|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Trump threatens 100% tariffs

Retail sales beat across the board

Market prices duration of metals run

Juniper sells $68M of Baytex

HOT OFF THE PRESS

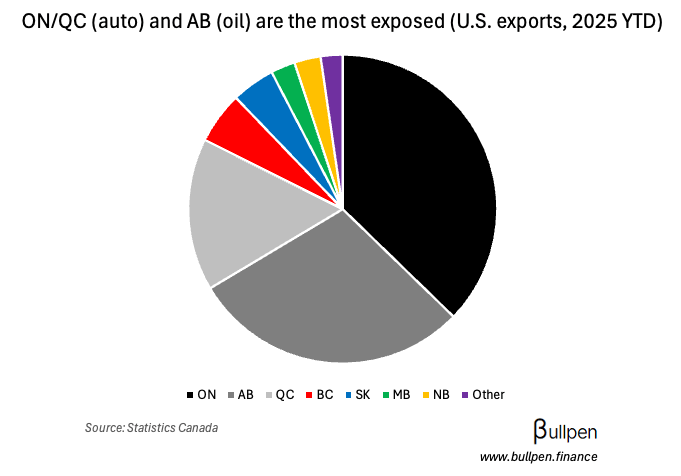

Trump threatens 100% tariffs on Canada

It didn’t take long for Trump to do a 180 on Carney’s China deal, threatening 100% tariffs on all U.S. exports in the event of a free-trade agreement. While Canada isn’t pursuing one with China…

… as it’s not permitted under CUSMA, the escalation further illustrates the tightrope Carney walks in attracting foreign investment and diversifying end markets.

It’s plausible Trump’s reaction was influenced at least in part by Carney’s Davos speech, with some speculating he’s gearing up to go for the majority…

… using the same “elbows up” rhetoric that won over voters the first time around. Let’s see what happens.

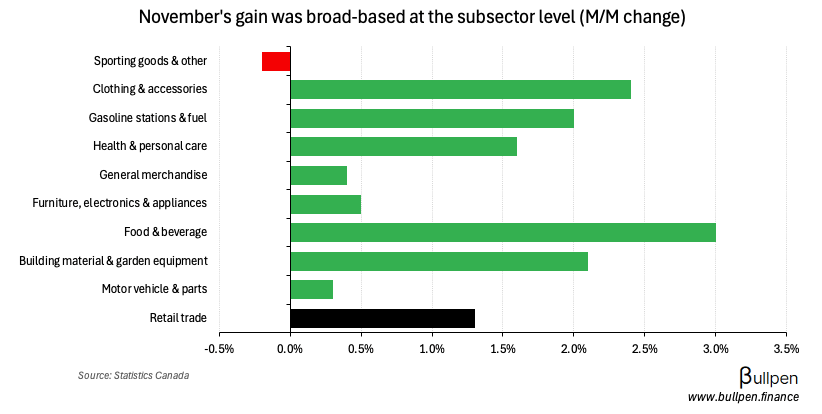

Retail sales beat on broad-based strength

November’s retail sales beat expectations, gaining 1.3% M/M on a 1.1% jump in volumes.

A 14% recovery in alcohol sales led the gain, reflecting the non-repeat of labour disruptions in October - though results were strong across nearly all categories…

… and provinces, with the only regions down M/M being immaterial on an absolute basis.

That strength looks set to subside in December, with preliminary estimates calling for a 0.5% decline.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

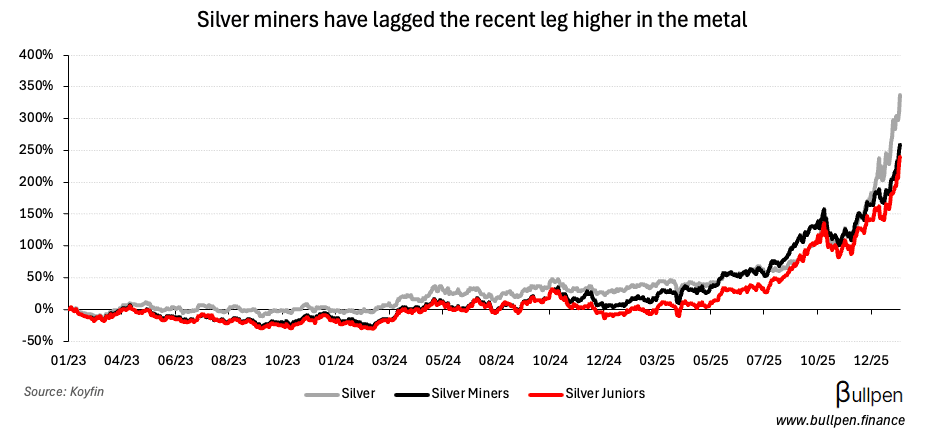

Miners keep notching new highs, but the extent of this performance relative to the underlying metal shows a clear distinction in the market’s perception of longevity.

