|

|

||||

|

|

||||

|

|

||||

|

|

WHAT'S ON TAP

Retail sales meet expectations

Canada to double non-U.S. exports

Trump kills Canada negotiations

FirstService falls 10% on guidance

Rogers gives update on MLSE deal

HOT OFF THE PRESS

Retail sales meet expectations

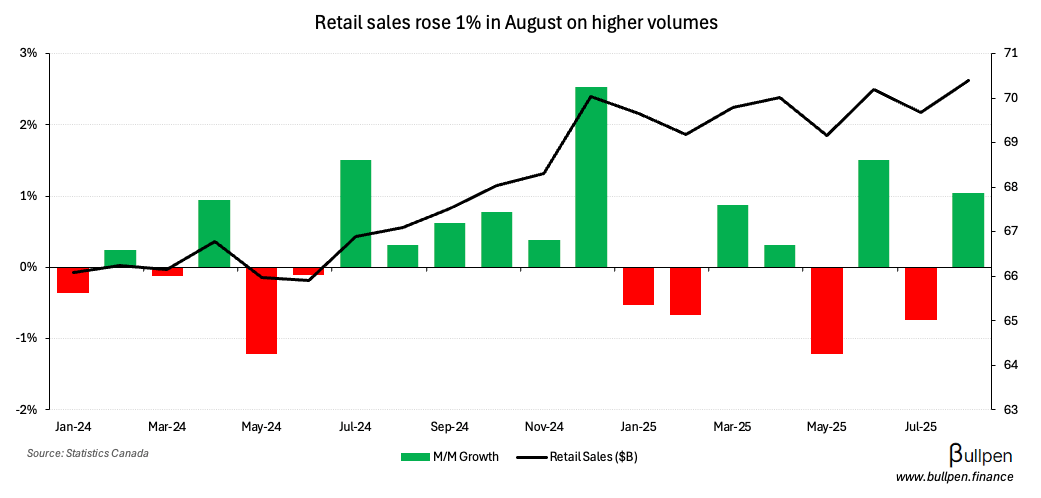

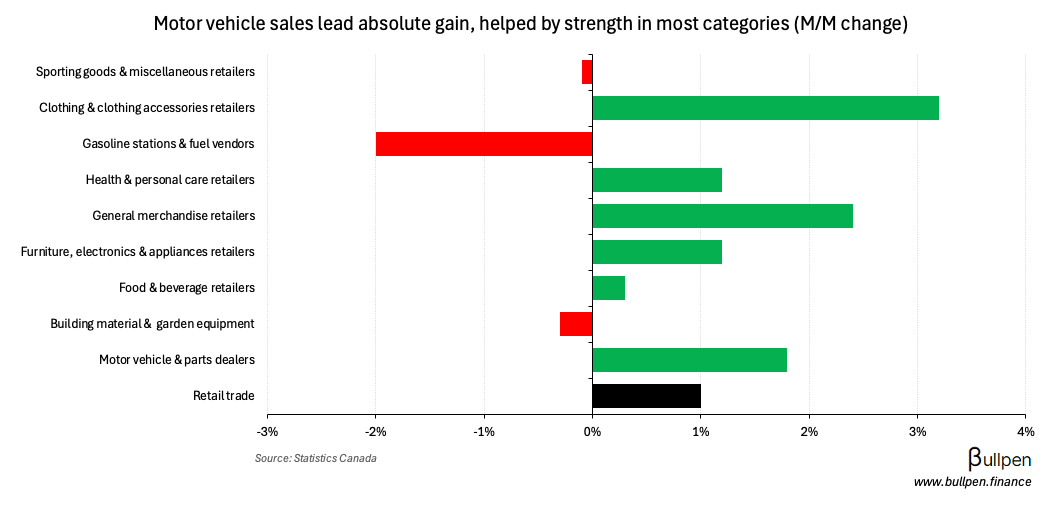

August’s retail sales shaped up largely as expected, gaining 1% M/M on an identical increase in volumes. Results were helped by a 1.8% gain in vehicle sales…

… which carried the group on an absolute basis, resulting in a miss on core sales - which grew 0.7% versus estimates of 1.2%.

