in due time.

Royal Gold offers $5B for SSL and HCU

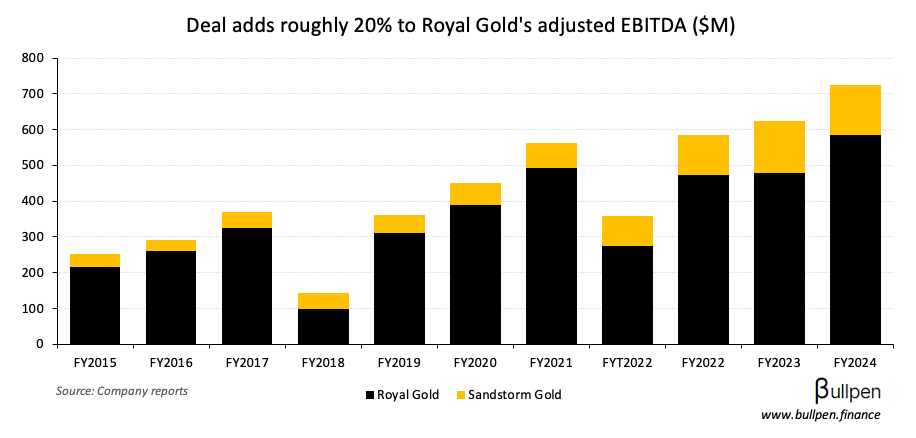

Both Sandstorm Gold (SSL) and Horizon Copper (HCU) are getting absorbed by Royal Gold (RGLD) in two deals worth ~$5B in aggregate.

The deal rationale is clear for RGLD, as its premium multiple allows it to absorb the two platforms accretively - diversifying its producing asset base with tier one miners (Glencore, Barrick, etc.) and adding ~20% to adjusted EBITDA…

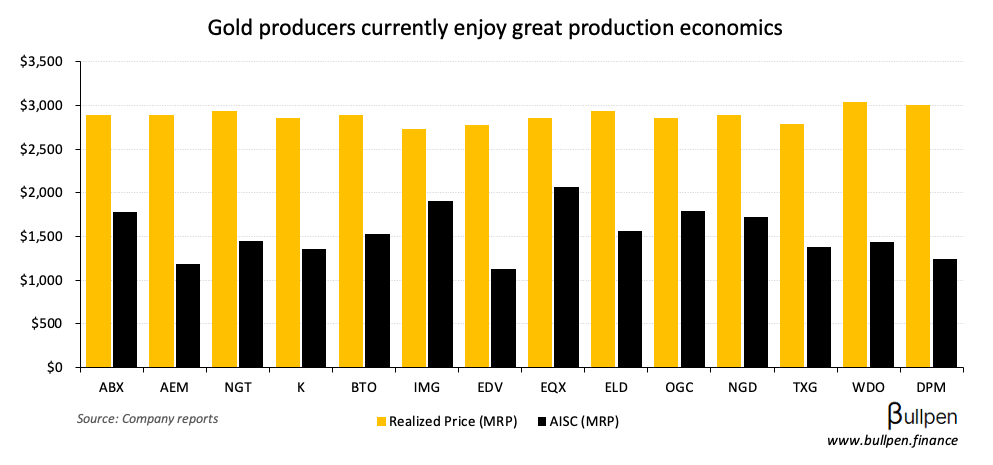

… at a time when leverage to gold prices is printing money.

With the offer coming in at a healthy premium to both SSL (~20%) and HCU (~70%) plus high break fees, it looks like this one will get over the finish line - taking two more Canadian-listed companies off the exchange.

FUNNY BUSINESS

On Monday shares of ATS Corp. (ATS) fell 8% on news that CEO Andrew Hider would be leaving in August. No CEO would ever admit it, but you gotta imagine some dark corner of his brain is smiling at the $450M price tag the market gave him.

To be fair, the company tripled revenue and more than tripled adjusted EBITDA under his leadership, making multiple acquisitions over that time period…

… but interim CEO Ryan McLeod should be able to steady the ship, given his ~20 years of experience at the company (currently CFO). With where ATS currently trades, the market may wait for a permanent leader before taking the lid off.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| James Strickland | CES Energy (CEU) | $155K |

| Nathan Fier | Mako (MKO) | $194K |

| Darren Hall | Equinox (EQX) | $116K |

| Ross Jennings | Millennial (MLP) | $289K |

| Patrick Carlson | Kiwetinohk (KEC) | $304K |

| John Assaly | Dollarama (DOL) | $228K |

| Pramod Jain | Comp. Group (CMG) | $187K |

CEO Patrick Carlson of Kiwetinohk Energy (KEC) is still buying…

ON OUR RADAR

Flagging the news that InterRent’s go-shop period has concluded, with the company not receiving any formal offers. The original $2B take-private bid feels inevitable at this point.

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

Well Health Technologies (WELL) jumped 13% on a guidance bump in its Canadian Clinics segment, with management now expecting more than $450M and $60M of revenue and EBITDA in 2025, respectively, representing >40% Y/Y growth in both measures.

The company also highlighted a robust M&A pipeline, including two clinic acquisitions that just closed and another five under letters of intent.

Vitalhub (VHI) was up 8%, extending its run after the acquisition of Novari Health for $44M, or roughly 4x ARR. It’s the company’s sixth deal since the start of 2024, as they continue to tuck in essential healthcare platforms.

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Firan (FTG) | 8.7M | 7.4M |

Firan Technology (FTG) reported a strong Q2, beating both top and bottom-line estimates and growing 25% Y/Y. The stock was up 9% yesterday heading into results (and up 70% since we highlighted it in January)… let’s see if the print was enough to keep the party going.

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇨🇦 Theratech (TH) | AM | -234K |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Ivey PMI | 53.3 | 49.1 |

| 🇺🇸 Biz Optimism Index | 98.6 | 98.7 |

| 🇺🇸 Consumer Credit Change | 5.1B | 10.5B |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Wholesale Inv. M/M | 10:00AM | -0.3% |

| 🇺🇸 FOMC Minutes | 2:00PM | - |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.