While silver has doubled since November, the producers are starting to lag - indicating the market isn’t buying the sustainability of current price action…

… like it is with gold, where producers have meaningfully outperformed the metal over the same period…

… driven by the geopolitical backdrop, fears of currency debasement, and ongoing central bank accumulation.

Those forces have staying power, but are less structural than the setup for copper - with many calling for a growing supply gap as power infrastructure, AI, and defense spending drive demand for decades to come.

With the miners more than doubling copper’s performance in recent years, it’s clear the market is underwriting longer-duration cash flows - rather than a cyclical or speculative margin expansion.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Bruce Ross | Royal Bank (RY) | $843K |

| David McKay | Royal Bank (RY) | $5.3M |

| Graeme Hepworth | Royal Bank (RY) | $337K |

| Anne Le Breton | BRP Inc. (DOO) | $1.6M |

| Josee Perreault | BRP Inc. (DOO) | $889K |

| Juniper Capital | Baytex (BTE) | $68M |

| John Assaly | Dollarama (DOL) | $419K |

| Stephen Laut | Cdn. Natural (CNQ) | $214K |

| Alan Franks | Kelt Exploration (KEL) | $1.2M |

| Robert Dickinson | Taseko (TKO) | $2.0M |

| Russell Hallbauer | Taseko (TKO) | $513K |

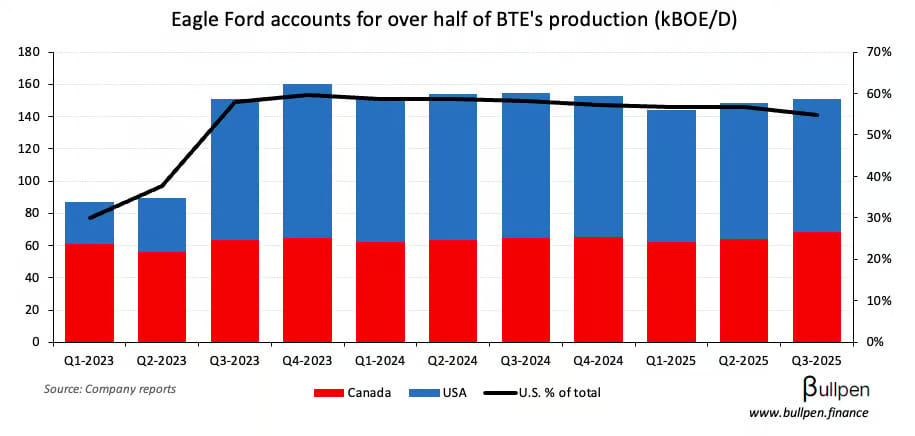

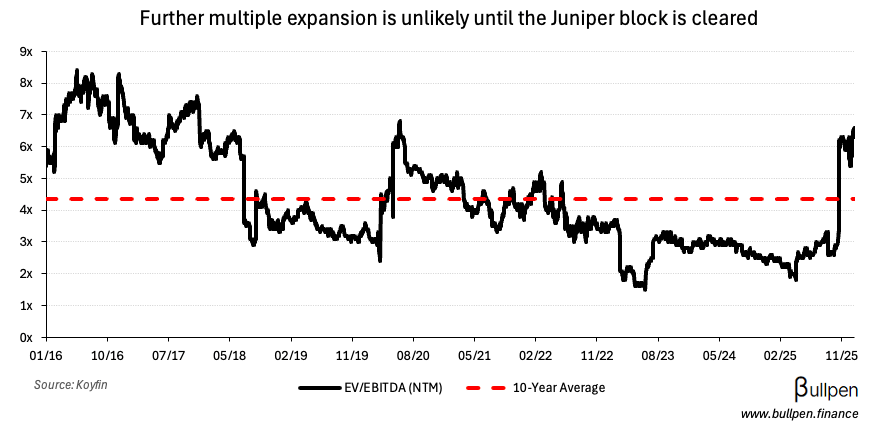

Flagging Juniper Capital’s $68M block sale of Baytex (BTE), which comes after the company’s $3.3B Eagle Ford divestiture - the source of Juniper’s position in the first place (BTE bought it in 2023 using stock).

With the U.S. shale thesis gone, it’s likely Juniper continues to work down its remaining 74M shares, with BTE’s buyback and a potential SIB on the other side.

ECONOMIC DATA

FRIDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Retail Sales M/M | 1.3% | 1.2% |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Durable Goods M/M | 8:30AM | 0.5% |

Was this forwarded to you? Join 6,000+ investors reading The Morning Meeting by clicking the button below.