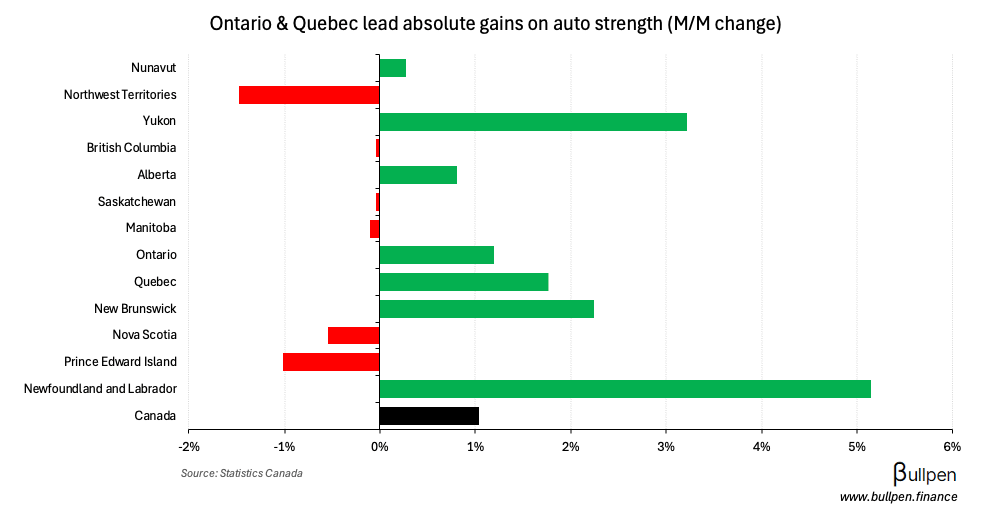

The strength in auto activity drove solid M/M performance in Ontario and Quebec, which led regional results…

… but should be short-lived, with preliminary estimates for September calling for a 0.7% drop in retail sales.

Canada to double non-U.S. exports

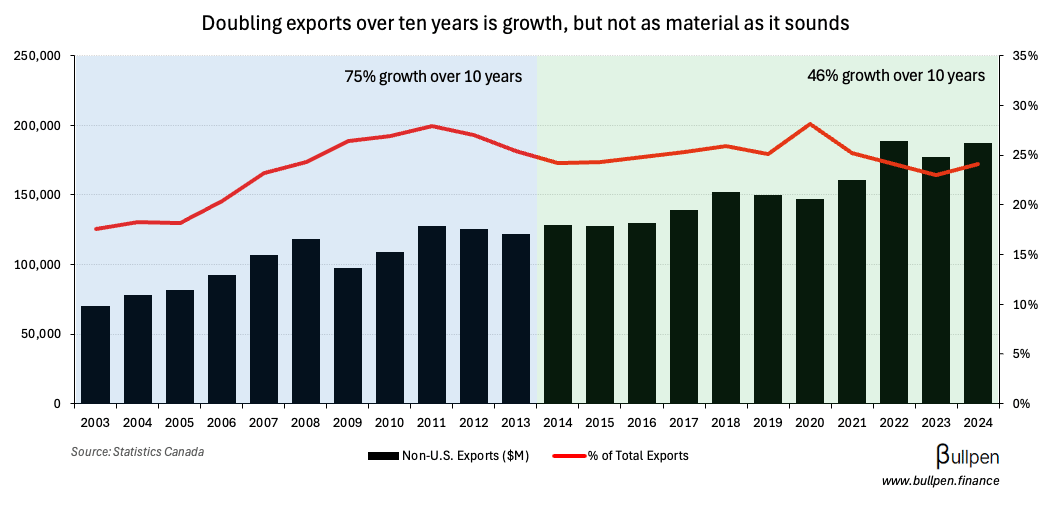

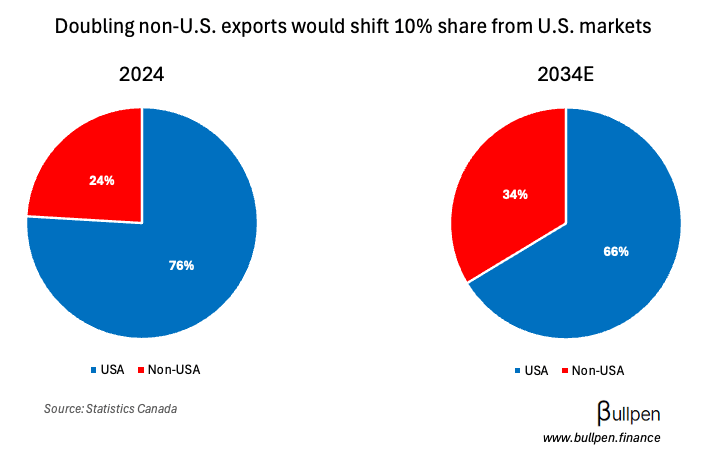

After Carney’s budget address yesterday, the headline doing the rounds is his aim to double non-U.S. exports over ten years - adding $300B in new trade. While ambitious, the segment is already growing quickly…

… meaning the impact might be less pronounced than headlines would suggest. Assuming a doubling from 2024 and 25% growth in U.S. exports over that time period (conservative), we’ll have reduced reliance on our neighbours…

… but not to the point where Canada can operate independently. Bottom line: there’s no short-term solution and it’s likely to get worse before it gets better.

FUNNY BUSINESS

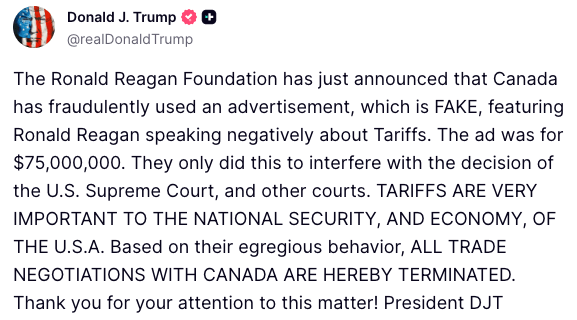

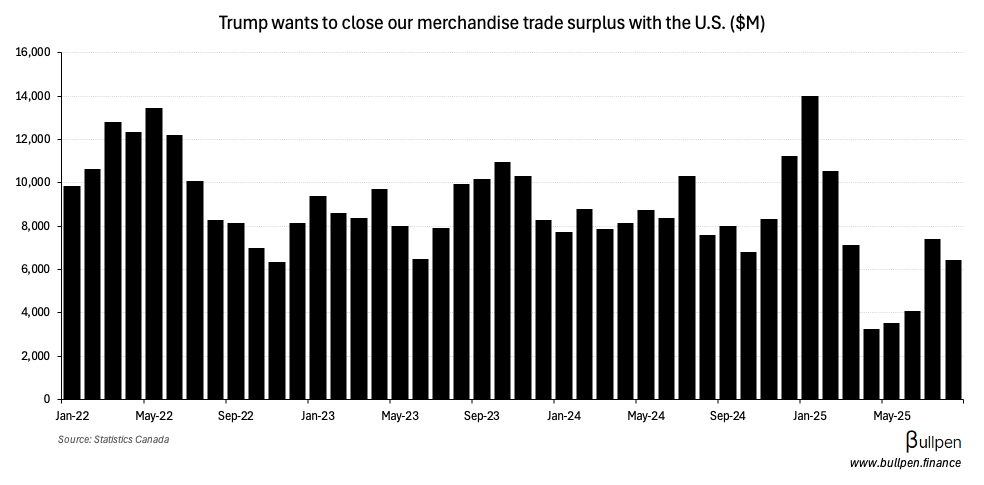

Speaking of pain, Trump has “put a stop” to all trade negotiations with Canada - citing an anti-tariff ad ran by Ontario…

… that’s likely to put Doug Ford in the hot seat for the next little while.

Regardless, Trump would have found another reason to stall talks until USMCA negotiations - leveraging an expiring shot clock to get rid of our trade surplus.

ON OUR RADAR

GAINERS & LOSERS

|

|

||||

|

|

||||

|

|

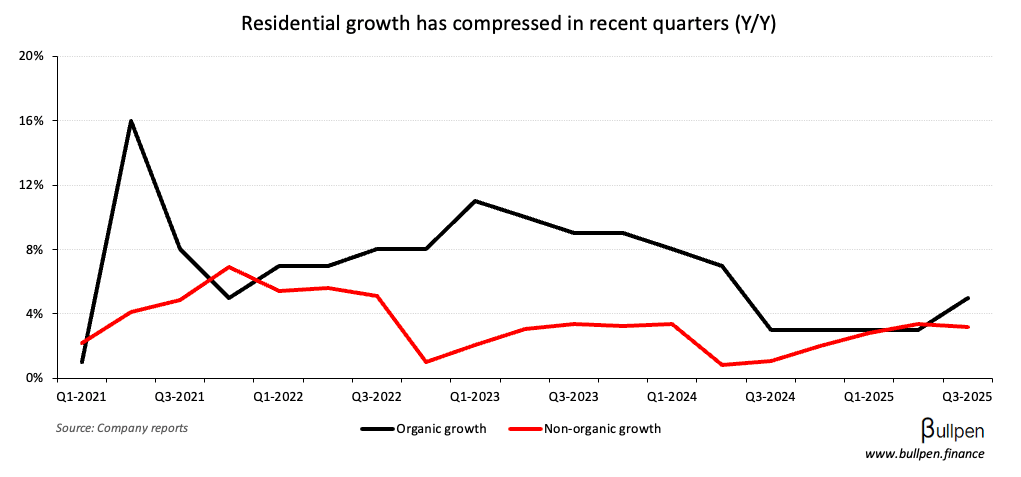

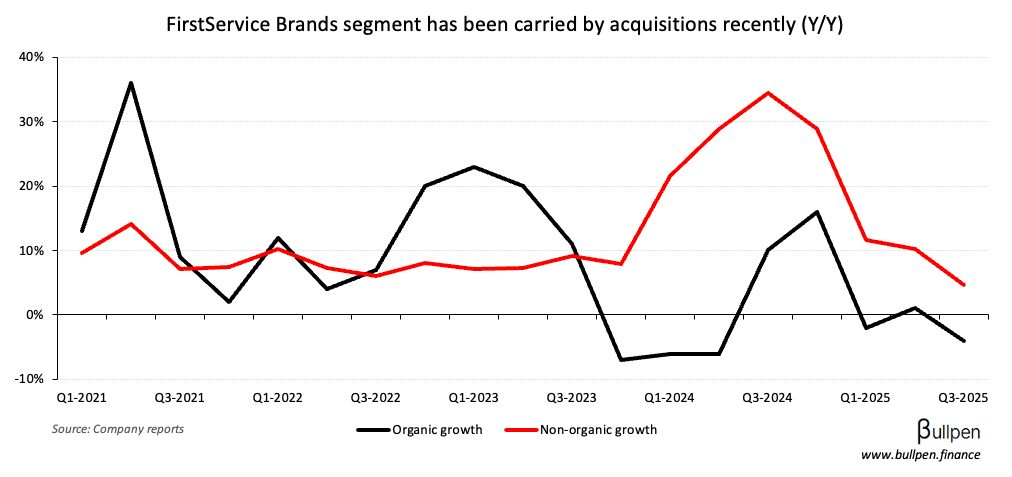

FirstService (FSV) shed 10% on a Q3 that missed small on revenue and beat small on earnings, but the selloff was linked to management’s framing of Q4 - with mid-single digit organic growth in residential…

… and material weakness in the organic growth of its restoration (down 20%) and roofing (down 10%) businesses, which have been under pressure through 2025.

With the stock now trading below it’s long-term average valuation…

… investors are waiting for clarity on an end market recovery before giving FSV a bid.

We’re in a good position, and we’ll start to see the growth come back. I just can’t tell you — I can’t give you dates in time. We need more clarity in the marketplace.

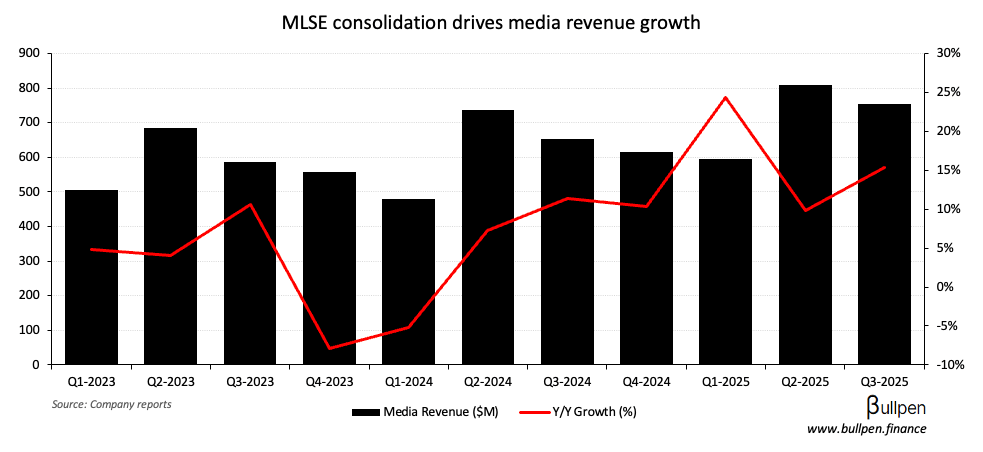

Rogers (RCI-B) hit fresh YTD highs with its Q3 results, gaining 3% on a top and bottom line beat - partially driven by its recent acquisition of Bell’s MLSE stake.

With the remaining 25% stake set to be brought in next year, the company is inching closer to a monetization event.

We anticipate a transaction could occur over the next 18 months or so, likely coincident with or subsequent to us acquiring the remaining 25% minority interest in MLSE.

INSIDER TRANSACTIONS

| Insider | Company | Value |

|---|---|---|

| Brent Todd | A&W (AW) | $193K |

| TWC Enterprises | Auto Properties (APR-U) | $9.7M |

EARNINGS

YESTERDAY’S EARNINGS

| Company | Actual | Consensus |

|---|---|---|

| 🇨🇦 Rogers (RCI-B) | 1.37 | 1.24 |

| 🇨🇦 FirstService (FSV) | 1.76 | 1.73 |

| 🇨🇦 Hammond (HPS-A) | 1.56 | 1.58 |

| 🇺🇸 T-Mobile (TMUS) | 2.77 | 2.57 |

| 🇺🇸 Blackstone (BX) | 1.52 | 1.23 |

| 🇺🇸 Intel (INTC) | 0.23 | 0.01 |

| 🇺🇸 Union Pacific (UNP) | 3.08 | 3.00 |

| 🇺🇸 Honeywell (HON) | 2.82 | 2.57 |

TODAY’S EARNINGS

| Company | Time | Consensus |

|---|---|---|

| 🇺🇸 P&G (PG) | AM | 1.90 |

ECONOMIC DATA

YESTERDAY’S ECONOMIC RELEASES

| Release | Actual | Consensus |

|---|---|---|

| 🇨🇦 Retail Sales M/M | 1.0% | 1.0% |

| 🇺🇸 Existing Home Sales | 4.1M | 4.1M |

TODAY’S ECONOMIC RELEASES

| Release | Time | Consensus |

|---|---|---|

| 🇺🇸 Inflation M/M | 8:30AM | 0.4% |

| 🇺🇸 Inflation Y/Y | 8:30AM | 3.1% |

| 🇺🇸 Consumer Sentiment | 10:00AM | 55 |

COMMODITIES

|

|

||||

|

|

||||

|

|

||||

|

|

||||

|

|

Flagging the move in crude prices, which are driven by fresh sanctions on Russian oil from the Trump administration.

Was this forwarded to you? Join hundreds of finance professionals reading The Morning Meeting by clicking the button below.